Note: I’m not a tax professional. I have no education in tax law (unlike this Toronto tax law firm – visit their site – who are well versed in Canadian tax law). I’m not giving explicit advice. Do not do what I say, or what I do, or what I say I do. You’d be better off looking into the Tax Services in Thailand at B Accounting, rather than doing it yourself if it’s not something you understand well.

—

Nothing super sexy about today’s post, but it is one I’ve been batting around in my head for quite some time. Today we’re going to take on a topic as old as civilization itself. Taxes.

Taxes are a very real problem in the game we play and ultimately it is no secret that getting your taxes in order is fundamental. Correspondingly, it is often a good idea to reach out to a business lawyer toronto or a business lawyer in your area if you need help and support with understanding tax laws. For us, there are Fuel Surcharges (which I would argue are a form of tax), Entry and exit visas, Tourism taxes, and all kinds of hidden taxes on airline tickets. Today we’re going to tackle the “Capital T,” Taxes; today we’re talking about income tax. We’ll start with a description of what Income tax is, and what it isn’t:

Income tax is a Tax On…Income

No surprise there, income tax is a tax on the amount of income you earn in a year. Different forms of income can be taxes in different amounts. Also different levels of income can be taxed at different rates as well. The history of income tax in the United States is an interesting one. Not until 1913 and passage of the Sixteenth Amendment was the legality of a direct income tax settled in the US.

Income Tax is not a Tax on What You Consider to be Income

The issue becomes that a tax on income is not a tax on what you consider to be income. It is a tax on what the government considers to be income. Someone cuts your yard and you pay them, they’re receiving income from you. Whether you issue that person tax paperwork or not they should report all their income at the end of the year.

What if you traded a stock, made a few clicks online and the stock went up? When you sold the stock your profit would be income, specifically capital gains. Capital gains are taxed at a different rate than employment wages, but they’re considered income of sorts.

What if someone borrowed money from you, and you agreed that they would pay you back with interest? The interest would be taxable income, again capital gains.

The 1099-K, Wonderfully Messy

What about income online? This wasn’t a problem at all until about 15 years ago. All those ebay sellers who were making sales via Paypal were running credit cards (like a business), shipping orders (like a business), and paying for inventory (like a business). Their profit should be taxed as income, shouldn’t it? These businesses were mandated to report everything at the end of the year even though no 1099 was ever issued. But how do you know if these online sellers were reporting the correct amount of income? You create a new type of 1099:

The 1099-K

Whereas the threshold for a standard 1099 is $600, a 1099-K is specific to online payment processors. The threshold for mandatory issuing of one is $20,000 and 200 transactions. This means if you earned $19,999 online by selling 200 items you would not necessarily receive a 1099-K. Similarly if you sold 10 items and brought in $25,000 you wouldn’t necessarily receive one either.

Only if you had 200 transactions and over $20,000 in income from those transactions would you be guaranteed to receive a 1099-K.

But remember, even though you may not be issued a 1099-K any income you receive you’re expected to report. And herein lies the issue for Churners and people who Resell goods for points/miles. We use services which deal with legitimate users and issue legitimate 1099s all the time. Paypal doesn’t care that you’re buying reloads with a CC and sending the money to your roommate anymore than they would if your roommate was paying you for goods or services via paypal.

Like playing Russian Roulette with a 12 Month Delayed Trigger

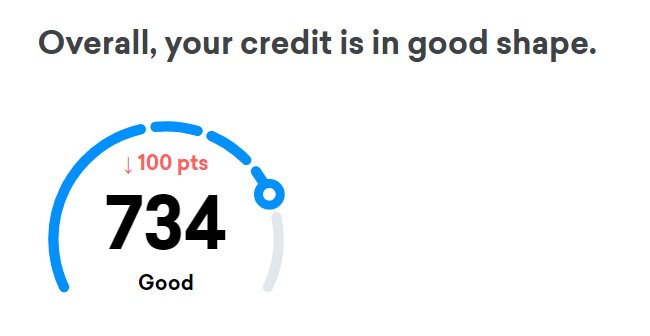

Keeping poor records, or no records of cards used for services which could be considered income is a quick way to make your life awful. As you can see from the above discussion you can receive a 1099 for any amount of income. You’re only mandated to receive them at certain levels. So assuming you’ll never go over 200/$20k and therefore not keeping good records is a terrible way to operate.

Come January when one of your online processors decides this is the year they 1099 everyone, you’ll be forced to explain away your income with expenses you don’t have any record of. Should you be audited you’d have a hard time explaining what you were doing.

Forced to issue and Choose to Issue. There is a Difference

Some services like Flint (I hate you flint), have taken the stance that they want to issue as many 1099’s as possible. Send $100 to someone using flint, and you’d find a beautiful 1099 in your mailbox come January. Are they mandated to send these 1099s? No, the federal threshold for issuing a 1099-K is $20k and 200 transactions.But there’s no floor for issuing them, and so you’re left reading about what companies did last year, in threads like this one, to find out if you can expect a 1099 in Jan/Feb.

