We’ve been talking about Spring Cleaning on the podcast the past couple months, before staying at home and social distancing was even a thing.

I thought to categorize the activities I’ve been up to in hopes it provides some food for thought for downtime in the coming weeks.

Idea 1: Close Unused Bank Accounts

If you’re like me, you’ve got “a million little holes in the backyard” including more than a few bank accounts. Now is a great time to take stock of those accounts, re-deploy unused funds, and scrutinize which accounts to keep open.

If you opened the account for a welcome bonus, closing the account can put you in a position to earn the welcome bonus again in the future.

But before going “scorched earth” on neglected accounts, consider whether the account might be useful in some way. Is it a good mobile money order depository? Is it a bank that plays well with bill pay services? If so, you may want to keep it around. If not, it’s time to close it out.

If an in-branch visit is required to close the account, draw the balance down to the minimum required to avoid fees. This amounts to large scale scrounging around for change in the living room sofa, but it’s a great time to make closing bank accounts a priority.

Idea 2: Redeem Shopping Portal Rewards

It’s amazing how frequently portals like to email about lame promotions, but they hardly ever email and say, “Hey, you’ve got money with us you haven’t cashed out.”

If you’re “portal adventurous” like I am, nose around and see whether you’ve got enough money at each portal you may have used to cash out. Some pay out automatically but most do not.

And don’t forget to check spousal accounts, and accounts you may have associated with multiple email addresses. What may have seemed like a clever idea for maximizing referrals and/or skirting shutdown may now be amounting to clutter. Clean up stray accounts while you’re at it.

Idea 3: Do Your Taxes

The federal tax submission due date was pushed out to July, but if you’ve got the time now get them over with.

If you’ve got a refund coming you’d like to get that sooner rather than later. If you owe, you’ve got until July to make payments.

If you owe, maximize those payments as a low[ish]-fee way to meet credit card minimum spend requirements. Or use it as a way to liquidate Visa/Mastercard gift cards.

I find that doing my taxes provides a useful checkpoint into how things are going. What pays the bills? What endeavors did I put energy into that didn’t move the needle? Knowing this gives me clarity for what to focus on going forward.

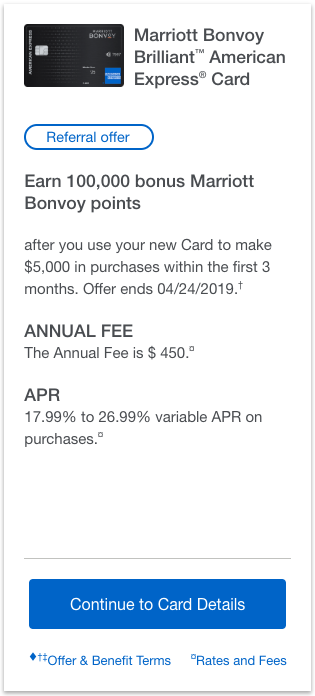

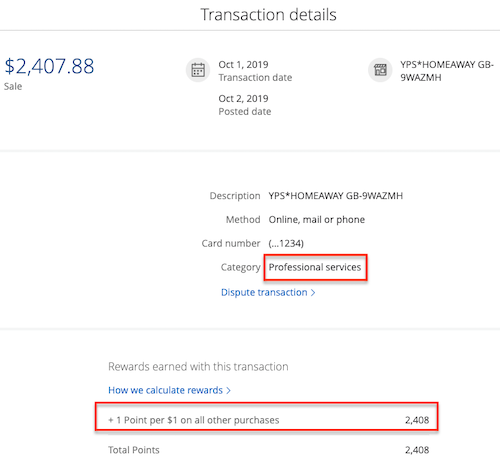

Idea 4: Review Your Credit Card Portfolio

If you’re deep into the points and miles game, this is a year-round activity. But for some people I think “a once a year churn” is a good strategy.

Especially with the viability of travel being so uncertain in the near term, it makes sense to re-visit what cards make sense for the coming year. What was once a great card might now be completely useless. Seek retention offers and/or close accounts that are ill-fitting.

Like airlines, banks are swamped at the moment. When possible, try using efficient channels of communications like chat, secure message or Twitter Direct Message to save your time and theirs.

Bottom Line

Last weekend I realized something. The reason a lot of projects don’t get done is because I fundamentally don’t like doing them.

Maximizing points and miles requires constant chasing and finagling. If you don’t like doing this kind of stuff, the game may not be for you.

But if it is for you, you might enjoy Episode 69 of the podcast where we discuss ways to boost points balances from home.