Yesterday’s post, “The Icarus Paradox,” talked about the tools that credit card companies have to fight back against us. There truly are roadblocks every step along the way. Each company, from Credit Card Companies to retailers to online and banking services can decide to react with AA.

Today we’ll cover how to insulate ourselves from the Adverse Actions(AA) we discussed yesterday. We’ll also talk about how to compartmentalize our finances to limit the spread and affects of account closures. None of what is listed here today will inherently stop companies from hitting us with Adverse Action, but it will help protect you and your finances in case of some type of AA.

Diversity Means Giving something Up

So much of what I discuss with respect to Miles are ideas and terms I borrow from investing in the stock market. Today we cover a cornerstone of investment advice: Diversify your portfolio. In the market this is done to spread out risk, and to minimize volatility. In Milenomcis it is done for those same exact reasons.

In the title image you can see that there is a balance, between risk and reward. Diversification techniques can help keep cards open–at a cost. Usually when you diversify you’re giving up maximum mileage earning.

A good example of this is the old Chase Freedom Exclusives program. Chase used to offer 10 UR points per purchase with a chase checking account. Adventurous churners figured out that Amazon allowed gift cards to be bought at increments as low as $.01, netting a profit of at least $.09 per GC purchase. You’re thinking, wow, that’s really smart. Well someone else is even smarter than you–they wrote a script to automate the $.01 purchases, and let it go. Imagine getting 100’s or 1,000’s or 10,000’s of orders in at $.01 and earning 10 UR for the purchases?

The low tech version of this is sitting at a gas pump and constantly swiping and pumping $.10 worth of gas. First of all–you’re costing whoever is running the transactions: amazon, the gas station, or any other store some amount of credit card processing fee likely much larger than $.01. Also, just think about how terrible that action looks to all parties involved. Is it worth losing your Chase cards, your amazon account, and all your saved up URs? Some might say yes– but I sure hope you say no.

Step 1: Diversify Your Portfolio (of Cards)

To diversify your cards means to hold cards from multiple banks and lenders, but also to keep some cards away from any MMRs, or other funny business.

You might love Chase and Amex. I know I do. But you shouldn’t build your entire strategy on these two brands. And if you’re flying solo and working this game without a significant other, you’re going to want to be doubly careful with this. When Chase, Amex, or any other bank come down on you they have been known to close all accounts and ask you to stop being their customer entirely. This is sometimes a temporary blacklisting, but other times can be semi-permanent depending on what you did.

Holding cards from multiple banks, and even holding multiple cards from those banks spreads out your risk. This only works to limit risk if you are cycling among all of your cards–holding many different cards doesn’t help spread out risk if you focus 100% of your churning on one specific card (or bank).

However even if you do focus on one specific bank holding multiple cards does give you backups in case one bank shuts you down. If Chase closes all your accounts you could switch to Amex and churn there. But if you don’t already have those cards open it is going to be harder (but not impossible) to open new cards after AA shutdowns. This is another unadvertised reason Milenomics advocates downgrading, but keeping cards open once your annual fee comes due, you never know when you’ll need to use those cards.

Similarly, you’ll want some cards that you just never mess with. Imagine if every card in your wallet was a Chase CC, and then all of a sudden, *poof* they’re gone. How would you buy gas? How would you pay for car rentals? Keep some cards (even non-rewards cards) in your dresser for these type of worst case scenarios. Hopefully you never need to use them, but ask yourself this: if your main cards are closed are you prepared for financial security without them?

Step 2: Diversify your Checking accounts.

In a lot of ways this is more important than step 1. I’ve placed it second only because less people use their checking accounts for Miles earning than use Credit cards. The idea is simple: Never have just one checking account.

If your paycheck is direct deposited, and your bills are auto-paid, keep all of that separate from your miles earning and depositing schemes. The last thing you want is your paycheck held up, or a bill payment missed/messed up because your account has been closed. Yes these are very unlikely, but with the cost of a new checking account approaching -$100 or more (that is, you get paid to open one), why wouldn’t you want more than one account?

