Point transferability between accounts varies wildly across banks. Wells Fargo is one of the most favorable banks in this regard, allowing point transfers:

- To and from personal and business accounts

- To someone else’s account, even if they’re not related to you in any way

Why

It can be useful to combine points earned between personal and business accounts for a single redemption.

It can be advantageous to transfer points to a rewards account with a more favorable redemption scheme. For example, if you have a Propel World card rewards are worth 1 cent each. However, if someone you trust has a Wells Fargo Visa Signature they can redeem points for between 1.5-1.75 cents a piece towards airfare.

The ability to earn rewards in one scheme then redeem in a better scheme increases the overall value of the program.

How

Transfers can be initiated online or over the phone and vary depending on the type of transfer you want to perform.

I’ll cover each of the online transfer methods below because each transfer scenario is distinct and there are some potentially painful mistakes you’ll want to avoid.

From a Personal Account to Someone Else’s Personal Account

This is the most common scenario. To perform this transfer the “from” account needs to know the “to” account’s 16-digit card number.

- Log into the “from” account

- Click on the GoFar Rewards account associated with the credit card you want to send points from

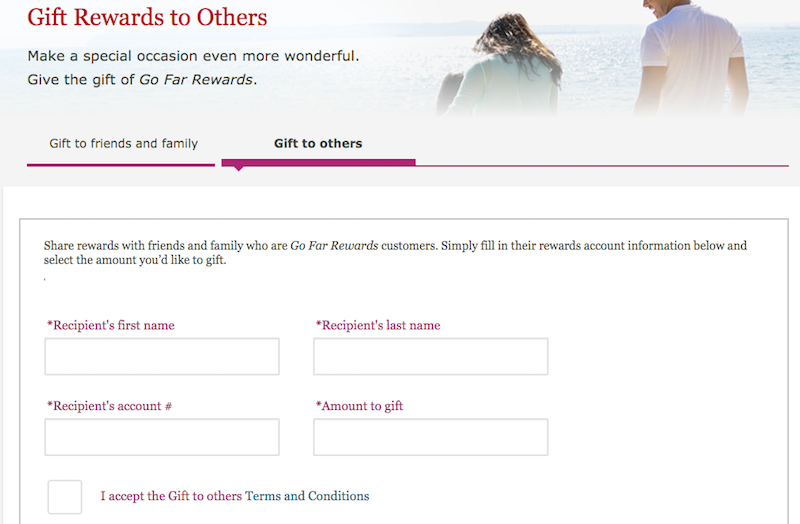

- Click on Share -> Gift Rewards to Others

- Click on Gift to Others

- Important! Do not choose Gift to friends and family. Doing so will result in a irreversible cash transfer rather than a point transfer which is not what you want because it nullifies redemption upside.

- Enter the “to” account’s name, 16-digit card number, and # of points you want to transfer then Continue

- Once the account number is confirmed complete the transfer – it should occur instantly

From your Personal Account to your Business Account

This can be useful if you have Propel World card and want to redeem for airfare with the more favorable rewards scheme the Business Platinum card offers, if you’ve opted for the Business Platinum Rewards scheme as opposed to the cashback scheme.

- Log into the Business account, ironically, by clicking Personal Accounts -> <Business Name> Accounts

- Click Business Card

- Click Wells Fargo Rewards at the bottom of the page where it says “To redeem your rewards and shop at our Earn More Mall® site, visit Wells Fargo Rewards.”

- Click Business Rewards Accounts

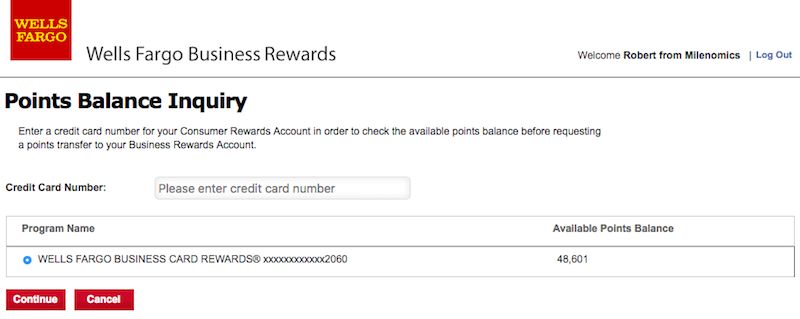

- Click Consumer Points Transfer

- Enter your Personal Credit Card Number

- Once the credit card is confirmed complete the instant point transfer

From your Business Account to your Personal Account

This can be useful if you have a Wells Fargo Business Rewards account and you want to transfer points to a Visa Signature for 1.5-1.75x uplift towards air travel.

If you have a Business Rewards card and want to transfer to a friend’s Visa Signature [I think] you’ll need a personal card of your own and will need to complete two transfers: One from your Business Rewards to your Personal GoFar Rewards. Then a second from your Personal GoFar Rewards to your friend’s Visa Signature.

