In case you missed it, Since I missed it, Southern Travel Girl wrote up a post about the US Airways Share miles promo. (Sorry Susan!)

Giddy for Points also wrote about the returning 100% share miles bonus from US airways. This is the same bonus that was around in September/October. I wrote about this at the time, in a post entitled “The best US Airways Credit Card is a Discover Card?” If you Haven’t already read this post, you should. I consider it an important way of looking at promotions to buy miles.

With US Airways bringing back their best promotion of the year the question I’ve read most is “Should I do this?” I can’t answer that for you. No one really can. Instead, today we’ll talk about what we can learn from this deal, and how best to decide for ourselves if it is a good fit for us.

Market Timing and Spec Miles, A Most Dangerous Game

Market timing is another term Milenomics borrows from investing. In investing Market timing refers to the process of buying and selling stocks in an attempt to predict future movements in the stocks or the market as a whole. Market Timing of Miles is similar–given what we know about the market of miles, should we be bearish–and spend down our miles, or bullish and collect more miles and points? If you want to learn more about which companies to invest in and buy stocks. You should check out, https://www.stocktrades.ca/best-canadian-dividend-stocks-2019/ for more information.

Very few people seem Bullish right now–and for good reason. United and Delta seem to be in a race to outdo each other by increasing the cost of awards. AA And US will merge, and that might not be a good thing for any of us. That leaves us with just a few programs which seem solid still– Avios, Southwest (which also went through a devaluation), And Membership Rewards.

If I was trying to Time the Market for any of these above miles, I’d actually feel most comfortable earning United, Delta, and Southwest miles. They’ve already devalued. The damage has been done, and while we might not be happy with the results, at least we know what to epect. For the long term these programs will probably be somewhat consistent.

The rest–AA and US especially, are programs I’m personally becoming a bit bearish in. Holding 400,000+ AA and US miles has me worried something major is coming. While I can’t do much about my balances right now–besides book a trip with them, or sell/trade them, I can stop acquiring more miles in either program.

I may be wrong–Market Timing comes with the risk that the market actually moves opposite to your idea. If I am wrong, the programs might continue to be great–and in doing that I’ve missed out on buying US miles during the current share promotion at a great price. Then the question becomes, will this type of deal ever come back again?

Speculative (Spec) Miles

Before we answer the question of whether this deal will ever come back again, let’s take a moment to talk about these types of purchases. Any acquisition of miles at the point where you no longer need them would be speculative. A “spec mile” is an opportunity to buy miles, or earn miles that might not come back in the future. From a Credit card offer that might likely be gone (and never come back) to a buy/share miles promo like the current US Airways one (good from Dec 2-6th only), you go in on the deal not because you need to, but because you think the opportunity is better than one that will come in the future.

Spec Miles are risky; you should know that before you start in on them. Money spent on Spec miles could turn into sunk costs, and those miles could end up never being used, or being used in the future for less than you spent on them.

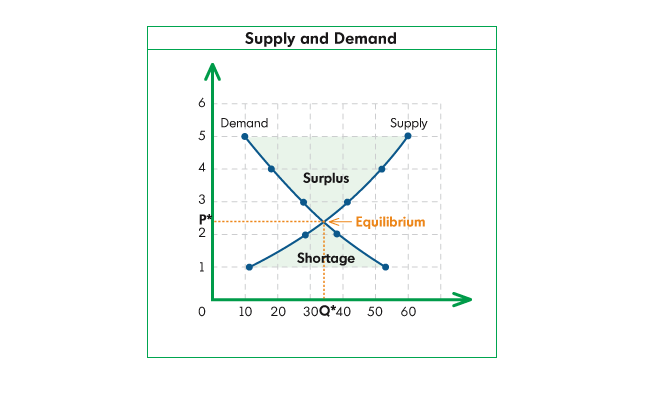

Remember, if your supply of miles is greater than your personal demand for miles, do you even need any more miles? If all your main travel for next year is booked, and you’re close to the amount of miles you’ll need for 2015 as well,then no, you don’t. Regardless of how good the deal is–you’re locking up money you won’t use for years to come.

Erosion of Value: Why Market Timing Doesn’t work

We’ve mentioned before on Milenomics that past performance is not indicative of future results. I was speaking in generalities in that post–but the idea is sound for Market timing as well. Market timing can be an especially bad idea when you incorrectly time the market.

The reason is that there are unseen forces at play, behind the scenes. Airlines who sell miles want our money, in exchange for miles. Credit card companies want our good credit in exchange for miles. In both cases, once the miles have been given to us–they can be devalued. Remember time decay and depreciation? They affect all miles, and in unknown ways at unknown times.

The longer you hold your miles, the larger a devaluation will hurt you–taking away miles, and costing you hard earned money. With the issues surrounding US airways and AA, the merger, and *A and oneworld, Milenomics does not suggest buying any US Airways miles unless you have a short term need for using them.

In fact, as we just saw with United–the more miles are out there, the more likely a program will need to devalue. The more people who take advantage of the US Airways share promotion, the more miles are “created” out of thin air, and the quicker the program will need to devalue.

