Update 4/23: There is an updated review of Lemoney here. Please be sure to read it.

Today we’re renewing an old series here on Milenomics; The Deal Debriefing. I’m a big believer that discussing deals after the fact is a great way to learn from each other in a non-confrontational way. The deal below (unlimited turbo cashback) is dead for now, so there’s less harm in discussing it. But I think it is important to go over it together and see what I, Robert, or you might have missed along the way.

—

Relatively little has been written about a new cash back site, Lemoney.com. In an effort to get to the bottom of the questions I have about this site I did some digging, and the more I dig the more I’m convinced Lemoney is a genius way to make a ton of money. What I’m NOT convinced about is who’s the genius, and who stands to actually make money, us or them.

What’s Unique About Lemoney

We’re all familiar with a few of these cash back sites–they rebate a portion of what you spend back to you. This is affiliate/click-through revenue; retailers pay it to (theoretically) direct purchases to them online; and these portals give back a portion (or all) of this to you the buyer.

Lemoney’s “secret sauce,” is Turbo Cashback.

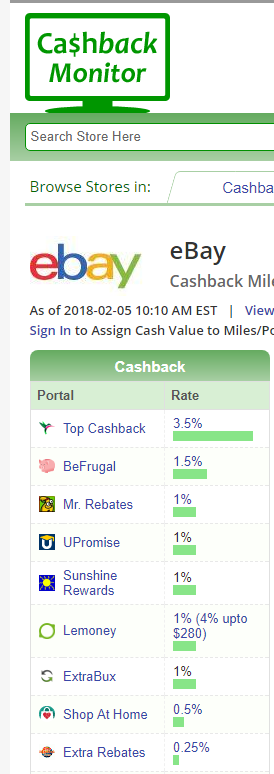

Lemoney’s standard rates are mediocre at best. I haven’t done an exhaustive survey, but of the sites I’ve checked they rank somewhere in the middle of the pack, and almost always behind the big name sites such as TCB and even eBates.

But you’ll notice when you search for Lemoney rates on CB Monitor that there’s an amount in parentheses:

