This post loosely follows along the post “Yes, you can have to many FF Miles.” It might help to read that first if you haven’t already.

Cash Back Sites:

I won’t spend too long familiarizing you with cash back sites. The basics are that these sites get a commission when you click from them to a retailer and make a purchase. Let’s say the retailer is paying 5% commission for a click through and successful sale. The cash back site gives you 4%, and everyone wins. The retailer makes a sale, the cash back site makes 1%, and you make 4%.

There are plenty of these types of sites out there. Fatwallet.com is one of the oldest and best known but there are many others, ebates (who now owns fatwallet), BigCrumbs, and many more. Each site offers a different amount of cash back, so you need to compare them before using one over the other. I usually check for cash back at www.evrewards.com to compare opportunities.

Airlines have partnered with these types of programs to pay you in miles rather than in cash. The allure is that you’ll get X miles per $1 spent. Milenomics will flip this idea on its head today. Instead of thinking about those miles as being earned from buying things, think that you’re giving up cash back for those miles. You’re buying those miles with the cash you leave on the table. Airline shopping portals are usually a bad deal for earning miles.

First a warning: I’ve spent far too many hours chasing down far too few dollars and miles with the likes of Cartera and Top Cash Back. I really hate dealing with either of them, but to me Cartera is “better” than TCB (Is it possible for anyone to be worse than Cartera?). TCB’s total lack of customer service is inexcusable in this day and age. I may have to file a SC suit against them (They owe me $250+ in Cash back.) I won’t even entertain a discussion of TCB for Milenomics. They’re just that bad. Cartera is terrible too, but a necessary evil (more on that later).

Ask yourself: IF for some reason I didn’t get the cash/miles is this still a good purchase? Do I have the time to waste chasing down the miles/money? Are you making the purchase JUST to earn the miles? Is the item less expensive elsewhere?

Ways to ensure you get the referral credit:

- 1. Install a second browser. I use Chrome for all my day to day browsing. It is great, but unfortunaltey the extensions in chrome and Firefox can block referral credits. I choose to do all my online shopping inside of IE. This also helps prevent click hijacks, as I can start from scratch once ready to buy.

- 2. Screenshots.

- 3. Screenshots. Seriously, important enough to make the list twice. I take a screenshot, multiple ones if needed and paste it into an email, sending it to myself after I complete the order. The subject line of the email is the order number, and I include how much Cash Back is expected.

- 4. Stick to major players (even if it means less cash back). I’ve used some really low rent looking cashback sites when I’ve had to order something, and they were the only site offering referral credit for that site. However for the most part I stick with the big three: BigCrumbs, eBates, and Fatwallet. They don’t always offer the best total cash back, but they pay out, and track purchases very well.

- 5. For Bank portals, use the bank’s card. I realize you don’t *have* to use a chase card to buy and get points at the UR mall–but if something goes wrong, and your points are missing you’ll be able to argue successfully. If the bonus for not using the site’s card is big enough, say to hit a minimum spend, then this rule can be broken–but know that there is a very real risk the points won’t post.

- 6. When things go bad, file a claim as soon as possible and follow up as well. Dealing with established CB sites mean better response when issues arise.

Why I almost always take cash over miles:

I’ll rarely choose to earn miles through shopping portals from the airlines. I’m sure a lot of you enjoy using the AA shopping portal, or the US DM Storefront. I’ll be clear, they have a purpose, but the important thing in this game is to not just chase miles. Getting caught up in the miles you might be spending more just to get more miles. Have travel needs mapped out, and set goals based on those needs. If you need miles in United, but AA has more miles offered at their shopping mall, is it still a good idea to earn AA miles?

Most of the time you’re buying miles for about 1 cent or more by using a mile earning portal. Why? Because you’re foregoing the cash you could have earned at a cash back portal. Flip that around, and you’re buying Money with the miles you give up. If a cash back site is offering 5% cash back, and an airline mall is offering 2 miles per dollar when you take the cash you’re buying 2.5 cents with each AA mile you forego.

