This post is now a permanent page accessible from the top of the site where the word “Glossary” appears. I’ve wanted to do something like this since the start of the blog, and have been slowly working on it these past weeks. What follows is a Glossary of Milenomics terms, ideas, and phrases. I’ll be adding to this as new terms pop up, and are discussed. For now if you’d like to bookmark it and refer back to it you can always do that.

#101- Traveler level 101—type of travel is almost always domestic. Also number of trips is fairly infrequent, maybe 2-4 per year. Light on the mileage needs, but also light on travel.

#201- Traveler level 201—Now includes international travel as part of the same light schedule. 1-2 international trips per year, 2-4 total trips per year. Heavier on mileage needs, but still fairly light on travel.

#301- Traveler level 301—Able to travel whenever and wherever you’d like. Work schedule is flexible enough, or the job can be done from anywhere. No limit on the number of trips per year. Very Heavy Mileage needs, and (Can be)very heavy on travel.

#401- Traveler level 401—Business traveler, on paid flights many times per month. May or may not pay for the flights yourself. If company pays for flights Mileage needs low—if you pay for the flights yourself mileage needs high. In both cases very heavy Travel.

AA- 1) Adverse Action– Any negative Action taken by a credit card or financial institution. This includes, but is not limited to, account closure, credit line reduction, or forfeiture of miles/points. 2) American Airlines- Mainline carrier, one of three Milenomics uses for International Award Travel. Award program is called American Airlines AAdvantage. Good redemption options on partner and alliance member airlines, except British Airways, due to Fuel Surcharges

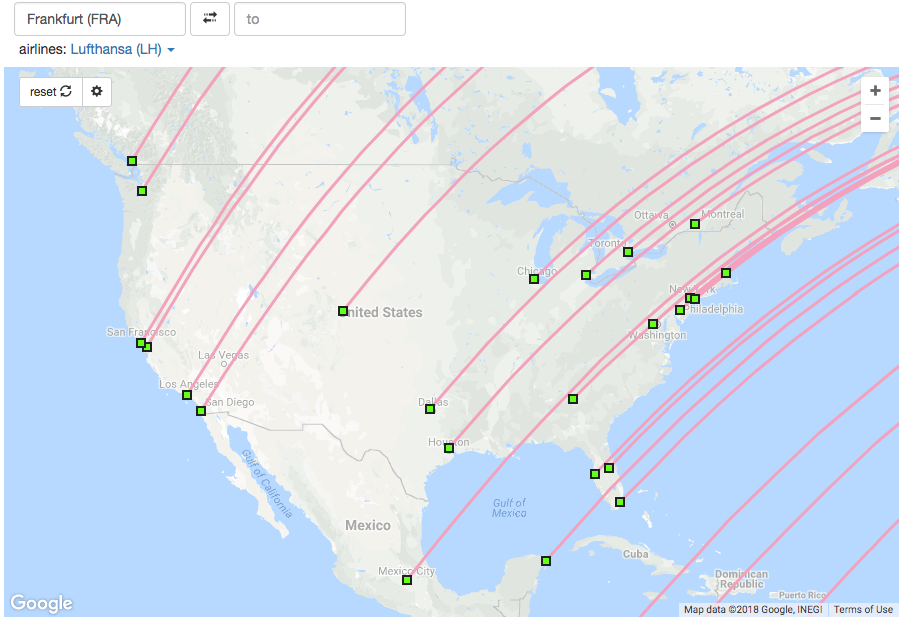

Airline Route Mapper- Software used to see routes and alliance member flights. Powerful tool to use in booking awards. One drawback is that it does not update automatically—and usually only includes current routes.

Alliances- Alliances are groups of airlines who codeshare flights, and cooperate on many levels. Alliances are very important to Milenomics as they allow us to book flights on any alliance member using another’s miles. AA is a member of Oneworld, US airways and United are both memebers of Star Alliance. Delta is a Skyteam member.

Avios- The mileage currency of the British Airways Executive Club program. The distance based nature of the program is simultaneously its strongest and weakest links. Great usage for domestic AA/AS flights, and as part of the Hybrid System.

Bearish- Thinking that a specific program is risky, especially in the mid to long term. Being bearish about a program would mean you’d likely want to hold as few miles as possible in it. See also: Bullish

Boss Coefficient- Part of T-Rate discussions–when flying with someone else your T-rate should reflect the higher of the two of you for both flyers. Comes from the idea that when traveling with your boss you’d probably book more direct flights. see: T-Rate.