The Exception to the Rule: Short Term Use

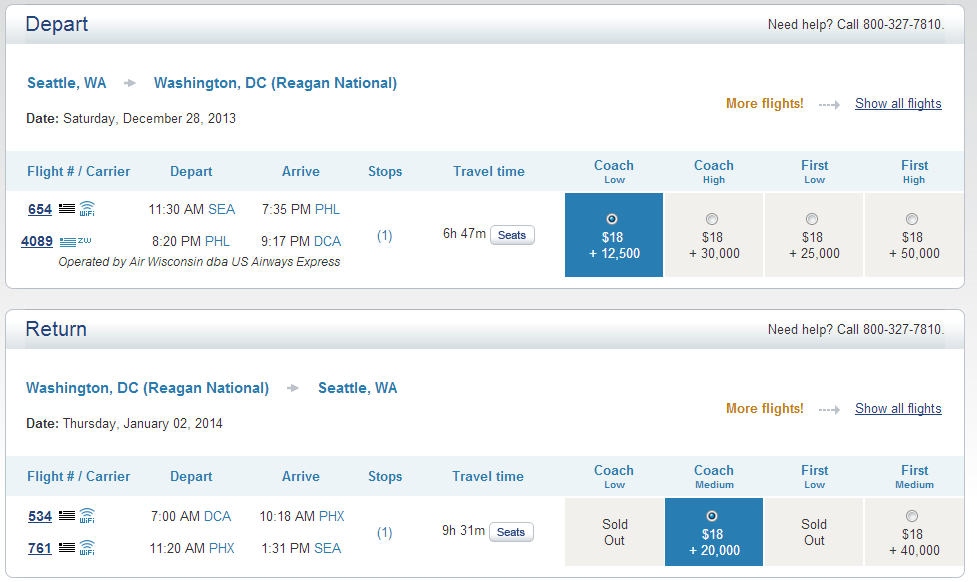

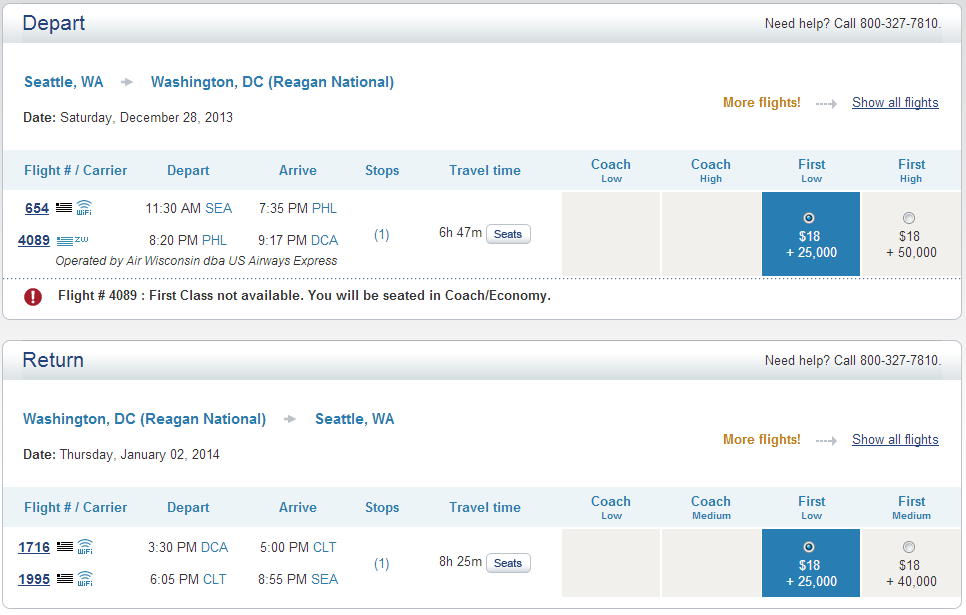

If you’ve got a great use for these miles in the short term, by all means, share, get your miles, and burn them as quickly as possible. One thing this does is give you a chance to cut down the cost of travel home for the holidays. In a completely unscientific pair of cities, SEA and IAD, I did the following search, for peak travel 12/28-1/2:

Using the Share miles promotion and holding a US Airways credit card you’d be able to make this trip happen for 27,500 miles and “just” $35 fees.

Using the 1.135 cents per mile from the share promotion you’d be able to buy the miles you need for this flight for just $312.13. Add in the $35 to book this, and you’re at $347.13. Not a wonderful use of miles, but you just saved yourself $298, and got to spend New Years with Family or Friends.

There are some lost miles–which you would have earned from flying this via paid travel- about 6,000 or another $68 at the 1.135 CPM you’d be buying those at. If you were already planning this trip–and were waiting for a cheaper way to get there–the share miles promo could be just that.

BYOE and the Share Miles Promo

Because I’m always looking for new BYOE ideas, I wanted to also include the following option. On the same dates of travel as above the option to fly in US Airways first class is available at the low level:

This would be 45,000 miles plus $35. Buying the miles needed during the share promo means you’ll pay $510.75 for 45,000 miles + $35 in fees + $68 in lost miles, for a total of $613.75. This is below the $650 cost to outright buy this ticket. You’ve instantly upgraded yourself for -$46.25 from the cash fare. Of course, this is more than $250 more than flying it in coach using the share miles promo, but I think $125 each way is a cheap “buy up” on an award ticket, don’t you?

Take a look at upcoming flights you’re looking to pay cash for–and see which have this type of availability. Upgrading the flight for negative cost is a no brainer–but even if the cash fare is a little cheaper and you’re spending a little more it might make sense–think of it as a cheap “buy up” to First. I flew US Airways First over Thanksgiving break, and was very pleasantly surprised with their level of service.

Should You Do This?

Probably not. If you’ve been tracking a complex international star alliance award, and need some miles to make it happen, sure buying them now might make a lot of sense. But if you’re buying Spec Miles because you think this is a great “deal,” what you’re really doing is Market Timing. And the best plans are often cut short by a program change. And as far as Spec Miles go–USDM miles right now are a risky proposition. I’ve got plenty of USDM–too many really, and for that alone I’ll be sitting this one out.

If you have a short term need for a flight–and that flight is serviced by US Airways, take a look at award space, and see if you can save even a little by buying the miles and booking the ticket today. Or use this as a cheap way to upgrade a paid flight to First class, and Be Your Own Elite.