This is likely the latest anyone has written a post about #MileMadness, as you’ll see this is a real update on spending that occurred in March. I’m sharing it to hopefully show how good ideas can turn bad and how important the float rule can be.

—

Some of you might remember that little tournament called #MileMadness which took place a few months ago. I’m updating my experience with one particular spending technique today, a full 9 and a half weeks after the tournament ended.

I’ve chronicled my experiences during the contest in an interview on Matt’s site, but I kept from openly discussing the Vanilla Reload Refund angle until after the contest was over. I’ll talk a little more freely about it here since VR’s are on life support for most of us. If you’re still able to buy them they are available to be refunded, but take my experience as a cautionary tale.

VR: A single Dipped Cone

I’ve often talked down about VR. However, I decided to purches them as part of my March spending strategy. I crafted a plan which would obey the rules put in place, and hopefully keep as much money in play as possible. My two biggest goals for the tourney were not paying purchase fees, and being able to cash out purchases without setting foot in a Wal-Mart (at night).

The rules of the tournament stated that a company guaranteeing you a payout would be as good as cash in hand the next day. The example in the rules was selling of a gift card; Once you had a promise of a check you could reset that amount of money the next day, even though the check might take a week to reach you. For VR I took this to mean that once I clicked refund, and Incomm promised a check, my cash for the tournament was free the next day. The judges agreed, and I spent March acquiring and refunding a fair number of these cards.

Beware the Float Rule

I’ve been playing this game long enough to know to obey (and fear) the float rule, which states that:

“If tomorrow your ability to cash out purchases went away would you have serious issues with paying your credit card bill? If the answer to that question is yes–you bought too many. See: MMR.“

I ran a test and refunded one VR, and about a week later a check came. One VR refund took a week, and so it would make sense that I could refund as the contest went along and have a steady stream of checks coming in. This was a terrible estimate of how the refunds would scale.

You need to always plan for the worst with the float rule. One single request doesn’t raise too many flags, but massive numbers like I was planning on refunding would certainly cause paperwork issues. I was expecting phone calls from Compliance Department mangers, and possible having to explain why, if I had no way of using the VR, I continued to buy and refund so many.

My answer whenever I’m asked why I’m doing what I’m doing is the simple truth, I do it for the miles.

With the float rule in mind I limited my purchases of VR to what I was comfortable floating. I assumed the wait to receive checks would be longer than the amount of time I had to pay my CC bills off. In my mind I estimated a month’s wait. When I’m wrong, I’m wrong…and this one I missed by a mile.

My first Refund was requested on March 7th, and over the next week I refunded 19 VR. I slowed my purchases a bit the next week, but still refunded another 15 over the last two weeks of the contest. A partial check for some of the refunds arrived before the end of April. Not Bad! My last refund was done on March 27th. If the timeline of the first check was followed I’d have the balance of my cash in Early to Mid-April.

9½ Weeks Later…

Only just yesterday did my check for all the rest of my refunds come in the mail, 23 in total. Incomm took their sweet time paying me my money. In their defense, I did get all of it back, every penny including my purchase fees. However they made me wait 9½ Weeks from the date of my last refund. In a way they received a 9-12 week interest free loan from me, and I had this money out of play for April and May–which meant I had to work around this in my spending.

There’s a happy ending to this story; all my money is back home, sleeping soundly. I knew going into this that my cash would be tied up, and it could be tied up for quite some time. I limited myself to what I knew I could float–and I’m writing this post to hopefully show you that when things go bad they can go very bad.

The End

Would I have refunded so many of these if not for the tournament? No, probably not. But going into it I wanted to also use the information gained for future spending. Sadly, VR died right at the end of March, but the lesson to be learned from it can hopefully extend to many more of you, and not just to VR.

Whatever you’re putting your money into, whatever the technique to earn miles, never forget you’re spending real money. Matt wrote a great post about Manufactured Spending leading to debt, and I suggest you read it if you haven’t already done so.

Limit your spending to what you’re truly comfortable living without for 3 months (or more). You never know when you’ll have to spend Another 9½ Weeks without it.

I can understand why they held your money so long. You were only an expense for them, and they want to discourage you from doing this. Agree?

