“Brandon Asks” is a Reader Q&A series where we take real questions from real people and do our best to provide helpful unbiased information on navigating the points & miles space.

This question comes from Jim who asks:

- Could you “refer” me to the card and get the 50K bonus?

- The sign-up bonus is only 50K now. Should I wait for a better sign-up bonus?

The *only* appeal of this card for me is the 3% dining bonus, which I already take advantage of as an AU. Though Chase is dipping its toe in Amex-like “Offers”, it hasn’t hit this card yet and I really value that perk with AMEX. It’s kinda hard for me to justify the $150 fee (annual minus travel credit) when the only benefit is the heightened % on dining (which again, I’m using as an AU). What am I missing?

Between us we have around 170,000 URs. I also have a Chase Ink, but no other Ultimate Rewards cards.

I also have an AmEx Business Platinum and a Citi Prestige, so I may be getting a little heavy on premium cards.”

Robert: Hey Jim, thanks for the great question. You’re certainly not new to the game with the premium cards you have already. I appreciate the opportunity to kick around some ideas for you to consider.

Before we get into it I’d like to review a few foundational items for readers that may be newer to the game.

When we talk about 5/24 we’re referring to Chase’s famous rule that they won’t approve you for a new Chase card if you’ve opened for 5 or more new cards across all banks in the past 24 months. This rule applies to all Chase Ultimate Rewards cards, including the Sapphire Reserve Jim is considering. There are a few Chase cards not subject to 5/24 but the cards we’ll be discussing in this post are all subject to 5/24.

If you’re right on the edge of 5/24 you may want to know for sure how many new accounts you have. Jim mentioned the free credit monitoring service CreditKarma, which I use too. But still, it may not be 100% clear how many new accounts Chase will think you have when you go to apply for a new card. Do they consider account you’re an Authorized User on as a new account? Yes. Are small business cards considered new account? Mostly no. What about store credit cards (like a Banana Republic card)? Yes. It’s more complicated than you’d think and it’s good to know where you stand.

Frequent Miler has a good suggestion in this area which is to use the free Experian app. That should give you a good idea whether you’re under 5/24 and ready to apply.

You mentioned getting shot down in-branch while over 5/24. That’s disappointing on a number of levels. For some strange reason Chase has different approval criteria depending on whether you apply in-branch vs online. And even stranger, applying in-branch if you’ve been “pre-approved” has shown to be an effective way to circumvent 5/24. As you’ve discovered getting pre-approved doesn’t guarantee approval. Not sure why banks do this but here we are still interested in getting more credit cards from Chase.

Finally, you mentioned refer-a-friend and being an authorized user on your wife’s still-open Chase Sapphire Reserve. Some banks including Chase offer a referral program where a friend can get a signup bonus for a card and you can get a referral bonus. It’s a great deal when it works out. Just make sure everyone is getting the best offer.

The fact that your wife has the card already, and that you’re an authorized user on the very card you’re considering applying for does not disqualify you from getting the signup bonus. Thankfully, I’m not aware of any bank where being an authorized user disqualifies someone from getting a signup bonus. This is one good thing about playing this game in two-player mode.

In fact, since your wife has a Chase Sapphire Reserve currently she can refer you for the card. With Chase, go to:

…and enter her last name, last 4 of her Chase card she’d like to refer on, and your zip code to see if she’s eligible. Not all Chase cards are eligible for referral, but the Chase Sapphire Reserve is. It’s worth noting that not all Chase cardholders are eligible for referral at all times.

For the most part you can only refer friends for cards where you’re the primary cardholder. A somewhat rare exception to this rule is that if you have an Ink Bold or Ink Plus card where referrals are showing up for the Ink Preferred card at the moment (which is considered a distinct product from previous versions of Ink cards).

What can sometimes make sense when considering a signup bonus is to accept a refer-a-friend link to get the ball rolling. Then apply for the card yourself. Then refer your spouse. I find it beneficial to “batch” things up like this mentally. If I do the work to understand a program for myself and consider it a good deal I think it’s smart to benefit twice as much from the mental energy expended navigating an offer and a program.

