Yesterday we learned about the Credit Card Calendar, and our seasons of credit card applications. If you haven’t already read that post, you’ll want to before reading ahead. Today we’ll talk about what to do when those cards come knocking for their Annual Fee.

In yesterday’s example I suggested 4 cards. Today we’ll use those same 4 cards as part of our talk on Annual Fees. We will imagine it is 11 months from now. We’ve applied for many more cards in the meantime, and these 4 are set to charge us our annual fee.

The cards aren’t really important, by now (11 months into our CCC) we’ve no doubt opened many more, possibly even duplicates of some of them. Keeping cards open isn’t a very important part of Milenomics. Also our usage has dropped off significantly as new cards caught our eye and earned our spending.

Milenomics uses the following 3 techniques to evade annual fees:

- 1) Calling and asking for an annual fee waiver.

- 2) Downgrading the card to something without an annual fee

- 3) Merging the credit line with another card we have.

Each of these has its pluses and minuses. I’ll step through them as we discuss what to do with our 4 example cards from yesterday.

With all four of our example cards, and with every card that has an annual fee come due, you first start by calling and asking for a fee waiver. I don’t come outright and say “waive my fees!” although I know some who do. I usually take a more subtle approach, and use the phrase “I’ve got too many great cards, and just need to cut back on my fees.” A good way to start might also be “When is my annual fee due to be charged?” and then when they tell you soon you can reply by asking if they can waive the fee, or go into your talk about cancelling.

This is also a good time to learn the importance of hanging up the phone. If there hasn’t been an offer to transfer you to the retention department* within the first few minutes, or an offer to “see what we can do.” thank the rep and call back the next day. If they start outlining the benefits of the card you’re better off saying “oh, you’re right,” and hanging up.

Note: The people on the phone you talk to are people. This is important to remember this all throughout the travel and miles game. In your Milenomics endeavors treat people the way you would want to be treated. Remember they have to sit and answer a phone all day long, and talk to many irate customers.

Our second weapon is to downgrade to a no fee card from the same issuing bank. Why would we want to do this? you might ask. Well the reasons are twofold. First, you always want to preserve the line of credit. The more available credit you have the easier it will be to get cards in the future. The available (unused) credit will help your credit utilization, and in the long run raise your credit score.

Secondly, and something i’ll talk more about tomorrow: Sometimes no fee versions of cards are just as good–or maybe even better than the fee version. If you’re rarely using the card anymore you can keep it in your dresser drawer for a rainy day.

Our last technique is to merge credit lines with another card we have. While this doesn’t give you the benefits of a no-fee card you do preserve the line of credit. Some banks, like chase, will only allow you to merge a maximum amount. If there is a cap, or they won’t let you move your line of credit, stick with downgrading to a no fee card.

Merging can also be helpful when you get into more advanced Milenomics and you really need those high credit lines. More about that later. 😉

One by one here are our chances at annual fee waivers from yesterday’s cards:

Citi AA Mastercard: pretty much a guarantee. I’ve had different citi AA cards, for years and years and each year I call they’re more than ready with a fee waiver. They will sometimes make a second deal as well, to get me using the card. One year was Use the card 3 times and we’ll waive your annual fee. This past year was just an on the spot waiver. I’d count this as 90% likely to be waived.

Chase MP Explorer Card: Another good case for a waiver. I’ve had this card a few times since 2010, and each time a phone call has ended with a waiver of the Annual Fee. I think your chances will be about the same as the Citi card, 90% that you’ll get a fee waiver.

Chase British Airways Visa: A little tougher. They’ve been known to give out Avios instead of cash for this one. I’d put your chances at a waiver as low as 30%. That said, I’d suggest a downgrade to the Chase Freedom. The freedom is Chase’s no AF card. Tomorrow I’ll be going more in depth on the chase Freedom, and specifically why it is better than the Chase Sapphire Preferred. Lastly, if nothing else, transfer the line of credit to your above MP Explorer Card.

Barclay Bank US Airways Mastercard: Not going to happen. We’ll apply again for this card between now and the annual fee coming up on this one, so for a while you’ll possibly have 2 of this card. Yesterday’s offer we applied for actually had a bonus 10,000 miles each year as part of the offer we signed up for. If this card is still around in 11 months, which I doubt, you’ll get 10,000 miles a week or two before your Annual Fee hits. Wait for those miles, and then call and merge the line to your second version of this card.

As you can see, we’ve taken care of our Annual fees for another 12 months, and we should still have our AA card, our UA card, maybe our BA card, and a now larger credit limit US card. These might be your first calls trying to have annual fees waived, if so it might take you a few calls to gain the confidence to ask for the waiver, or say no to small first offers. That is normal–pretty soon you’ll have made so many of these calls you’ll be a Milenomics pro.

The hardest cards to get a fee waiver on are the American Express Starwood Preferred Guest Card, and the Chase Sapphire Preferred. We’ll be covering those in future CCC posts, but in the meantime if you’re tying to get out of the fees on those my advice is to convert the SPG to a Blue Cash, and the CSP to a Chase Freedom.

