Today’s post is focused squarely on supply side Milenomics. I won’t get into how many miles you should be collecting, but I will caution you, you should be keeping an eye on your totals and stay away from hoarding miles. Switch to cash back cards when you’re at a safe supply level is an excellent way to balance cash back and miles. Whether you’re earning miles or money, the following advice is true either way.

See Also: Finding your Limits, Removing Inefficiencies in your Churn.

Scaling Works Great, Until it Doesn’t.

If I think that I need more than 200 tomatoes I can just plant another tomato plant. I’ve gone from one plant, 200 tomatoes to 2 plants, 400 tomatoes. This is a very rough, very academic, simplistic form of scaling production.

For my garden my inputs are land, water, fertilizer and my time. My total land for planting might only allow me 10 tomato plants, so this is a hard limit I need to keep in mind..

But even with unlimited amounts of land and water I can’t scale to infinity because of my time. Even if I had unlimited land at some point I’d have to quit my job and become a farmer full time. And even then with only 24 hours in a day, I’m still looking at a hard limit there as well.

So if I’m in the business of selling tomatoes (I’m not) and I see that my Tomato crop is booming, I need to always keep an eye out for where my scaling falls apart due to limits.

Similarly, while I’m working to produce Miles I want to keep an eye on where my scaling starts to break down. Next, we’ll discuss a few of the roadblocks to scalablity.

Roadblock #1: Daily/Monthly Purchase Limits.

We’re all familiar with these types of limits. The most famous of these is the CVS $5k per day limit. Daily purchase maximums such as these, and your monthly Credit Card Limit are a few examples of this.

Example: My local Rite-Aid will limit me to 2 cards on credit per trip. I know this is a store imposed limit–but it is still one I need to keep in mind whenever I plan a trip there.

Keep these limits in mind and plan trips around them. Group your purchases to Save on time and Travel, and increase the amount you can spend beyond any one store’s Daily purchase limits.

Roadblock #2: Time

Today I’m asking you to also consider your time in this scalability. The first step in doing so is to ask yourself how much time you can reliably give to this effort. If it is 1 hour a day or 9 hours a day, know this amount and stick to it. Your Maximum Daily Hours should take into consideration your goals, but also your current situation in life, and your Supply and Demand for miles. Someone who’s trying to churn enough money to pay their tuition might decide to dedicate 5+ hours a day to this. Someone else with a family and plenty of other hats to wear might decide they only have an hour to do so.

Consider the following examples:

A. 1 hour work x $10k spend (and liquidation) at 2% = $200

B. 2 hours work x $20k spend (and liquidation) at 2% = $400

C. 1 hour work x $10k spend and liquidation at 4% = $400

In the above we’ll often forget this extra hour of our time in comparing option B and option C. It is easy to think you’re netting the same amount when you look at what you’re taking in–Never forget your time in your calculations. The true calculations for the above should be:

A. 1 hour work x $10k spend (and liquidation) at 2% = $200 ($200/hr)

B. 2 hours work x $20k spend (and liquidation) at 2% = $400 ($200/hr)

C. 1 hour work x $10k spend and liquidation at 4% = $400 ($400/hr) + 1 extra hour of time at your T-rate. For me that would be $425.

Scale your time last. Working 2x harder is great, but working just as hard and netting the same amount as if you worked 2x as hard gives you 50% more of your time:

Roadblock #3 Liquidation Limits

Even if we’re able to scale to infinity on the purchase side we’ve got to be conscious of our limitations with respect to liquidation as well.

Something like the hard limit on the number of swipes you can do at Wal-Mart is a good example of this. There might be ways around this limit, but those ways include wasting 10-15 minutes of your time. And while cashiers should in theory allow you unlimited swipes, at some point you’ll draw attention to what you’re doing and be shut down entirely.

As your total number of cards to liquidate increases your ability to liquidate them actually decreases.

It is for this reason that you’ll want to seriously consider passing up $100 and possibly even $200 gift card purchases. With the right multiples that might not be true–but consider the scalablity of your liquidation when you purchase any item. $2500 is cheap and easy to liquidate when you’re talking about $500 cards, and nearly impossible to do in one day if you’re talking about $50 cards. It isn’t the total, its the quantity.

Example: Evolve Money was a great service which has in the past scaled very high. A theoretical limit for the service might have been $30k in payments per month ($1k per day x 30 days). However with the current 4 payment limit per month you’re now limited to no more than $4k per month per account. What that means is that you’ll also need to adjust your purchases due to this change. Whereas Evolve was a great way to dump $100 and $200 cards in the past I’m now using it almost 100% to get rid of $950 Reload-it packs, since I want to maximize the value I get from the service.

Scalabilty is also loosely related to the float rule. You should consider what you’ll need to hold onto without being able to liquidate due to issues of scale. Had I bought $12,000 in $100 Gift cards instead of VR thinking I could liquidate them Via Evolve I’d need two and a half years to liquidate them all at the current 4x$100 per month maximum.

Be ready for any liquidation method to die tomorrow.

