Note: Yesterday’s post was all #101. Today’s post is the opposite. Also, if you’re new to Miles this post is not for you.

We’ve discussed the similarities between miles and investing before on Milenomics. We all know investing carries risk–and something your broker will often ask is how “risk tolerant” you are. If you want to tap into larger returns you need to be ok with higher amounts of risk. As part of today’s post I’ll ask you to think of this same risk tolerance with respect to miles.

If you want to really get the full value of your miles you need to get your hands dirty, and take on some risk. That risk could come from earning miles in risky ways (low risk). Or from spending miles in ways that airlines don’t like, say hidden city ticketing (medium risk). And finally risk can come from from buying and selling miles (Oh My! High Risk). How much risk you’re comfortable with is a very personal decision. Today’s post is high risk, but also high reward.

Now that I’ve got that out of the way, today I’ll go over the ways that Membership Rewards can open doors–both officially and unofficially.

Membership Rewards Don’t Get the Same Love as Ultimate Rewards

Online it seems that Chase UR own the night. I like UR–I’ve written about them quite a bit. Ultimate Rewards have some great things going for them. MR’s airline transfer partners aren’t as mainstream as UR. UR has Southwest, United, and British Airways (among others). MR has Delta, British Airways, and a host of foreign carriers. This doesn’t mean that there’s no use for MR–in Fact the opposite is true.

MR transfer partners can handle all your travel needs–from US domestic flights to International premium cabin awards. You need to get familiar with the partners that allow you to make “sweet-spot” redemptions, like ANA. Depending on where you live ANA could work really well (See the comments in the post here for an example of how excellent ANA miles can be if you live in a small *A city).

Take a look at the current MR transfer programs (all are US transfer partners):

Now maybe you’ve never heard of some of these–that’s fine. If you have a ton of MR you really should read up on a few and see which might work for flights in your demand schedule. We’ve written about Delta and British Airways extensively because those are the two programs I often use for Hybrid System bookings. Note: Not all of these transfer at 1:1, some transfer at less than that, and some at more (with bonuses).

Now maybe you’ve never heard of some of these–that’s fine. If you have a ton of MR you really should read up on a few and see which might work for flights in your demand schedule. We’ve written about Delta and British Airways extensively because those are the two programs I often use for Hybrid System bookings. Note: Not all of these transfer at 1:1, some transfer at less than that, and some at more (with bonuses).

SPG creates Orphans, Membership Rewards Saves Them.

Think back to the post on pooling miles. Central to that discussion is ensuring we aren’t stuck with small “orphan” balances of miles. I know I have some small balance accounts myself, and I’m sure you do too.

What good are those accounts for our large travel plans? How much are those orphaned miles worth to you? Right now–possibly $0. They may even have a negative value–to use them you’ll need to sink money into buying miles before you can tap the orphaned miles you have. With MR you can rest assured knowing that low balances in programs that are MR transfer partners can be replenished as needed. You can hold lots of MR and then transfer them to the specific program you need them in right before a booking.

This is why I prefer MR over SPG. SPG says you can transfer to any number of airline partners–more than either MR or UR. In reality that transfer can’t be done instantly, and can take 1+ week. That’s no good for booking tickets when availability can change daily.

In fact SPG creates orphaned miles--while MR rescues them. This is because it could be very possible for you to initiate a transfer with SPG–and then lose the award seats you were trying to book. Then you’re stuck–the miles only go one way, and you can’t reverse the transfer. Now you have to make the booking work somehow with those miles, in that program. If you wanted to change alliances you can’t. With MR you might not have as many options. But you could decide which is the best way to book the trip, instantly transfer the miles you need, make the booking and call it a day.

Using MR the Milenomics Way

Now that we’ve got the basics of MR out of the way, today’s post is not going to be discussing specific MR transfer partners. Posts like that have been done and re-done. I’ll instead talk about why I love MR, and how I use them.

Why I’ve come to love MR is that they’re almost like a currency of sort. If you want to make a trade for something there’s almost always someone willing to take MR as part of that trade. Anything from Vacation rentals to award booking–to transferable miles can be had with MR. Is trading against the Membership Rewards terms and conditions? Probably, the official wording from Amex is:

“If you are eligible to transfer points, you’ll see this option listed in the Travel category on membershiprewards.com. The frequent customer program account that you transfer points into must be held by you or an Additional Cardmember linked to your program account.” Source.

Myself and associates of mine have been trading MR for quite a long time–and don’t know of anyone being shut down for it. If you do–please leave a comment. Still as I wrote at the top of the article, this is a high risk maneuver, and should only be attempted if you’re ok with that.

