It’s been some time since I first reviewed the new-ish portal, Lemoney.com on the blog. If you read the initial review you’ll remember that I was somewhat convinced the site was either brilliant or a complete scam. Today I’ll update you with some new information and my recent experience with the site.

A quick recap of Lemoney is as follows: Brilliant Turbo Cash back, which is limited to one use per month. Rates are great for Turbo, but mediocre for non-Turbo purchases. 4 month wait to cash out purcahses, with a $25 minimum as well. They also issue 1099s over certain thresholds.

Short Term Progress

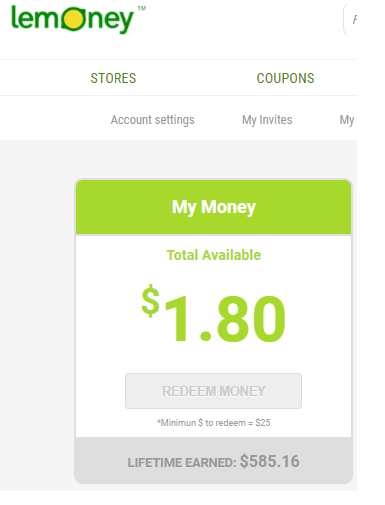

Back in February I mentioned that I wasn’t able to recommend the site. While I had plenty of cash back track properly, and at somewhat insane rates compared to what is out there, I hadn’t seen any of that money.

Today marks 4 months after Lemoney’s last “Unlimited Turbo Cashback” offer. And I’m happy to say that my funds not only went to payable on time, but they’re now sitting safely in my Paypal account. Unfortunately, they haven’t anounced another Unlimited Turbo Cashback event,(more on that later) which is actually good for their long term health. All signs point to their legitimacy.

Longer Term Goals

Lemony actually reached out to me two months after the review post went live. They included an awful lot of well written points that directly addressed some of my concerns. In an effort to be transparent and also to try to get some more information out about Lemoney I’m posting some of some of the information they included here. All italicized text is theirs:

How can Lemoney pay that much?

Our team is composed of engineers and economists with a background in finance and e-commerce. We developed proprietary algorithms to generate a balance between how much we earn in affiliate commissions and how much we can spend (Turbo cashback + Community Cashback).

By default, we share part of our revenues (which varies in accordance with our algorithm) with the user who made the purchase. From the remaining amount, we separate a share to pay community cashback. Depending on the algorithm, we can use the entire or part of the affiliate commision to pay cashback and community cashback.

This makes sense, and is likely why they’re constantly tweaking the Turbo Rates, sometimes on a daily basis. They’re dynamically balancing incoming affiliate cash and outgoing Turbo Cashback. This is actually a good thing, it means they’re focused on not going broke.

Turbo Cashback

This is a strategy developed by our team to offer aggressive cashback rates to Lemoney members. The higher rate is applied up to a certain amount. This is a result of better commission agreements we are able to get from merchants and the turbo rates we want to offer. Then, we balance with the regular rates we offer on additional purchases made. We also have the option to pay part of it out of our own pocket. [emphasis mine]

Unlimited Turbo Cashback

Unlimited Turbo Cashback is offered in specific promotions because we love to give back to our customers – and we want them to keep shopping and earning the best rates while growing their communities.

Note: I specifically asked when the next Unlimited Turbo Cashback period would be, I was told “We currently don’t have any plans to do another Shop Unlimited times with Turbo promotion in the foreseeable future.” This is bad news, as Turbo Cashback is the main reason to use them in the first place.

MLM x Pyramid scheme x Lemoney Community

Lemoney is really strict when it comes to fraud and/or schemes.

Before initiating our operation we hired a legal firm to validate it.

Lemoney doesn’t sell products directly. Lemoney users shop for their products on 1700+ store’s websites through the Lemoney portal.

All revenue earned by Lemoney and distributed to its users comes from affiliate commissions or paid placements.

Lemoney is 100% free to join and use. We do not make money from user acquisition.

Lemoney offers a unique business model and we work hard to make sure it doesn’t bring any risks to the users.