Sam: Thanks Jim, Robert. This one is a great little puzzler. 5/24 is certainly a shift in how to approach Chase cards, but it isn’t the end of the world for getting new Chase cards. I have some more specific questions for Jim, but first I think it is important for Jim to consider that he doesn’t actually have a 5/24 rule. He really has a 10/24 rule. Because he and his wife are likely playing this game together. And because of that they want to be strategic about this and keep their individual 5/24 scores safely below the max while they open more than 5/24 cards in total between the two of them.

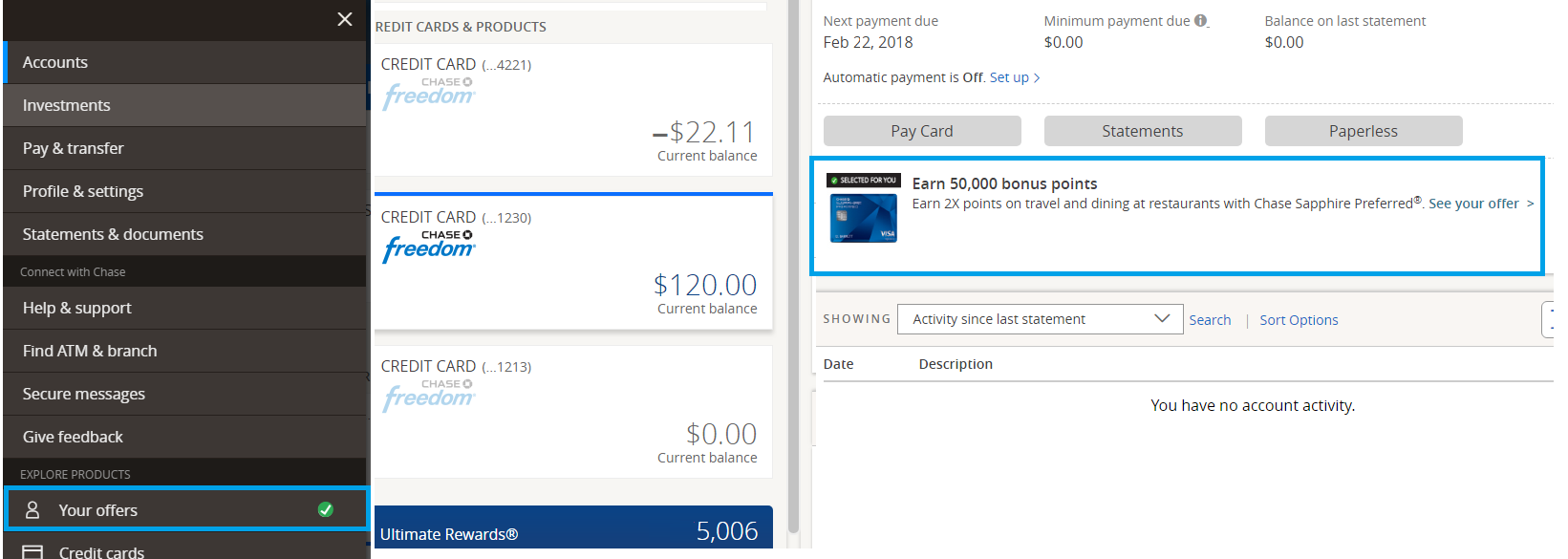

I think Robert’s above intro is great general background and required reading anyone new to all of this. I would add that Chase has a ‘Your Offers’ section, and these offers do bypass 5/24. Any chance you can log in and check your offers Jim? They’re under the menu at the top left and then “Your Offers,” or on the right of your listed accounts:

Jim: Unfortunately I don’t have access to those offers. I’m still using the old Chase.com interface.

Sam: Ok, that’s not ideal but it makes my recommendation a little easier. If you had access to those offers and if a CSR or CSP was in there I’d say take Chase’s personalized offer when you’re over 5/24. Without being able to see those offers my recommendation at 4/24 is that your next card should definitely be a Chase card.

