Yesterday the news was announced–March will be full of Madness this year as blogs and readers compete in a Tournament to see who can earn the most miles. I feel similar to Milesabound’s recent post on the subject, I’ve got an already busy schedule, and don’t know about the time element of the tournament. Milenomics (and by extension, myself) places a very high value on time over all other things. I’ve written that I was thinking of increasing my T-Rate from its current $25/hr. However I just can’t do that with this tournament coming up.

Will I win the tournament? I won’t know until the end of March, but I’m preparing for battle so I will be ready on Day one. I’m doing what I can now to ensure victory, and I’m WIN-terizing my wallet to do so.

I’m still formulating a complete strategy for the month, so you’ll have to wait and see what my plan is. Instead, today I’ll go over how I’m readying myself for this month of heavy spending. I’m treating this like winterizing a car, in anticipation of a long, cold winter. Not only do I need to have a plan, but I need everything in order for that plan to be executed properly.

Basics: The Wallet.

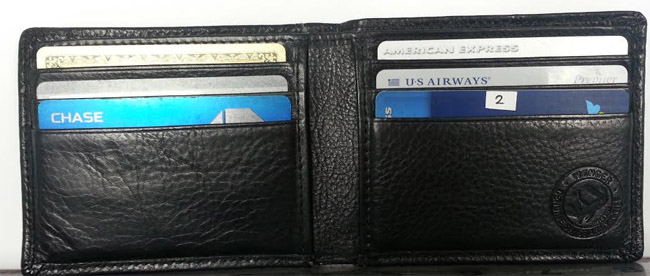

My wife recently gave me the perfect gift: she replaced my old wallet with this new upgraded one. I’ve got capacity for 10 cards if I load one per slot, and if I Double up I can hold as many as 16 cards. This is no Costanza Wallet, it folds thin, and sits in my pocket ready to be used at a moment’s notice.

It also has a detachable smaller inner wallet (pictured above), which allows me access to 4 of my most frequently used cards for faster spending. These Speed Slots can save me precious seconds fumbling to try to pull out a card from inside.

Questions you might be considering:

-Will I use all 16 slots?

-What about my four “Speed loading” slots, What cards will I put in them?

-Who cares about your wallet!? (well, I do)

My wallet is over-sized and fits Money orders in the billfold (this gift was incredibly well thought out!), so I’ll be able to hold those along with my cards to hopefully become a Mobile Mile Earning Powerhouse.

Introducing: The Cards:

I’m at a bit of a disadvantage in this area–as I don’t have a 5x card right now. I’d identified this as an area I wanted to correct in my March CCC applications, however those will happen too late in the month for this tournament. I’m not about to accelerate my application process and so I’ll have to stick with the cards I’ve already got:

Slot #1: Amex Gold PRG. This will likely be my Go To card for most of the month. 2X in grocery stores and a 15,000 MR bonus for spending 30k mean I could see 75k MR in March from this card. Will I meet this high of a spending threshold? Will the card break or melt from continued swiping? Will Amex FR me into oblivion? All this and more, at Milenomics in March.

Slot #2: Bluebirds. I don’t think a single person will attempt this contest without at least one Bluebird. I’d like to share the system I use for keeping track of my loads on my Bluebirds, something I call the rotate and flip. I’ve placed 4 small stickers on each Bluebird with the numbers 1, 2, 3 and 4 on them.

When the card has not yet been loaded for the month I place it behind another card, in this case my ID:

Once I’ve loaded my first Daily limit onto the card I put it back in front of another card, this time again my ID:

From here I just keep rotating the card after each load:

And then I flip over to the back where I have two more stickers:

After my 5th load I pull the card from my wallet and keep it safe until the next month. This can help me to know when I’m at my limit on a BB and saves me from being declined on loads.

Slot #3-5 Chase Freedom (3): I’m really hoping to push these pretty hard. I haven’t bought any “gas” at “gas stations,” so I’m really hopeful I can use these 3 up to their full potential and earn a cool 24,750 UR along the way.

Slot #6 Blue Cash Everyday (2):Here’s where I’m at a serious disadvantage. I’m not holding high % versions of this card, and there’s no Annual Fee or minimum spending calculation in thie tournament. I’m capped at 3% for all my Grocery store spending on this card up to my yearly $6,000 per card. This is going to make things harder for me, but I always like a good challenge.

