If you’ve been playing this game for a while it’s likely to have happened to you.

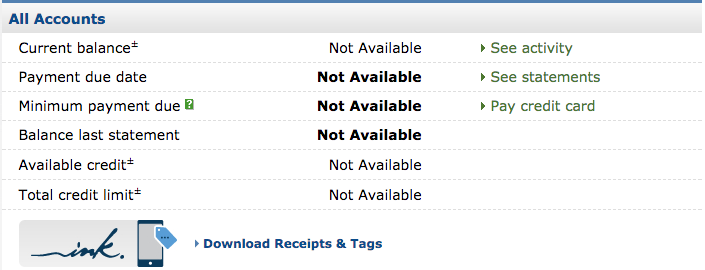

You log in to your credit card account online and see that some or all of your rewards points have gone missing. You poke around and things don’t seem right. Your available credit has gone to $0.00 and you think to yourself:

This is it. This is the big one. They’ve shut me down!

Sometimes it actually is a shutdown, but thankfully more often than not it’s a glitch. If you’re not careful, a glitch can turn into an actual problem – if you overreact.

The key is to gracefully discern shutdown from glitch so you can decide what to do next.

Here’s a checklist [for my future self as much as you] if you think you’ve been shutdown…

DO

- Try going incognito in your web browser

A lot of times, browser cookies have gotten fouled up after many bank logins. Going incognito gives you a clean slate and may enable the bank’s systems to display your account information correctly. If this turns out to be the problem, clear the cookies for the sites associated with that bank and try again in your main browser window. - Try a different web browser

Some banks are picky about which browsers work well with their site. Have a few popular browsers installed on your system even if you don’t use them regularly so you can check whether the issue is browser dependent. - Try checking on the bank’s mobile app

Most mobile banking apps are still a bit clunky to work with, but they do provide a “different” way to look at your account information. - Give it time

A lot of glitches resolve in a manner of minutes. Others take overnight. Especially if it’s a night or weekend give it some time to see if the condition self-resolves. - Try a small test purchase

One sure way to know whether you’re shutdown is to try a small test purchase. Like reload your Amazon account balance for $0.50. If your card is declined (or a decline was the first thing that led you to believe you were shutdown) it could just be a fraud alert. Time to call the number on the back of the card. - Ask friends the same card whether they’re seeing the same thing

If you’ve got some friends with the same card ask them nicely if things look okay for them. It could be a semi-widespread outage. - Call the number on the back of the card

The first thing I like to do is use the automated system to check my available credit. If you’ve got available credit you’re likely not shutdown.

If your card has been declined and you have an available balance it’s likely a fraud alert.

If you need to proceed to speaking with an agent (or if your call goes straight to a bank representative) ask harmless questions like “I was just calling to check my available credit” or “I’m having trouble making a payment online and was wondering whether it’s just me?”.

There are a lot of reasons why things may be temporarily suspended (accidentally missed a payment, too many login attempts, suspected fraud) that you can patch up over the phone.

DON’T

- Panic

The worst thing you could do is overreact to a glitch and hastily transfer all of your flexible reward points out to some 1:1 travel partner in hopes of avoiding total loss. Yes, it’s a risk of carrying point balances in bank point programs – and one we should all account for. But by overreacting and taking extreme measures a temporary glitch could become a self-inflicted wound. - Call the bank and ask whether you’ve been shutdown for specific shenanigans

If you’d like to avoid “eyes on your account” for whatever reason it’s best not to call. But if you do call keep things as general as possible. For example: “My card was declined and I was hoping you could check whether there’s perhaps a fraud alert on the account?” Not: “I noticed all of my rewards have gone missing and was wondering if it could be related to buying gift cards?” - Prematurely elaborate

Say there is a fraud alert on your account and a phone rep starts reviewing recent transactions with you. They ask if you recognize a $505.95 purchase at your favorite store. Do you recognize the charge? A simple “yes” will do. Remember: A fraud alert is there to protect you and the bank. They’re not accusing you of defrauding them. - Get needlessly aggressive

Say you log into your account and all of your rewards have gone missing. Calling up a first line rep and threatening them with a CPFB complaint if they don’t re-instate your points immediately won’t do you any good.

When accounts do get shutdown first line reps are usually confused by what they see in the system because it’s an unusual condition and the informational messaging they’re getting is just as confounding to them as it is to you.

Save your thunder for when you’re speaking with someone higher up after your account has actually been shutdown.

Bottom Line

When we play this game we tend to become far more involved monitoring transactions and checking our accounts online. We therefore notice more than your average customer when things aren’t right. When you think you’ve been shutdown take the time to determine whether it’s “the big one” or a glitch.

Hopefully it’s a temporary condition that will self-resolve or one that you can patch up with the bank.

What to do if you actually have been shutdown is a different topic for another time. Bank policies vary on whether they confiscate the rewards in your account or allow you to redeem them. It’s important to be aware of these differences when deciding how many points you’re comfortable carrying with a given bank. We’ll go into that in more detail in a future post.

At first, I thought your advice was prompted by the shutdown of the federal government. Only after reading a bit, did I realize it was prompted by Chase’s conversion of the Ink Bold MC. 🙂

Yep – that was exactly it! Thanks for reading.

Great post. Thanks, Robert!