As we settle in for the holiday I wanted to share with you a pretty good little Triple dip opportunity I’ve started working on. The components you need for the opportunity to work are as follows:

1) A Best Buy willing to sell you Visa Gift Cards on Credit.

2) A Card which pays you 5% back on purchases at Best buy. (Citi Dividend is my card of choice for this, see Kenny’s great writeup on how to get one still).

3) A Best Buy Reward Zone account

4) A Fuel Reward Account. I wrote a little about Fuel Rewards here before, and if you’re interested in singing up, consider using my FRN Referral link.

I’ll step through the deal, and talk about how I analyze these types of offers.

First, a Word about Fuel Rewards

In my personal opinion there isn’t a WORSE run program than the Fuel Rewards Network. There are multiple ways to earn Fuel Rewards, and most of them are awful deals. Their shopping portal is terrible, and the ability to determine just how you can earn fuel rewards is so complex I’m not even sure that the following works. I know that it should work, and that I’ll be trying it this week.

The basics of FRN are as follows: You earn rebates on fuel at Shell gas stations. You need a physical FRN reward card to use your rewards at the station, and only certain stations participate. There isn’t really a limit on the discount you can earn from your FRN, but the rewards do expire.

Today’s deal works because there is a promotion currently going on until 3/2015 which pays out on Electronics stores. The promotion works as follows:

So for every $100 spent on a linked Mastercard you’ll earn 5 cents back on gas, up to 20 gallons. This might look like a 5% rebate, but I assure you it is not. Remember your units are important here, and you’re earning 5 cents per GALLON, not per $1. You’ll need to figure out how many gallons you can buy in order to convert this to a %. If you max this out and do fill up for the full 20 gallons you’d be looking at a $1 per $100 purchased rebate (($0.05 x 20 gals)/$100) or 1%.

So for every $100 spent on a linked Mastercard you’ll earn 5 cents back on gas, up to 20 gallons. This might look like a 5% rebate, but I assure you it is not. Remember your units are important here, and you’re earning 5 cents per GALLON, not per $1. You’ll need to figure out how many gallons you can buy in order to convert this to a %. If you max this out and do fill up for the full 20 gallons you’d be looking at a $1 per $100 purchased rebate (($0.05 x 20 gals)/$100) or 1%.

I’ve verified that my local Best Buy is a part of this promotion. However, I would pretty much guarantee that no one at the Best Buy has any idea the FRN promotion is going on. In addition I’ve seen extra rewards mysteriously appear in my FRN account for purchases in the past. It seems there are sometimes overlapping promotions. I’m hopeful something similar happens in this case, as it will make the numbers even better.

Best Buy Reward Zone–2% Back and Elite Plus

Deals from American Express have allowed me to spend an awful lot at Best buy this year and none of it has cost me a penny. I’ve qualified for the Elite Plus level with Best Buy already. There aren’t really good benefits to their tiers since gift cards don’t get the bonus points regular spending does. But as an Elite/Elite Plus you can bank your Reward Zone points.

You should actually earn Elite Plus through the process if you complete the full $6000 in spending I’ll be outlining below. I personally won’t assign a value to Elite Plus, but you might find it useful, and if you do add in the value to your calculations. Worst case you’ll earn $120 in BB Rewardzone certificates and have to use them on something at Best Buy.

If you have American Express cards and were able to get in on the Amex Sync Deal for Best Buy you should use those first, and then consider this deal. Because the FRN deal does not support Amex cards this triple dip doesn’t work with American Express cards, only Mastercards.

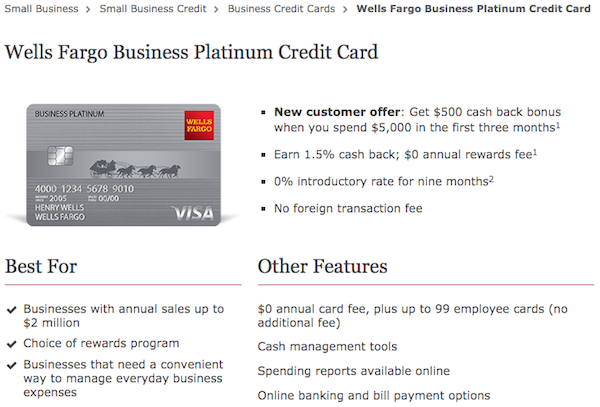

The Case Against Using a 5% Cashback Mastercard

A few months back I followed Kenny’s excellent advice and downgraded a Bronze AA MC (which was already downgraded from a AA Platinum earlier this year as part of an 11-month itch call.) The card I switched to was the Citi Dividend Mastercard, offering up to $300 a year in rotating categories.

