A long standing format here on Milenomics–the Deal Debriefing is where we look backward at a deal that is either dead, or has ended. These posts are not to brag, not to boast–they’re to work harder and smarter the next time something similar comes around. The key here is to share what worked and what didn’t work, with an eye on the lessons we can learn from the deal.

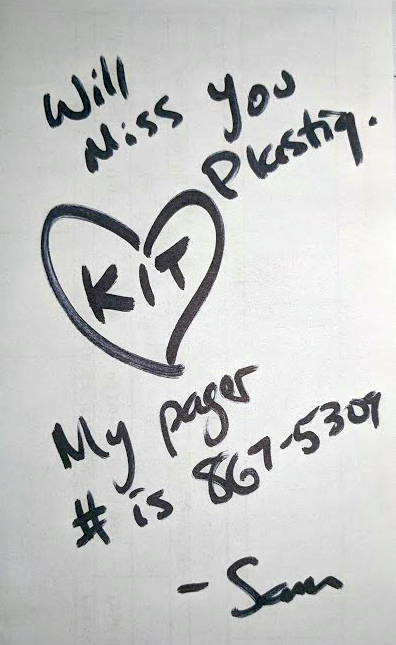

Plastiq.com — Had a GR8T Summer! K.I.T <3 Sam

Plastiq’s summer promo was almost too good to be true. So good that early on they changed it, dropping it down from $500 to $250 per transaction. With no cap on the transactions there seemed to be no real reason to go down to $250, other than to maybe scare some people off from the clicking.

All. The. Clicking. I think that the promo was partially paid by Mastercard and partially by Logitech, in an attempt to sell more mice.

Deal of the Year

Robert dubbed it the deal of the year– I think I agree. One thing is for sure, I think it will be in strong contention for a Milenomics year in review award at the end of 2018–unless something amazing comes along in the next few months.

The thing that was great about it was its broad utility.

- It could be executed entirely online.

- It could be used to meet min spend on Mastercard credit cards.

- Or it could meet any credit card minimum spend by way of MCGC purchases.

- It could be used with Mastercard credit cards that earn high everyday rewards or were targeted for this promo.

Remember a while back when Blackhawk networks missed their quarterly numbers and many grocery stores stopped taking credit cards for gift cards. Blackhawk said that once retailers were chip & PIN enabled they’d start selling gift cards again. And to give sales a boost they’d run promos on VGCs and MCGCs. We’re seeing those promos now.

The Plastiq deal coincided with heightened fuel rewards on MCGCs at grocery stores. When we lost Visa GC portal Cash back we saw the rise of MCGC cash back. There was a nonstop assault of MCGC deals at Staples and OD/OM deals over the summer.

All of this came to a point at the exact right time, with Plastiq.com’s promo being the way to liquidate all of these cards. And liquidation is everything in this game.

We tried our hardest to beat the drum on this promo here on the blog–I do hope those of you reading this were able to use it to earn buckets of miles and points.

I think this summer promo really shown the light on how strongly a company like Mastercard can push their money around and how calculable we as a group can be for large enough companies. More on that later–but needless to say I don’t think it was a coincidence that MC promos were flying left and right all summer long.

I actually wouldn’t be surprised it Mastercard just buy plastiq and fold it into a feature of Masterpass.

Bottlenecks:

There were a good number of these–areas that slowed down or ground production of miles to a halt. I’ll cover some of the ones that affected me, and I hope you can share some of yours in the comments section. Removal of Bottlenecks should be a key strategy for scaling anything–so practice here makes perfect somewhere else.

Floating Aimlessly

Central to me was the float time for some of these transactions. GCs.com might take a week to get me cards in hand–then I’m looking at 8-10 days for Plastiq payments to clear. That’s almost 3 weeks turn time when you count paying the CC bill off.

For some of you Plastiq.com’s summer promo might have been your first opportunity to work on revolving spending. This is indeed next level–where you have money flowing inward and outward over and over, with no clear start or end to a cycle. I hope you found it interesting.

I’d at times not use Plastiq because of this very issue.

Update: Make sure to read SgFm’s comment below about shutdowns.

Cash Flow (or lack of)

Tied to the above–the idea of statements posting with large balances can have a negative effect on your credit score. Floating 3 weeks meant a lot of times my statements closed with large balances as I awaited the funds to pay them off.

A solution to this could be the use of savings to pay down debt. For 1 month this summer I was running so cash lean I had almost no reserves, and almost all liquid cash was tied up. It meant juggling accounts in ways I hadn’t done in a long time.

This is actually good practice for scaling as well–going bigger than the size of the net you are using the catch you if you stumble.

Cards That Just Wouldn’t Work

This deal was pretty complex–you were often times buying cards from a store, that would come inactive. Then you’d activate them online with a secondary site–and then add them to masterpass and try to use them in Plastiq.

Cards failed at multiple steps along the way for me (particularly MCGC from Staples). Customer service at the card issuers were helpful–but didn’t always solve the problem. I had/have one $200 card that no matter what just won’t work on Masterpass-but works online elsewhere and in person.