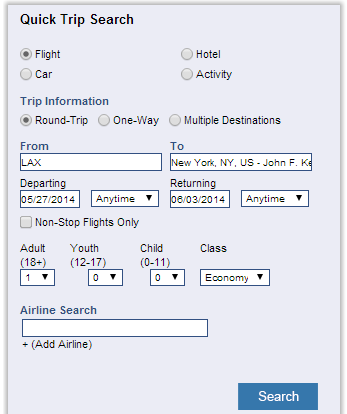

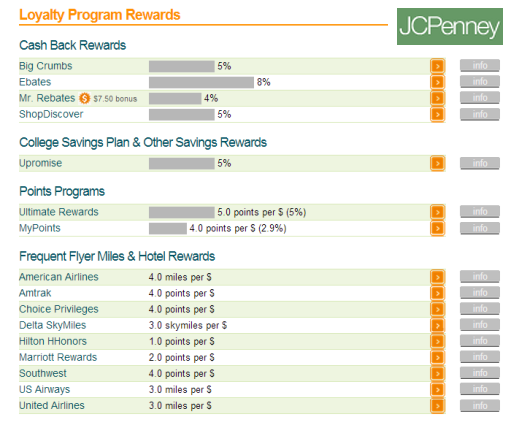

A good example of this is the following:

You can see here, if you took the AA miles, or the UR points you’d be giving up 8% cash back. What that means is you’re “buying” those AA miles or UR points for 2.0 CPM and 1.6 CPM respectively. The reverse would be that you’re selling 4 AA miles at 2cents each or 5 UR at 1.6 Cents each. In this way you’re converting Miles into money.

Looking at my cost tracking sheet, none of my miles come close to costing me 2.0CPM through my Milenomics Mileage Runs (MMR), so I’m taking the 8% cash and if I need more AA or UR I’m generating them through a MMR. Also when things go wrong with shopping portals you need to spend time fixing things. Remember, Time=Money. The tips above help minimize issues, but there will problems, which will raise the cost of those miles more as well.

It isn’t always so cut and dry:

I just recently needed new tires. I always shop at America’s Tire, and so I loaded up evrewards.com to see who was offering the best cash back.

Mr. Rebates does pay out, I’ve used them and at 4% I would continue to do so (AA miles cost 1.33CPM in this case). Instead I went with the AA shopping portal. Why? Because there is a 2,000 mile bonus going on right now for purchases over $35 made via the AA shopping portal.

Mr. Rebates does pay out, I’ve used them and at 4% I would continue to do so (AA miles cost 1.33CPM in this case). Instead I went with the AA shopping portal. Why? Because there is a 2,000 mile bonus going on right now for purchases over $35 made via the AA shopping portal.

My purchase of tires will qualify me for these 2,000 extra miles, meaning I will come away with 2900 miles for this purchase. Assuming I left 4% cash on the table ($12) I bought these miles for $0.004. That’s the kind of buying of miles I like to do. It helps my Mileage Costs go down, and is the smart play. I’m pretty sure the bonus miles won’t post. Because AA uses Cartera for their mall, and I’ve had such bad luck with them, I’m guessing I’ll need to send a few emails, and include the value of my T-Rate in the final cost of these miles. So there are opportunities where it makes sense, but don’t automatically assume miles > $.

When Do Mileage Portals Make Sense?

For some of you who don’t have access to as many cheap miles through other MMRs it might make sense to buy using the miles instead of the cash. This is why knowing your CPM is important. In doing so you can set a point where you’re in for miles, rather than money. For me that point is $0.01. If your threshold is under 2CPM then you’d probably take the miles in all of the above examples. However I’m asking you to think about this so you’re making more informed decisions.

Some will disagree, and say that using these portals has earned them so many miles. I’ll counter with one of the following two questions:

- 1. Did you totally saturate all your avenues of generating miles, MMR/otherwise?

- 2. Do you have a near term need for these miles?

If you’ve saturated your opportunities for miles elsewhere and need miles, these portals might work for you. If you’re like me, and have access to more miles than you can use right now, You’ll see the value in switching to an all cash back strategy for online shopping. The importance of Cash in travel is big. You can’t pay for everything with miles.

Buying Money with miles I leave on the table means I’m really buying flexibility. That money could even be used to buy miles again. You could Leverage the cash to buy miles in programs like Lifemiles, and US Airways when they have cheap miles sales. You retain flexibility, and can gain use of the cash immediately if you need to.

Note: The logic in this post could be extrapolated to MMRs and could be used to argue that having a 2% CB card means all miles earned through buying GC/VR have a 2CPM opportunity cost. . While true, in practice you’d probably get shut down very quickly at high levels. This is why Milenomics advocates shifting MMR spending around on cards and not relying on one card. Also CB Portals aren’t going away anytime soon, and a simple “Cash only” at your local store could end your 2% days.

That’s not to say there isn’t a place and a time for churning those Gift Cards and Vanilla on cash back cards–as well as on Miles earning cards. But that is a discussion for another day as this post is already quite long.

Be smart with your cash, and smart with your miles – #Milenomics

[rule]