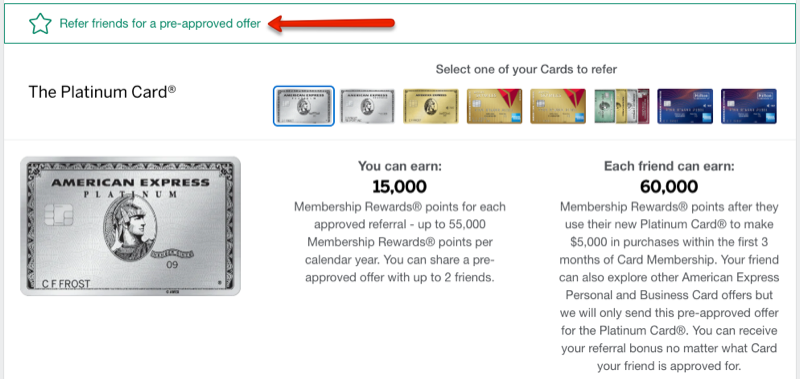

Today I’ll outline offers that are trickling in on the Amex Offers section of some accounts for the American Express Premier Rewards Gold (PRG) card. This is noteworthy becasue the standard offer on this card is awful. 25,000 MR for $2k in spending.

The Offers

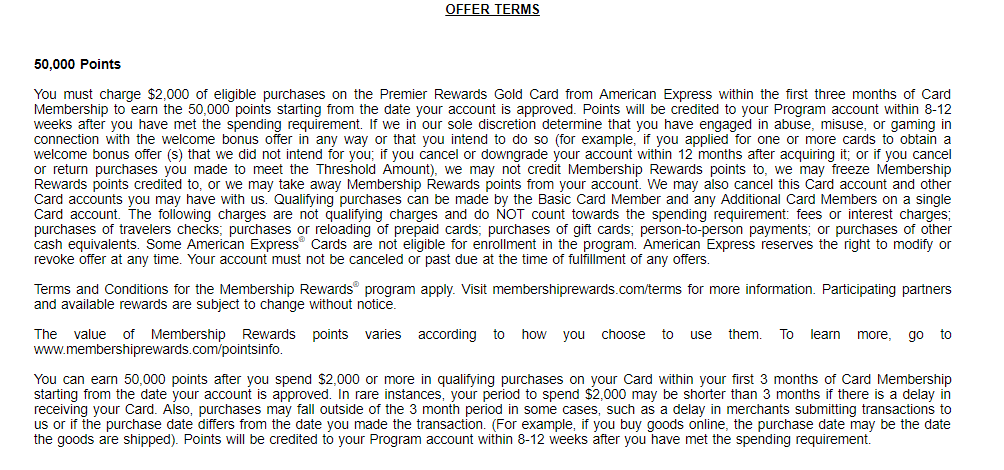

Today I’m seeing the following 50k/$2k offer under ‘Amex Offers & Benefits’ on my American Express Everyday card:

Other readers are seeing a 25k/$1k offer under ‘Amex Offers & Benefits’:

Both of these offers do not have the ‘once per lifetime’ wording:

The 50,000 point offer is a slam dunk, churnable, no annual fee, an easy to meet minimum spending requirement. In addition because the $100 Airline credit it includes is by calendar year you will earn it twice ($200). That makes the offer worth over $700.

I’d pause at the 25,000 point offer, mainly because the 50,000 point one exists, but if you’re going to spend $1k in the next few days that offer could be a good card to apply for because Amex will issue an instant card number after approval.

Amex PRG-A Not Just a Use Less Card, A Useless Card.

The card is a bit of an oddity. It is almost universally worse than all other MR earning cards Amex has. It offers 3x on travel booked directly with airlines (Thanks Michael), 2x on Gas and 1x Everywhere else. It also has a $195 annual fee, with a $100 credit towards airline incidentals. You must select an airline for this credit, so it isn’t a blanket $100 like the great FNBO TravelElite card. In fact this card is inferior in every way to that FNBO TravelElite card.

The earning structure, high annual fee and weak airline credit don’t even make it a sock drawer card. They make it a bonus and cancel card. I’ve had this card in the past and cancelled it right away once the second year Annual Fee hit.

Forever Over 5/24

I lamented this in yesteday’s Shop Talk post, and today here I am even further over 5/24. I just couldn’t resist this offer. $0 annual fee, 50,000 MR with an easy $2k spending requirement and $200 in Airline incidentals before the card gets cancelled.

Be sure to check your “Amex Offers & Benefits” to see if you also have a targeted offer for this card. And don’t forget to cancel it next February.

Thanks for the nudge, been meaning to cancel

No Problem, RG.

Which section of Amex Offers is this in? I don’t see anything :((

If you’re targeted it would be mixed in with garden variety AmEx Offers.

I was not targeted and have many AmEx cards. My wife has fewer AmEx cards and was targeted.

We’ve both had this particular card before.

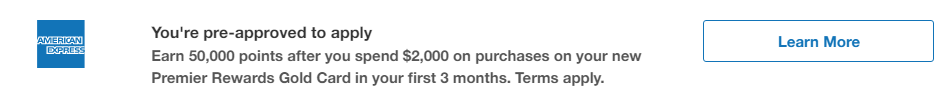

Al: here’s an image of how it would look: http://www.milenomics.com/wp-content/uploads/2018/03/Pre-approval-offers.png

Just curious, how many Amex CCs and Charge cards do you have? I used to get this offer when I only had the OBC. After I signed up for the PRG, I also started seeing offers for Platinum. Since’ I signed up for that in 2016/17 and a bunch of other cards, I haven’t seen any offer for any card even though I have three other cards that could be upgraded and I no longer have the Amex PRG and Platinum for over a year.