Slot #7 Starwood Preferred Guest Amex: I’ll be using this for non bonus spending from time to time during the month. It sits in my wallet, but rarely gets use because of this next card:

Slot #8 Fidelity Investor Rewards Amex: 2% cash back everywhere. This card is so cool it doesn’t even advertise its best features. I’ll be churning on this quite a bit, and it will probably be held in my “speed loading slot.”

Who’s sitting out: Sorry Chase Sapphire, you’re out. I’ve decided to switch this card over to a Chase freedom in the next few weeks–that switch-over will happen sometime during the first week of the contest. Even my US Airways Dividend Miles MasterCard is in play. CSP…you’ve disappointed me greatly!

Standard Milenomics Disclaimer:

The last thing I want to have happen during the month is for my wings to be clipped. Do I need any more miles? No, and I had been scaling back MMRs until this tourney came along.

-Should you do any of this? No, probably not.

– Isn’t this foolish? Yes I think it is foolish to spend money for no reason other than to earn a trophy. However, I LOVE TROPHIES.

–Could one or more of my cards be shut down? Yes. To avoid this I’ll try to limit my spending on any one card to 1-2x my Credit limit for the month.

What Might Change?

This is the area I’m working my hardest on. My standard monthly churn won’t work for the tournament. As part of cutting costs as much as possible I want to hit as few stores and as quickly as possible on my churn. Limiting us to a $5k bankroll (per day effectively) is smart, but also could drive my costs WAY up. Will I buy any VR during the month? My streak of not buying them has been going on for more than a year, and I’d hate to end it. But that trophy just looks so sweet:

What Won’t Change?

I’m obviously going to keep a close eye on my time spent and distance traveled. The tournament doesn’t account for those two variables, but I will be. Does this mean I’ll leave miles on the table, probably. Do I stand a real chance of winning this tournament? Probably not–but if you never try, you’ll never know!

Follow along with updates here on Milenomics, as well as on Saverocity.com. Whatever happens I know March will be an exciting time. Also if I’ve missed something and you’d like to help me along, send me a message on Twitter @Milenomics, or Facebook.com/Milenomics, or email me, Samsimontravel@gmail.com.

No Wells Fargo? No Blue Cash Preferred? I learned my grocery store tips from you, and you’re telling me you’re not earning 5-6%?

TJ: I know… 🙁 I’m at a serious 5% disadvantage for the tournament. I’m holding 2x Blue Cash Everyday which earn 3% Cashback at grocery. I updated the post to include them and I’ll be maxing out their $6000 each for $360 in March, but still–It is not ideal. My march applications were going to be heavy on 5% cards, but they won’t come in time for this tournament. I’m pushing a boulder uphill, and will need all my craftiness to get to the top. Not to worry, I’ve got some surprises up my sleeve. 😉

Good luck!

I am churning right now and working on the 100K AA card so march will be a busy month for me too. Luckily some work travel popped up where I get to earn free miles and points. I am even going to complete the Carlson say 3 get 1 free (38k bonus) next month. I currently have a $14k spend requirement to meet so I have work to do!

Also if my estimates of timing my Southwest Visa points posting are correct I could have the Companion Pass as early as tomorrow! Fingers crossed!

Happy churning!

Thanks Robert! I’ve still got to come up with a plan, and clear some time in my schedule to spend $5k each day, which isn’t going to be easy. Fortunately I’m leaving to Costa Rica on March 28th, so the madness will end a little early (and I’ll be rewarded with a well needed vacation).

Excellent news about the CP as well.

Good luck; you’ve got some really fierce competition. I hope no one gets their account(s) shut down. This will be interesting to watch; I’m hoping to learn some new tricks.

From the perspective of a spectator who is relatively new to the MS game and who proceeds cautiously and slowwwwly, I am a lot less interested in who wins than in how the various bloggers go about it, given the tools each has at his or her disposal. I am also pleased that the rules will allow extra “points” for creativity and deductions for unethical strategies. At the risk of sounding like Pollyana, while winning is nice, it is also how you all play the game. I sure hope no one gets shut down!

Elaine, I’m pretty cautious as well, which I think is good. I like to think I’m creative but ethical–I guess the contest will tell me if I’m right about that. 🙂 You’re right–it is how you play the game that ultimately counts. I have a few high earning strategies that I won’t use; they’re on the other side of my comfort line but…I’m interested to see if anyone else will use them.

Best of luck! Your lack of 5x cards is gonna make it tough! Please forgive my ignorance – I’ve had a BB for about 15 months but just one. How does one get multiple BBs?