So then the question becomes is there another Chase card you can better use that will count towards 5/24? And I’m struggling to come up with a general recommendation that isn’t a business card. There certainly can be better recommended cards for specific situations. And being at 4/24 you can look looking at doing something pretty advanced like a business then personal card combo like this comment on a post on DoC alludes to. (h/t Amol over at Travel Codex).

Jim you say in your question that your wife applied for her CSR and then added you as an AU. If you do have her refer you for a CSR I’d caution you against adding your wife as an AU on the newly opened card. Doing so you’re now bumping her up one on her 5/24. Adding her means you’re technically using two of your 10/24 married slots using the same apply and add AU strategy you used from your first CSR.

So if you get a CSR you won’t want to add your wife as an AU. And if you’re committed to keeping the CSR for the 3UR on dining then the card your wife has is the best one for you to keep long-term. You’ve already removed the hit that her approval and your added AU card will do to your 10/24.

And if you’re not keeping this new CSR then you’re in it purely for the bonus. So I’d recommend a pure bonus:bonus analysis of what card to get next.

Robert: Sam makes a great point with this being a 10/24 situation. There are benefits to playing this game in two-player mode.

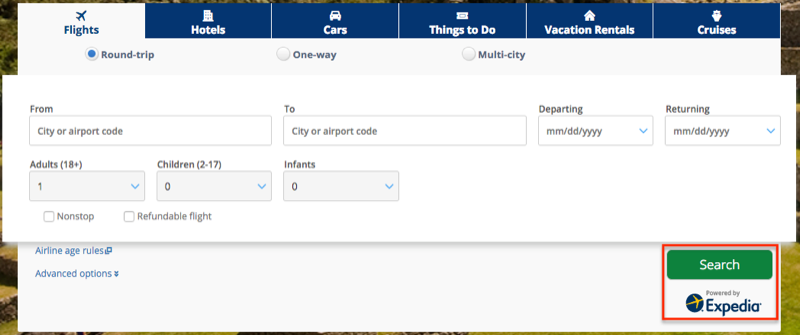

That said, I like to keep the more “high involvement” cards in my name. And if I get to pick, I’d choose to get and keep the Sapphire Reserve in my name since it becomes the redemption workhorse when “living the Chase lifestyle” and using it to redeem many of your URs with 1.5 cpp uplift towards travel booked through the Chase portal.

Let’s pause for a moment though and consider something we haven’t touched on yet: The Sapphire Reserve has a $75 annual fee for authorized users. That being the case you’re paying $75 for 3x at restaurants. With a Citi Prestige card available to you that’s a pretty big premium to pay for an additional point per dollar for dining spend. You’d need to spend $7,500 at restaurants annually to justify the $75 AU fee. Even with reimbursed business dining that can be hard to justify.