John: I can understand why they did it, but I don’t agree with it at all and think it smells of bad business ethics. They claim the refund process will take up to 10 days on their site. They also say that they will reserve the right to limit refunds–but they’re neither obeying their 10 day clause nor limiting your refunds. Instead they’re playing the waiting game.

I chose to not waste my time calling about it, but as you can see from Marathon Man’s comments he spent quite a bit of time (At his T-Rate, time=money) calling only to get the runaround. When someone is dealing with me (in business) and money is involved I don’t play around. Especially if I’m the one who owes them a payment! I expect businesses to treat me the same way; my money is just as important as theirs is, isn’t it? I might even argue that [to me] my money is more important than theirs is. All of that’s not just good business it is also common courtesy.

You could claim I was taking advantage of the VR refunds–which I was. But as I said they could have limited my refunds, and they chose not to. At that point they should have abided by the 10 day turnaround they quoted on their site. In addition my phone number and contact information was correct on every refund I did; a phone call to me to explain the delay could have made all the difference in the world. Getting ahold of me is 10x easier than me trying to get ahold of their Compliance Department.

Mar 30 for me and my wife. 14 VR total. I was THIS close to dropping the paperwork in the mail to sue them in small claims court. FDIC claim led to nothing and Mindy from corporate compliance said there were batch problems in early May (no idea why it wasn’t taken care of in April) that delayed everything for me and 3 other people with big amounts. I know the other two and well, now we know the 4th! hahaha.

Question: Why are all these corporate people named Mindy or Megan or something and they dont have a last name or ID number but they claim they are the only ones there?

We could have loaded these to BBs in April and May had we known they would do this. And as is typical with all things related to Bancorp, they do everything they can to discourage the max levels of what their own T&Cs actually allow. They should be put out of business and everyone who works there should be strung up by their—well…

This below is the letter I fired off to the email address she had given me when she asked me to confirm my checks would finally arrive. Sorry for taking up all the space, but i figured you all would enjoy reading it and might feel the same way:

****

TO:

registrationsupport@incomm.com

Hello Mindy,

My wife and I received all the Incomm checks for the 14 total Vanilla Reload pack refunds.

Thank you for seeing to it that these finally arrived.

I must say, however, the entire process was grueling and in many ways quite unprofessional. You have heard me voice similar sounds bites of that notion, but now that you are able to read all my thoughts in this email, maybe you can use what I am writing to help change things.

Some months ago I had done one VR refund for $503.95. I had mentioned to you I do load prepaid cards and I have also used Vanilla products for my small promotions business. Sometimes I could over purchase or have some issue with something.

Anyway, your refund process allows for one to fill out a simple form found at this link, which your company freely offers:

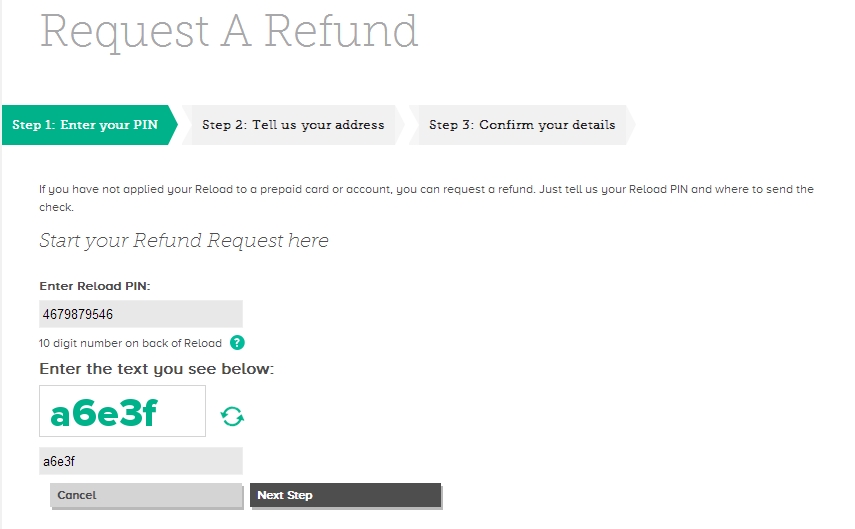

https://www.vanillareload.com/index.php/refund

ON the form one can enter their name and address and the number of the card being refunded, and once submitted, a confirmation number is provided and a note at the bottom states one needs to wait UP TO TEN DAYS to receive the refund. I have attached an example of such a refund page with your company’s words on it.

