Reader Kate Posted a comment last week asking about how to keep everything straight with respect to payments, due dates, and such. Today I’ll start a two part post about this. I won’t get into payments and due dates today, but that is only because I want to step back a moment, and discuss purchase tracking first. Purchase tracking is the first step towards ensuring you “close the loop” with all your purchases and payments.

Today’s post was also inspired by a tweet I read yesterday:

“I just spent a $1k in this raggedy-ass CVS. For these 2 slips of plastic. That I’m going to throw away in an hour.” – Newbie #travelhacking

— Ariana Arghandewal (@PointChaser) January 15, 2014

In which an office-mate of @Pointchaser mentioned that he was buying two pieces of plastic for $1,000 and will be throwing them away in an hour. The cards we buy and load/spend start their life out as simple pieces of plastic. In fact seeing them all arranged on the shelf at the store so neatly makes it hard to place a value on them.

We purchase and activate them–but then remain active for such a short period of time, hours or minutes, that we then think of them as trash. At the very least, they’re not trash until your credit card is paid back in full.

Today I’ll go over some of the tips I use to keep purchases in order, ensure I know when cards are unloaded fully, and generally keep my wits about me while juggling so much plastic.

Purchase Tracking, Milenomics Style

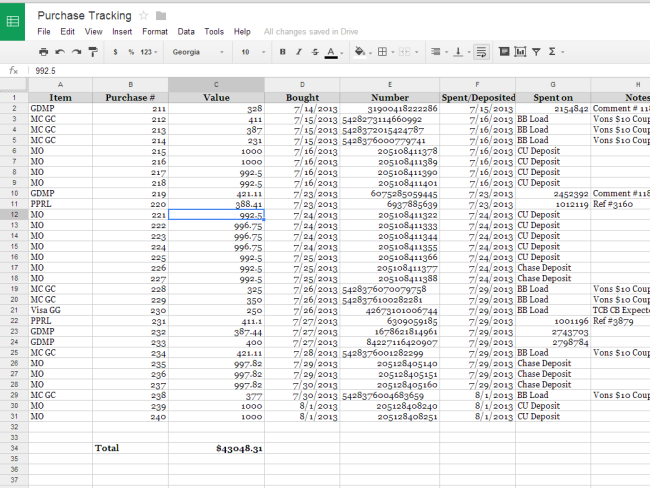

I introduced you to the idea of cost tracking back in September. Keeping a spreadsheet on your phone and inputting the mileage and cost of each item is important to know your total cost for each mile. It is this total Cost we use when booking seats to try to get our investment of time back out of the purchases we made.

Today’s post is about tracking purchases to ensure you don’t lose track of money. Sloppy purchase tracking is a slippery slope, and can lead to losing cash. One lost VR, or misplaced GC could wipe out a year’s worth of profits. Even if you’re sure you won’t lose these items, Debit cards have been hacked and drained, VR have been loaded after purchase by someone else. Getting your money back will be much easier when you follow a good method of tracking purchases.

Hold, Then Fold

Hold then Fold is easy to remember, and important to do. Whenever I’m done with a purchase–say a VR card is empty, or a debit card has been drained I fold over a corner. Sometimes I’ll fold them back and forth and break them off, other times just a fold and then I know the card is at $0.

Hold then Fold is simple, and can instantly show you which cards are empty and which cards aren’t. Doing a hold then fold also allows me to keep multiple cards in my wallet and know which have been loaded and which haven’t. It eliminates the possibility of accidentally throwing out a live card as well.

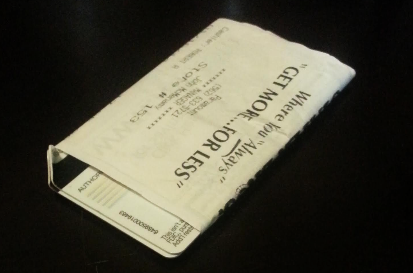

Save Those Cards and Receipts; Roll and Tape

Just seeing a fold on the edge of the card doesn’t mean you can throw that card out. For some excellent info on what can and does happen when you screw up read the Vanilla Chronicles on Will Run For Miles. Even when you start your Hold then Fold process, do not throw out your cards until you balance at the end of each month. The reason is simple–what if something went wrong, and a card didn’t load right? If the card is in the trash you’re stuck.

I’ve heard card issuers sometimes want register receipt scans, front and back of card, basically anything to prove you’re the person who bought the card, and not a scammer trying to defraud them. Again, chalk this up to the scam artists out there–but we need to keep information about our purchases in case something goes wrong.