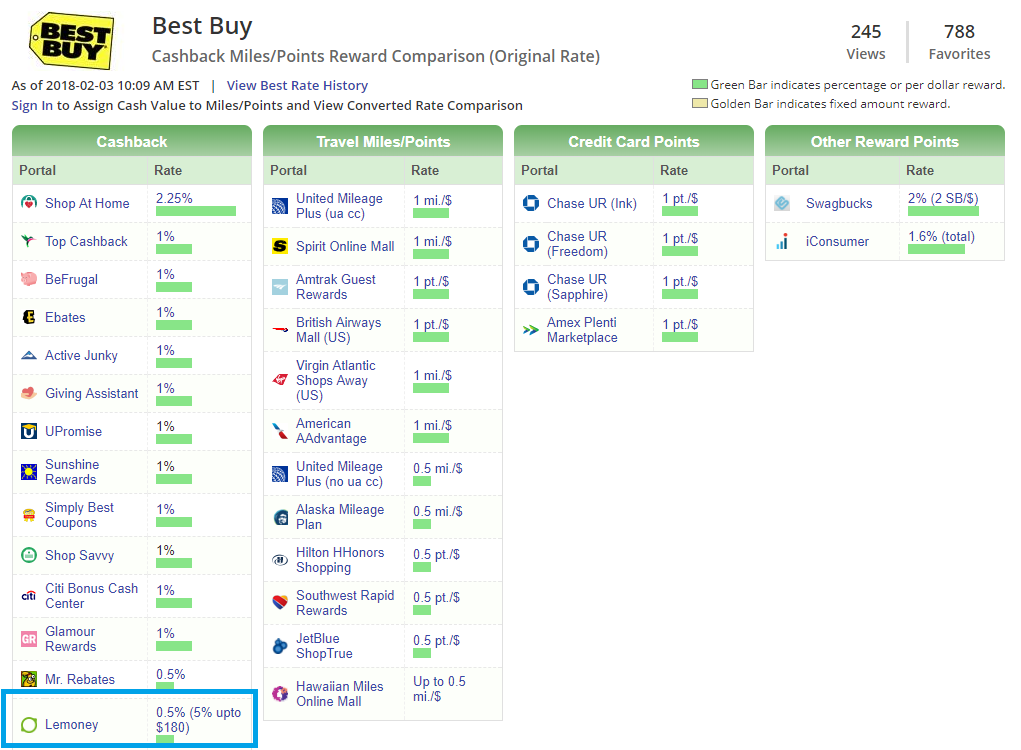

That’s their Turbo Cashback rate. Once a month, on your first purchase, you get to use your Turbo Cashback rate. Turbo Cashback is an abnormally high rate for the first $X of your purchase amount. After you reach the cap amount the standard cash back rate takes over. This can be extremely lucrative–for example take a look at the payout for Best Buy:

Lemoney’s Actual rate (.5%) makes it the worst portal payout for BestBuy. But their Turbo Cashback is 5% on up to $180. If you bought an item for $200 you’d earn:

$180 x 5% + $20 x .5%, or $9 + $.10 ($9.10)

That’s an effective rate of 4.55% cash back on the $200 purchase. Easily bests all other portals in this situation. But as you spend more your effective rate of cashback goes down. And this is only good for one purchase a month, across all retailers on Lemoney’s site.

One Trick Pony

Ok you’re thinking, so I should pretty much avoid Lemoney except for the first purchase I make each month?

That’s a pretty strong strategy, and Lemoney’s combating that with a few things:

Referral Residuals – Everyone who you refer to Lemoney earns you a percentage of their cashback. This is MLM and CB combined basically. The same economies of scale work here–if you have a huge ‘pyramid’ (<-my word choice) you can do almost no shopping on Lemoney and make good money. The amounts earned are tiny–you’d need a network of 1,000s, or even 10,000s to see some real residual income here.

CBonus – These are given out by Lemoney as a reward for activities. Their page about Cbonus has specific instances listed as to when you earn CBonus. In my experience I haven’t seen much use for these, possibly because I don’t have any downstream referrals. If you have a large enough ‘pyramid’ CBonus can multiply your kickback. I guess some people might find a situation where they have a huge pyramid and can make more money with CBonus than actual purchase cashback. If that’s you I’d love to hear more about your experience.

Extra Turbo Cash Back periods-From time to time they’ll tell you that you’ve earned an additional slot for turbo cashback. This is usually later in a month. I think the idea of turbo cash back is absolutely genius. The original idea behind cash back was not to get customers paid out on purchases they were going to make anyway, it was to drive more business to the online retailer. Do standard portals do that? Maybe…but maybe not at this point. There are toolbars that auto-click you through CB sites, and ebates runs TV commercials. That’s probably not what retailers really want, they want organic shopper growth. Turbo cashback resets the industry, and represents a way to push customers to not just spend, but to spend more.

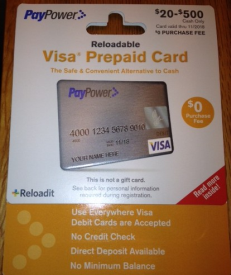

Unlimited Cash Back – Twice (that I know of) they’ve done this. For about a week each time Lemoney allowed unlimited Turbo Cashback, across all stores. This was either their dumbest idea or their greatest idea yet. I did a lot of shopping during the previous unlimited Turbo Cashback period. Everything tracked withing 2 hours and for the correct pending amount.

What’s extremely concerning is that my purchases were almost all at a retailer that traditionally pays out in 3-4 weeks. But Lemoney is saying 4 months before they’ll pay out (120 days). Additionally, the retailer in question has recently put a cap on monthly CB purchases. Lemoney doesn’t display this cap in ther T&C at all. Will they respect the cap? Will they pay out at the Turbo rate for all my purchases? No one knows. Which leads me to my next question…

Who’s Footing the Bill?

Fantastic Turbo Cashback rates, downstream revenue, a model unlike any other portal. So I wanted to know who’s paying for all this Turbo Cashback? That’s what I’m mostly trying to figure out with this post. I’ve asked Lemoney directly, and their response was beyond generic:

“We worked really hard to negotiate great rates with our partners, which is how we’re able to offer you Turbo Cashback. We’re always working on negotiating better rates so we can offer even more cashback to our customers!”