As my Flint example above shows there is no firm floor on when a 1099 can be sent. Instead assume your tax implications before you go into a mile earning scheme. For someone like Square you might be able to squeeze a few pesky $100 cards through without a 1099 being issued. Or square might decide tomorrow that they’re going to 1099 everyone who used their service anytime during this year.

Amazon Payments Has Spoiled Many of Us

Amazon Payments (May she Rest in Peace), has really spoiled us. AP never filed a 1099 on any of our activities even though she could have. With a $1k max per month and 12 transactions per year the 200/$20k threshold was never really in danger of being crossed. I don’t know if merchants who used Amazon payments for legitimite business ever receieved 1099’s but I would assume someone did 200 transactions and $20k with the service, and someone, somewhere got a 1099 for it.

There isn’t a safe way to proceed at any level with any service. As I mentioned earlier just because a firm didn’t issue 1099s last year doesn’t mean they won’t wake up this year and say “hey, we should issue 1099s!” and come January/Feb 2015 you’ll find one in your mailbox.

Today I’ll implore you to consider the following philosphy:

Always Assume a 1099 Is Coming

For any service you sign up with, and process payments, sell goods or transfer funds always assume they’ll 1099 you. If you’re buying GiftCards and liquidating them in person they go ahead and toss them when you’ve balanced everything. But for online payment processors don’t be so quick to throw them out.

Marriage for the Sake of Tax Avoidance?

I posed an academic question on twitter a few weeks ago; Assume a husband works as a waiter, and his wife shows up to the restaurant, eats a meal, and tips him. Is that tip considered taxable income? Since the money is being transferred from her wallet to his (in esssence from their wallet to their wallet) would it then be tax exempt? To make the exercise more complicated, assume they live in a community property state.

I’m pretty sure the tip is taxable, but I never got a clear answer. It seems since the tip is going from one spouse to the restaurant via their merchant account and then from there to the server it would be taxable as income.

The angle I was working was to find a restaurant which participates in the iDine network, get hired there, and have my wife drop a $10k tip on me while working. If the tip was not taxable I’d be looking at a solid 100,000 miles for said tip (along with any dining bonuses that tip would qualify me for).

I’ll admit this is more of a moonshot type idea, and I don’t think I’d be successful in the process, but these types of academic ideas are great ways to try to earn more miles. However being Married does have one advantage over being single, and that comes from the Unlimited Marital Deduction.

Being Single means Gifts *Are* Taxable

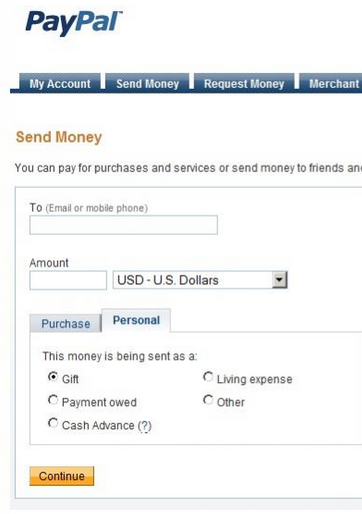

Consider a payment company, I’ll take one of the ones that’s out there: Paypal. Let’s say you somehow figured out a way to load your paypal account with a credit card, and then you sent that money to a friend who cashed it out, and then your friend did the same. Paypal gives you a few options for sending money, some of which charge fees:

The solution is easy, right? Send it as a gift–which paypal doesn’t charge any standard fees for:

Even for those of you who are married I would seriously consider documenting as well as possible what exactly you’re doing. And for anyone sending money to a friend/non spouse I would really think twice about doing so. If you were to send $3k every month for 12 months as a “gift” to a friend, and t hen your friend went out and sent you $3k ever month for a year as well you’d each end up with a gift tax liability of $22,000. The reason is you’d have sent $22,000 more than your $14,000 Gift tax exemption.

I’m actually advocating marriage for the sake of earning Miles and points here! So go on out there and get hitched! But you’ll also maybe want to consider the tax implications of marriage before you do. 😉

What To Do With All These 1099’s?

Come Januaray if you open your mailbox and find a pile of 1099’s you’re going to have to do something besides pay the tax on the whole amount as income.

You have a few options, but your best option is to keep detailed records during the year, and discuss the issue with your tax professional. You’ll likely offset the reported income with expenses, and/or claim a Unlimited Marital Deduction if you were sending the money to your spouse. But these options have risk, and you could be opening yourself up to a future audit. Things to consider when you reach for those Paypal Reloads or sell a few laptops online.

What is the iDine network? Also, how hard would it be to get hired as a waiter? It seems like that’s the drawback to this whole plan. In addition, even if you could get hired, you would end up with a lower income than at many other jobs. Or, if you worked part-time as a waiter in addition to another job somewhere else, you would lose a lot of free time on your schedule.

For the vast majority of people who have no experience working in restaurants, I think it’s easier to manufacture spend using more traditional methods, such as with Visa gift cards. However, all this tax information you give in this post is good to keep in mind when using Paypal, or when buying and selling merchandise.