The Roll and Tape technique I use is to roll the long register receipt around the cards which were bought on that receipt. I tape the receipt to the card and file it in a shoebox. I can quickly pull any cards up should I need to. If you do nothing else, Hold & Fold and Roll & Tape your purchases. For more advanced purchase Tracking, let’s take a look at the spreadsheet I use, and the tracking technique I like.

Advanced Purchase Tracking–Secret Codes and Numbers

In my car is a sharpie pen. When I get back into the car from the store I add a number, the next in a series to the front of the prepaid card I just bought. If the last card I bought was 324 then the next is 325. On the receipt I write 325 next to the same card, and then 326, next to 326. On the back of the card in the space for signing, I write the amount of the load. I write this amount because I load odd amounts, if you always load the same amount you might skip this step.

This information gets added to my spreadsheet for tracking of purchases. Click on the image of the spreadsheet above and copy this spreadsheet to your google drive, or save a copy to your computer, and then add it to your phone. When you leave the store take 1 minute and input the date, card number, type, where you bought it, purchase tracking #, and credit card used to buy it.

These six pieces of information create the basis of all our purchase tracking and payment balancing information. If you’ve not been doing such tracking I urge you to start. We often forget that the small piece of plastic or cardboard in our hand is worth as much as $500. Always think of it as such–even when it is empty, treat it as you would treat a $500 bill.

Putting a code on each card, as well as on the receipt gives each purchase a trackable number. Should I need to go back and dig through old cards I can look on the receipt for purchase #210 and then unwrap that bundle of cards, knowing card #210 is there. For Money Orders I keep all stubs, knowing that if anyone comes asking about my purchases I’ll have information to prove that I was the person who bought and deposited them. Keeping these stubs also helps for balancing at the end of the month.

A simplified version of all of this would be to start at a predetermined amount each month, say $499.01 and buy every additional purchase in .01 increments. This would give you a unique amount for each purchase, $499.01, $499.02, $499.03, etc. You could skip coding each purchase with a purchase number, as the amount on the card would be the purchase # at that point.

Note: If you’re cashing out Debit cards with money orders you’ll want to write the gift card as the card used to purchase the MO, but track both.

Month End Close

Yes, this is just what it sounds like, at the end of each month I do a month end close out. It doesn’t take nearly as long as it sounds. I open the purchase tracking sheet, and go one item at a time, one by one. I double check by looking through MO stubs, logging into the bank, Bluebird, or anywhere else I’ve loaded or deposited items. If I find the item (again this is where random amounts help), I mark it verified. All verified and I know everything matched up that month. This is the earliest I’d be comfortable in throwing the cards out.

I’ve found that I’ve missed cards while doing month end close–I’m sure I would have eventually come upon them without all of this purchase tracking. But when dealing with tens, or even hundreds of thousands of dollars why leave it up to chance?

Why So Much Work?

I hope all of you adopt at least one item from this post today. I know that all of this seems like a lot of work–I assure you once you get into the swing of things it is not. Hold & Fold takes no time at all, and filing your purchases using the Roll & Tape method is something that can also be done regardless of whether you use a spreadsheet or not. Entering data for purchase tracking and cost tracking I takes about 1 minute.

I treat my MMRs like a business–because they are just that. I’m in the business of manufacturing Milenomics Manifolds after all, and I’m doing so with my own hard earned money. As much as I write about hating to lose Miles I hate losing money even more. Tomorrow I’ll go over paying bills, keeping track of due dates, and how I make sure everything gets paid.

For now what’s your best tip for keeping track of purchases? Any ideas to streamline my process would be greatly appreciated as well.

- Let’s put our best ideas forward

- Let’s help each other out.

- Let’s be #Milenomics.

Everything below this line is Automatically inserted into this post and is not necessarily endorsed by Milenomics:

I use paper clips around the receipt and card. I use a sharpie on the card to indicate where the money went- , account type and owner as well as date. if there are random amounts left on a card, say $1-$5, i drain them at the gas pumps. It takes a little longer but you know the card is empty. There’s a box next to my tax records where I throw all the receipts, cards, and mailers.

Yesterday, I figured out 1 of several gift cards didn’t arrive in the mail. The documentation will be important to figure out which one is missing, if contacting the company is required.

Great post!

While I admit I have not been this thorough I do keep all the visa/mc debit cards, VRs, and other manufacturing cards in a box. I will step up my record keeping a bit now!

I would also add rebates. I do quite a few rebate deals. I always get the free after rebate items at staples and donate what I do not need (and write that off!). I also do it at newegg and any others I can find as it is free mixed manufactured spend. These days more and more rebates come as visa cards. I find that they rarely get PIN numbers so I use them in other ways. I have a spreadsheet of when I filed the rebate, the amount of the rebate, and the type of rebate (check, visa card, gift card, etc) and have a column for when I receive it in the mail. I of course scan all mailed rebate forms in case an issue comes up!

