Sam: I’d like to turn our standard Shop Talk format on end today. Instead of a guest post, or our usual banter I wanted to discuss a question that’s been on my mind for a few weeks. This topic has been sitting in the draft box unwritten for a while: “Is it too late to start earning frequent flyer miles?” Here I’m talking about hard, airline backed, capital M-Miles, not bank points.

If you haven’t started earning any miles yet you can definitely relate to the question. If you’re a seasoned pro you might even be thinking about quitting at this point. What’s the best way to proceed for each of you? I’ve got plenty of thoughts on this, but I wanted to see how you feel about it as well Robert.

Robert: I’ve been beating the drum about bank points for a while now. I definitely prefer them over airline miles for most of my travel. But airline miles do have their place in my personal approach to this game and I think for many others.

First, on the earning side while actually flying it’s not like airlines give you the choice of some alternate reward currency so you may as well take what they’re giving.

Second, if you’re looking for international flights [especially] in premium cabins airline miles still provide outsized value. Sure, you may be well positioned with transferable bank points but ultimately you’re using airline miles and navigating the headaches that come with award charts and availability.

On the earning side, I like to think of this from the perspective of someone who rarely flies. Because if you address the challenge of earning points & miles without flying you’re addressing the puzzler at the extreme.

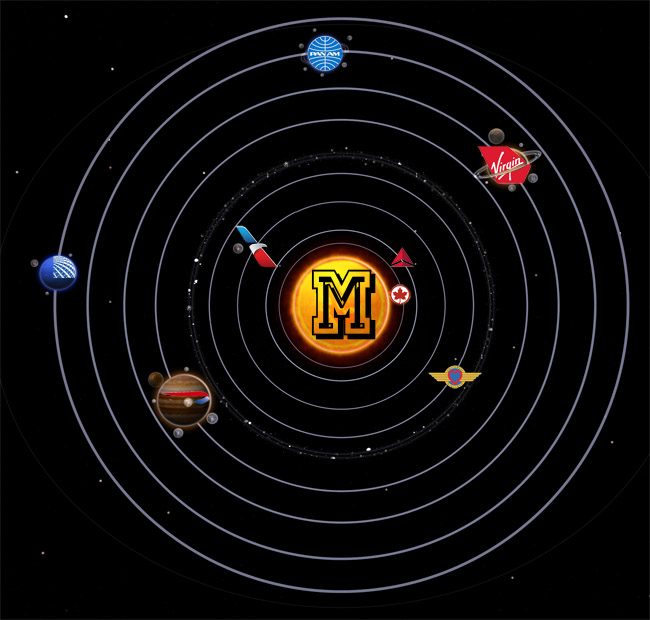

What this leads me to is the question of Which airline credit card should I get? which I recall @MilesAbound brilliantly answering: All of them!

Given a long-enough time horizon and travel needs, the signup bonuses from all of the major airline co-branded credit cards provide value I’ll almost certainly be able to leverage. It’s just a matter of prioritizing these signups relative to better options.

And more importantly, to use the miles wisely such that you leave more flexible and valuable currencies for travel needs that aren’t well-funded by airline miles, but are better funded with bank points or cash back.

What are your thoughts on this, Sam?

Sam: International Premium cabin awards are probably the best use of frequent flyer miles, I’ll agree with you there. Is that feasible for most people on sign up bonuses alone? Yeah I think it is–2 cards per person and you’ve got outbound and return flights covered on very restrictive routes and very restrictive days. Expand to a family of 3 or 4 and you’ll have a little harder time–but still doable if you factor Business cards in the mix as well. We put something like that together a few months ago for a “Brandon Asks.” Boston to Singapore.

But that’s a very specific use, to some very specific locations. I’ve just overheard too many of the negatives lately to recommend anyone start out by earning frequent flyer miles. I was sitting on an AA flight and heard the FA reeling in a CC app: “50,000 miles would get you two flights anywhere in the US you want to go.” That’s between 100% true and a total lie. The game is just way too nuanced and complex. That’s great for someone who wants to put the time and energy into learning the ropes. Or someone who travels a lot, and like you said already earns BIS miles.

But really if you’re starting out, sticking with Bank points gives you a very nice soft floor to land on if you need to. Someone else (maybe even me!) might tell you that it is possible to earn 2+ Cents per MR, but if you’re unable to make that work you can pull the ripcord and cash out those MR at 1.25 cents per (Schwab). When you’re stuck with 68,110 AA miles and your work schedule is such you cannot make anything happen with them you’re sort of stuck holding them. And scammy AA will explode those miles into a pile of nothing if you don’t [creatively] use them for 18 months.

If you wanted to dabble in FF miles you could always transfer some MR to Delta/BA (two of the easiest to use programs) and get your feet wet. Or on the UR side you could transfer to United/BA and make some sample bookings there. (Ed:I’ll edit this and add an easy TYP partner later).

Robert: Good luck finding an easy TYP partner! ?

Sam: Wow, after really trying to find one, I gave up. I guess I won’t add an easy TYP partner, as none really does exist. But the idea is sound; I think these bank points allow you some cover –as you start to convert MR/UR/TYP to hard airline miles you will start to see that the value of a mile can be between 0 and 2+cents. And as you do that you will also start to make the connections between the abstract nature of miles, routes, award charts and the cold hard truth of your travel.

Robert: The approach of starting small to see whether it’s for you is smart and works well in this game.