Boss Baby Coefficient- Subset of above Boss Coefficient, but pertains to travel with children. Time is even more valuable/limited with kids so this is usually higher than a normal Boss Coefficient.

Breakage- The loss of, or forfeiture of any points, miles or money injected into this game.

Bullish- The opposite of Bearish; thinking that a program is a good value, and wanting to collect more miles in that program.

BYOE (Be Your Own Elite)- The Milenomics Elite Program. Like Elite levels in airline frequent flyer programs the Milenomics BYOE program allows you to pick and choose which services you want to guarantee you receive when you fly. Born out of frustration with airlines over-promising and under-delivering, BYOE takes matters into our own hands.

Closed System (Credit Cards)- Any credit card which earns points or “miles” which are tied to the credit card company and unable to be removed. Closed System cards usually give each point a fixed value, sometimes less than 1 cent, other times above 1 cent. This value, while fixed, can change. Closing the card outright usually means losing the points. Special cases of Variable Value closed System cards are the Chase UR program and Amex MR program, where points can be transferred out to airline and hotel programs.

cpp – Cents per point of value achieved when redeeming a point currency for a reward.

Credit Card Calendar (CCC)- The CCC is a quarterly application spree used to beef up account balances. Knowing the amount of spending you’ll be able to put on these cards will allow you to earn huge average points per dollar during the months following the CCC applications. For significant others applications are spaced out every 6 months, with each person alternating applying during each 3 month session. Tied closely to the seasons: September (Fall), December (winter), March (spring), and June (Summer).

Denial-of-Service Attack- Occurs when you expect a certain level of service, usually in a premium cabin, and don’t receive it. DoS Attacks, although rarer, can also happen in coach. Examples include: poor service from attendants, lost luggage, bad or inedible food, and any malfunction of seat/entertainment system.

Diversity (of Accounts)- Balancing risk and reward, with an eye on keeping accounts open, and banks happy. Usually means giving up miles, by not going too hard too fast on certain deals or techniques. Also can be spreading out of purchases across many cards to lessen each one’s exposure.

Earn Ratio: Your Earn ratio is the ratio of earning to burning in your personal travels. The most common Ratios are either 1:1 or 1:2. Some people are fortunate to have >1:1 Burn ratios; ie: Dual-Earn, Single-Burn (2:1) The smaller the ratio the harder your travel goals are going to be to complete with miles. Earn ratios help you know how aggressive to be–and also help you to know the target levels you want your accounts to have to avoid orphaned miles.

EQM-Zero- Flying 0 Elite qualifying miles per year; Having 0 EQM miles at the end of the year. Assumes you flew every flight that year as an award flight. Something to strive towards even if impossible for your specific demand schedule.

Financial Firewall- Separating your legitimate finances from your MMR linked finances. Compartmentalizing to limit exposure during Adverse Action. See also: System of Accounts

Flexible Flyer Miles- The idea that the Term “Frequent Flyer Miles” is incorrect—and that miles must be used with flexibility; in time, route, or cabin class.

Financial Review (FR)- Often used by CC companies Amex and Citi to verify financial information matches with spending patterns. Can result in AA (Adverse Action), or can result in no negative action.

Frequent Flyer Fingerprint- The idea that no two flyers are exactly identical; Made up of your traveler type, as well as your answer to a few other travel questions, such as where you like to travel and where you live.

The Float Rule- If tomorrow your ability to cash out MMR purchases went away would you have serious issues with paying your credit card bill? If the answer to that question is yes–you bought too many. See: MMR.

Gonzo Suite– A premium hotel suite, often at a Hyatt hotel, with greater than 1,000 SF of space and some other amenity usually not found in standard hotel rooms such as a grand piano, terrace, dining room, or full kitchen.

Host Program- The program you hold your miles in. This is the airline frequent flyer program your miles are in–not the airline you want to fly on, or the alliance members you’ll search for award space. Host programs’ rules must be followed for all award bookings, and often vary from one alliance member to another.

Hybrid System-Technique whereby a one way flight and a round trip, with stopover flight are put together into 2 trips. The first leg (one-way) is usually flown on either: Southwest, AS/AA (With Avios), Virgin America, or Jetblue. Could even purchase the first leg with cash if the flight is low cost enough. The second part of the trip is flown on Delta/AS with a stopover allowed in Delta hubs. Works best when you live in a Delta Hub

The Icarus Paradox- Credit Card companies’ ability to use the same tools we use to fly to clip our wings. The idea that overuse and misuse of cards can lead to Adverse Action.

Law of Supply and Demand (of Miles)- Rule Milenomics live by where you estimate your demand for travel (and miles) and earn your supply according to that. Too much supply means a surplus, and miles and money are left wasted; too little, a shortage, and money is spent that need not be.