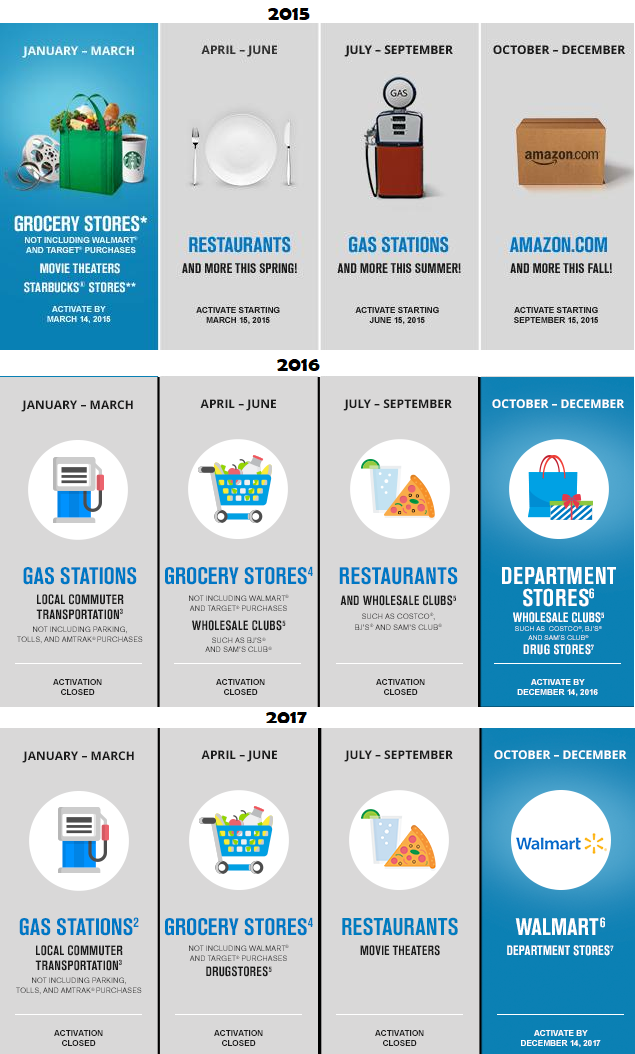

I’ve been channeling my dining spend towards a variety of cards the past year. Unbonused min spend is always justifiable towards dining in my mind. I had a $50 per month retention bonus on the Prestige card for spending $1,500 month for 7 months. The Citi ThankYou Business card gets 3x on dining in Q4 each year. Chase Freedom has 5x on dining from time to time. My point being: There are a lot of good ways to earn rewards on dining besides the Sapphire Reserve and I don’t think the incremental difference of the 3x it offers on dining to so highly differentiated.

Since you and your wife have 170,000 URs between the two of you that’s worth $2,550 toward any travel booked through Chase thanks to 1.5 cent per point uplift with the Sapphire Reserve. If you “just” had a Sapphire Preferred those URs would be worth $2,125. That’s a difference of $425 if the predominant way you redeem points is through the Chase portal.

If you’re redeeming URs with more leverage through 1:1 transfers that’s great. But there’s something freeing about being able to thumb your nose at award availability and do what you want to do travel-wise without being constantly at the mercy of award availability. That’s why I personally justified getting a Sapphire Reserve without any signup bonus at all.

Like you point out: The $450 annual fee minus the $300 travel credit each year make the Sapphire Reserve a $150 annual fee card. When you’re redeeming a lot of URs at 1.5 cpp it becomes easy to justify that fee. If you’re not redeeming this way it’s more challenging.

So for me it becomes a question of whether you’re going to buy in whole-heartedly to the Ultimate Reward program. By that I mean making effective use of your existing Ink card. And supplementing that with Freedom 5x cards. If you are then I can justify maintaining one Sapphire Reserve for 1.5 cent per point redemption between you and your wife perpetually. If you’re not interested in going all-in on Chase the next card to get becomes a more “one and done” transaction where you get the signup bonus and move on.

Sam: Robert’s on fire with this last section here. He’s hit on a lot of small, but very important things to take into consideration. What I think Robert’s alluding to is the fact that the question shouldn’t be, “Should I get a CSR,” but rather “Where does a CSR fit into my overall personal credit card system?”

Before I go on the first question that comes to my mind is: Jim is your minimum spend pretty much all real? (non-manufactured)

Jim: It is all real spending now. I used to do some manufactured spending but it has become too hard for me to continue.

Sam: Thanks. That makes things a little clearer. As Robert covered above when you’re churning through a sign up bonus you’re probably earning the highest effective ‘rate’ you’ll ever earn. If you do that through restaurant spend on 2-3 cards per year and space those out between you and your wife you could consider that extremely high bonused restaurant spend.

On a $4,000 sign up bonus for 60,000 UR (10k referral from your wife) you’re looking at 15UR per $1 of restaurant spend. And all of a sudden your old CSR becomes a lot less useful because of this.

And if a CSR becomes a lot less useful for the one reason you need it…do you still need it? Can you downgrade your wife’s CSR to a CSP or even a Freedom, cut the Annual fees and sacrifice nearly nothing on the earning side? Yes, it seems like you could.

I’m a huge fan of Freedoms, I currently have 5 between my wife and I. These are UR powerhouses, and something you should seriously consider switching to. Even an average person doing only real spending on these should have little trouble earning 15,000 extra UR a year at 5x on one Freedom card. That’s in addition to the $0 Annual fee. You’re up over $300 a year holding a Freedom vs. a CSR. Every year.