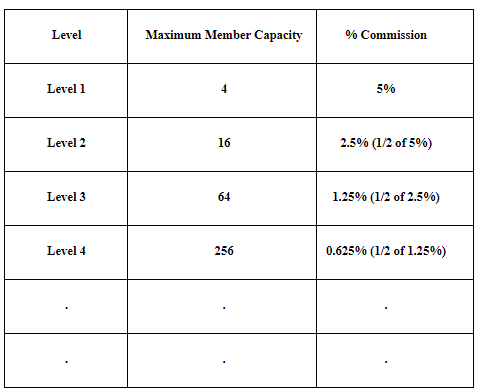

They seem to realize the “community” side is also a unique function of the site, and are focused on using that to grow organically now. The amounts you earn from your downstream referrals are clearly published, something I neglected to mention a few months ago:

The above is a % of the % that your referrals earn. If someone made a $100 purchase and earned 2% back at level 1 you would earn 5% of 2% (.1% net, or $.10). The amounts here aren’t going to get you rich quick, but they can be significant if you have a large enough group hitting an unlimited Turbo event.

Redemption time

Unfortunately, with the merchandise returning period, it takes some time for retailers to confirm and make the commission payment. This is why we need to wait for 4 months to release payments comfortably. Though it may take some time, our customers always get paid. We are extremely careful with our customers’ claims, and our team is already working on a feature that will provide the fastest payments in this market.

Reading between the lines, it seems the Turbo rates are (as we all assumed) being paid out of the profits of non-turbo clicks. And it seems the unlimited events were indeed funded out of their own pocket to try to make a splash and gain some market share. I’d be 100% certain too before cashing out if I was losing money already on a purchase. They’re probably going to be much tighter with the purse strings moving forward–and rightly so.

Should You Use Lemoney.com?

All of the above is nice–but it is way too complicated for the average user. Their site is a technical marvel, it allows you to selectively add or remove Turbo cashback after a purchase has been made. It also has a running total of all your clicks, and the tracking seems to be not only fast but very accurate. There are massive amounts of data at your disposal: about your community, your cashback, your payouts–there’s almost too much information.

That’s not to say too much information isn’t a good thing, but ultimately with cashback it really is just all about the money. In my view no portal is the right tool every time, but all of them can be useful as a tool when it makes financial sense. But it seems clear their Turbo rates are the teaser, the eye candy to hook you. When you’re comparing rates at CashbackMonitor and see a high ‘teaser’ rate I think they’re also banking on your inability to do quick math.

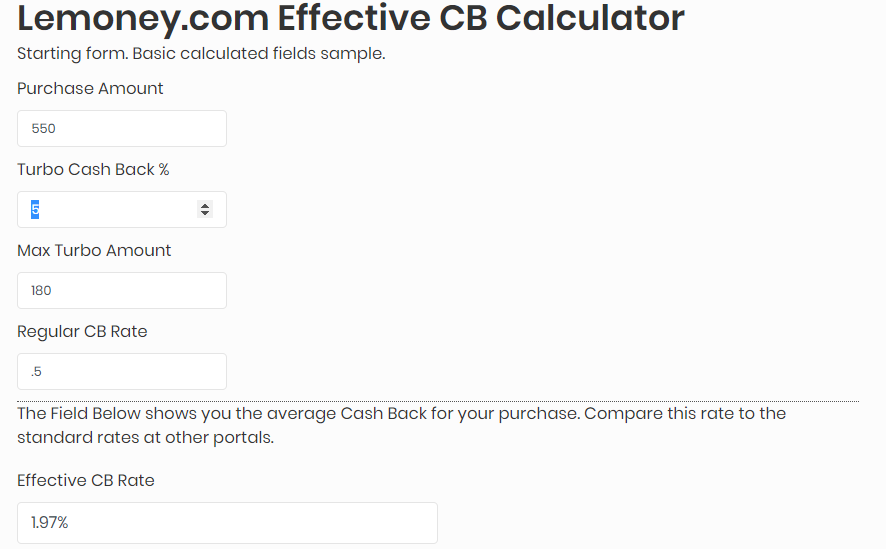

To help make sense of it all I’ve put together the following Lemoney.com Cashback Calculator. It converts their ‘Turbo’ cashback + Standard cashback into an Effective CB rate, something you can compare to other portals directly and see if it makes financial sense to use Lemoney or not.

Fill in all the fields below, and the effective rate will auto calculate.