Legacy Carrier- An old guard domestic airline that is part of an alliance. American, United, and Delta are legacy carriers. Southwest and JetBlue are not. Often relevant in context of their utility towards international award redemptions.

Leapfrog Method- Planning out your next trip, as well as the trip afterwards to ensure most efficient use of miles. Also allows you to be earning in two programs simultaneously with goals to reach in both. Once one trip is booked earning focuses on the trip following that, and then another destination is picked and focused on as well.

Low Level Hedge- Techniques used when there are no low level award tickets available. Ideally used when little flexibility in dates. See also: Next Day pricing.

Market Timing- The strategy of deciding whether to spend down your mileage balances or acquire more miles based on future ideas about a specific program. See also: Bearish and Bullish.

Milenomics- 1)Blog found at www.milenomics.com, a way of rethinking travel to save money and miles. Placing a value on your time, comfort and travel needs. 2)Plural; Persons who follows the ideas set forth in Milenomics. Singular; Milenomic, as in “Jim sure is a Milenomic, isn’t he?”

MMR- Milenomics Mileage Run. Term given to the process of purchasing financial instruments (prepaid cards, reloads, MOs, GCs, etc) with credit cards to earn Flexible Flyer Miles. Costs include the fees for the cards, as well as time, and travel.

MOPO– Money Order Point of Origin. The store you purchase your Money orders at. Using the MOPO you should map out all the closest other stores and banks you can use to do all your MMRs. Your MOPO can be thought of as an Anchor point, which you use to limit travel and time spent.

MR – An AmEx Membership Reward point.

Next Day Pricing- The price of a flight if you took it tomorrow. Can be useful in gauging the eventual price increase of a flight while waiting for award seats to open up. A component of the Low Level Hedge.

Open System (Credit Cards)- Any Credit card which moves the points/miles earned into another account, often held by the hotel or airline the card is branded with. Open system cards have the benefit of variable value to each mile, as well as no danger of losing points when accounts are closed.

Operation Twist- Utilizing the free one ways of AA tickets in conjunction with avios, southwest, virgin America, or Jetblue to create a free second trip. Best used when you live close to, but not at a major AA Hub city. When the mileage used to fly from your home airport to the hub city and back is less than the free trip Operation Twist can save money and miles.

Orphaned Miles- Miles that are not usable either due to account balances being too low to redeem for even one flight, or programs not flying to places on your demand schedule. Orphaned Miles represent lost money and should be avoided at all costs.

Penalty Box– A hopefully temporary limitation on the ability to earn rewards from a bank for new welcome bonuses and referrals. Usually used in conjunction with Amex.

Range Anxiety- The fear of not having enough miles, leading to hoarding of miles. The idea that using your miles will leave you with too few.

Rule of 7– Quick way to approximate the number of miles you will need to travel. Take miles flown and multiply by 7. Useful to estimate the total number of miles you’ll need this year. Does not take into consideration Business/First flights–so be sure to adjust accordingly for those should you decide to BYOE and upgrade yourself.

Saver Level Availability- Award flights that are available for the lowest number of miles possible in a fixed value award scheme. Also the flights bookable with partner miles. Most commonly relevant with legacy carriers.

Spec Miles- Miles bought for purely speculative purposes, without a clear use in mind. Can sometimes result in great values. However, when spec-miles go unused they represent money tied up in a program.

The Staples Effect- 1) During a MMR and the item you’re most interested in buying is not in stock, so you step down to a different instrument, at a higher cost, just to earn some miles. 2) Suspending your most rational judgment in the face of earning points. Most commonly occurs at Staples when $200 cards are out of stock, and instead 2 $100 cards are bought at double the fee.

System of Accounts- A strategy and part of your Financial Firewall, where accounts are set up and coordinated to tie into services which require name/address matches. Keeping accounts separate from one another in 2 person mode through the use of different addresses and different checking accounts.

T-Rate- The value you place on your time in all areas—MMRs, flights, connections. This is a number that is not set in stone. As time goes on you’ll get a better idea of where you see your T-Rate. A good place to start is $10/hr.[rule]

TYP – A Citi ThankYou Point.

Uplift- The amount of value achieved per point when redeeming points for an award.

UR – A Chase Ultimate Reward point.

Thanks! I was wondering what “MMR” was for a while…. My fav term (not situation!) is the Staples Effect and I sure hope it doesn’t happen to me tomorrow at Staples!

How do I load my cash card online if I only have the 10 digit#.