But if you do convert down your CSR to a CSP or a Freedom you’d lose the 1.5cpp uplift on all your UR. Robert put a point on it above, you’re losing up to $425 if you were to convert to a CSP and then book travel with all your points. As you earn more and more UR this ‘lost’ value increase. Or does it?

If the day came that your current Ink’s transfer partners won’t cut it and you find yourself wanting to book a large amount of travel in the UR portal call Chase, ask for your Freedom/CSP to be upgraded to a CSR. You’ll save the annual fee in the meantime and still have access to the 1.5cpp UR portal if you ever need it. No sign up bonus, but you’d have access to that uplift on all your points.

If you’re not planning on traveling anytime soon then a CSR is a hole in your wallet you throw money at. This is because a CSR is not the most effective warehouse for UR, a CSP would be a more effective warehouse of CSP, and a Freedom would be an even better warehouse since it could probably earn you more UR and has $0 fee.

I keep coming back to the question I opened this section with, Where does this [next] card fit into your overall credit card system?

Robert: I appreciate the clarity on Jim’s lack of enthusiasm for manufactured spending schemes. It’s gotten harder to the point of it being not worth it for a lot of us.

That said there’s still a lot of value to be had in making the Chase Ultimate Rewards program the predominant bank point program you’re focusing on. If you’d asked about a co-branded airline or hotel card we’d be asking about your demand schedule. But since Ultimate Rewards can be redeemed for cash -or- with upside towards travel they’re good for everyone who can manage their credit card portfolio effectively.

Somewhere between “just getting signup bonuses” and “manufactured spend” is an intermediate area where you’re juggling credit cards for category bonuses. You know the drill – “use this card at gas/groceries/drugstores” and this other card for “everything else”. Some people find even this task distasteful, and rightfully so. There’s just not enough upside in category maximization for real purchases to waste the cognitive bandwidth required. The potential for marital strife alone should make it a non-starter in many homes.

For me, it’s a lot less cumbersome to just rotate through the cards that need minimum spend than categorical juggling. And that’s what I’ll aim for in my recommendation to Jim: Simplicity.

Should Jim get a Sapphire Reserve for himself to match his wife’s? I’d say: Not yet.

I think he should hold off on getting his own Chase Sapphire Reserve until just before his wife cancels hers so she can refer him, get the 10,000 point referral bonus, then once that posts cancel her Sapphire Reserve. I’d recommend doing that a couple months before your wife’s annual fee is due to give the referral bonus time to post. If you cancel a card while a signup bonus is in flight I don’t think you’ll get it.

Jim, when is the annual fee due on your wife’s Sapphire Reserve?

Jim: 6 months from now.

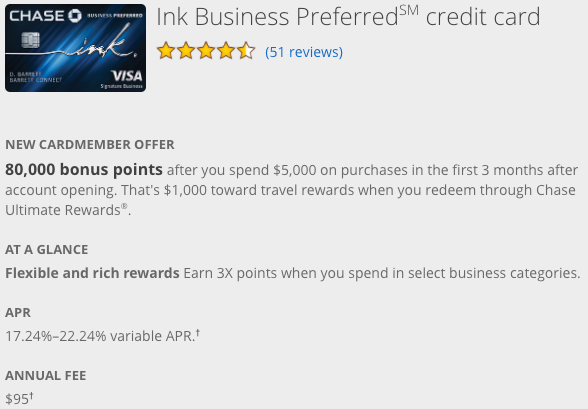

Great. You’ve got time to pull off what I’m going to recommend then. I’m debating whether Jim should get a Sapphire Preferred (50,000) -or- an Ink Business Preferred (80,000).

Jim, which Chase Ink Business card do you have currently?

Jim: I have the Chase Ink Plus.

Robert: Great. The Ink Plus is considered a different card from the Ink Preferred.

If Jim were to get a Sapphire Preferred, he’d have to wait 2 years before he could get the signup bonus again for *any* Sapphire card (Preferred or Reserve). Chase’s T&Cs on their Sapphire cards is now:

“The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 24 months.”

