Ahhh Spring is in the air. The bees are starting to buzz, and the chill in the air is slowly leaving. I’ve got my garden prepped, and am just about to harvest our winter veggies before I put in some spring berries and tomatoes. How are you getting ready for spring?

Here on Milenomics a new season means just one thing: Credit Card Applications.

The Credit Card Calendar (CCC for short) is the process of applying for credit on one of two timeframes:

One Player Mode: Once every 6 months.

Two Player Mode: Alternating applications every 3 months.

Since I play in two player mode, Fall saw me applying for new cards, Winter my wife applied, and now it is my turn again to apply.

Potential Benefit #1 of the CCC: Supercharged Chase Freedoms

If you’re like me you probably think that the Chase Freedom is a great card to earn UR. Premium Chase UR cards have the transfer benefits of Chase Ultimate Rewards which the Freedom is lacking. A combination of a freedom (or two, or three) and a premium card give you the best of both worlds. I advocate we should all to have such a setup, but I hate paying a $95 a year annual fee for this “benefit.” Playing the CCC allows you to maintain the transfer benefit for years to come for $0 out of pocket.

This is done with a little something I like the call the Ultimate Rewards Shuffle. When applying for new cards It is very tempting to go all out and apply for the same cards in both you and your SO’s name at the same time. The downfall of doing this is that you overlap benefits. Because Milenomics doesn’t advocate holding credit cards and paying annual fees we want to extend the amount of time we can use our free first year annual fee waiver. To do this we’ll need to be particular with our applications.

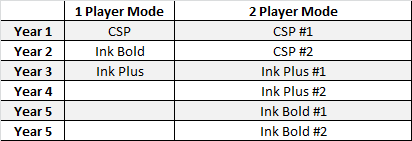

The Ultimate Rewards Shuffle allows us to alternate between cards year after year, keeping the transfer benefits for our Chase Freedom Ultimate Rewards and never paying an annual fee. I’ve outlined what a possible shuffle might look like for both 1 and two player modes of the CCC:

The above shuffle assumes you want uninterrupted access to UR transfers. In reality you may only find yourself transferring UR 2-3 times a year. If that is true then you could feel free to spread out your 1 player applications to once every 18 months instead of once a year. This would give you coverage for 4.5 years off of just the above three cards.

I’m currently shuffling between a CSP and an Ink to keep my transfer ability. I don’t have a need for a lot of miles, as I’m fairly well stocked up for the next few years. Whichever cards you decide to apply for, ensure they fit into your demand schedule, and your personal system for Conservation of Miles.

I’ve gone ahead and put together the following applications to continue the UR shuffle and pad my point balances as best as I can.

Spring CCC Applications: Nothing too Exciting

In the past I’ve selected imaginary applications for us to apply for, and then used those applications to book pretend travel. I’m pushing back from such a post this season, and focusing more on my actual card applications. Next Season we’ll return to a more fictionalized approach, for reasons which I’ll outline later in this post.

I’ve always advocated looking at your demand schedule and filling needed demand for miles with applications that help you earn miles you will use. I’m asking you to continue to do this. Be specific and targeted in your applications–a mile earned but never used is a terrible thing. I’d rather you consider cards which pay a mileage currency you will use rather than cards with large bonuses you’ll be years away from using.

My number applications this Season were small–just three cards. The first of these is the card I really needed for the March #milemadness tournament:

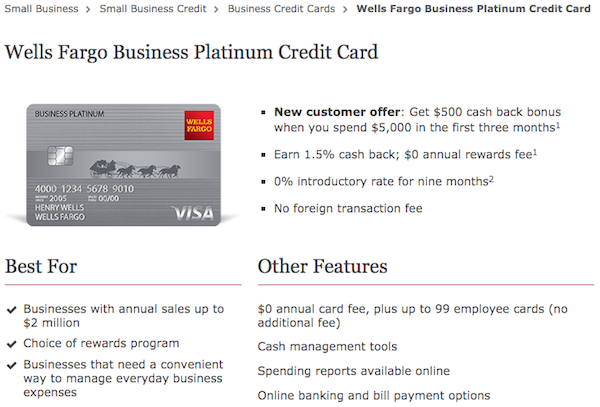

1. Wells Fargo Visa Signature 5% Cash back card:

Applying for this card was a two step process for me.