For more on this read today’s FreequentFlyerBook post on branching out to other stores for liquidation

Economies of Scale in Mile Production

All of this leads us to look at our own personal economies of scale in the production of miles. An example of this is the recent Safeway $20 off when you buy $200 Visa gift cards deal we discussed last week here on the blog. The cost for miles with this deal is negative–spend $6.95 to get $20 off of groceries. However this negtive cost is only true in the short run.

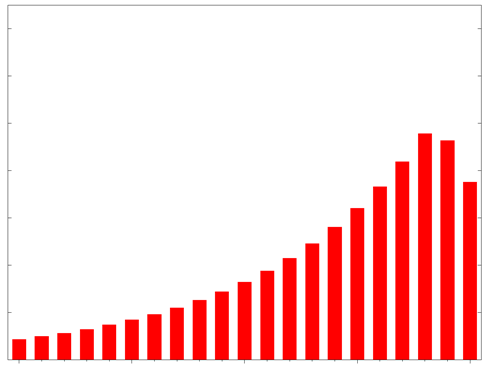

We’ll get into the reasons why this is true by stepping through this above chart. Imagine this chart is a visual representation of your costs to produce, and your output of miles you’ve earned through the Safeway deal. We’ll discuss the different points on the chart as follows for the $200 Safeway deal:

Q: As you start purchasing your costs are your time, and your travel, along with $6.95 in fixed costs. For each purchase you make let’s assume you earn 2 $10 off coupons, which work to drive your costs lower and lower. At point Q you’re buying 1 $200 card, and “earning” $13 in free groceries, for a total cost of -$13 (plus your time and travel).

Moving from Q to Q2: As you move along the LRAC curve between these points you start to see benefits from economies of scale. Maybe you’re able to buy 2-3 $200 cards per trip, cutting your costs down. In addition you’re able to consolidate your coupons and use them all in one trip, further reducing your costs for the deal. You can then unload them at home nearly instantly with AP or EvolveMoney.

Q2: At point Q2 your time and travel have been averaged out by your coupon purchases, and you’re earning miles and money along the way. At this point your cost to manufacture (C1) are at their lowest point. You’re running at peak efficiency. This operation is so great, it should be able to continue driving costs down forever, right?

No. As you can see your LRAC (Long Run Average Cost) starts to creep up slowly. You’re now into Diseconomies of scale The reasons for this increase in your cost could be as simple as:

1. You now have more coupons that you could ever hope to use. Having no use for your coupons, you now can’t get any value from them at all.

2. Or you scramble to use them and purchase things you don’t really need, and at prices which aren’t competitive, wasting money along the way an negating the coupons’ actual cost savings.

3. On the liquidation side you’ll see increasing costs as your ability to liquidate quickly from home goes away and time, travel, and fees start to add to your total costs.

Whatever the reasons your costs will creep up once you’ve passed maximum efficiency. That isn’t to say you shouldn’t continue purchasing past Q2, just that you should seriously consider when to stop going in on a deal.

I often stop my purchases of gas point earning cards once I feel I have more gas points than I can safely get rid of. Otherwise the costs to acquire will continue to creep up as unused gas points no longer help offset purchase fees.

Having an operation with many different production lines running all at peak efficiency should be our ultimate goal. Maximum efficiency also frees up your time to take part in another deal, and increase your total miles earned. Remember, as we discussed above we should be working smarter, not harder. And we should respect our maximum daily hours whenever possible.

Hidden ways to Scale Production

When you’re faced with no longer being able to scale a deal you have a few options. Before you consider stopping that production line you should try the following to increase the miles you’re producing and/or lower your cost to do so:

Increase the multiplier on your credit card. In this way you’re continuing to scale up beyond your normal capacity. Going from a 1x to a 2x card or from a 2x to a 3x card means you can continue to see economies of scale beyond your current limits.

Double or Triple Dip. Can you earn cash equivalents like coupons, gas rewards, or rebates through purchases? If so keep an eye on your logical limits to scaling these rebates/coupons.

Lean out your Liquidation costs. There’s no sense in traveling farther than you need to if all you’re doing for liquidation is buying $500 Money Orders. Look for Gas, Drug, or Groceries closer to home that will sell you these same items on debit. Use the time you save to scale up production.

Scale past your own limits: In the above Safeway example we discussed being unable to continue to use an infinite number of coupons. The same holds true for Gas rewards–you can only use so much gas. Look for ways beyond those limits. Do you have a neighbor who’s buying diapers all the time? or someone you know who could use gas rewards for their fleet of vehicles? If so, work out a deal where you sell them your coupons or gas rewards for a discount. I’ve successfully sold gas rewards to a local delivery business at 50% of face value. This means I can increase my production of those cards which earn gas rewards and shift my entire LRAC curve further to the right (LRAC2):

Wrap Up:

Full production at maximum efficiency is a beautiful thing for all of us to strive for. Today’s discussion of scaling doesn’t change the basics of what to do once you have those miles:

1. Know your Total Costs. Keep track of these costs with a tracking sheet that shows your average cost per mile. Include your time and travel as these are very real costs, and are often times limiting factors.

2. Use your miles whenever the cash price of a ticket is equal to or greater than your cost to manufacture your miles. In this way you realize your investment of your time.

Knowing the total cost to manufacture miles will let you stop activities which are not a great use of your time.

If you have tips to save time, travel, or money while trying to earn miles feel free to leave a comment below.