Brandon: iDine is the company that runs all the airline mileage dining programs. These are the ones which pay you miles when you dine with your registered card. I agree, the difficulties in the plan are numerous, but I’m always trying to brainstorm a next big idea. 😉

I have zero doubt in my mind that I would not have what it takes to work in a restaurant, and I would last just one day (maybe even less!). Waiting tables is hard work, that is for sure.

It’s hard work to do well, you could just be one of those people who do a really bad job of waiting tables. 😉

I like your thinking Jamie. If I do a terrible job then my $10,000 tip would certainly not be for service! LoL.

@Brandon

dude…it was just an intellectual exercise on testing the limitations of the 1099 rules.

In your example, the restaurant’s payment processor would send them a 1099 for $10,010 and the restaurant owner would document this as $10 in revenue and $10,000 in tip income, which presumably must be distributed on waiters’ 1099s. (If 1099s aren’t distributed for tips, if those are only self-reported, the restaurant is going to have audit-bait ratio of claimed revenue to total receipts).

If indeed the $10,000 is reported on a 1099 from the restaurant (an independent third party) to your wife, good luck explaining to an auditor that the restaurant can be treated as a pass-through.

Having said that, I like your thought process!

Neil: Way to ruin the plan with reality! Lots of great advice packed into your comment. Your commented reminded me of a piece Mark over @Travelblaw wrote about IRS rules for tipping as well: http://travelblawg.boardingarea.com/guide-new-irs-tipping-rule/

That is an interesting article that you linked. I really dislike it when I see gratuities listed as 22/20/18 and I HATE it when those amounts are boosted by calculating them on the post-tax (rather than pre-tax) amounts.

It isn’t one of the points he is trying to make, but in either case (tip or automatic gratuity) revenue doesn’t just disappear (which is kind of what you want in your case) – it’s on a 1099 somewhere whether as tip income or non-tip taxable income.

This a great blog post. More people are getting into MS and they should think about what the tax impact will be. A lot of MS, probably most, does not result in income or gift tax, but everyone should think now about the questions that might be asked and how you will answer them. I am not a tax professional and if you need real advice, you should meet with one.

In some circumstances, the tax result of a transaction requires an interpretation and assumption about its real core. To be a gift, the donor must have acted based on a free and distinteretsed spirit of generosity-a long way of saying that the person handing over the money had a primary purpose of making a gift, not doing something else.

In the case of the wife giving her husband/waiter a $10k tip, she might have had generosity as her reason, in which case it is a gift and the marriage exclusion means there is no income, gift or other tax I know of. If the wife is a rock star and her husband is her manager, the $10k may be because he did a great job. In that case, the 10k is extra pay for hubby and it is taxable as earnings of some type to him (it may be and likely is a business deduction for rock star wife but both would have to report it, consider payroll taxes and other issues, etc). Those $3k a month PayPal payments back and forth likely have no intent as gifts and would not be subject to gift tax.

So it’s all based on intent and we can just decide what our intent was and make this all go away, right? NO. In tax matters, the burden of proof is on the taxpayer (that’s the trade off for self-reporting). So if, in your example, two people are swapping payments each month with the intent of piling up points or miles or rebates, and if one of them gets a Form 1099 or is asked what’s was going on, that person should have or be able to create records that show payment amounts, and dates each way. Also, emails in which the two have stated that there is a quid pro quo (I’ll send you what you send me) would be very helpful to knock back an assertion that these are gifts. In the wife/husband case, any communication between them might be helpful too.

There are so many angles out there now it is hard to generalize. However, it seems resellers may have the most issues to deal with since they are running a business, making a profit or loss, and that means income tax (or not). They also have sales tax to consider and I think Internet sales are now subject to sales tax, though I haven’t kept up with that at all.

Folks should also realize that once you are in a dialogue with the IRS, you may in the end not have tax issues if your records are good and there is in fact no gifts or income. However, most or all of your activity will be on the table and cash reporting and structuring issues could arise and be big issues.

The takeaway here is to ask yourself: What’s the worst tax interpretation of what I am doing, true or otherwise? Then start a system to keep records to show that the interpretation you believe is the accurate one can be supported. You don’t need accounting or anything fancy-here’s an example of what I do with gift cards. I buy GCs with credit cards, and use the GCs to by money orders. All very legal and non-taxable. The worst interpretation of this would be if someone saw that I am depositing large amounts of cash equivalents (eg. MOs) and thinks that I must have some income that the GCs are evidence of. My “records” are just the drained GCs, and receipts for the purchase of the GCs, for the purchase of the MO, and the deposit. I usually buy in groups of 4, so I have the 4 drained GCs, and a small sticky on each one on which I write the MO amount, the date I bought it, what CC I used, the dates activated and drained. Lots of words but it takes about 30 seconds to do. Then I take the CC receipt, the MO stub and my deposit ticket and the drained GCs, and I wrap the whole bundle with a rubber band and keep the bundles in chronological order. With this, I can show if I had to that every dollar of GC came from a CC purchase.

Sam: Comment. Of. The. Year. This should be required reading for anyone getting into the game. I’m going to update the post with a note for everyone to read this. Thanks for the post!