I do this a lot when I’m dabbling with new approaches to earning points & miles. Gift card/event ticket reselling. If you start off with a safety net by buying GCs from a retailer you frequent or an event you wouldn’t mind going to if you can’t resell at break even or better you didn’t lose out on your experiment. Once you get a feel for how things go build from there or abandon the approach.

Sam: I think you’re right–it really is a solid plan for a lot of what we do. The 3PGC and concerts are some great examples. One more thing I want to mention, is I think that people put in their head the idea that Miles are going to help you travel a whole lot more than you already do. I think there are people who wish they traveled, and then there are people who make travel a priority. “Wow this credit card will get us free trips and start us on the road to many great vacations,” is flat out not true for the majority of people. That’s eerily similar to the idea a lot of people buy into when purchasing time shares. If you don’t travel now, and haven’t traveled because of personal reasons No amount of miles will likely change that. And you’ll just be locking up money into programs which, like time shares, you get no use out of.

Robert: Interesting you mention timeshares – I’ve been meaning to write a post about that. My approach with those have been very similar to what I mentioned above with starting simple then getting more risky for deeper discounts.

I’m a huge fan of the Four Seasons Residence Club Aviara north of San Diego.

The first time we went there, it was part of a timeshare preview. The second time it was by renting a week through a broker. The third time we rented from a private party through RedWeek.

As I was negotiating with the owner the first time he made a very good point. I said I could rent from the broker, pay with a credit card, and have peace of mind that I wouldn’t get swindled. He said “Yeah, but if you rent directly from me you’ll save $300. That’s what I get for spending my Saturday morning haggling with you.” We came to terms and I rented from him again the next year.

My point is this: It’s smart to start simple then get more complicated as you build out your comfort zone.

As you get more clever the percentage discount you get increases.

Continuing the example with timeshares, the last time we went to Aviara I paid with bank points and stacked a Four Seasons 4th Night Free offer with Citi Prestige 4th night free. We got the accommodations we wanted, had date flexibility, and booked with the property through bank points to achieve a very deep discount.

Extend this concept to airline miles and you’ve got a winning strategy.

Sure you could sign up for a credit card from Banco Popular and book Lufthansa First with Avianca miles topped off with Citi ThankYou Points. But I’m way more comfortable booking that through United the first time.

Sam: Extremely well put there Robert. Start simple and build out from there. Overloading early is a great way to blow it. Along those lines, I think there’s realistic and idealistic viewpoints to pretty much everything we do. The idealistic are things like “this timeshare is going to get us traveling more,” The realistic is, “We didn’t travel before, we don’t travel now, and we’re struggling to use it at all.” If you’ve been bitten by the travel bug, and if you want to save money on your trips or travel a little more comfortably for the same amount then this is absolutely the game for you.

I like what you’ve written about the comfort from a program like United vs. the ideal from a Banco Popular/Lifemiles/TYP/LH booking. And one other thing I think doesn’t get enough play is that not every successful booking ends up becoming a successful trip. Say you were able to string together that LH award booking–if plans change It is a whole lot easier to take a refund and redeposit into your DL account than it is into a foreign carrier’s account that has a hard mileage expiration (ANA, I’m looking at you).

Maybe the answer to our question is that it is never too late to start earning Miles, but it can be too early to start earning them.

—

Readers: What do you say about this? Leave your comments below

“50,000 miles would get you two flights anywhere in the US you want to go.” That’s between 100% true and a total lie. ”

It’s 100% true, as long as “where you want to go” is Cleveland and you don’t mind making three connections in a basic economy middle seat. My hope is that people new to the hobby will read your post. It’s the kind of reality check newbies need. Unfortunately, many of the blogs that pump credit cards give people the very mistaken impression that free luxury travel is there for the taking. There is a certain high that comes the first time you redeem points for a premium cabin seat on a long haul. Or stay in a luxury suite for pennies on the dollar. It’s what inspires many of us to devote significant time and energy to repeat the experience. But that high seems increasingly harder to attain. With every new devaluation and every new restriction on signup bonuses, the game gets harder and more complex. Thanks for helping people navigate what’s left of it!

If you ever want to fly in international first class on an A-list airline, then it’s never too late to start earning frequent flyer miles.

Singapore Airlines and Air France are unique in that they are transfer partners of AmEx, Chase, and Citi. They make for very nice pooling opportunities. Citi also has Qatar and Ethiad which have amazing premium cabin experiences.

It really is possible to get the dream redemptions that are out there. It just means starting your search early for award space, being persistent and being patient. I redeemed for level 1 Delta One business class awards to Europe and first class to Tokyo on JL earlier this year and I’ve already booked first class awards on CX, BA and Emirates (on A380s with showers) for the coming year. It is possible.

Hi Michael: Thanks for the comments, and the positive data points. I think it helps give readers a little context if you mention if you’re a solo traveler, travel in pairs, or have a family.

The Delta redemption was for 2. The rest were for solo travel.

Thanks for the update Michael.

The difference is perhaps it has gone from moderately easy to do this and get when and where you want from miles to only being doable with planning and flexibility. But as long as it remains doable it is still worth it. And wait until the economy goes south again to really judge the state of the game

The only airline miles I will earn without a specific goal for them are Southwest miles. All the other airlines I am only going to collect there miles in any large quantity if I have a specific use for them and I am fairly confident in the availability on that route. I have really changed my focus to hotel points and bank programs the last 7-8 years. The big 3 airlines have just raised the frustration level way to high when it comes to redeeming points.