0:24 Q3 2024 5x Categories

- Chase Freedom: Gas (and other stuff)

- Discover: Grocery Stores, Walmart (For the first time in FOREVER!!!)

- Citi Dividend: Gas

- Why do banks have these cards? To move our spending onto these cards long after the quarter ends.

04:05 Transfer Bonuses

- Citi -> Cathay Pacific 15% (7/20)

- Chase -> Aeroplan 20% (7/31)

- If the space is there and these miles will be used, great to get a discount. Probably not worth speculatively transferring.

08:33 New DeltaOne Premium Lounges Coming in 2024 (OMAAT)

- JFK: June

- LAX: Late 2024

- BOS: Late 2024 (adjacent to already-open 3rd SkyClub in BOS, in International Terminal E)

13:26 Staggering Decline in Usefulness of giftcards.com Visa/MC GC

- At one point these were a fantastic way to earn miles and even hit sign up bonuses

- Recall buying Amex GC and then flipping those to GC.com.

- Now what can we do with these?

- There’s certainly a draw with 5-10% off sales. But those are usually small dollar cards

- Scale vs spread

- None of this really matters because there’s nowhere these cards even work

19:34 Checking Account with Free ATM Withdrawals Worldwide?

- First Republic had this for $15k

- Chase requires $75k min balance Sapphire checking to avoid fees

- The louses at Chase deactivated First Republic debit cards before the Chase cards arrived. Gah! Do they have the same PIN? I think so? But I go to the ATM infrequently in the US so I’m not sure.

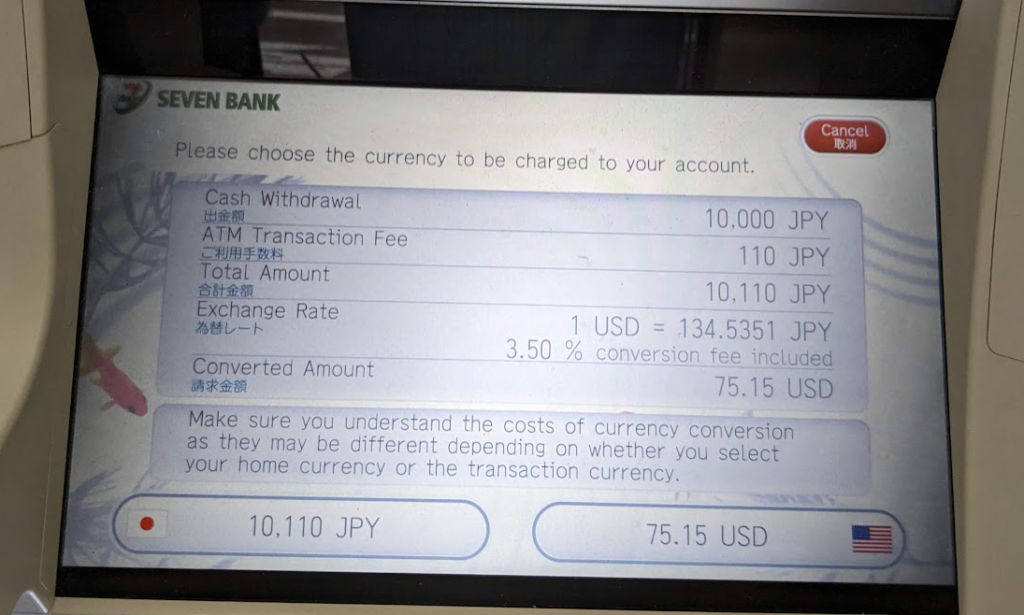

- Am I over-thinking it? Just pay the fees? Well, it’s not just the ATM fee, there’s a “foreign exchange rate adjustment fee” that’s a percentage (usually around 3%) of the amount withdrawn on top of the ATM fee:

- “Surcharge Fees from the ATM owner/network still apply. A Foreign Exchange Rate Adjustment Fee from Chase may apply for ATM withdrawals in a currency other than U.S. dollars.”

- When presented with the question of whether you want to be charged in foreign or USD choose the local currency if your bank here has no Foreign Transaction fees. (Say no to Dynamic Currency Conversion). Example:

- But the real scary thing is where the ATM you’re withdrawing from tacks on a dynamic currency conversion fee, they don’t disclose the percentage, the ATM interface makes it confusing to figure out what’s going on, and you end up paying what is or feels like a lot more than you should to take money out of an ATM.

- I really just like to be able to withdraw a reasonable amount of foreign currency as I go without worrying about fees adding up.

- Schwab Checking has free international ATM withdrawals with no minimum balance

- Schwab debit card was expired (never used), I don’t know what the PIN is, and their phone tree sends me in circles. Thought to go in branch but is there no such thing as a Schwab checking branch?

- Chatted, guy told me I “may have to speak with Schwab Checking. I thought I was chatting with Schwab Checking!?

- Maybe Volcker doesn’t get the credit he deserves

- Update as Robert is leaving to Japan and will be using this debit card.

36:48 International Data for Cellphones. Current Status

- Being connected is pretty much a necessity at this point

- There are multiple ways to handle this, and with multiple price points and [potential] gotchas

- How to handle this is also a factor of your current provider, plan, phone and where you’re traveling

- Example: In Mexico many plans ‘just work’ as if you’re home.

- How do we each play this when we’re outside the country and what pros/cons do these methods have?

- Sam: Complicated, but I want data, and really only want data. I’ve had a setup for a decade plus that decouples my phone number from a cell provider (think: wifi calling but over mobile data). That’s nice because I can do everything I want/need with my local number with just a data bucket.

- E-SIM has changed the world (literally). Gone are the days of visiting a kiosk in the airport (rip off!) or scouring the prepaid-data wiki for tips on buying and activating plans. I’ve had some wild stories of activating prepaid SIM cards overseas. ESIM changes all of that.

- Basics: Your phone can hold a physical SIM card, or a digital one. Because these are digital now you have providers (Airalo, Dent, Saily, etc) that sell service in other countries (data only usually) for cheap with customer support and easy one or two click install.

- Pros: Really cost effective for data hogs: I did this last summer in Japan: $10 per person for 2 weeks worth of data (5-10gb). We hotspotted for the kids who’s phones don’t support esim.

- Norway I’ll do the same, it is about $11 for 5gb there. Some providers have region passes, which are nice and include a bucket of countries like “Eastern Europe” or “South Asia” for hopping around.

- Negatives: Your phone number and text messages for your current provider probably won’t come through unless you can figure out how to turn on wifi calling and hotspot. I’m not an iphone user so I defer to mostly the ways that android handles these things. I do believe imessage will continue to work over data, but can’t confirm firsthand.

- Another negative is that you can have issues with the install, and if you bungle it and somehow delete your main SIM card you could have service interruptions when you come home and switch back.

- Zero roaming or other charges because you ‘turn off’ your home service completely.

- Robert: I enable the AT&T International Day Pass. $12/day for the primary, $6/day for each additional line on the same plan. “Only pay for the days you use, no extra charge after 10 days per line, per bill”