My tip: If you use gift cards and have a few dollars left I find that grocery stores are a great way to use it up. For example my local Kroger self checkouts are smart enough to drain gift cards and ask you to pay the balance. I have also been able to do this at Walmart. I am sure there are other options out there too!

On the flip side I tend to find a lot of gift cards on the ground in my Kroger parking lot. I always pick them up and run a balance check on them. So far I have found: Starbucks $3.57, Visa $0.99, and Kroger GC $1.52. One man’s trash is another man’s treasure? It is literally finding money on the ground!

Every penny counts in this game and in life too!

LoL I love it Robert, Like finding quarters in the pay phones when I was a kid! I can’t imagine why someone would throw out a card with a balance on it, but I’ll start looking.

Good point about the rebates as well. Tracking them is just as important. I also think that some rebate companies are not to be trusted, so keeping scans and such is great advise as well.

Exactly! It is just our quarters have been adjusted for inflation now and are plastic!

I am in New Orleans this weekend for a quick 3-day trip and I found another $50 Visa gift card on the ground.

It was even bent up like someone thought it was empty and tossed it. I picked it up.

We stopped at a coffee shop and I called the number on the back. It still had $3.20!

Pick up the gift cards guys. You never know!

I use a hole punch on the lower right corner

Of the card to mark it as spent. I plan to

Make a “house of cards” using hot melt glue

In the the near future!

I find it funny how many things we do that are similar. Always having a sharpie, coding receipt to card etc etc. I am very detailed myself otherwise I dont know if it would spin out of control. Nice post here 🙂

MU: I’m surprised as well, I had no idea there were so many of us Sharpie Carrying card-coders out there 😛 I always worry that something will slip through the cracks, and don’t want that to impact the bottom line. Thanks as always.

I deeply appreciate this support group for us Sharpie-marking, plastic-card-purchasing, travel-aspiring freaks. We all run on a similar treadmill, and it is great to advance best practice. Keep up the unique and helpful posts. Thanks!

Add my name to the Sharpie club.

When I get gift cards from rebates [which usually do not have a PIN and thus cannot be loaded onto Bluebird], I write the remaining balance on the card in a Sharpie as I drain it. Why do I do this? Because I find this way easier than looking up the balance online or via phone every time [and time is a valuable resource that should not be wasted…].

I agree with the poster above that grocery stores are great places to do split-tender transactions.

Good suggestions. I’m also a card corner bender (or corner snapper on the VRs), but unlike in your photo I would think it would be better to bend a corner without the magnetic stripe, just in case you do need to swipe it in the future. I no longer use a sharpie to write on the cards, unless there is some partial balance left over.

I also find the penny-as-counter trick works well for buying MOs, though for my system I use the pennies of the total transaction to signify the day of the month; e.g., a purchase made on January 19 would be for an amount like $x,xxx.19. Works for me, and doesn’t require keeping a master answer key.

PawTim: I never thought of using the purchase price as a way to encode the purchase date. Really creative way to track dates and purchases, I’m digging it.

Exactly! It is just our quarters have been adjusted for inflation now and are plastic!

I am in New Orleans this weekend for a quick 3-day trip and I found another $50 Visa gift card on the ground.

It was even bent up like someone thought it was empty and tossed it. I picked it up.

We stopped at a coffee shop and I called the number on the back. It still had $3.20!

Pick up the gift cards guys. You never know!

Excellent post! I had started a tracking spreadsheet myself, but you’ve covered some very important additional details. One thing I noticed is that Rite-Aid receipts list cards/Moneypaks as ************0000, so there’s no way to tie them to a card. Have you experienced that?

I like the odd purchase amounts. Do you ever get questioned about them? I suppose it can’t be worse than, “Back again, huh? All $500 again?”

e36: The odd amounts help with tracking for Moneypacks. I track based on my internal combination of MP# (Up to MP06 for March), and an amount. It also helps to keep receipts squared away. I absolutely hate how the 00000 is shown on MP receipts from Rite-aid. If there ever was an issue *knocking on all the possible wooden objects around me* I’d have no recourse if I bought each one for the full $500. $497.12, $497.13, $497.14…gives me some level of tracking at least.

As for odd looks–I Almost always start smaller than $500. I like to test registers and cashiers, and keep notes about both. Starting with an $217 purchase for a MP is way less suspiscious than $500. As you start to get to know the cashier start scaling it up, $308, $422, then just hold at the high $400’s.

Yeah, great points. I was so set on maximizing the amount to fee ratio that I didn’t think of the potential downsides. I’ll be tweaking my system based on your advice. I appreciate it.