Of course there’s the possibility that this is actually true. Other portals will negotiate special rates for retailers, and no one else targets an amount as effectively as Lemoney. If your average order is $100, a retailer could enlist Lemoney’s Turbo Cashback to kick in up to $200, and try to bring the average purchase amount up. I really don’t think this is the case[yet], Lemoney is just too small. Their twitter account has 573 followers at the time of writing this post, MrRebates has 1400, TCB has 8,000 and ebates has 71,000.

There are a few places the money could be coming from. First of all–their regular purchase rates are poor almost across the board. Some amount of that could be subsidizing the turbo purchases. For example, at .5% a best buy purchase is probably netting Lemoney a .5% profit (I’m assuming Best Buy Pays 1% to the portal). Since Turbo Cashback is limited to once per month the rest of the month’s purchases could cover the turbo boost portion for the members who take advantage of that. There’s just no way that legitimate purchases can cover some of the insane turbo rates and unlimited Turbo periods.

Secondly, Lemoney could be opening their own wallet here. Certainly they’ve made a splash with some in the CB crowd who have only noticed them for the Turbo CB feature. Gaining that kind of traction organically would be tough, and possibly just as expensive. This blog post itself would not exist if Turbo CB didn’t exist and Lemoney was just a normal cashback site. And VC money has been known to be thrown around in dumber ways in the past (Greatbridge Group, Drop, Juicero etc).

And Finally, and most worrisome to me, Lemoney could just be one giant Ponzi scheme. They could be paying out past payments with future growth. It certainly would explain the abmormally long payout period (120 days). And Some of the things they do, like you earning a portion of your downstream revenue, actually align with pyramid/ponzi type schemes.

That said, I want to be 100% clear: I have no idea if Lemoney is actually a giant scam, but it also doesn’t make any sense to me. Indeed the long payout time could just be Lemoney making 1000% sure that they’re paid their affiliate revenue before paying you and I our money.

Full disclosure:I have not yet been paid any money from Lemoney. If that changes I’ll update this post.

This is Not a Shakedown

This is not a hit piece, I’m not writing this to put pressure on Lemoney. I’m genuinely interesting in seeing them succeed. Because I love being paid to buy things I’m going to buy anyway. And I equally love when VC money flows to our pockets. And I hope that is the situation here.

Are any of you playing with Lemoney? Did you hit the uncapped Turbo CB hard? Anything to add? I’ll keep an eye on Lemoney myself, and if you have any info to share this post is a good place to do so.

What is your referral code or link?

Hi Teri: Thank you for thinking of the site for a referral. At this time I’m not comfortable referring anyone to lemoney. The post is not a recommendation to use their portal as I have some some serious concerns about users getting paid out. As I detail in the post, I’m being told 4 months for a purchase that should take 4 weeks.

I actually had a really good experience with them on a stubhub turbocash. My purchase did not track at all and I contacted them by email to try and recoup. Over weeks, they worked with stubhub directly on the issue, asked for my order info/receipt a few times, kept me updated proactively and politely. It took a long time for them to confirm stubhub would pay up and at no point was I (a natural skeptic) more than 5% sure I would ever see my check, despite assurances. In the end, LeMoney issued a check to me by paypal sooner than the 4 months.

Joanne: These are the exact kinds of data points I was hoping to spur with this post. Thank you for sharing.

Thanks for being so considerate! I will await further data points.

The Lemoney.com business model forces the consumer to ask extra questions:

1) is the extra money worth the extra payout time?

2) is my purchase big enough that 1% from TopCashBack or BeFrugal nets out to more than the turbo cashback plus regular cashback from Lemoney?

3) Can I split my purchase between 2 portals or between multiple orders over time and is it worth the extra time to do so?

The extra cognitive headroom required to profit from Lemoney is why it will fail.

Sharp, quick take on their hurdles El Ingeniero. #1 is the worst of them in my view because if we’re assuming failure at some point then whatever’s pending and unpaid will be wiped out. Slower payout means larger potential losses for us.