In that early instance months ago, I did in fact receive my full refund check in that time frame.

Fast forward to late March, when my wife and I had the 14 cards to refund. I naturally assumed this same process should apply. Boy was I wrong!

First, nothing happened for the first couple of weeks. Not a peep. Then when I called, I was told to fax or email in identification to prove it is me. Well, first off, nobody has a fax machine. I am glad your company provided the email option. To me it is more secure anyway. Faxes lay on the floor of an office. Emails go to the recipient. Don’t make people fax things. It’s ancient.

Secondly, why make people send in THEIR life story and sensitive materials if nobody there is going to provide theirs? For example, I just know you as “Mindy” and frankly I cannot even be sure that’s really your name.

As I said, I do a lot of promotions work and lemme tell ya: I have to deal with many customer service CSRs and managers, and compliance and security departments. Seems all of them have a Mandy or Mindy or Megan, who wont give their last name or ID number or even their direct phone extension… and who all say, “well sir I am the only one here so it will get to me.” I tend to think there’s a script for saying that. I mean, come on woman! Don’t YOU ever have to call customer service somewhere about some issue you have and you want accountability?

Either way, the fact is my refund with you, and nearly every step of the process involving it was a total cluster.

First, one has to call in and enter a VR number. Then you get options. If you need to speak with someone, you wait on hold. Could be a minute, could be 5 minutes.

Then that CSR—usually not a very educated or clear speaking individual—takes down your information and may start a case number.

If you need a supervisor, you wait again. Could be 1 minute and could be 20 minutes.

Then you have to repeat everything. Again, all these people only have first names! Why? Are you afraid of your customers or do you not want to give accountability? Why do you require all this security information (our names, address, DOB, SSN, etc and copies of IDs too) if you wont provide it? That’s pretty shady. How can you even work for a place that has that low level of standards?

Now if there’s a problem you have to call back and go through the entire thing again. Maybe you have a case number now so you can quickly get that in with the first line CSR and he or she will get it, but you still have to wait on hold and then wait to get to a supervisor. There are no times when, even after you have waited for any days or weeks, where you are given a break and become allowed to get past this gauntlet.

At the time we finally met, I had to go through those above two levels and THEN wait to get to you too.

These calls take time, Mindy. Time that I am not getting paid for. Why does Incomm want to take my money in that way?

I began to think that the company does everything it can to wear out and anger anyone who dares to have an issue with one of its cards or dares to try to get a refund through. To that end, I was quite prepared to file suit in small claims court (my wife’ would have followed suit shortly thereafter)… I have attached a scan of the form that I was literally about to send had my checks not come as you finally promised.

When we first met I was livid because I had to go through so much just to finally get to you, in compliance. You may recall I was driving my car (to work) and had to pull over to read you all the confirmation numbers of our cards again. Yes, at this point, since it had already been nearly two months, I had neglected to mention which ones were filed by my wife (actually we sat together and I did them all so geesh, what’s the difference, really!) and which were filed by me. But you knew I was long since waiting for over $7,000 in refunds and I was furious as well. You certainly didn’t exhibit any calming assurance or customer service assistance. Nevertheless, you did tell me the checks would come and you took down each confirmation number. That was May 15, I believe, and that is when you said you finally released or approved my claim. TO be honest, I had no idea it wasn’t already released or approved… after all I had sent in ID long before, wrote a long letter explaining my situation, and was still thinking in terms of the ten day rule—which had now been pushed out to many times that amount of time.

This fueled my anger about the theory that your company wants to delay the payment and processing of anything it can for who knows what reasons, but that it certainly does not like the fact it has to refund people at all.

I have run into many companies that tend to have seemingly smooth running processes when everything works in automation, but as soon as something goes wrong, it all falls apart and they have no ability to intervene or manually assist someone that is caught up in the glitches. It’s like they cant and do not want to all at the same time.

I filed with the FDIC.

My FDIC complaint resulted in a letter saying that the OCC would handle it

Nothing came of that as far as I know and then I began speaking to you.