So I’m going to recommend the Ink Business Preferred. It comes with an 80,000 point signup bonus after spending $5,000 in the first 3 months. The $95 annual fee isn’t waived, but the signup bonus is generous enough to offset the annual fee.

For spend, the Ink Plus gets 5x at office supply stores and telecom. The Ink Preferred would seem inferior for its 3x on travel, telecom, shipping, and “advertising purchases on social media and search engine optimization” – but I’ve heard of some crazy things earning 3x on the Ink Preferred card. These differences largely don’t matter for someone who’s not into manufactured spend, but I think diversity is good in this area.

Once a few months has gone by and the Ink Preferred bonus is successfully behind him, Jim’s wife could refer him for a Sapphire Reserve if he falls back under 5/24 again. That way he’d have another 50,000 point signup bonus, the 10,000 referral bonus, and the 3x at restaurants he likes. Plus he’d maintain the ability to redeem all their URs with 1.5 cent per point uplift.

And if she’s comfortable signing up for business cards, Jim could then refer her for the Ink Business Preferred for 80,000 plus 20,000 points for the referral.

There’s been some chatter recently advising not going for new Chase business cards since the approval process lays eyes on your account and can trigger shutdowns. I do think that’s a real concern for some. But you don’t manufacture spend, you’re under 5/24, and you’ve established business spend history on your existing Ink Plus card. You may even be seen as a profitable customer for Chase.

I don’t think the Sapphire Reserve bonus is going back up. I do think the Ink Preferred Bonus could come down (say to 60,000 as other Ink cards have been in the past). And I’d save the Freedom cards for later.

So this is what I’m going with. Final answer:

- Ink Business Preferred 80,000 now for Jim

- Sapphire Reserve 50,000 for Jim 4 months from now via referral from his wife

- Ink Business Preferred 80,000 for his wife via referral from Jim once min spend has been met on Jim’s Sapphire Reserve

Total Ultimate Rewards earned: 240,000 worth $3,600 with 1.5 cpp uplift with Jim’s Sapphire Reserve (in addition to his existing 170,000)

Sam: I know we’ve both hit you with a lot here Jim. But If I had to boil down both of our positions I’d say we’re in agreement that you should actually be *more* invested in Chase products and less invested in any one Chase product.

Any application that will put you at 5/24 needs to be a Chase card, but before that a Chase Business card is the best bet. Robert’s hit on this with his excellent recommendations and I agree that his path forward should be the way you go.

I’m also extremely bullish on that Ink Preferred 80,000 point offer. I think it is a fantastic opportunity that doesn’t get nearly enough discussion. And being a business card makes it even more enticing. The strategy Robert has outlined above is really solid, so I don’t have much to add but I will offer a slight tweak on it.

After you get your CSR and your wife gets the referral points you should downgrade your wife’s CSR to a Freedom. This will be in 5-6 months, right around when the annual fee is due–and hopefully right around the time that Chase Freedom pushes Restaurants as the 3 month 5x period. If you review the last 3 years’ worth of Freedom bonus calendars you’ll see that 2 out of 3 years have had the 3rd quarter for Restaurant spend:

So if you follow Robert’s advice on what to apply for next and you downgrade to a Freedom you’ll have some powerful UR earning cards at your disposal. I know you said above you don’t like to manufacture UR–but I hope that when you take a look at what you’re holding and the current 5x and 3x UR bonus spend opportunities you’ll reconsider.

The ability to manufacture UR with these cards is vastly superior to any kind of earning you can do with your ‘organic spend,’ and while I know it has gotten tougher lately I’m confident there are some avenues that could work for you with these cards (Ink Plus, Preferred and Freedom).

Once you’ve gotten the above applications out of the way I’d suggest you get a solid 2%+ back card for everyday spending. Depending on what’s currently in your wallet you might even be able to product change to one. But that’s a conversation for later, you’ve got a solid 6 month plan ahead of you.

And finally, I’m 75% confident your wife will at some point in the next year receive an offer for a CSP or CSR in her ‘Your Offers’ Section, allowing her to bypass 5/24 limits. My wife has her 3rd CSP, and I’m on my 2nd. 2 of those 5 CSPs were had via Chase personalized offers.