Between now and the end of the year Best Buy is one of these categories. Before starting to spend my $6000 at Best buy I first wanted to analyze the deal and see what my costs would look like. I took a hard look at the numbers for the deal:

Expenditures will be:

29 x $200 Visa GC, $5.95 per card fee. $172.55. Liquidation could cost add another $5-$20

Stop right here if you value your time at all.

There’s no point in trading $172.55++ for $300. Almost all of our profit is eaten up, and we’re working for less than our T-Rate. Considering that I would likely need to make multiple trips to Best Buy for these purchases I was almost sure I would let this one go. Amex’s Sync offer are literally twice as lucrative, especially when you do a split tender at the register.

In fact, it was this initial analysis of this Best Buy 5% offer that has caused me to try to get as much value out of this deal as I can. I would have never seen the FRN angle if I just drove off and happily assumed my 5% card was making me $300 by buying $6000 in Visa Gift cards.

Additional Value in the Trip Dip

As I stated earlier you’ll earn at least $120 in Best Buy Reward Zone points. I don’t always have a use for these points–so I’m going to discount them to a $100 value. In addition The Fuel rewards of 5 cents per $100 spent should mean a total of $3 off per gallon of gas. Maxing this out at 20 gallons would mean a $60 return. filling for fewer gallons would mean less of a value. I’ll probably get about $50 in value from these FRN points.

That changes things a bit, so let’s revisit the deal:

+$298.63 – cash back on 29 VGC’s and fees.

-$172.55 – Purchase of GC’s

-$20.30 – Liquidation costs

+$100.00 – BB Reward Zone points.

+$50 – Fuel Rewards

Which means I’m coming out with $255.78 after all points post.

Update: Make sure to read the comments of this post, as other Milenomics readers have already added some great additional ways to sweeten the deal further. (H/T Adrian & Maria)

Don’t Forget to Calculate $/Hr

From now until the end of the year I’m going to be busier than ever. Right now my time is worth every penny of my T-Rate. I’m fortunate that I drive by a Best buy on my way home every day, so I can discount my mileage and only add in my time.

Eyeballing the number of Best Buy Trips I’m going to take I’d estimate the purchase side to take me 3 hours, and the liquidation to take 1 hour. That’s 4 hours total on this deal.

When manufacturing miles I add in my T-Rate. When earning cash back, since cash is fungible, I simply divide my net by my hours and ensure I’m making at least my T-Rate.

$255.78/4 hours = $63.95/hr

I’m well above my $25 T-Rate, so I’ll jump in on this.

Small Quadruple Dip Possibility

Since you’re already at Best Buy you might as well sign up for a Shopkick account (not bothering to put my shopkick referral here) and give the cashier your shopkick phone number. As Miles, Points and Mai Tais has already covered, you will only receive Kicks for the $5.95 purchase fee, but why leave these on the table? And who knows, you might somehow earn a few extra kicks.

Wrap up

I’m estimating that this will take me a few weeks to handle completely. I do not want to be anywhere near Best Buy in the coming few days, and so I won’t be able to test the basics of this out until after the weekend foot traffic dies down. I’ll do a debrief to see how well I do at the end of all of this. If you jump in on this let me know in the comments section below.

You can improve on this deal, best buy sells shell GCs, (at least in my area) which you can use the rewards certificates to buy. Then use the GCs at shell along with your FRN points.

Adrian, awesome tip! I’ll update the post in a bit to make sure readers see it. Thanks for adding to the deal, I can realize a better return on the rewardzone points using them for gas.

Nice write up Sam. If you’re new to FRN, there’s currently a bonus $.20 off/gallon after your second fill up and a bonus .20 after you link a MasterCard (at least in my area–south Texas). This is only good 1x but could add another few bucks to the bottom line.

Thanks Maria, I’ve had an account since earlier this year, so I’m out of the running for those promos, but I know other readers might find a good use for them. Question for you: is it just me, or is FRN almost impossible to fully understand? They have so many confusing promos that I can’t seem to make heads or tails out of whether I qualify for some of them or not. I *feel* like there’s a ton of possible value in the program, but just can’t fully commit.