I have had other colleagues in promotions who purchase your products. Some believe Incomm is full of total scammers and that they make customers go through all of these hoops in till they give up, or in a case such as mine, that the company would purposely hold large sums of money for as long as possible to obtain something from it–all while discouraging us from being involved with that ever again.

This is what is believed, Mindy. I would hope you of all people would want to change that image if you can. Either that or work somewhere better. Again, this is what people believe.

Nevertheless, towards our latter calls, I could tell you did in fact know that (A) I was not some scammer trying to take $7,000 that was not mine, and (B) that your company had in fact held the ball way too long here. You told me there had been some problem with batches dating back to early May.

While I find this quite unacceptable and should almost demand interest on the money I had to wait for for over two months, I am at least comforted to know that you were someone who finally stepped up and admitted there had been an internal problem. This is why I am writing you now. Because I think you can help fix things—if not just from the customer perception, at least the procedural standpoints.

Many people would rather have a company tell them something went wrong but here is exactly how it is being fixed and when, than to be led on to believe nothing is wrong and it must be the customer’s fault. Or to be railroaded and constantly told it’s being worked on and here’s another case number, please wait.

So by the end, it was your tone—your conversation with me on the phone—your actually calling me back when you said you would—those were the things that prevented me from dropping that small claims court paperwork in the mail.

And that would have been fun… I mean, in some states like mine, they’d award triple damages when I would have won the case. I would get the fee back for filing, and you would have had to send a lawyer all the way out here too.

Well, as I said, the checks did come. So thanks for finally sending them.

I have bought many Incomm products in the past and will likely continue to do so, but if there’s a problem—be it some sort of refund request or an issue where a card fails to activate on purchase, many people like myself would really appreciate it if your company would get its act together on HOW to handle problems so the customer goes through the least pain possible. That is, unless this is what you hope to really do.

I know Incomm is part of Bancorp and they are absolutely horrid in dealing with related issues. In one such case, I happen to have a Bancorp branded prepaid card from which I did bill pays to my equity line. This is available and allowed on the card’s website and not prohibited in the T&Cs. But I got a call from some angry staffer telling me they would shut the card down if I did it again. I asked where it stated I could not do it, and they told me they were telling me now in this phone call. Strange. Well, the card was shut down one day without notice and I filed with the FDIC for the $2.95 that is still stuck on there.

I am a man of principle, Mindy. And there are many like me. We will not tolerate bad service without accountability. If you have a list of people who are naughty and nice, make a list for people not to mess with too. I’ll follow your rules and terms and security procedures. You please respect ALL of mine!

Thanks for reading. I really do not expect a reply but I do welcome one.

ME

BTW the $2.95 on the other Bancorp claim did arrive yesterday. No note no nothin. Funny, huh?

Marathon: I interact with Compliance Dept. people, and they seem to me to have zero compassion and zero sense of humor. I’m sure that’s a bi-product of dealing with large sums of money and scammers all day, but I don’t appreciate it. You’re correct about the 10 day claim, and their total disregard for it. I think the issue became; Once the refund angle became popular they saw way more refund requests, and didn’t know how to handle them. Combine that with a possible want to hold our collective money as long as possible and you have this mess.

Too funny about Mindy. Reminds me of another compliance Dept I spent some time talking to…now that you mention it I think her name was Mindy too (at paypal)? It’s very possible she’s the same Mindy, since Paypal and Incomm are both based in Atlanta…

I’m glad you were made whole as well.

From what i have gathered, the paypal cards are run by bancorp incomm as well so same lady

We love you too, Marathon Man!

NANU NANU!

I had the same issues with paypal refunds. I called weekly for over a month and was always told the matter was under investigation.

With no end in sight, i filed a complaint with the texas department of banking since they are considered a “money services business” rather than a bank. I then called the issuer directly rather than the customer service number to say a complaint had been filed and would they like a copy faxed or wait to hear from the state. They called back in a hour and the refund was received inside a week, including the $3.95 fee.

Check your state regulation of money service business (check cashers and such) to make complaints since the feds don’t really deal with the reload cards.

Thanks!!

Now, who is the issuer?

The VanillaReload site is down so I can’t verify but I believe that the VanillaReload cards fall onder the same corporations as well as regulators.