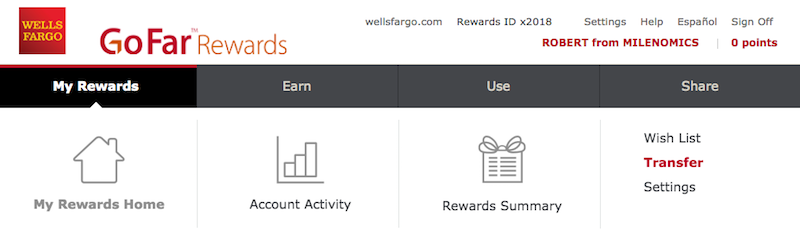

- Click on GoFar Rewards associated with the Personal account you want to transfer to

- Click My Rewards -> Transfer

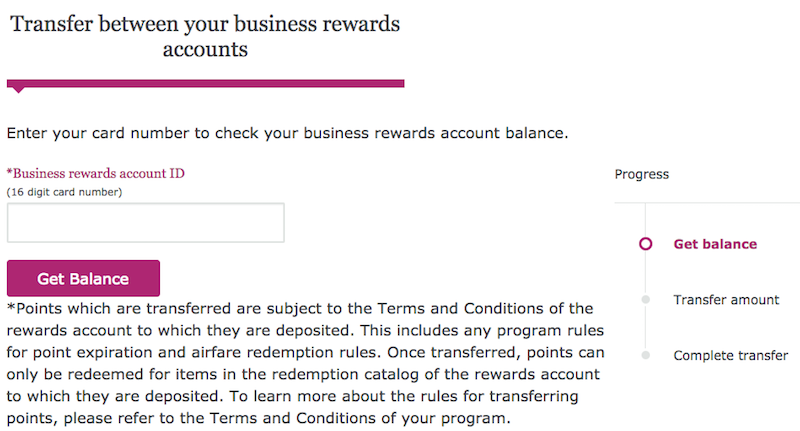

- Enter the Business Credit Card Number you’d like to transfer from then Get Balance

- Enter the number of points to complete the instant transfer

Caveats

- Be sure to avoid the Gift to Family & Friends option (mentioned above but stating again here for emphasis). It’s a trap and once transferred this way points become cash and redemption upside is lost.

- Avoid performing a lot of point transfers in a single day. When I say “a lot” I mean like 40 transfers. They’ll lock your account and could require you to go in branch for ID verification. This can be particularly painful if you live in a state with no Wells Fargo branches.

- It’s still not clear whether the Business Platinum Rewards $500 signup bonus is reliably converted into a 50,000 bonus for those who weren’t targeted and who opt for the rewards scheme on that card.

- It’s still not clear [to me] whether signing up for a Wells Fargo Business card resets the 15 month clock for Wells Fargo Personal cards. This is relevant for someone going for the Propel Word 40,000 signup bonus a few months after getting a Business card.

Bottom Line

Favorable point transferabilty is a key characteristic of valuable rewards programs, and Wells Fargo’s policies on this are about as good as it gets.

Take advantage of this to maximize the value of Wells Fargo rewards cards. Beacuse there’s no such thing as great credit cards, just great credit card programs.

Datapoints welcomed. Let us know in the comments or on Twitter @milenomics

Good write-up.

Could you expand into how the booking flights with points work? Eg if you cancel, do they refund the points or a cash statement in the card account? You see what i mean?

I don’t have a lot of experience with canceling flights booked with WF Rewards.

One time, I had to book over the phone for some unrelated reason and the agent strongly suggested that flights booked with points didn’t even qualify for the typical 24 cancellation window airlines provide. That once booked you were at the mercy of the airline’s terms for cancellation.

It could get interesting if you book a refundable flight to see if it might provide a high leverage cashout mechanism. An area ripe for exploration for some, but for me I’ve been happy using them as intended towards flights I actually want to take.

2 player mode. Applied for Biz Platinum and then Propel World and got approved for both.

Will be interesting to see if both bonuses post. I’m right there with you, and optimistic they will.

Maybe due to large spending on the credit card, currently my 1 point is worth 1.75c. Would this high conversion rate stay there forever or it will expire? If it expires, when?

It comes after spending $50,000 on the Visa Signature within a year.

It will expire, but I’m not certain on the exact timing.

Even when it expires you still get 1.5 cents per point for travel.

Hi Robert, old post but I have a question.

Do you have experience with the Wells Fargo Go Far rewards program? I’m wondering if they use Expedia or Connexion and if the value truly is 1.5 cents per point (looking at possible inflated prices on portal)

Hi Elliott – I’m not sure who they use but I have *not* seen the prices to be inflated.

Most of my searches have been for domestic flights, and usually one-ways. But the prices always seem to be spot on with Google Flights/airline direct.

Hope this helps…

That does help, thanks. Seeing as how I’m above 5/24 and mostly fly United, I may get PC my CSR for the Wells Fargo cards and combine them with my ALT reserve. The dynamic pricing for united scares me and I don’t earn points/fly enough anyway.