Step one I applied for a new checking account with Wells-Fargo using this link. This is an offer for new WF customers to receive $100 for opening a checking account. There is a requirement of using your debit card 10 times, or direct depositing once to receive the $100. I funded the opening deposit of the account with a Chase Freedom, and the purchase was coded as a Department Store purchase, earning UR.

Net Gain: 550 UR and $100.

Step two: After my account was opened and my debit card arrived I applied using this link for the Wells Fargo Cash back consumer credit card. This card has a promotional period of 6 months where it earns Earn 5% cash rewards on gas, grocery, and drugstore.

Application Outcome: Pending review

2. Chase Ink Plus Business Card

My second application was for the Chase Ink Plus card. I won’t bore you with a detailed description of the card since it has been written about ad-nauseum on almost every blog. I applied to keep the Ultimate Rewards Shuffle going, and the 50k UR and 5x in certain categories were great bonuses on top of the Shuffle.

Application Outcome: Pending Review

3. Barclay Arrival World Mastercard

This one is a card that I was apprehensive about applying for–I was actually swayed towards it by a few readers. I applied based on the recommendations of those readers to apply, take the $400 and run. I’ve been cruel to Barclay in the past–taking the bonus from US Airways cards and cancelling after the 10k anniversary miles hit. I’ve also applied for 2 US airways cards myself in the past year and a half. I wouldn’t be surprised if this card doesn’t come through for me.

Application Outcome: Pending Review

Order of Operations and New Credit

I kept the Arrival card last in my round of applications since when applying for credit cards order of operations are important. I like to check which credit report will be pulled and then rank my applications in order from most important to least.

For these three applications Wells Fargo wouldn’t “see” the Chase application, and Chase would only see Wells Fargo (if they pulled the same report, which they didn’t). Barclay could theoretically see both Chase and Wells (if all three pulled the same report).

Which credit report is pulled will be based on the bank and the state you’re located in. This means your experiences may be different than mine. Chase and Barclay both ended up pulling TU and Wells pulled Experian. Because of this to Chase and Wells Fargo I looked like I hadn’t applied for a new card in 6 months, but to Barclay’s I looked like I applied for 2 cards in one day.

Pending, Pending, Pending…

Pending does not mean denied. Sure an instant approval is always best, and I’m sure you’re scratching your head as to why all three of my apps went straight to pending. My theories behind this are twofold:

First, I recently moved and changed my mailing address. While my address change has been reflected on all my cards and bank accounts it is still a new address on my credit report. This means extra scrutiny by banks as a new address is never as preferable as a longstanding one.

Secondly, I’m pretty high up there in available credit. I’m over 3x my base pay in credit lines, and getting more and more credit isn’t something banks will do forever. While this might seem like a bad thing, Milenomics advocates holding onto our credit lines for just such a reason. Holding $25k in credit with Chase might mean you’re not instantly approved for a new Chase card–but it will also make splitting that $25k to open the new card a powerful argument.

Splitting existing credit means a bank is not taking on any new risk, and instead you’re just shifting the existing credit lines around a bit.

What’s Next?

I’ll be calling Wells, Chase, and Barclay (I’m not looking forward to talking to Barclay) reconsideration lines later today to see about getting these applications pushed through. I’ll of course update you as to my success or failures on the matter.

Sadly, this will be my last season playing the CCC calendar for a while. I’m about a year and a half away from looking to buy a new place, and I need to get my credit inquires down, and clean up my Authorized user accounts and such. I’ll miss applying for cards, but I’m pretty well stocked up for the next 18 months.

