The idea of how miles “work” is often hard for people to comprehend right away. This learning curve can be quite hard to get past. Twice before I wrote about this: “why are frequent Flyer Miles so hard to use,” and “The basics of Frequent Flyer Miles.”

Today I’ll write about miles from a different perspective in the hopes that it allows you to see another perspective and better understand the limitations miles often have.

Limit Your Thinking of Miles as an Investment

I often draw connections between systems I know to help understand systems I don’t know. When learning something new I like to relate it, even in small ways, to something I already know about. It is for this reason Milenomics borrows from investing and economics to put together a way to think about miles.

Borrowing terms about investing works for miles because miles are an investment of sorts. They’re not a store of value–and we should not invest in them. If anything, they are a very time sensitive investment. In the short term they hold value pretty well since we can book 11 months out with them. In the long term, miles that are great today might be terrible in a year or two (United, I’m looking at you). Mergers, bankruptcy, alliance members leaving–all add to the uncertainty in the long term with Miles.

Time Decay of Miles

Today we’ll introduce the idea of time decay. Time Decay is a common term in investing, especially with stock options. As I mentioned earlier, long term, miles depreciate. Think of someone who earned their miles by flying–these are affectionately referred to as “butt-in-seat” miles (BIS). My friend in this post earned almost all his Delta Skymiles as BIS miles. Just before he went to redeem them he was hit with a devaluation. Time, and Delta (the airlines) had eaten away at his miles.

This type of steady value, and then quick dips is similar to how the price of a stock option works. Miles are similar to stock options in a few ways:

1. They have a value in the short run–but in the long run they continue to lose their value (depreciate).

2. Some miles expire just like an option. While you can reset the clock on these in very simple ways, the expiration is very real.

3. With an stock option it is sometimes cheaper to let the option go than to exercise it, or sell it. Miles can be the same way. When you have very few miles–Say just 5,000 AAdvantage miles –using those miles probably would mean you’d have to buy up to 12,500 miles somehow. It may be best to just let them go–just like letting a stock option expire when it would cost you more (comission) to close out the position.

4. When you’ve got a “sure bet,” be it a stock pick or miles, you need to get in, and out quick–make your booking and let someone else get caught holding the bag.

Depreciation of Miles Over Time

To Milenomics the “value” of miles is very subjective. Part of why Milenomics doesn’t publish a list of what miles are “worth” is that something that might be very valuable to you might be useless to me. And the miles that have great value to me might be useless to you (say if your home airport isn’t served by a carrier).

The overall trend is for miles to depreciate over time. This is similar to the depreciation of any asset, with the difference being that the depreciation comes in spurts, like the time decay of an option. Depreciation and Time Decay are awful to our miles. They erode value over time. While right now you might have enough miles for a trip, in a year or two, assuming your mileage balance remains constant, you’ll no longer have enough. If your ability to earn more miles is significantly reduced the value of your miles (to you) has depreciated quite heavily.

The Loss of Value is Different For Each of Us

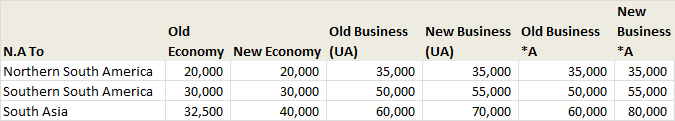

Today’s post does not help to put a specific value on miles. Just like how miles are worth a different amount to each of us; Your rate of Decay and my rate of decay are very different. Today I’ll use the Old and new United award chart as an example. If I use my United miles to travel to Asia, and you usually book awards to South America with your United miles–you’ll see very little change over the last devaluation:

The difference between the old and new awards for travel to South America is negligible However for me, trying to travel to South Asia, the loss of value has been huge.

This is why Milenomics uses certain miles for certain travel (also known as the Principle of Mile Conservation) Between the United Award chart changes and US Airways merging with AA, 2014 will surely bring with it adjustments to the programs Milenomics chooses for Domestic and International flights. Since those events have yet to occur, for now the current mix of programs I use is still:

For the future, using what we know about time decay and how miles depreciate–look at the programs which have just announced a devaluation. High on your list should be using those miles prior to the devaluation. If you can’t do that, then use them for a redemption that hasn’t devalued much–or increase earning in those programs to offset the devaluation.

Whatever you Decide–Don’t Hold Your Miles

One investing idea we need to never use is “Buy and Hold.” A cornerstone of Milenomics is getting a firm idea of how many miles you actually need, earning them in the programs that make your travel happen for the least miles (and money), and then using those miles. If needed, switch to another mileage program to fulfill other flights on your demand schedule. Once you reach EQM-Zero switch to cash back earning. Along the way use the tricks you’ve learned to reduce your costs to increase your earning.

The value of our miles decays over time. Unfortunately we can’t always know a devaluation is coming–but when we hold very few miles the effect each devaluation has on us is minimized.

While it is never a good idea to stockpile a large amount of miles in any one frequent flyer account and hardly ever use it, what do you think about stockpiling an enormous amount of points in a single transferable points program? I have a cousin who has 250,000 AAdvantage miles precariously sitting in her frequent flyer account, and she doesn’t earn miles particularly quickly. I feel like she should hurry up and book something in order to reduce her stash at least by a little bit.

On the other hand, my friend has a collection of > a million Membership Rewards points. Do you think there’s a high risk of that devaluing or OK? It’s interesting to note that my friend doesn’t redeem his points quickly because he can charge his company’s expenses onto his own credit card, so he has a nearly endless stream of points coming his way. He also wants to always get at least 2 cents of value out of each point, so he oftentimes ends up paying for plane tickets instead of doing award redemptions if there’s only high-level award space available.

Brandon,

Is your cousin paying to fly other flights? If she’s got those miles and isn’t traveling–maybe there’s a reason. Travel is not free–even when flights are paid for with miles–so for right now the best move for her miles might be to use them, but the best move for her could be to not. Make sense?

As for your friend–I’m 100% against that type of hoarding. His quest for 2CPM or better has him spending real money. It sounds like he’s suffering from Range anxiety.

Instead of booking 1.2-1.7 cpm redemptions he’s buying tickets for $$$. In the case of an average $400 ticket if he spent 30,000 MR on it he’d only realize 1.3 CPM. However if he buys one $400 ticket, and then redeems another at 2CPM he’s spent 20,000 MR and $400 for $800 worth of flights. If I was your friend and had a never ending stream of MR I’d sell them to a mile broker and pocket 1.3 – 1.4 cents per and call it a day. At his rate he’d never burn through his MR at 2CPM. And if he stopped earning today (using the above sample flights) he’d spend $40,000 on flights that weren’t up to his 2CPM valuation to book another 100 flights at 2CPM.

This is why Milenomics values our miles at what we put into them. Your friend puts almost nothing into his miles–except that he constantly “rebuys” by spending cash on flights instead of his MR. He’s reinforcing his 2CPM valuation because he’s spending cash below that amount. I’d sell those 2MM for $25k and open a Roth IRA–if he’s really able to top up so quickly off almost $0 real cost he should be thinking big picture.