In my last post I talked about how we can remove inefficiencies in our personal Milenomics Mileage Runs. In doing so we spoke a little about the some of the limits that are in place for certain deals: Store purchase limits, Credit card AA limits, Your Time, and Cash Flow Limits.

Today we’ll start to think about what your limits should be. The very first thing we should do is get a feel for how many miles we think we will need this year and next. Putting down all the possible flights we’ll be taking into a demand schedule will help us know how many miles we’ll need to get to EQM-Zero. This number will be our yearly goal for miles.

The Rule of 7–Using it to Calculate Your Mileage Needs.

A quick, back of the napkin calculation of our mileage needs can be done using the Rule of 7. Simply put, take the number of miles you will fly–and multiply this by 7. This will roughly give you the number of frequent flyer miles you would need to earn and use to get to EQM-Zero (in economy). In our test case we had a 50,000 mile a year flyer needing between 292,00 and 375,000 miles– using the Rule of 7 would have put us at 350,000; pretty close. Remember this is per person, so you’ll want to do the same calculations for every person you’re earning and burning miles for.

Once you earn your goal in miles, give yourself a buffer, and some miles to upgrade your bookings to First should your want to. At this point you should start to incorporate cash back cards into your strategy whenever possible.

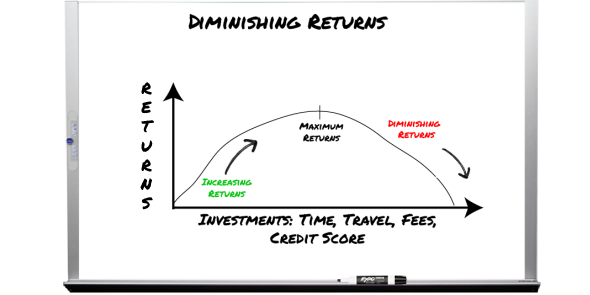

How Much of A Good Thing is Too Much?

We can’t control the limits a store puts on us–but we can look at how much is too much for each of us. Remember the Milenomics addage:

- Bulls make Miles,

- Bears make Miles,

- Pigs Get slaughtered.

Sure some cards from banks like Citi will allow you to blow right past your “credit line” and charge 2x or more than that line. But from a bank’s perspective charging more than your maximum in one month can only look bad. Think of your credit line as the maximum risk the bank is willing to take on with you. Even if you charge up to your limit, and pay it off–and then quickly charge up to your limit again you’re doubling the risk the bank is taking on.

What we should do is focus on increasing our credit lines–through the strategic merging of credit lines from other cards. I outlined this in the post–“The 11 Month Itch.” This is all part of why we don’t just close our cards–that credit line can help you reduce your % of total line you use each month to hit your goals, and make you look less risky to the bank in the process. Charging $7k a month on a card with a $5k CL is a sure way to eventually have your wings clipped–but double that credit line by merging cards, and you’re $3k under your $10k line each month.

- Note: If you’ve got a time limited offer, such as a 5% card, and it is from a bank you could care less if you’re shut down from–by all means have at it. With a 6 month countdown and a $7,000 Credit Limit you could only earn $2100(less fees) if you used it for exactly your max each of those 6 months. Pushing that to double your CL for even just 3 months means the next 3 are all gravy.

- -If that same card is from a bank you want to keep other cards open with (say Citi) you’ll probably want to take that into consideration, and play within the confines of your credit limit.

How Much Time Should You Be Spending on Collecting Miles?

How Much Time Should You Be Spending on Collecting Miles?

This is a very personal one. Only you know how much time you have to put into this. If you’re always swamped you might not have any time for MMRs. In that case you’d probably focus on signup bonuses and keep it at that. On the other hand if you’ve got plenty of time, and a schedule that allows you to travel at any time you’d probably want to put more time into MMRs.

Subdivided by our Milenomics Traveler categories the following chart should help with general estimates of the amount of time you will want to use on MMRs:

- #101 level: You may be fine with just signup bonuses. If you’re not traveling much, you don’t need 300,000 mile balances in your accounts. If you think you will start to travel more in the future then you can always shift to more mileage earning then. In the meantime get a good cashback card or two and start earning cash for your few trips you do take a year. Use as much time as you feel comfortable using–and also make sure your T-Rate is set at an appropriate level for your cost tracking.

