Reader Gene Asked for a detailed post on the process of redeeming Worldpoints earned on the Fidelity Investor Rewards Amex, which just so happens to be The Best Cash Back Card on Earth. In response I’ve put together this post. I’ve also added a little bit about using the card to book flights, which can be a very good use of the points earned with the Fidelity Investor Rewards Amex.

Quick Recap: Best. Card. Ever.

I’m in love with you Fidelity Investor Rewards Amex. You’re always by my side[pocket] waiting to spring to life. There are plenty of great uses for you. From non-bonus spending, to gift cards at sources that earn 1x on every other card I use you almost daily.

Earning points happens at a 2 worldpoints for $1 spent, and can be redeemed at a 1 point = 1 cent redemption level. This makes the card a minimum 2% cash back card.

When it comes time to redeem your points the options are intimidating. I’ll step through redeeming for cash here today, and then go (again) into detail on how to supercharge this card into earning more than 2% back in certain situations.

Choose your Adventure: Cash, or Cash and Other Options.

Part of the confusion in redeeming rewards with this card is the FIA card services website is awful. On the rewards tab there are two options, right next to each other. “Manage and Redeem Fidelity Rewards” and “Redeem Worldpoints” are literally side-by-side:

Selecting “Manage & Redeem Fidelity Rewards” Is only to be used if you want to take your rewards as pure cash, at the 1 point:1 cent ratio. Clicking the orange button takes you to a very y2k-esque looking page with the following options:

The first option seems like the way to go, redeeming to a Fidelity account. Fidelity really wants you to use this option. The FAQ of the card has the following language:

This language insinuates that the only way to receive a full 1:1 payout for your points is to take the points as a credit into a Fidelity account. If you do have a Fidelity account, then sure, go ahead and take smaller redemptions into that account at 1:1. But the above chart stops at 20,000 points for a reason

Above 25,000 points all options turn into 1:1 redemptions.

Just make sure you’re redeeming 25,000 or more points, and you’ll get a 1:1 redemption for all three options. Since there is no bonus for taking a credit to your Fidelity account or having a check cut, just take a statement credit equal to the number of points you’d like to redeem by clicking the statement credit button and entering the total points on the next page:

Confirm that this is a 1:1 redemption earning you 1 cent per point:

The basics to remember are that you can redeem for sub 25,000 points only to a Fidelity account at 1:1. Above 25,000 points you can redeem 1:1 as a check or statement credit. I simply wait until I have 25,000 points, and then take a statement credit.

Travel Awards, Approaching 2.8% Return on Spending

I cover the following in more detail in this post “The Best Travel Cash Back Card, and How to Use it.”

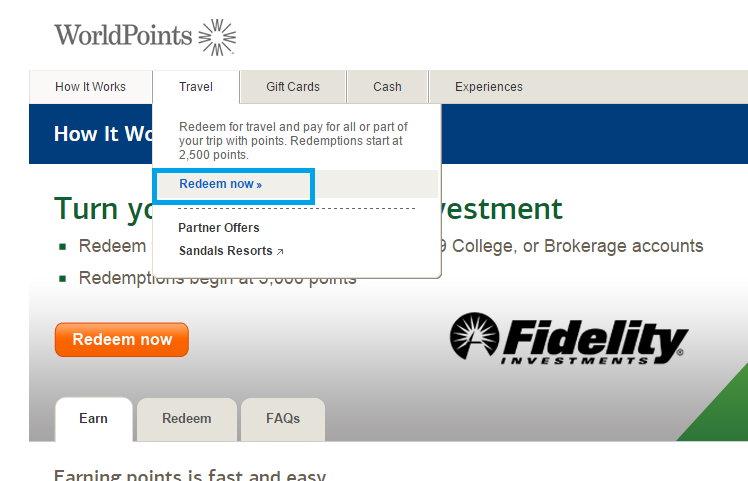

Selecting the other option on the Rewards tab, “Redeem Worldpoints” as shown above leads you to the main Worldpoints portal:

Everything here is a waste of points except travel. Gift cards aren’t even 1:1 redemptions:

Which means you’d be better off buying a $250 Amazon Gift card and taking a 25,000 point Statement credit. I’ll step through a strategy in which you keep an eye out for fare sales that are great uses of Fidelity points, and use Worldpoints to book fares and receive a higher return on your points.

