Programming note: I’ve been gone for a little longer than expected. Thank you to those who’ve dropped notes to me and messages checking to make sure I still have a pulse.

Miles Are Dead (You Heard it Here First)

I think it is important that you (the new reader) understand the bias I (the old writer) have with respect to miles. I’m bearish on miles right now, and I’ve always been skeptical of the value of miles. Don’t get me wrong, I love miles. I LOVE THEM. They’ve opened the world to me, and have created a financial stability in my life that has literally changed my financial future for the better.

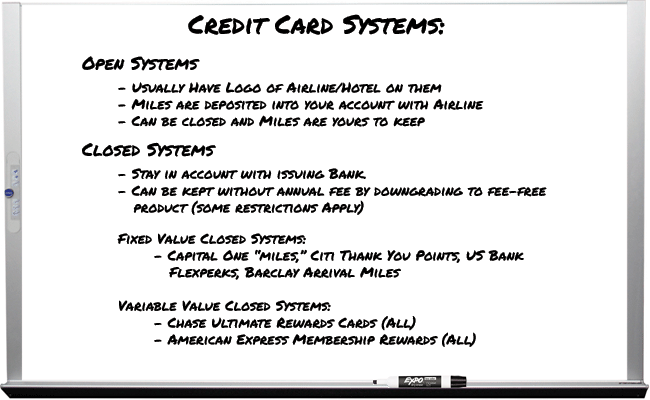

We’ve never advocated hoarding miles here on Milenomics, so I thought it fitting that this reintroduction of sorts start with a detailed rundown of the death of the frequent flyer mile. 2016 is going to likely be the year you come to realize that Miles are dead. I’m talking about true, open system miles, not closed or variable value currencies:

As miles die the push to make you *think* miles are just as useful has only gotten stronger. Marketing from both the airlines who issue the miles and the Credit card companies who pay out in miles necessitates this. They can’t come out and tell you “Good luck, you’re earning nothing for your spending or flying.” So the spin it, “more seats” or “more [higher than before] low priced awards.” The spin is there to confuse you, take your hard earned money, and lock it away into a program for which the rules can be changed for the worse on a whim.

Opportunity costs are higher than ever

We’ve discussed opportunity costs before, and how your subconscious can hurt you. Now more than ever your opportunity costs are probably causing you to manufacture miles at a rate that is phenomenally bad. The only situation I would consider currently “worth” manufacturing miles for use in travel would be if you Need to travel in a forward cabin.

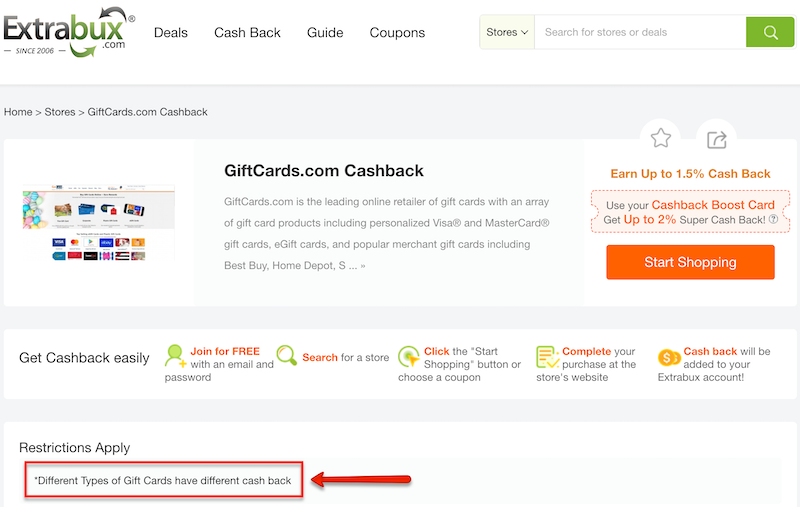

There are excellent 2-7% cash back opportunities right now. Forgoing those and trying to earn miles through anything but Credit Card Signup bonuses will likely mean you’re losing a large amount of money. We don’t usually detail specific deals here on Milenomics, and that’s not a trend that will likely change. However we’ll go into a detailed look this next week in a post outlining how non bonus spend can hurt you even when you’re using the right card for it.

You Probably Already Have All the Miles You’ll [N]ever Need.