- #201 level: You may or may not be able to survive on just signup bonuses alone. Creative use of miles, including the hybrid system, and operation twist, as well as programs like Southwest mean you might be ok with just signup bonuses (at least in year 1). Eventually most #201’s will need to generate more miles than can be done reliably with just sign up bonuses. How many is going to be answered by how many passengers you travel with and what cabin you want to fly in–First class, Business class, or Economy. A family of 4 who wants to fly business class to Asia is going to need a 500,000 miles or so to accomplish just that one flight. In reality being a 200 level traveler is the hardest–your mileage demands could be very high, and your time to earn miles could be extremely limited.

- #301 level: The description of a #301 level traveler is that The sky is the limit. This applies to your travel frequency, destinations and the miles you’ll need to accomplish this. Fortunately if you’re a #301 you have the time to get into all kinds of mile earning plans. Throw everything you have at it–keeping an eye on your T-rate and costs to manufacture. When you see your costs cross past your cash back percentage you know you’ve gone too far, scale back your operation. If you can’t feed your mile needs you will want to prioritize–and focus on buying the cheapest fares you can with cash, and saving miles for expensive fares. See the post Titled “Miles are dead–long live cash fares.” for an example of a flight you should buy instead of use miles for.

- #401 level: You may be in a bit of a short squeeze just like the #201 level traveler is–too busy to earn a ton of miles, but busy flying very frequently. Hopefully your company is paying for your status, and allowing you to keep your flown miles (yes, sadly I have friends who’s companies keep their miles). If that is the case you should augment these likely large mile balances with signup bonuses and enough MMRs to reach your personal travel goals. Ironically, 400 level Milenomics often fly a ton for business, but only once or twice a year for leisure. Their personal travel needs reflect more of a #101 level traveler even though they’re flying for work much more often.

Ultimately Milenomics’ goal is to help you earn the miles you need, and use them. We need a plan because miles are not free. Collecting miles is NOT our hobby–spending miles on travel should be our hobby.

We really don’t want to earn miles we’re not going to use. Setting a limit on our mile earning helps us know when to stop. Remember, a mile saved and not spent is a mile wasted.

“Collecting miles is NOT our hobby–spending miles on travel should be our hobby.” Good reminder for me.

I have definitely been focusing on the earning rather than the burning and enjoy strategizing/acting on how to get miles/points much more than the work involved in spending them. In fact, I have considered some strategies to spare me the un-fun aspects of booking award travel: a) using an award booking service; b) going for cash back cards, and just booking the flights I want when I want them; and c) preferring the much easier to book hotel award nights over harder to book award flights.

Now I should calculate my rule of seven.

Elaine: I’m sure many more readers feel the same way. I started the blog because I’ve been there too. The larger the number, both in balance held, and amount spent, the harder it feels to spend the miles. Use the rule of 7 to estimate the number of miles you’ll need in a year–you may be surprised how low a number it turns out to be. Holding miles way in excess of that number means you should either travel more with them–or switch to cash back cards and use/save the cash for trip expenses.

Booking tickets only gets easier the more times you do it, and once you see the relative simplicity (which is masked by low availability) of booking you should more confident doing it.

Never charged more than my credit limit before except for the previous Citi Biz credit card . I only have 1k credit limit and I need to meet 3k spending within 3 months for my 50k AA bonus miles. So the first month, I bought 3 X VRs for a little over $1500(so past credit limit of 1k) For each $500 VR I bought with the credit card, I waited for it to be posted to my account then transfer money from B of A or Bluebird to cover it. Do you think I can do the same strategy this coming month so I can complete my 3k spending by the end of the 2nd closing statement date without having CITI shut me down? BTW, when I bought the 3rd VR, it didn’t go through so I had to call Citi to okay the transaction which Citi bank did.

Sil: I’m not able to say whether you’ll be ok or not–but if you can complete the spending without going over your line I’d try to do that first. You could buy $1k this month and pay it off as soon as possible. The day after the statement is cut, buy the last $500.