Electronic Payments > Paper Checks

Electronic payments not only lived a week past the expiration of paper checks–they were faster on the float side, and better all around. I unfortunately used a paper check payee. Those of you who could make repeating payments to an electronic payee were faster and leaner. A future goal should be to find or implement an electonic payee (HELOC? PLOC?).

Paying Taxes

This promo made paying taxes with a credit card (MCCC or MCGC) fee free. Shout-out to the reader who seriously considered doing 288 estimated payments by hand at or around $250. I think I talked this reader down from the ledge, but I applaud the ambition.

Click Automation is Key

I didn’t get into plastiq the way I did in the past with other bill payment services. But for those of you who really were cranking on Plastiq.com the key was automation. There were just far too many clicks, far too much typing, and way too many things to go wrong if you didn’t automate and went over say, 200 payments by hand.

A script to clear your Masterpass wallet is needed at a minimum. I would often times load the cards to my masterpass wallet and then unload by doing plastiq payments while waiting in line at WM. Vinh outlines some good techniques in this post as well, he definitely knows how to scale a deal, so always consider what he says.

Upsetting Everyone You Know

One negative of this promo is that bills you normally paid in one or two chunks were now being broken into $250 or less payments. I had my mortgage company call me and ask “why?” and if I could please just pay regularly. I ended up switching to different payee, and pretty much gave up on the mortgage. Others prepaid everything and anything they could get their hands on. I’m not a huge fan of big forward payments–I think you erode the value in the points with the loss of paying with inflation adjusted dollars.

Moving Foward

Moving forward Plastiq is pretty useless to me. Is it possible that payments under $.19 are fee free. Which…combined with a script to pay over and over could get your Plastiq account banned pretty quickly. It could be useful to drain small dollar cards that have a promotion covering their fees.

Beyond those uses, this was yet another deal where having a PO Box, or a second address was helpful. For those of you who’s spouses have a different last name, that probably came in handy as well. These are both assets you should be trying to leverage as new deals come and go. Consider setting yourself up with a second address for a future deal that comes along.

The real takeaway is that you now hopefully have payees already set up and verified for the next time Plastiq runs a promo. One thing that’s all but certain is that someone, somewhere at Plastiq HQ is looking into the volume of payments they took in over the summer. That level of volume has to be enticing to them, on some level. Hopefully they can see the market for low-fee debit card payments. We know there’s a market for this at around a 1.72% fee based on what TIO.com offered. If you recall fondly typing $491.40 repeatedly you’ll know what I mean.

We’re unneeded right now, but they’ll come calling for us again sometime soon, which is why I told Plastiq to K.I.T….

—

Add some of your takeaways from the deal to the comments section below. We’re stronger as a team!

I initially thought that I would run my mortgage payments through my MC in $500 increments, but I soon found that my credit union deposited the checks into my account directly instead of applying them to my mortgage. When I found that out, I went a little crazy. I’ve been churning since then and will have close to $100k moved through the card when it’s all said and done. On my Citi Prestige card that’s worth a minimum of $1250 if I apply towards airfare purchases. Awesome promo! My only limitations were having enough cash on hand to float the money and my card’s credit limit.

Ben: Awesome, thanks for the detailed description. There was a lot to learn about float and balancing limits and such with this promo–those are skills that you can use in the future now that you’ve got experience.

Was everyone just paying legitimate bills with this deal or did people figure out how to get the cash back in their bank accounts to pay off everything?

Nate: there’s a common theme to a lot of the people who were able to do good volume. See this comment: http://www.milenomics.com/2018/09/just-when-does-the-plastiq-masterpass-promo-end/#comment-18501 and Ben’s directly above you.

That said–there were also a lot of people paying legitimate bills.

Well unfortunately not all payees were happy with getting MANY paper checks for $250. I personally know of 2 people that had their PLOCs closed by a major bank, as result of sending $ via Plastiq to this particular bank. For one of those people the “float” period turned out to be a serious issue.

SgFm: Thanks for the comment. This is so important for readers to see I’m going to update the post and include a link to it.

Citi closed all of my accounts after i did about 2500 in 250 payments. Wish I had never done that crap, so stupid to lose at the AA miles opportunities I was banging out every 2-3 mos for 2500 in unnecessary spend. greed killed me

Citi raised my limit on 3 cards!! I was running aboiut 25 ~$250 transations daily. Never even triggered a fraud alert. I actuallythink now that it stopped their algos will think I moved my business elswhere.

You mean paying to a Citi account? Or paying from a Citi credit card?

What a productive summer. Plastiq have wrote for me over 3300 cheques, very close to $1M. Talk about killing some tree…

lol

The default font on your site looks terrible, at least in Firefox on Windows at the default size, e.g., “e” looks like “c”. It looks a little better if I zoom in or out.

Steve: I appreciate the feedback. I’m glad the larger/smaller font works for you. I’d like more info on this issue as I personally view the site on firefox 62.0.2 (on windows 10), and have no issues with the font. Can you email me a screencap: samsimontravel@gmail.com