Written by Milenomics contributor @RobertDwyer

One of the best books I’ve read the past few years is Dan Ariely’s Predictably Irrational. Every chapter is packed with fascinating examples of how we think we make consistently sound decisions but often do not.

If points & miles have been on your mind lately I think you’ll find the concepts illustrated in the book obviously linked to situations that present themselves on a daily basis.

A simple experiment

The most memorable example for me is where Ariely describes an experiment they conducted at an MIT cafeteria. They offered people the opportunity to buy one (only one) chocolate:

A Hershey’s Kiss for $0.01 -or- a Lindt Truffle for $0.15.

With these 2 options 73% chose the Lindt Truffle.

They then conducted a similar experiment, but dropped the price of each by $0.01. The Kiss was now $0.00 (FREE!) and the Truffle was $0.14.

With these 2 options 69% chose the Hershey’s Kiss.

Why was it that a price change of $0.01, just one cent, caused so many people to go for the Hershey’s Kiss instead of the Lindt Truffle? Why would people pass up the opportunity to buy a chocolate as amazing as the Lindt Truffle for just $0.14? It was the power of FREE!

The power of FREE!

There’s something disarming about an item being free. It absolves us of the burden of scrutinizing the value of the free item and minimizes the chances of feeling foolish for having purchased something that was a bad value.

But we humans aren’t so good at identifying the downside associated with choosing the free item, whether it be the opportunity cost of the Lindt Truffle forgone or the chance that the free item might be ill suited to our needs.

Examples in points & miles

In Predictably Irrational there’s another experiment that’s actually something we might be faced with in the pursuit of points & miles: Would you rather have a $20 Amazon gift card for $7? Or a $10 Amazon gift card for FREE?

Astute gift card resellers will know to go for the $20 for $7 over the free option, but your average man on the street goes for the free option by a wide margin.

What about some more involved options?

Fee-free credit cards vs cards with annual fees

Before I got into this stuff my credit card selection criteria was simple: No annual fees and cashback only.