In addition, finding a bank close to the rest of your MMR stores could help you save on gas and time–and if that bank isn’t one you already have an account with you can kill two birds with one stone. Open a new account, and use it for depositing of Money orders, or CA’s on prepaid cards, and save gas and time, lowering your Mileage Costs. You also insulate your proper finances from any Adverse Action by keeping things separate.

Sometimes a bank will offer you a rate reduction on a mortgage or car loan for holding their checking or credit accounts. Imagine the financial cost of losing this reduction due to AA? It just isn’t worth it. Throwaway checking accounts are very important to Milenomics. Between my wife and I we have 7 checking accounts. Is this more work to keep track of? Yes, but it also allows me to know that no matter what I do my #1 bank, and the one with which I do my “real” banking will remain open.

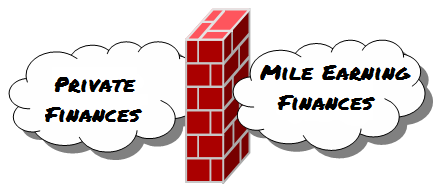

The Milenomics Financial Firewall

Today I ask you to start creating your own personal Firewall. Something to stop the spread of any AA that might come your way in the future. Having the Financial Firewall in place can even help you to earn more miles than you otherwise would. Ideally you’d have a hard line between your “real” private finance accounts and your accounts you use for Mile earning. Realistically that isn’t possible for everyone, as your legitimate finances might be with Chase, Amex, or any host of other banks. Instead try to insulate yourself as much as possible from your risky actions, and also have a plan if accounts are closed. Lastly, consider a P.O. Box to give yourself or your spouse separate addresses, which may help when an address is blocked by a service–afterall it’s cheaper to buy a new P.O. Box than move!

Setup a System of Accounts

Setting up a system of accounts allows you to separate checking accounts and credit cards by risk of closure and reward (in miles). This will be your financial firewall. You can also coordinate accounts and services to ensure that companies who check the owner of checking accounts (Cough *Bluebird*) will see two distinct checking accounts and each account in the proper person’s name when they go query your bank for address information.

It is incredibly important I mention: don’t lie to financial institutions. If for example you want a Bluebird card for your spouse, make sure their name is on the checking account you use for said Bluebird account. If you want to open an account for your spouse, put their real financial information on the forms, and get their approval first.

This does require a level of trust, and openness, even among spouses. Your personal relationships are more important than any miles–and so if your spouse or significant other doesn’t want you meddling with their financial world–don’t do it. Instead create the best system you can within those parameters.

If you’ve got more leeway with your S.O. think about a system of accounts where you are using your credit cards in a more aggressive, risky way, and theirs in safer, less aggressive ways. If your spouse is on board and is fine with you using their information and signing them up for cards, you still may what to adopt this risky/less risky type of setup. If your cards are shut down you’ll have your second set to back you up

One Final Benefit of Diversification

Lastly, I’d like to cover a general benefit of Diversification that doesn’t have to do with your account shutdowns. When you diversify you’re likely also spreading out what you do into different programs. Yes, VR are wonderful, and CVS became a lot of people’s favorite store a few months ago. But if tomorrow CVS stopped selling VR–what would you do? Is that entirely where all your focus is? Diversification helps to force you to learn about new programs, and new ways to earn miles.

Deals get shut down. Blame the bloggers, blame the forums, blame the scammers (like I do), but the simple fact is that few, programs for earning miles that worked 2 years ago are still working. Sure some are, but along the way many, many great deals have come and gone. Balance your risk of account Adverse Action by having many projects going at once, allowing you to weather any storm, be it account closure, or deal stoppage.

I know this type of discussion is nowhere near as exciting as earning and burning miles, but I don’t think it is brought up enough out there. You can earn many, many millions of miles while still being cautious.