Anyone who’s followed “The Hobby” for more than 2-3 years will likely tell you the “Golden years” were behind us. Whether that is true is a matter for another post; but one thing that can be gleaned from such thinking is this: You likely earned millions of miles in that time. If you’ve been diligent in balancing your supply and demand of miles then you might have almost no miles on hand. I’ve got far too many. My daughter’s birth sidelined our travel for a while; and in the meantime card offers came that I just couldn’t pass up.

Before you book with miles seriously consider all your balances, and consider which give you the flexibility you need in your travel before booking. The reason you likely won’t need to use any of your miles are the following reasons:

–Domestic Ticket prices are falling: Prices have finally started coming down. If you’re flexible enough to use miles you’re probably flexible enough to buy less than “ideal” tickets at a savings. Connect in Denver to save $200? Sure. Leave on a Tuesday? I can do that. These were concessions you used to make when using miles. Now you’re just doing it with paid tickets instead.

–The Flight Deal ruins international mile redemption for most of us. Thanks to the excellent work done by these guys and gals you likely will have opportunities to fly to far off places using the same flexibility we just discussed. International travel with miles hasn’t always made sense except in forward cabins; and so long as you’re not too concerned with where to go you can find some excellent deals on flights that make the cost per mile phenomenally bad.

Full Disclosure: I hold way too many miles. I’m drawing down in the programs I see little future value in, selling those I can, and starting to collect those which I think will have the most value for me in the future. I’m bearish on the entire mile multiverse right now.

“No Knock” Devaluations Sting

Today’s Alaska “no-knock” devaluation only further intensifies the death of the mile. In fact I wrote this whole post prior to the surprise devaluation from Alaska today. There’s always going to be a risk of these types of events, and when they happen they can literally make your miles both worth less and worthless.

Worth less: Your miles won’t cut book what they booked yesterday. They’re worth less than they were prior to today.

Worthless: You were collecting these miles for exactly one reason. They’re now useless for that reason, unless somehow you can earn the additional miles.

The reason I want you to consider miles dead is that you really, really need to know what you’re doing now more than ever when you’re playing with miles. The old “Follow the leader” type thinking does not work with miles that are lifeless and on their deathbed.

Miles are Dead. Long Live Miles!

While miles are dead, at least as we used to know them they certainly do still exist in a newer, less useful form. We’ll be outlining that form in the coming weeks/months here. For the vast majority of people Miles certainly are dead. Lets take a day to grieve for them, and then move on and celebrate their life and the new form they take after today. We’re not the majority, and so we’ll find a way to earn, use, and abuse our miles. Hopefully we’ll do it without making too much noise about it, and without drawing too much attention to the fact that our miles are alive and well.

Moving forward we will refer back to today as a guidepost to remind you to keep a close eye on your stash of miles, but we’ll still use miles when they are the right tool for the job.

Glad to have you back, you’ve been missed.

Thanks Douglas 😀

Looking forward to more posts

Meh. How many people really care about the AS devaluation today? A hundred perhaps? But I guess it sets the twittershpere alight since so little else to pad the blogs these days…

As for Golden Age of MS, that is long behind us – not even debatable. Now it’s relatively crap offers from second tier issuers with usually limited scale – a far cry from the Good ol Days of a few years ago.

But if you played the Game reasonably well, you should have millions of ultra low cost miles available to use. As such, devaluations should barely cause one to bat an eye. So what if it’s another 50/100K? Big deal. Yawn.

I’m with you; the number of people affected is low, extremely low. Anyone getting into the game right now, or even in the last year really needs to consider that they’re playing a very different game than those of us who’ve been in it for 5+ years.

Not sure if you’re a new reader or an older lurker; but my core audience tends to be those who aren’t totally “in-the-know” and are likely easily swayed by bad advice. I tend to play the skeptic on the blog as an advocate for those who aren’t totally up on the risks associated with collecting miles.

So good to see you back! I too look forward to more!

The hard part about taking advantage of good CB offers is that it is a whole lot easier for me to spend miles/points, than it is to spend the “cash” in the “cashback” on an expensive room or ticket. Not rational, but it is a real barrier for me.

Again, so glad to see you back to blogging.

It’s great to see you back. I hope things are going well.

They are. Life is good, and things are starting to slow down a bit to the point where I felt like the hobby (hobby as in writing the blog) could finally be picked back up.

That’s good to hear! You have a unique voice in this hobby and I missed it. 🙂

Pleasant surprising to see this pop up in my RSS feed today! Welcome back!

Thanks Jason. Good to hear from you here too.

Glad you’re back. You’ve been missed.