I haven’t spent much time trying to figure it, maybe subconsciously I find little value add. They have decent promos and it’s nice that promos can be stacked but for day to day stuff seems my time is better spent elsewhere.

Thanks for another great write-up and analysis!

Have been spending thousands at best buy this quarter but none of the spending was tracked by the fuel network. Don’t see a link to claim the missing points …

Elite or elite plus does come in handy for early access of their black Friday deals 🙂

Sherman, there isn’t a way to retroactively get credit that I know of. You’ll also need to register the exact card you’ll be using with fuel rewards and I believe only Mastercards are valid for this promo. But an extra 1% back is better than nothing!

Also, very cool to have met you and be able to keep you up mind while reading your comment.

Great write-up! I’m from LB as well, so I was wondering which Best Buy you go to that’s an FRN partner. Also, off the subject, but where are you unloading non-Metabank and non-US Bank gift cards now? Walmart in Lakewood has a new code that won’t accept OVs (loading on BB nor MO) from me since Nov.1, so I am stumped. You say that the 29 cards above would cost you $20.30 which is $0.70 per card, and WM is the only one that I know that charges that cheap for MOs, so I wonder. Fill me in, please. 🙂

Great write up! Still new to the game, so I didn’t know that Best Buy was a play. Since I’m also from your neck of the woods, which Best Buy exactly is an FRN partner and also willing to sell Visa gift cards by credit? I’ll be using the Amex Offers for a few of my cards this time around!

Also, I noticed that you are paying $0.70 to liquidate these cards at worst case scenario. As far as I know, only Walmart charges that cheap for money orders. Since Nov. 1, (at least for me), the Lakewood WM system will not recognize my One Vanillas for loading on BB nor for MOs; only Metabank and US Bank cards work. Prior to that, it was smooth sailing between 4 BB cards. What are the other ways currently? Thanks.

John,

You’re right about OV and Walmart, I don’t yet have a good solution for turning those into MO either. For the time being I’m using metabank cards at Wm.

As for the best buy angle in this post I went to signal Hill and struck out; no prepaid visa cards on the rack. I did make a legitimate purchase with my linked Mastercard so I can see if the fuel rewards do track and I’ll update if they do.

And for the amex offer of $25 back on $250 you should absolutely maximize that play before switching to something else like this fuel rewards Mastercard deal. 10% back from amex can’t be beat.

Yah, well I’ve got about $7,500 in OVs that I have to liquidate, so my alts have been Evolve Money and Square. With EM, I use it to pay my store cards. A good trick would be getting the full $500 through to pay a store card like say Target and once payment goes through, I would have Target’s CS mail me the credit check (we don’t spend much at Target).

The Square alt is a bit trickier as I have to give out referrals to family and friends and utilize their accounts and mine to get $1000 fee free swipes per referrer and referee. That’s about all I could think of.

I swear you had written about Rite Aid doing MO’s with debit cards. CVS only does cash. 🙁 Is the OV route seriously dead now??? I’ve heard of Simoncards. Have you played with that yet?

RE: Best Buy, I’m going to try the Lakewood one between DelAmo and Candlewood just to see. Let me know how the FRN works out.

John: Two ideas you may want to try; the first is an Amex for Target (AFT). Cost would be $3 per $1000 to load, and there isn’t a guarantee that target employees will let you use OV, but they should work. Alternatively you could try to get your hands on a target red amex (Somtimes called a redbird). No one in CA has them, but you can buy one on ebay for $30 or so. These would load for $0, just like a BB/Serve card does at WM, except at target, with OV’s processing as credit. Both have a weak point at the employee level, registers should allow OVs to work, and there isn’t a policy against using them (yet).

I may have written about Rite-Aid and MOs in the past. Rite-Aid has changed their policy to MO for cash only. The registers still allow MO with debit, but finding a store employee who allows it is tough.

There are other more technical ways to drain, but the above is probably the best first step. Best of luck in getting those OVs taken care of.

I don’t know how to give you notice of deals, but since you’re in my neck of the woods, here you go!

http://get.mogl.com/spend10get10

Applicable to participating restaurants noted in the link. They had this promo during the holidays. It’s legit. I got the cash back and the cash back that I normally would have gotten without the promo. I had 4 accounts and averaged 6 restaurants each day. So, whomever is in AZ and CA, enjoy!

John: Thanks, looks like a nice little promo. I’ve actually got nothing planned for lunch today, so I’ll give it a whirl. Also, you can always email me at samsimontravel@gmail.com for future deals.