Readers, do you have any tips to add for staying safe in this game we play? If so leave a comment here, or tweet @Milenomics. We’re smarter as a team.[rule]

One precaution I think should be considered is transfer Ultimate Rewards points or other transferable points to airline frequent flyer programs very soon after earning them. Let’s say hypothetically, you store hundreds of thousands of points in your account for months or years, and then all of a sudden you get your accounts closed for, e.g., buying too many Chase gift cards. Taking this precaution wouldn’t make it easier to regain a positive relationship with the bank, so the priority should definitely be avoiding a shut-down to begin with. However, it at least would somewhat reduce the consequences in case of disaster.

Thanks for the great tip Brandon. This is an excellent example of limiting risk at a cost. Transferring to an airline or hotel you’re giving up flexibility and in the case of MR transfer bonuses. I am often left SMH when someone has 400,000 or more UR sitting with Chase and they’re churning every possible way you can. When the account closure comes down then they realize they should have transferred out. :

This is great advice. I have a couple different checking accounts that I use for miles and points, but I have to admit, I’ve been bad- I will occasionally deposit a MO or two into my personal account (certainly not enough to throw up any flags though). As for the credit card diversification, I couldn’t agree more. There are just so many great credit card products out there, why wouldn’t you want to use them all! I will even let a card or two go dormant for a month or two while I play with the others, and I’ve found this is a great way to trigger targeted promotions! It’s amazing how sometimes you’ll get a “Earn 5xs points at whatever store” email from the bank that feels left out.

As for Chase URs, I never like to keep more in my account than I’ll realistically use (although this hasn’t been a problem because I’m pretty good at burning paying for a family of 3). If for whatever reason **** hits the fan they are going to have a lot harder time getting their points back out of my United account. I know this is blasphemous to even suggest it, but UR is always good for cash back too!

Good tip on the targeted promotions. Like putting a kid in time out: “Citi, I want you to think about what you’ve done, and come back with a targeted promotion for me.”

Citi:”how’s 3x on your next $2500 in spending sound?”

Me:”Your time out is over.”

This topic is the piece of my strategy I struggle with the most. I diversify my MS with VRs, GDs, RLs, and GCs through BB, GB, AN, and PP (and shortly with MOs through MVD) but struggle with the fact that while you need to avoid MSing too much on certain cards, not many cards are worth MSing on and if you spread your activity too thin you end up with only a few points in a lot of programs.

Personally, I have 12 cards, 4 of which I would MS regularly on if I could (Fido 2%, Ink Bold, Hilton Amex, and USB FlexPerks) and 2 I mix in on occasion (PRG and Carlson). I’d be happy to MS for UR, MR, HHonors, and Carlson pts on more than 1 card but there aren’t any others with category bonuses that make sense for to MS on.

MLH: What about grocery stores? Is that available to you, or are you doing that already with the Fido and Flexperks? There are some decent cards with bonus in grocery purchases.

At the end of the day sometimes there’s a greater need for miles/cash than there is for diversification. Sounds like you might be in that type of groove right now. Might want to just take whatever techniques you can to limit exposure should a shutdown occur, if you’re not comfortable with the economics of earning at 1x. I do the vast majority of my earnings at 1x, you can make it work, you just need to figure creative ways to double dip so you cut fees in half (in essence turning a 1x into a 2x card).

Your comment on spreading too thin is a good one to be wary of. Points you never use due to small balances in many programs are money in the trash.

Gas and Grocery are my bread and butter and I hit up CVS occasionally. Gas: Hilton, Ink, PRG, Fido. Groc: FlexPerks, Hilton, PRG, Fido. CVS: Fido, Carlson.

I do need to learn more about dipping techniques as I don’t currently employ any.

My take away… open a P.O. Box. I’ve been meaning to do this for months now. My wife’s business could use the P.O. Box as an address but I never thought about the miles and points benefit.

I vote Mr. Milenomics as having the best new blog! FANTASTIC information.

Thanks to you and this article, just opened my first account for mile & points earning only… Time to slowly move over to it.