Quick Summary: If you’ve experienced a Chase Sapphire denial it could be because Chase won’t approve you for a Sapphire card if you already have one. But by applying for a new Freedom card (or performing a product change) you can get around this limitation and get approved for a new Sapphire card.

This Brandon Asks question comes from Justin who asks:

“My friends were recently shaming me for paying for an expensive meal with ‘just’ the Sapphire Preferred for 2x instead of the Sapphire Reserve for 3x. I ran the numbers and I’ve got enough reimbursed work expenses to make the Sapphire Reserve worth getting, but when I applied Chase rejected me because:

You already have a SAPPHIRE-branded credit card account with us.

I’d like to get the 50,000 point signup bonus for the Sapphire Reserve, and I only want to carry one credit card.

How would you navigate this situation?”

Sorry you were rejected for the Sapphire Reserve but don’t worry – you can patch this up.

There are a number of ways to go from a Sapphire Preferred to a Sapphire Reserve and get the signup bonus. I’ll provide a few options here and you can decide how much work you’re willing to put into it.

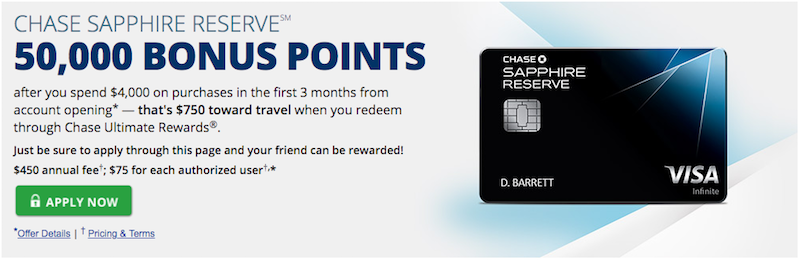

Chase Sapphire Denial: Offer terms

Chase’s policy is that they won’t approve you for a new Sapphire Reserve card if you already have a Sapphire Preferred card (and vice versa). You have to click “Offer Details” to see this info, but it is in their T&Cs:

The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 24 months.

If you just wanted a Sapphire Reserve card and didn’t care about the signup bonus you could product change from the Sapphire Preferred to the Sapphire Reserve. But if you want the signup bonus it’s a little trickier.

How to play it

If it has been less than 2 years since you’ve gotten the signup bonus for the Sapphire Preferred you’ll need to wait it out.

But if it’s been more than 2 years here’s how I’d play it…

First, you probably have some Ultimate Rewards in your account and it would be nice to preserve them through this migration to a Sapphire Reserve.

The strength in the Chase Ultimate Rewards cards is in the program as a whole, not necessarily because of any one great card.

That being the case, I think you should consider exploring more of the Chase card portfolio. I’d recommend you sign up for a Chase Freedom Unlimited. That card comes with a 15,000 point signup bonus after spending $500 in 3 months, but its value is enduring: The Freedom Unlimited bonuses spend at 1.5x everywhere and has no annual fee.

This would serve two purposes:

- It would boost your earnings on non-bonused spend by 50% over the Sapphire Preferred

- It would preserve your Ultimate Rewards when you cancel the Sapphire Preferred

Once you’re approved for the Freedom Unlimited, you can transfer the points from your Sapphire Preferred to the Freedom Unlimited and then cancel the Sapphire Preferred.

Other options

Some might suggest you product change the Sapphire Preferred into a Freedom card that earns 5x in rotating categories each quarter. But if you’re not interested in juggling 2 cards you’re probably not interested in juggling cards on a quarterly basis.

Another option would be to simply downgrade the Sapphire Preferred to a Freedom or Freedom Unlimited. You’d forego the 15,000 point signup bonus with this approach.

Either way, once you no longer have a Sapphire Preferred you’ll be in a position to sign up for the Sapphire Reserve. Chase should then approve you since you won’t have the Sapphire Preferred any more.

Summing it up

After this you’ll have 50,000 from the Sapphire Preferred and 15,000 from the Freedom Unlimited if you go that route. Plus you’ll be earning 3x on travel and dining, a $100 TSA PreCheck reimbursement, and all of the benefits that come with the Sapphire Reserve – like the ability to easily redeem all of your Ultimate Rewards for 1.5 cents per point for any travel booked through Chase.

If you decide later that you don’t like juggling 2 cards you can transfer the points from the Freedom Unlimited to the Sapphire Reserve and close the Freedom Unlimited. But I don’t think that’s too much work to handle, so see how it feels then decide?

Drop us an email or hit us up on Twitter @Milenomics if you’d got a puzzler we can tackle.