As my needs change I’ll continue to keep Milenomics updated, and will continue the CCC for those of you able to still play along with me.

My wife was just turned down (initially pending) for the Arrival on account of too many new accounts. FICO was 780-something, and she had four accounts opened about 100 days before the Arrival app.

Good data point thanks Nick. I’m definitely not looking forward to talking to them. Chase and Wells I’m not too worried about, but Barclay’s seems so tight on new credit for churners that I’m expecting a No from them. I’ll call sometime after lunch and document the calls for others.

Good luck with Wells Fargo! I got denied for their card but was more relieved than anything after the hopelessly backwards process of dealing with them on the bank account and cc applications. In the end, I liquidated one VGC in the process and wasted a bunch of my time and a lot more of theirs.

What do you mean by needing to “clean up my Authorized user accounts and such” and what does that have to do with applying for a mortgage? Is being an authorized user on your wife’s cards a bad thing when applying for a mortgage?

Charlie: I don’t believe being an AU in and of itself is a bad thing. My concern is her new accounts pulling down my average age and any revolving balances being seen on my report as well as hers. Old, long term Authorized user accounts aren’t so worrisome for me. The newer cards she’s applied for in the past year have shown up on my report as AUs, I’ve got 3-4 total on my reports. I want to get them off and keep my credit files as clean as possible to allow for the least headaches as possible.

AU cards showing up on credit reports are a negative in my view. I don’t like the current trend–I’ve seen banks get more aggressive matching names and addresses to credit files and reporting AU cards even without SSNs. I don’t like having those accounts on my file since the line is technically not guaranteed by me.

AU showing has a positive side as well.

I piggybacked on my Mom’s credit when I was 18. She put the bulk of her line on one card and added me as an AU. She never carries a balance so it was a great boost to my credit and kept my utilization really low.

Now I’m doing the same for my kids. Credit scores effect more than CC applications. Slowing down when getting ready to apply for a home loan is smart. Frequent soft pulls might be a good idea too.

About half of employers pull a report on applications/new hires as well. Even though the impact of applications is minimal anyone looking for work might want to keep the 5-7 point drop per app in mind. I almost never see warnings about this, even though many people who are new to the game are young.

Haley,

All excellent points. I too have “lent a hand” with AU’s for young credit scores. I’ll go a step farther and say that your Credit Score is the single most important number in a person’s life. Everything from borrowing costs, credit worthiness, purchasing power, Churning, insurance costs can be influenced by your credit score. Especially For those on the bubble, and between one tier and another every point does count. Thanks again for the comment.

If I read correctly, you can open a WF account and fund it with a cc? Can you basically do any amount and then withdraw (leaving enough in to meet the minimum to avoid fees of course)?

Neil: the cap at Wells is $500. Also some cards may treat that as a cash advance. Chase didn’t do so for me.

OK thanks – and I hadn’t even thought about the cash advance issue so I’ll be sure to stick with a Chase card.

WF is a royal pain to deal with as their CS folks are not strong. Additionally, their online payment engine won’t accept EFTs greater than 5k. No, that is not a misprint…although the banking industry wrote the book on EFTs and online payments, Wells won’t accept a 5k+ payment. All that being said, I am in month 2 of my 6 month 5% window and am enjoying it. Further complicating matters is a credit line only about 40% of my other accounts, yet again – maximizing the 5% cash benefit has been gratifying and a fun game to play. I look forward to hearing how your experience goes with them…good luck!

Thanks for the feedback Jake. I’m new with WF–haven’t had much trouble with them yet, but the game is just starting to get underway. I’d love to talk shop and know what you’re doing monthly. Feel free to email me if you’d like to keep it off book. Samsimontravel@gmail.com

What does CSP stand for?

Bob: Chase sapphire preferred.

Just curious – how come you don’t call the reconsideration lines when you don’t get instant approval?

Degania: I did just that. You can read about the results here: http://www.milenomics.com/2014/03/spring-credit-card-reconsideration-phone-calls/