Should your wife receive that offer then convert your CSR to a Freedom Unlimited and run another year with her CSP. You’d then have two Freedoms, one normal, one Unlimited, a CSR/CSP, your Inks and a ton of UR at your disposal.

I stand by my earlier recommendation to avoid adding each other as AU at least in the short run. As you can see above there are a lot of great Chase cards you can get in the short term as part of an overall application strategy.

There will be a point where you’re pretty much locked out of new Chase applications, because there really are more than 3 great offers from banks other than Chase every year. And if you adopt the idea that you’re going to be perpetually spending towards new card bonuses you’ll be looking at being over 5/24 for a long time to come.

Take this opportunity and follow Robert’s game plan above while you’re under 5/24. You’ll knock out 2 solid offers and then as soon as your wife drops below 5/24 do the same for her. You’ll be sitting on a nice cache of around 500,000 UR, you’ll have multiple Freedoms and the ability to upgrade one to a CSR when you’re ready to make a UR travel portal booking at 1.5cpp.

What do you think? What did we miss? Any tools you use that would have been helpful in situations like these? Join the conversation by leaving a comment below. And drop us an email or hit us up on Twitter @Milenomics if you’d got a puzzler we can tackle.

Holy cow. I thought *I* was into the points game but you guys take it to an entirely new level!

🙂

Two follow-up questions:

1. Does Chase Freedom Unlimited card count against 5/24 rule?

2. Does AU on cards count against card holder’s max or against AU’s

max assuming AU also is card holder on other Chase cards?

1. Yes

2. It counts against AU’s max. I’m not certain I understand your question, but I *think* see where you’re going. Let me try to explain…

When Chase goes to check whether someone has 5 new accounts across all banks opened in the past 24 months they look at your credit report. If you’ve been added as an AU on someone else’s account that counts as a new account for you.

Adding someone as an AU to your account does not increase the number of new accounts you have, because adding an AU does not appear as a new account on your credit report.

Hope that helps.

I’ll add that you don’t give Chase your AU’s SSN’s the same way you do with American Express. They do a name/address match based on their information. What I now do is I add my Dog as an AU and hold the card in my or my wife’s wallet. That way they can’t find a name/address match and won’t ding anyone’s credit report with the AU card. When’s the last time someone ID’d you on a real charge anyway?

Wow! I just found you guys (linked on someone else) and your information is SO solid! Thank you for the effort you put into this writing! Very clear, even for my newbie-self!

You add your dog as an AU? Woof.

Yep. Especially beneficial for those Chase offers where they give you X if you add an AU and make a purchase. Those are never worth a CR hit but can’t pass up an easy batch of points/miles. Has also made for some really interesting credit card offers in the mail.

Friendly reminder that the Chase Ink Preferred also provides cell phone insurance when you pay your bill using the card, in addition to 3x UR. That’s a nice perk, and even though the Chase Ink Plus/Cash cards earn 5x UR on cell phone bills, it might be worth it to put that spend on the Ink Preferred, depending on how many phones you have tied to your account.

My husband travels for work a few times/year, sometimes more frequently and often needs to rent a car. We also need to rent a car for some of our travel. I like the primary rental car insurance feature quite a lot, and for that reason as long as he travels for work, he is going to keep and use the CSR. I have my own (we both got our CSRs during the 100k sign-up) and I will hang on to mine for the forseeable future. I also like the roadside assistance perk, as we don’t have that through our car insurance, nor do we carry AAA anymore.

Oh, sheesh, over commenting on my old comment from awhile back. Did the Google for some commentary on CSR in two-player mode, and here I am.

It still makes sense for us to keep my husband’s card for his work travel, but mine? Eh. Probably not. We are together for all family travel and a lot of my dining spend.

I still have until March for when my next AF hits, and then I will be sure to get my $300 travel credit and then downgrade to another Freedom.

We have yet to use a Priority Pass lounge on family travel, but afaik you can still bring unlimited guests in with the CSR priority pass, so mine wouldn’t be necessary.