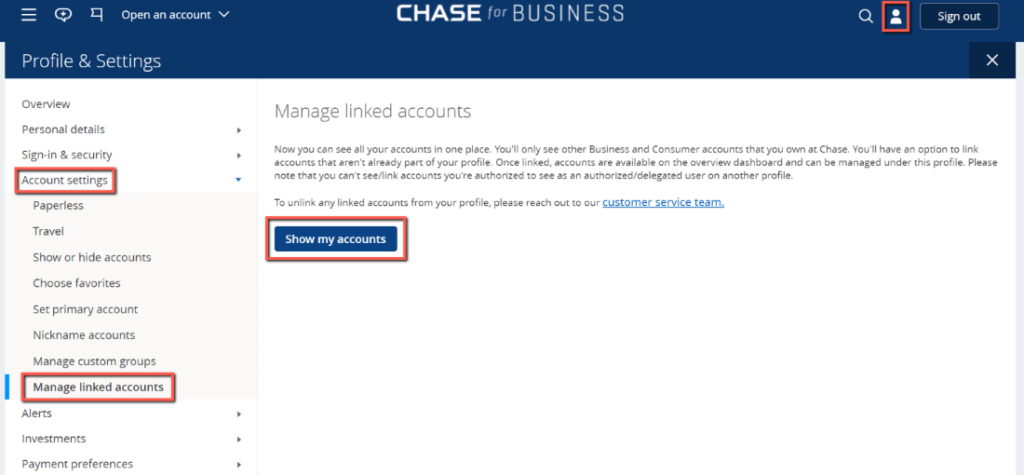

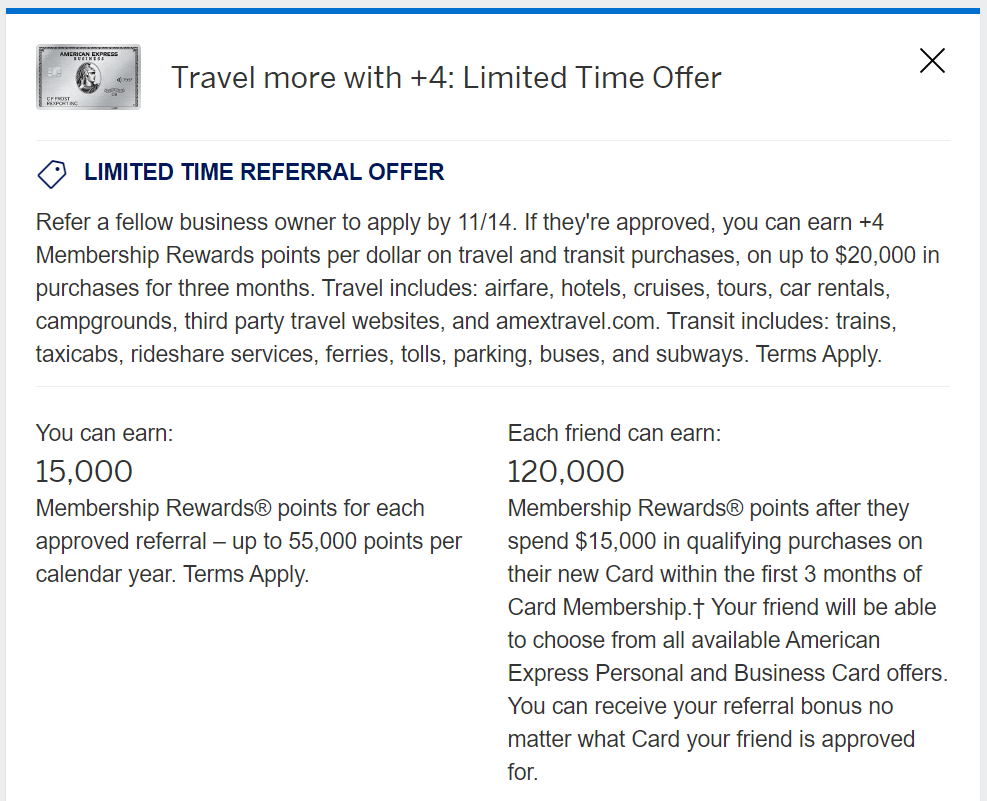

In hindsight I can see that I was limiting myself to cards with little risk, but also relatively little reward. I mean, who could justify a card with a $550 annual fee? If the signup bonus is high enough and you’re able to take advantage of other benefits, high-fee credit cards can be a great deal. But I avoided cards with fees to skip the hard work it takes to scrutinize them and navigate the complexity required to extract solid value out of them.

I didn’t want to feel foolish for making a bad choice.

Fee-free liquidation vs costlier options with scale

Say you can go to a nearby store and liquidate a Visa Gift Card for free -or- you can pay 1.75% to liquidate it online. Which would you choose?

Although the in-store option is free on paper it is limited in scale, consumes time, and is [for many] subject to variability that might make a visit a complete waste of time. Hypothetically if you could reliably liquidate many thousands of Visa Gift Cards online for 1.75% each day it would unlock a lot more scale and overall profit.

Yet knowing there is a free liquidation option out there makes the 1.75% seem “expensive” even if it is a better choice.

Hotel free night certificates

Many co-branded hotel credit cards come with an annual “free” night certificate. It’s really not a free night though. It’s a restriction laden voucher you paid an annual fee to get. Making matters worse it expires quickly which leads to non-use and depletes your cognitive bandwidth each year you carry the card.

Avoiding fuel surcharges

Nobody likes fuel surcharges and we all do our best to minimize them when booking award travel. But there are some cases where I’m fine with paying fuel surcharges.

If it opens up award availability that’s otherwise not there far in advance. If it enables me to use a milage currency I have an abundance of (thus relieving pressure on other mileage currencies). And if it enables me to use a companion certificate and is an overall better option than other booking avenues.

Bottom line

I’d encourage you to take a look at your travel, points, miles and cashback goals for this coming year and scrutinize whether the power of FREE! might be messing with your mind. Consider what you really want to get out of the time you spend playing this game and stay true to those goals.

After all: Would you rather have a free vacation limited to a certain set of destinations? Or, say, 75% off precisely the experience you want?

Good topic and something I think about a lot. With all my mile currencies, it’s getting harder to figure how and what exactly I should pay for. I find myself doing things just to satisfying my inner self who wants something free . Like pick a hotel outside a city center because it’s free. Or do a weird flight route.

Worse place for “free” is the buffet. ?

Good article. But that means I shouldn’t read your FREE blog. (kidding!)

Good idea. I’m going to start charging $.01 for subscritptions. Then we can get rid of the paywall and advertise it as FREE!

RIP Tio.

May it live again someday.

Where could you liquidate VGC at only 1.75%? Haven’t heard of such a low rate so far.

See the comment just above yours for more info 😉

I like to have proven go-tos in my arsenal I can always travel to, & really enjoy, at my disposal so I know I’m always making use of my points/miles acceptable for me if all else fails.