Jake: The card is one per person, those with more than one are using different people for the additional cards. Most people with more than one are using a spouse/parent/child’s SSN for it. I believe borrowing a family member’s SSN will hurt us during the “ethics” portion of the floor routine 😉

I’ve read a few of the posts by your competitors in the challenge, and so far it seems that all of them have a handicap of some sort, whether it is not having a 5% card, having a full-time job as well as kids who’ll still need parenting, lacking some avenues due to past shutdowns and/or leaving early for an already planned vacation. I suppose a cynic could say that the contestants are just setting up the back stories they might need to explain why they didn’t win, but I think it just reflects the fact that MSing is what we do along with all the other things we do too! I am glad you and your colleagues have agreed to step up to the MS plate and – here I go spouting Pollyanish again – I think that makes you all winners.

I thought the rules only allowed a $5K starting wad. And that’s all you have access to – so you’d need to recycle that same $5K throughout the month (and hence makes it somewhat of a challenge). But if it’s $5K a day and you don’t need to recycle that same $5K, those with 5x cards will blow you out of the water and the contest is a snooze fest.

And what’s the deal with worrying about doing only doing 1-2x your CL? What sort of self respecting MSer is so timid?

Frankly, this smells more like a chance to discuss and pimp cards mercilessly for a month than the chance to learn anything new.

Paul: The rules are “evolving” by the day. When I signed up it was $1k, now it is a $5k. bankroll. Yes you need to cycle, but they’re allowing the cycle (as far as I can tell) to be really short–Buy a VR for $1k and load it to a BB and you can use that $1k the next day. Buy a MO and that money is back in play the next day as well. Is that realistic? We’ll see how the game shakes out. I also think 5x cards will take it, but I’m scrappy–and won’t give up without a fight.

2X my CL for a few reasons: One, because we all agreed that doing one thing over and over would be boring, and against the spirit of the tourney. There’s some type of “style points” for creativity to try to stop people from doing 5X at the same store over and over and over, not sure how that will work. And secondly, As far as I can tell the rules effectively cap me at around $150k spend in the month. I won’t be focusing on one card so no reason to go above 2x my limits.

No card pimping here–we won’t be discussing new cards until the end of March, and I won’t be divulging all too many secrets in March since others could use them against me. Time will tell how successful this is. Also, I really do want that trophy. #TeamMilenomics

I am so jealous. I am physically in Canada and unfortunately you need to have boots on US soil to play in this tournament.

Maybe I’ll put up a similar challenge in Canada over at Creditwalk.ca. Unfortunately, no good opportunities for this in Canada 🙁

Good luck. You and Frequent Miler are the 2 guys I have my money on to win this trophy.

This is totally the type of contest that I am really interested in; unfortunately I’ve decided to sit this one out but I’m rooting for you

Good post, but jeez, no 5X cards at all? I assume you’re stocked to the gills not just with extra BBs but also other less popular unload cards like PayPower and PayPal and and and. If not you probably should be although all of these of course carry the risk of you getting your money frozen. I suppose by the rules that wouldn’t matter, since you get the money back the next day.

I wonder if somebody has done the math on the cash outlay needed to play this game? Given that a real transfer back to my bank account from BB takes about a week, I assume you need to be prepared to use up $5k x 7 = $35k or so during the tournament. Is that right?

Glenn, thanks for the comment. I am pretty stocked up with reloadable cards, but I’ll be adding in more as the contest goes along should I need them. I’m really trying to go the whole month w/o a VR, but I doubt I’ll be able to. Also, the risk of account shutdown (not CC but reloadable cards) is a very real one. Not only do you have to float cash that is tied up but that money should in essence be “off the table.” If $2k get caught up in a MVD closure, not only do you have to float the $2k but you also now can only play with a $3k bankroll (I think).

As Far as bankroll I don’t think you’ll need $35k to play–because your CC will allow you some float. Since the max you could spend is around $5k per day the larger your Credit Line the less cash you’ll need. I’d estimate that you could play with as low as a $0 bankroll. In reality some events will need cash on hand as you wait for bills to be paid, and cash to be freed up. Because you could end up with accounts frozen I think $5k to $10k is what it will take to be safe, not sorry in this game.

Any chance you will be in Charlotte for the events there?

Elaine: I’m trying to make it happen–but I’ll have to wait until the week of to see if I can take a half day Friday. I’m only looking to go if I can book something getting in late Friday night instead of a crazy red-eye after work Friday.

Ah, the disadvantages of jobs!

Great to hear that it might be possible and hope it does work out!