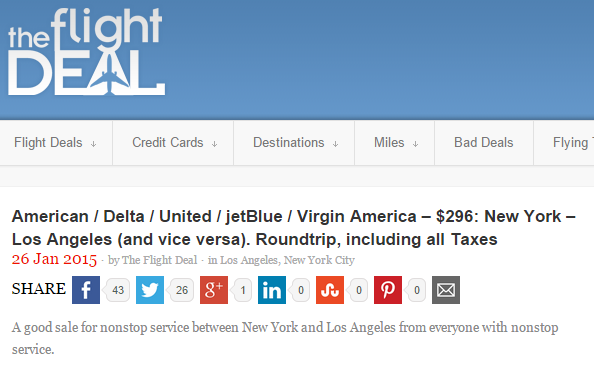

Keep an Eye on www.theflightdeal.com for <$400 Fares

I’ve twice leveraged a good deal on www.theflightdeal.com into booking with Worldpoints at a higher value than 1:1. The method of doing this works as follows:

– Scan your Demand Schedule for any upcoming flights, especially those which you’ve been unable to find good low level award space for.

– Search www.theflightdeal.com for flights to/from these city pairs, in the below example I’m using NYC and LAX.

– Check itaMatrix for dates and times that work best for you, keeping the price of the ticket below $400 (More on this later).

– Remember you must have a Saturday night stay in order to book at the 25,000 point level.

I love this technique because it allows you to choose ideal dates and flights and not worry about award space. It also lets you select flights regardless of price so long as they are below $400 r/t.

Example booking: NYC to LAX in March.

Let’s say that you follow theflightdeal on twitter, and saw them tweet about a NYC-LAX fare sale:

You know you want to go to Los Angeles in March, and loading up ITA Matrix you see that the good deals on this flight continue through March:

Let’s say you’re flexible, but want to leave on a Friday. Your options are the 6th, 13th, 20th, and 27th. The first three cost the same amount, the final costs $72 more (23%).Booking on the Fidelity site any of these options cost the same amount: 25,000 Worldpoints + $30. Going with the March 27th option any flight that day would cost the same 25,000 Worldpoints and $30 copay:

And here are the corresponding flights in the worldpoints portal:

This can also be an effective low level hedge when low level awards aren’t available on your date. It also helps when the only awards are red-eye flights or early AM travel. Because airlines often charge more for prime days and times so long as you stay below $400 you can “splurge” and book those later flights without paying any more out of pocket..

This can also be an effective low level hedge when low level awards aren’t available on your date. It also helps when the only awards are red-eye flights or early AM travel. Because airlines often charge more for prime days and times so long as you stay below $400 you can “splurge” and book those later flights without paying any more out of pocket..

The above example, a $381.20 flight represents nearly the maximum value which can be extracted from this process, and does in fact turn the Fidelty Amex into a 2.8% Travel Cash Back Card.

Note: AA flights purchased on Fidelity’s portal have ticketed in Q and G fare buckets for me. I’ve been unable to upgrade with instruments on them, which is contrary to what I suggested in an earlier Fidelity post on the matter. Consider the ability to upgrade these fares to be unlikely at best.

Wrap Up

Most of the confusion in redeeming Fidelity rewards comes from the overwhelming number of options in doing so and a poorly (re)designed website. There are too many options; Deposit to Fidelity accounts, Cut a check, order gift cards, and Statement credits to name a few. The only two I recommend using are Flight deals (Premium Air Reward only), and Statement credits.

I’d always suggest using your miles before booking paid flights with Worldpoints–but if you’re stuck, or have a very specific flight you’d like to take, try a Worldpoints Premium Air Reward booking.

Who buys the ticket and if changes to tickets are needed, who do you deal with?

=>Is this similar to Citi TYP where tickets purchases are outsourced to Connexions Loyalty and if you need to make changes to the ticket, you have to deal with CL rather than the airline itself?