“There are excellent 2-7% cash back opportunities right now.”

I need to hear about those 6 and 7% opportunities. What can you tell us?

Phil: I should have been more specific. At the top end of those offers (6-7%) you’re going to have to use those points for travel. Not exactly pure cash back, unless you had already planned on spending $X for a trip and can substitute money for points. You could also broker tickets to friends/family and earn those returns though splitting the savings with them. With Family and With Friends you can leverage that card for a World of Fun 🙂

WtF are you talking about?!?!? ; )

Nuff said 🙂

I’m just waiting for that discount bump then it should work.

Thanks

You were my favorite writer along with Greg of FM and Freequent Flyer because you kept things realistic with monetary value of time and opportunity costs. Great to have you back!

Thanks so much Jig. The landscape has changed enough that I think I can be relevant and still bring some new spin to the world of points and miles. Or at least I hope I can.

Thank you for a thoughtful article which coincides with my calculations showing that cash back cards are currently beating many travel rewards credit cards for net return after the annual fee for many possible redemptions. I have the AMEX Starwood, AMEX Hilton HHonors, and the Chase Marriott Premier cards of which the Hilton and Marriott cards are only primarily used at their respective hotels while the AMEX Starwood gets measured spend based on our projected points use. My better half recently signed up for the AMEX Starwood for the 35k point offer (low hanging fruit). Airline points just don’t seem worth the trouble today.

Trouble is, all the number crunching indicates that a combination of three cards – AMEX 5% Blue Cash, Citibank Double Cash, and the new Citibank Costco card will yield a higher return after annual fees while eliminating time spent evaluating loyalty point program returns. I already have the AMEX 5% Blue Cash and the Citibank Double Cash and will likely get the new Citibank Costco card in June 2016.

We will likely use the Starwood points at a Starwood hotel. I think the Starwood card will disappear after the Marriott buyout after which cash back seems like the only option.

So, what am I missing? Thanks for the help.

Jim: Not much. You’re exactly the type of traveler I had in mind while writing this article. To be frank, don’t pass up the sign up bonuses that these cards are going to offer you; but don’t put your loyalty into their points/miles either. You sound like you have a good handle on your specific needs and are in a good place. I’m crushing the Double cash right now as well. You might be missing WF, but that ship might have sailed so I would be hesitant to recommend it since it really is a pure volume play, rather than a long term strategy.

Thank you for the reply. Does WF mean Wells Fargo? More specifically, the Wells Fargo Visa card? If so, I would not have bothered due to the 6 month limitation on benefits. You are correct that my strategy is more long term. With AMEX and Chase clamping down on credit card churning, a long term cash back strategy seemed the best bet for increased annual return with minimum time invested. Too often large signup bonuses mask a credit card without a compelling value proposition for continued use. It is interesting that there are cash back options with excellent returns while the travel rewards programs continue to offer less and less return.

Jim: Agreed on all points. When/Where can I find your blog? I’d love to read more of your thoughts 🙂

I have no blog. But, given the fact that I am making comments on your blog, I am flattered. Thank you. One of my evening amusements was writing the equation for the cash rewards on the AMEX 5% Blue Cash card and then graphing the result. If I wrote a blog, it would be to educate readers about the impact of points/$ earned, $/point redeemed, total annual spend, and yearly fees on net annual return relative to a no annual fee cash back card. I imagine this might be a bit too technical for most folks. Have a nice evening. Am I speaking to Sam?

Based on my spending patterns, I calculate that the three cash back credit card combination above should yield a minimum return of about 2.8% of total annual spend with very little personal time investment other than knowing the right bonus categories for each of the three cards. If credit card churning and manufactured spend are not an option, is there any travel rewards credit card that is worth keeping and spending on that reliably exceeds that cash back return after its annual fee for most transactions if extensive international travel or business/first class airline class seats are not how I travel? All spend is personal and not covered by a company. I would appreciate any insights.

FYI, for anybody following this thread, please be aware that while the AMEX 5% Blue Cash card does not directly charge an annual fee, the reward structure has very low rewards for the first $6500 in annual spend thus incurring a cost if that money were spent on another card such as the Citibank Double Cash card. Thus, the AMEX 5% Blue Cash card is just like an annual feed card in that return is a function of total annual spend. Individual total annual spend may indicate that the AMEX Blue Cash Preferred card may be a better option for lower total annual spend. Overall return under such scenarios may be be in a range approaching 2.5%. You would have to run the numbers for your individual situation.