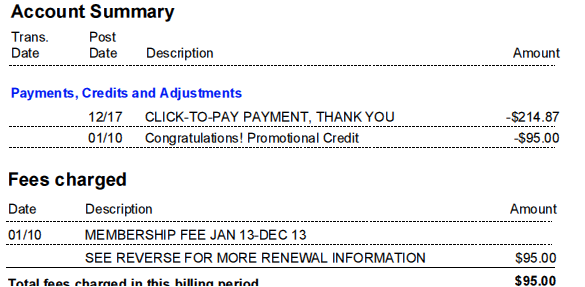

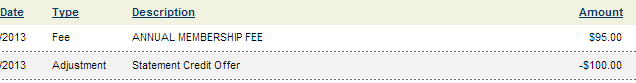

Special note: Yesterday I said I hadn’t paid an annual fee in 4 years. After I wrote that I went back and checked some of my notes and saw I actually made money on my fees over the years. The above example from Chase was a small $5 profit. One year they gave me $150 against a $95 annual fee. Citi has also given me miles and a fee waiver.

I’ve also made money by downgrading my AMEX cards to no fee, but then using them on SBS to net $25 per person. Giddy for Points wrote about Small Business Saturday in this post. If you’re not using your Amex on SBS you’re leaving $25-$100 (or more) on the table. I’m ahead the $75 per year in my case by downgrading and then using the SBS credit x 3 cardholders.

As always if you have a question, follow me on Twitter @Milenomics. And stay tuned for our First Milenomics Blog Giveaway sometime this weekend!

Everything below this line is Automatically inserted into this post and is not necessarily endorsed by Milenomics:

Would a good strategy be to close the cards after you’ve received the bonus so that after 12 months you can apply for the same card again and receive the bonus?

Great question Donnie. No, I would not recommend that. Banks have been known to even “claw-back” the bonus if you cancel too soon. Also the 12 month “cooling off” period is usually specific to Amex products. Citi and Chase have different internal rules about getting the bonus again. With Citi it seems to be around 18 months from account opening, and Chase possibly not ever giving you a second bonus. The good news is that different types of product usually count as a first time bonus. So with Citi we can do MC, Visa, Amex, and then repeat. With chase you’re more limited but there are plenty of great options for Visa/MC, as well as UR earning cards. We’ll get more into it as the CCC posts come back around for the Winter season of applications.

The larger issue is that by outright cancelling you destroy the line of credit. Either convert to no fee version or merge the credit line. Never just outright cancel. Also as time goes on the line staying open will continue to help your credit score (through reduced utilization %).

Really good post, very simple and easy to follow along while still being very informative!

Perhaps you’ll elaborate in a future post about the Chase Freedom card, but I was wondering if you could give me your thoughts on downgrading to the Chase Freedom card vs. outright applying for it to get the bonus miles? This is probably one of the few annual fee free cards that also has historically offered a bonus miles/points.

Also, I think it’d be useful for readers to know the ramifications to your points when canceling a card within a bank point program (AMEX MR, Chase UR, etc.) vs. co-branded cards.

Keep up the good work, you’re on my “must read” list!

AndrewP: As far as applying for the CF- the bonus is now so low (maybe $100?) I’d rather “spend” an application on something else from chase and then downgrade to the freedom. Tomorrow I’ll write more about the best way to get a Freedom, so be sure to read that.

Also thanks for the idea about a post on programs vs. co-branded cards. We’re starting out with pure FF Miles on these cards, so nothing to lose right now–but tomorrow’s Chase Freedom post will have some discussion about that as well. You’re psychic I think! Thanks for all the positive comments, I really appreciate it.

Thank you so much for this post. Yes, I have a wallet full of cards and I have always been hesitant to call and ask for a fee waiver. Your explanation will help me the next time those fee times roll around.

I just applied for, received, and met the minimum spend…based on your comment about the Freedom card, I’ll just wait until next year and change (hopefully) to the Freedom.

I am curious about the impact on credit associated with card retention. I had heard that you should hold on to your oldest cards in order to increase the average timeframe you held cards. It sounds like your strategy closes or swaps most cards within a 1 yr timeframe. Love the blog. Thanks

Bill, thanks for the feedback. Age of accounts actually takes into consideration both open and closed accounts.

http://creditboards.com/forums/index.php?showtopic=422281 Closing an account doesn’t affect avg. age except after the account fully falls off your Credit Report.

However, using the Milenomics techniques in this post if you downgrade to a lesser card your account stays open. Your credit report doesn’t show “Chase Sapphire Preferred” and then a new entry for the downgraded “Chase Freedom”, just “Chase Bank/NA Revolving credit-1234” or something similar. The account number stays the same, your report keeps on thinking it is the same card. Even if you do close and merge the line of credit to another card your Avg. Age will count the closed card, and you’ll keep the line of credit for your % of utilization.

just called chase twice (tried diff reps) and ask to change/downgrade my BA account to a freedom…they both said this wasnt possible.

is there a technique for downgrading the BA account to a freedom please??

Mr. Cool: Did you try retentions dept? Specifically call and say you want to cancel the card, speak to retentions–and ask if there’s a no fee card they could suggest to keep the line open. Try to steer the conversation towards the Freedom, or say you’d like to cancel. When all else fails you may have to merge the credit line to another Chase card you have (or soon will apply for).

Please update with your experiences.