P: Thank you for the detailed account of your Amex cards, and when your offers were showing. As for me I have 4 personal CC and 1 Business CC. No other charge cards right now.

P, same for me, as far as it not showing up. I also have a Plat, so it might be the reason a Gold offer is not showing up for us. (Plenty of other decent offers to go after, though!)

Hi, different perspective for what its worth. I’ve had the PRG for a number of years, and continue to get value from it year after year, despite contemplating cancelling it each year. I think its utility is underappreciated by many.

The $100 credit will allow one to purchase $100 worth of gift cards from several Delta, American, Southwest, Alaska, etc. Also, I have received alot of Amex offers on the card, including many unique ones and spending bonuses (like spend 10k get 20 k MR, and repeat 3x) that easily cover the annual fee for the card. I find the uncapped 2x on grocery very useful as many grocery stores have seasonal or holiday offers of discounted merchant and visa gift cards. So in the last 12 mos, I’ve easily earned over 200k MR with the card and used enough good Amex offers to easily cover the annual fee and this keeps happening each year. By the way, I use the Platinum card for 5x on Airfare, but note the typo above as it offers 3x on airfare (not travel) purchased directly from the airline (not Amex).

Michael: I really appreciate the opposing viewpoint on this card, so readers can see a more full picture of it. I’d caution you to compare it to other cards, and even other Amex cards (like the EveryDay Preferred) and not just what you receive from this card itself. I’ve also edited the typo above and credited that to you. Thank you for bringing that to my attention as well.

Sam: I think it’s important to point out that Michael did specifically compare the grocery bonus with other cards. The fact that it is uncapped can actually be meaningful instead of “useless.”

Roy: I appreciate you continuing the discussion on this card. I read Michael’s reply very differently. To me the cornerstone of his reply seemed to be Amex Offers, which he said had contributed to at least 60k MR, and covered his Annual Fee. Those same offers were likely available on a card like the Amex EveryDay ($0 annual fee), so to say that they’re a feature of this card is not a fair comparison. While those offers make you feel a stronger affinity towards this card they are in fact independent of the card, its annual fee, or its earning structure.

The idea that a casual spender, even one who likes to take advantage of grocery store gift card deals to the tune of $25k a year (50k grocery MR) would be better off with this card is not in fact true. On that same 25k in grocery spend and for the same $95 a year you could earn 27k MR on a Amex Preferred Everyday and an additional 38k MR on something like a Blue Business Cash (65k MR). And you’d likely have access to twice the number of Amex offers on those 2 cards. I realize not everyone can carry a Business card so this isn’t a totally fair comparison, but still I think it needs to be considered, along with cards from issuers other than amex.

If Michael is spending $100k on grocery at 2X on the card he would be considered a heavy hitter (to me)–and if he is a HH he’d likely have a 5% back grocery card, a few capped grocery cards, a Blue Business Plus which also would earn 2x MR on $50k a year with no annual fee. If he’s maxing all of those out and then still spending $100k on this card I could get behind the idea of keeping this card active. But then he’s still missing out on the churnability of the card, as evident by the above offer.

I want readers to consider things like the above before they just pick this card up and fall into the habit of using it for a few years. I have a good friend who’s carried this card for 4+ years. He forgets to use the $100 credit from time to time, he puts all his spending on it for a very low effective earning rate, and he keeps paying $195 a year for that luxury.

As a further point of clarification, I have oversight for about 15 different Amex cards for a number of people including, personal (including SPG, Hilton, Plat, old blue cash, ED and EDP) and Business (SPG, Plat, Blue Business Prederred) The Amex offers on the PRG have been different, numerous and stackable. For example among many ofhers during most of 2017 I was getting 3x in Whole Foods and could stack with spending bonuses. This was effectively providing 5x on 30 K in Whole Foods. None of my other cards had similar Amex offers and I never saw it mentioned on a blog. I bought mostly VGC. I suspect because Amex knows this is a weak offering they provide these opportunities to motivate people not to cancel. Combining that opportunity with other other grocery offers once each of the ED and EDP are maxed out (the PRG 2x uncapped) I found an isolated grocery store inadvertently not charging activation fees for a few weeks, holiday negative cost visa gift card offers, other gift cards for personal use, gift giving or resale. I keep planning to cancel the card and then these amazing Unique Amex offers show up I decide to keep the card another year. So I averaged somewhat over 1k/week on this card. That can be Manageable by many mainstream standards. Let’s see how 2018 unfolds and if I use or keep the card.

Michael: Love the reply and thanks for the added details. “I suspect because Amex knows this is a weak offering they provide these opportunities to motivate people not to cancel.” That explains these targeted 50k offers, and I hope this is indeed the case with unique Amex Offers moving forward. If any unique offers show up I will try to showcase them here so we can all be a little stronger. Looks like I did indeed jump to conclusions, sounds like you’ve got a good thing going. I’m glad you and Roy both commented here, as I think readers are better for it.

First time with this card, got it with a 50K signup bonus for $2000 spend. The PRG is our highest fee cc since we are not big spenders, used some offers but honestly not a lot of spending on it. I called when the AF was going to post. Without any hesitation, they gave me an immediate $50 retention credit, with another $50 credit after $500 spend in 90 days. Then I got my $100 airline credit for buying 2 gift cards, so I’m ahead $5 and keeping it another year. It’s worth a try.