[CP_CALCULATED_FIELDS id=”6″]

Sample Calculation

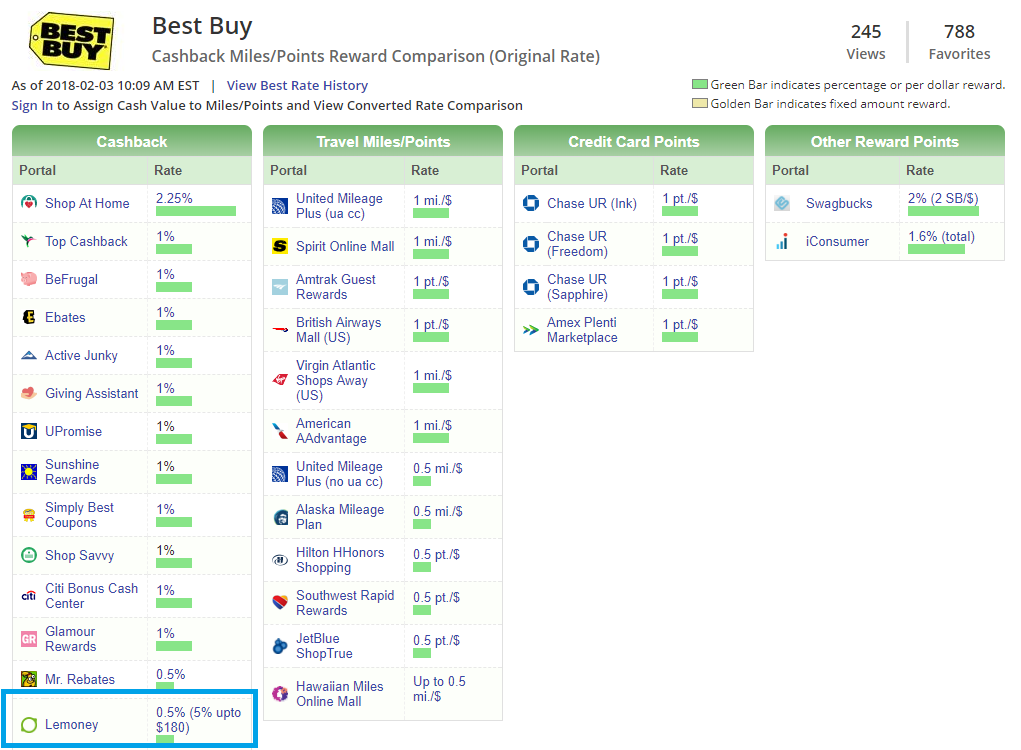

As an example here’s a screenshot from CBmonitor:

It is showing Lemoney at 5% up to $180 and then .5% from there. Let’s assume you’re buying a $550 item, should you use Lemoney, and specifically your Turbo Cashback for this buy? Using the above calculator, plug $550, 5%, $180, and .5% into the fields above. The calculator spits out the following:

We’re looking just a 1.97% effective CB rate, and we’ll be waiting exactly 4 months to see that money. With an established portal paying 2% (swagbucks), if this was me I’d pass on this ‘Turbo’ Purchase and use a standard portal. Consider using the above tool whenever you need help making sense of Lemoney’s confusing Turbo CB rates.

A Once a Month One Trick Pony

I can still potentially see Lemoney revolutionizing online cash back the same way Fatwallet(R.I.P.) did almost 20 years ago. The idea of Turbo Cash Back as a tool to increase spending, or as a way to lure customers is effective. I’m interested to see how they develop, and especially interested to see how they handle Black Friday this coming year, and if it will be an Unlimited Turbo Event again.

As for using the site, run the numbers using the above calculator, make sure you consider the long payout times, and use Lemoney as another tool in your toolbelt. The portal tracks very quickly, and very accurately. I would use it once a month at a minimum to earn your Turbo rate on purchases you’re going to do anyway

I don’t understand how you calculated the 1.97 effective rate. Can you expound upon this calculation?

Jane: thanks for the question. The cash back earned is 5% times the first $180, ($9) plus .5% times the balance of the purchase ($370), $1.85.

That makes the total cash back $10.85. divide that by the purchase price ($550) and you get the total cash back rate, 1.97%.

Why does it take so long for the cash to be payable with Lemoney? I waited over nine months for ONE Priceline purchase to become payable. That’s just obnoxious. With befrugal, it’s payable within 30 days, especially if you bid which charges you for the room right away. The rate is lower than the Turbo cash back for Lemoney, but it’s not worth it if I’ve gotta wait nine months to get it.

Totally agree!