MR are like a shadow currency and a grey market exists for them. When you know about this grey market there are actually two values to MR: the published, and unpublished values. I often times try to get better value out of my MR on the grey market. A good example of this can be seen in Virgin America:

Grey Market MR Example

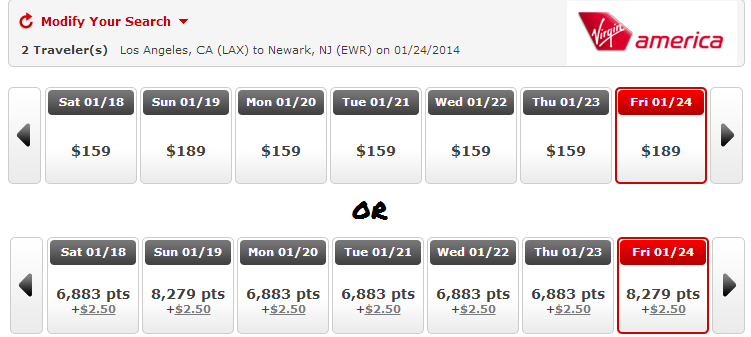

The official transfer ratio for Membership rewards to Virgin America Elevate points is 2 MR to 1 VX Elevate point. This sounds like a ripoff compared to 1:1 transfer partners–but VX Elevate points are a lot like Southwest RR points. They’re worth a fixed value, with no blackout dates. An example flight from LAX-EWR with VX prices at:

With values of 2.2-2.3 Cents per Elevate Point you see why MR transfer at a lower ratio than say–BA avios or Delta Skymiles, the points are expensive because they’re fixed value.

To secure 8,279 x 2 you would need to transfer 33,200 MR points for this booking. With the ticket price hovering around $189 per person this would mean $378 worth of flights for 33,200 MR, or 1.1 Cents per MR.

Note: The above does not take into consideration that there might very well be a flight LAX-EWR bookable on AA with Avios for just 12,500 avios (or 10,500 MR with the current 20% transfer bonus). If so for just 22,000 MR you could book your two tickets. However if no awards seats exist, and prices are reasonable VX can be a great option.

Can we do better on the Grey market? Lets check.

Quickly searching for a trade I do see one being offered at 1.66 MR to 1 VX Elevate. This saves us .33 MR per Elevate point. This would bring our total MR needed to 27,500, a savings of 5,700 MR or 17%. Could we maybe talk this person down to something like 1.5 MR per VX? Possibly. This is where your ability to deal comes into play.

While not a great use of MR at 1.3 CPP if you’ve decided to fly VX for a reason, say no award seats on anyone else that flies nonstop LAX-EWR, you’ve saved yourself 5,700 MR by making a trade instead of using the standard MR transfer option.

Before you transfer MR to any program at least look at options to make a trade happen. Someone who’s got 150,000 BA Avios and can’t seem to find a use for them is going to be a “motivated seller” of those Avios. Sure right now 1MR =1.2 Avios–but you might be able to push that to 1MR – 1.5 Avios (or more) if the timing is right. That represents a total savings of 50,000 MR, and a net savings of 25,000 MR on top of the 20% bonus currently active.

Why does this work?

Looking at the above trade you’re probably asking wonder why this works? Plain and simple: Miles aren’t the most flexible of currencies. If the holder of Avios wants to take a trip with Delta–he’s out of luck, until you come along with your MR and make his trip happen–while saving yourself Miles.

Someone might have transferred all their MR to VX during a prior transfer bonus. Maybe they now wish they had converted to a different mileage currency. Whatever the reason they’re stuck with miles.

On the other side is you: you’ve found a redemption you like and you don’t have miles for. Sometimes, like the above VX trade, you trade for miles you could otherwise transfer MR for directly, but at a more favorable ratio. Trades can even happen across mileage types that aren’t in the MR program. For example a trade was recently completed as 38k WN RR points for 30k AMEX MR.

The two parties agreed that 1MR = 1.26 Southwest WN RR point. This is actually a better transfer ratio than UR—>WN gives you. Will everyone be able to attain this 1.25 ratio? No, because the market is very small for these trades. But finding a party to trade means giving up what you have to get what you need. If the alternative is paying cash I always look for a trade.

☒ High Risk.

☒ Not for Everyone.

I can’t overstate the risks: The market to trade is very small–and as such is very volatile as well. In the short term you might be unable to trade at all. In the long term you’ll likely find good luck in executing trades. Additionally there are possible issues with traders scamming each other, and with account shutdowns. But when you’re stuck and there’s no way for you to travel without buying a ticket, a trade can save the day. And even when you’re not stuck a trade can save you miles and money, by giving you a more favorable transfer ratio.

Milenomics is already subdivided by Traveler type, and and again by a dozen or so categories. I won’t put a risk meter on every post–but I will section off the high risk ones starting today. If they’re above your risk tolerance that’s ok. Watch for them; They’ll be labeled “Risky Business.”

Interested in joining the market, where would one find this?

There’s the coupon connection on FT. Any other forum (travel or otherwise) you’re on should have a group of like-minded individuals looking to trade.

“Sometimes you just gotta say What The F “. Sorry, had to with you throwing around Risky Business =)

LoL! Such a Classic. Not sure which influenced me more–Trading Places or Risky Business. 😛

Could you go into more detail on doing these trades? What site did you use?

J: See my reply to Calvin above. The post is a good intro into MR & their value for trading miles–which, while against terms of most programs, is not illegal. Some of my trades are done IRL, some are done online. Just like we need to retrain our brain to think in “award ticket” type bookings instead of paid flights, we should also think of our miles as a type of currency, which can be molded to our needs in extreme situations.

Awesome post! Never actually thought of doing this now that’s thinking outside the box! I love yor blog posts keep em coming!