I’m excited to be home from my trip up to Seattle, Port Angeles, and The Olympic National Forest. Quick getaways like this are an excellent use of Milenomics. The flight up was 7,500 Avios, the flight back was a free one way, as part of the hybrid system. Posts were spotty while I was away–I haven’t yet figured out how to properly schedule a post, but that’s high on my to-do list.

—

Today we’ll discuss taking our Milenomics lessons and applying them out into the real world. Mile earning and spending have the potential to help you outside of just travel. If you’re hesitant to get into earning and using Miles, I’d like this post to try to gently push you along towards earning miles, and using them for [all] your flights.

What follows is a collection of my experiences, and how Mile earning and spending techniques found in Milenomics have helped me. While I can’t guarantee they’ll all apply to everyone here, they are meant to show you that there can be benefits, outside of travel, to the game we play.

Complicated Finances Call For Simple Error Checking

I started heavily getting into miles a bit beofre getting married. Prior to this, keeping track of all my accounts was easy–I knew all my bills were due certain days, and I could keep it all squared away without too much trouble. Enter Credit Card Churning: new accounts were being constantly opened, and had to be juggled with old existing accounts. Churning meant constantly having real and fake spending on the same accounts.

I had to get things in order, and fast, if I wanted to make sure something big didn’t fall through the cracks. The system I came up with was to put all my Mile spending into Mint.com. Using Mint.com I was able to setup sort of a General Ledger, as spending automatically hit the account, and then I could include negative items when I cashed out. What was left (fees, profit somtimes) would keep a rolling total of what I had spent that month on my miles.

Fast forward a year, and I’m newly married, and juggling twice the finances. My wife had her own set of cards, bills, and due dates. My old habit, prior to getting involved with miles, of keeping track of everything squared away in my head would surely have caught up to me, and qiuck. Juggling 20+ credit card accounts is not easy right now, but it sure is easier because of all the practice I’ve had from MMRs and Credit Card Churning.

If you’re not already using Mint.com or something similar, I highly recommend it. Think of it as an online version of Quicken (now owned by Quicken actually). Whether you decide to use it for your Mile earning, or just for your personal finanace it is a great tool to have, and helps you keep track of everything from bill due dates to budgeting.

System of Accounts Protect You From More Than Just AA

If you look at my Credit Card and bank statements you’d think I’m either a serious shopaholic, or a money launderer, or maybe both. I’ve discussed setting up a system of accounts, so that you have your real finances separated from your Milenomics accounts. The benefits I illustrated were for earning more miles, while also insulating you from AA and one account shutdown taking out both you and a spouse

We discussed Financial Firewalls as important backstops against one closure having a domino effect, causing issues with your “real” accounts as well as wiping out the two of you versus just wiping out one of you. Today I’ll flip this idea around with a real life example of my own:

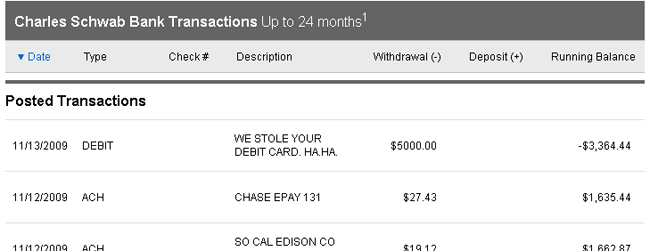

I woke up one day a few years ago and my real bank’s debit card was somehow cloned, (even though I never use it) and used to the tune of $5,000. My checking account was quickly zeroed out–and actually went negative, with a margin account covering the difference (what a mess!). To make matters worse, this was done on a Thursday. The morning I woke up, my paycheck had been direct deposited into this account–however it didn’t dent the negative balance.

Schwab froze my debit card, and sent a new one out. However in the meantime I had no access to cash. No way to pull cash from this account, and no way to pay bills due to the negative balance. I was told to sit tight for a day or two while they sorted the whole thing out–and the money obviously would be put back.

For that weekend I was dead in the water with this account. My rent was due–bills were to be paid. Had I been a single Checking account kind of guy I would have had to explain to a few people the issue at hand, or spend more time on the phone with my bank, and ask them to expedite the reversal of all of this.

Instead I shifted gears, and used one of my burner checking accounts. I had access to cash should I need it, and with all my credit cards still accounted for I was able to buy anything I needed without issue. The situation was a bad one, but the only effect it had on me was one 30 minute phone call.

Spending Miles Can Re-wire Your Brain

Not only do tickets booked with miles usually allow more flexibility than paid tickets, but using our Miles to fly can also help our problem solving skills. The flexibility miles offer–along with the learning curve in using them brings about problem solving skill-sets that aren’t used by most of us.