ABC: Great questions. The process is similar to other CC travel portals and run by a third party. I haven’t had to make a change yet so I can’t speak to the process for changes first hand.

I dug a little and found this: https://fiacardservices.orxenterprise.com//terms#rst which lists “Loyalty Travel Agency LLC” as the seler of tickets for Worldpoints. According to SEC information here both Connexions and Loyalty Travel Agency are one in the same.

Nice post! I’d be interested in hearing your philospophy on this vs. pursuing a 5X(+) everywhere strategy for unbonused spend via reload and prepaid cards. If you’ve written something on that already would you point me to it?

VRHunter: I haven’t written anything specific, but I’ve alluded to it I’m sure. My philosophy is to break away from the idea of your everyday spend is an avenue for generating big amounts of miles/points. The problem with a 5X everywhere philosophy using prepaid cards is that it assumes one of two things: Unlimited ability to use a 5x card to buy prepaid cards, or a false idea that using 5X prepaid cards for everyday purchases increases your total 5x Spend.

Amex brutally taught us that #1 is false, and The basics for #2 are that if you’re hitting your 5x cards as hard as possible, as much as possible, and liquidating without issues, then you’re already earning the “max” 5x you possibly can. Saving a few prepaid cards and spending them for everyday doesn’t mean you’re earning 5x on everyday spend–because those 5x prepaid cards could be cashed out instead of used. In reality you’re only saving the cost of cashing them out–which is usually well below 1%. In those situations a 2% card is twice as good.

Another way to think of this philosophy is this: Just what is your “everyday Spending?” If you go to a drugstores and grocery stores 3x a week to buy $2k worth of prepaid cards, are they not, in essence a form of your everyday spending? If you’re able to cash out those purchases I’d argue that yes, prepaid cards are a part of your everyday spending. Spending that 5x on your “everyday prepaid purchases” and then cashing those out will earn you $X per month. Spending the rest of your everyday spending on a 2% card will earn you X+2%(y) every month, a net increase.

Additionally I’m a budgeting nerd–the ability to pull in all spending data off of credit card allows you to know exactly where you money is going. I firmly believe that holding a prepaid card and spending as you see fit leads to overspending–eroding your “5X” return in a second, more sinister way.

Thanks for this wonderful, informative post. I have the fidelity amex and now believe I need to use it more often.

Have you tried using it for manufactured spend for loading Serve automatically, earning 2,000 points per month? I’m wondering if it will go through since Serve is amex. Would not want it posting as cash advance.

Thank you Lyn. I have a softcard enabled Serve account and load $1500 a month to it from my Fidelity Amex for a total of 3,000 points per month. No issues here.

Does the BOA Travel Reward card offer world points redeemable in a similar way? What about when stacked with the Platinum honors 75% bonus?

Chucks: I’m not sure if it does as I don’t have access to the card. I would guess no–because readers have had trouble replicating these 25k flight redemptions even on the Fidelity Visa card.

Are there tiers above 25k = <$400? My Fidelity Amex was set to sweep to my Fidelity account, so I don't have any points ATM, but checking on a $917.57 flight shows it requires 91,757 points. I assume that it goes to 1 cpm above 25k? However, since I don't have points in my account, given FIA's site is so bad, I wanted to make sure that was the case.

Unfortunately the 25k for ≤$400 flights is a special case. Once you go over $400 the redemption rate reverts back to 1 cent per point. Because of this there is no real benefit to taking a flight redemption at 1 cent per point since you can take a cash redemption at that rate and buy a ticket outright.

Does this require just Fidelity Amex card or do i need to have fidelity visa credit card also.

I just tried with Amex and it display in normal 1CPM.

S:There has recently been a change to the site, and it appears you now do need 25k worldpoints in order to see the Premium Air Rewards. You do not need a Visa Card, only the Amex.

Is the deal over for non us flights?

I can see flights to asia below 1150 but not at 85000 poins. Do I need 85k points to view those awards?

A change back in April now means you must have enough points to see these lower cost awards. You could try a 25k award to make sure.

Can points be transferred between the Fidelity Amex and a BofA world points card?