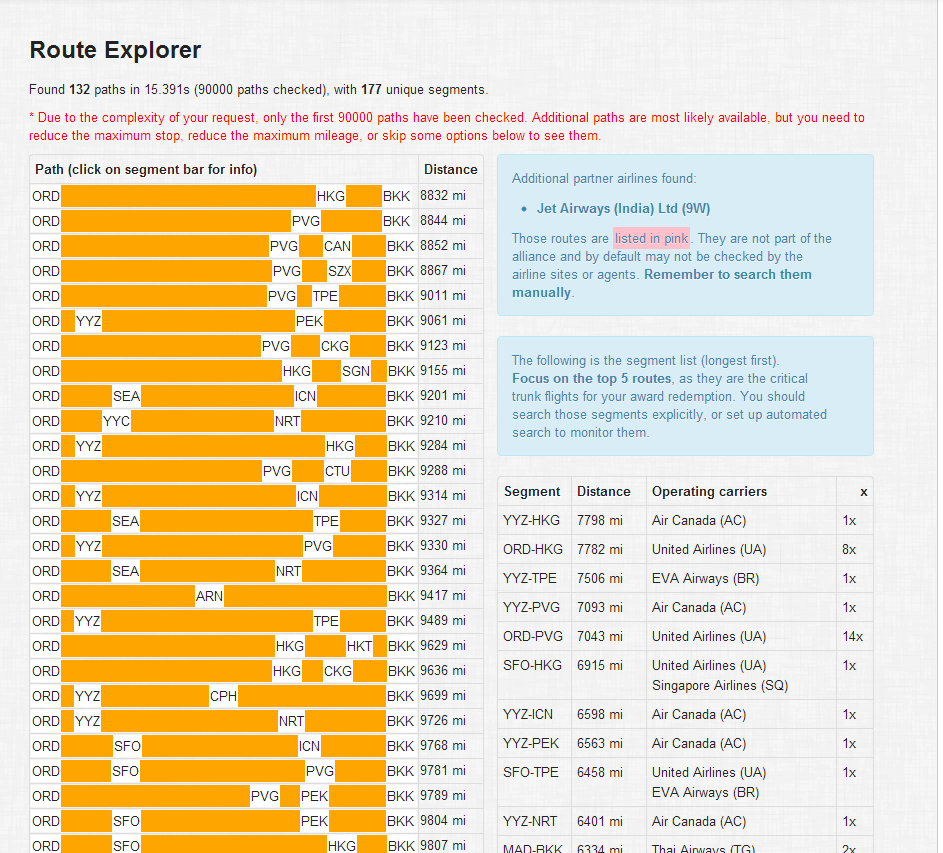

Solving the problem of how to get to a specific place with specific miles is an extremely complex one. Just look at the possible routes between ORD and BKK from our Award nexus search:

That represents 132 different ways to get from ORD-BKK. 132 possible combinations, and this is only for *A, and only from one location. If you were holding both oneworld and *A miles, and wanted to juggle the two to make a booking happen, or decide which had better availability for your dates you’d easily be looking at 200+ options.

While that sounds daunting, in reality the solution is usually less complex than that. But getting the most value from those miles can be an exercise in research, trial and error, and thinking outside the box. Sometimes the solution ends up so far from where you thought it would be, and along the way you’ve learned a lot too.

When something is easy–too easy, we’re not getting much from it. Milenomics is not going to be easy. “Push button, receive prize” gets old. real. fast. Learning and applying what we learn should be done not just for miles, not just for travel, but for everything we do. Approching new problems in the real world with the same mindset we approach award redemptions can lead to amazing solutions we didn’t know even existed.

Consumer Spending Controls

No matter what blog you read, the #1 Rule of using Credit Cards to earn Frequent Flyer Miles is:

NEVER hold a balance.

Doing so is not only very expensive, but it also means somewhere you spent too much on something. Mileage Cost Tracking has stopped me from paying for unnecessary miles, and saved me money there.

In the real world I’ve limited my spending as well. It was easy and enticing to hold a balance when I was much younger. As my available credit ballooned, if I had kept this up I would probably be looking at a mountain of personal debt. Knowing that the miles I earn are only valuable if I do so without holding a balance has led me to spend less.

Combine this with my budgeting via mint.com and I’ve got a firm handle on my finances, thanks to collecting Miles. Overall my focus has shifted, from collecting “stuff” to collecting memories, trips, and seeing the world.

I’ve talked about how international travel changes you for the better. Seeing the world reminds you that materialism is overrated–and memories are underrated. Create more of the latter by giving up some of the former.

—

What are the examples you have where Mile earning or spending techniques have helped you in the real world? Share them in the comments, on twitter @Milenomics, or on Facebook.