Today’s post comes out of a comment I left a few months back on Robert’s Hilton Amex Double Dip post. For the past few years I’ve been making sure to verify American Express sign up bonuses as soon as I receive my cards. This sprung out of a horribly messed up application I had a few years back where an offer did not attach to my card, and I successfully fought to have it attached after the fact. Doing this simple 5 minute process on day one gives you some peace of mind, and helps solve the problem while you still have time to meet minimum spend.

I want to make sure to cover this for anyone out there who might have a shiny, new Amex card in their possession right now. In my experience it is nearly impossible to argue with American Express and correctly get a bonus to post to your account once the 3 month window has passed. They simply don’t seem to have a mechanism in place that allows retroactive posting of large 5 and 6 figure bonus amounts. To see how bad this can get see Milenerd’s post here.

Finally, a Use for Amex Chat Reps

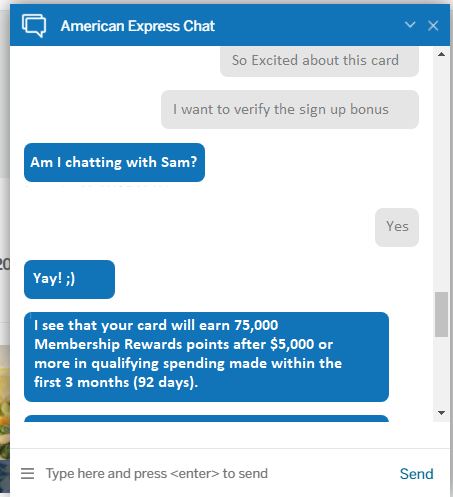

Amex’s chat reps are legendarily bad. Horrendously bad. So bad they have to ask you your name lest they forget who they’re talking to. (Ok maybe they ask you your name for security purposes). But They’re nothing if they’re not helpful with this one task: Verifying that your current card has the correct sign up bonus.

When I receive my new Amex cards I make it a point to chat with a rep and ask for clarification of the sign up bonus on the card. In the case of my shiny new Amex Gold Business card I made sure to ask, especially because the card didn’t flag the welcome bonus checker that Amex has been testing.

As you can see from the above image they have access to this information and can pull it up right away. If for some reason the bonus is not attached they can open a case–and you can check back with them weekly until they are able to see that the bonus is correctly attached. Thankfully the Amex chat window now also retains chat history. This means you can go back and review the chat log and have proof if you ever should need it.

Keepy RATs at Bay

Whether you believe Amex RATs are terrible, noble, or don’t even really exist–the fact remains: After you’ve spend $5069.50 towards your $5,000 minimum spend at an online retailer who’s name rhymes with whiffed-yard-ball giftcardmall.com the last thing you want to do is ask Amex to research your account.

Chatting to verify the sign up bonus before your Gift Card spending allows you two benefits. First, you can sleep easier knowing that you didn’t invite eyes onto your account. Second, if the points don’t post you can make a second run at the bonus requirements using real spending. In my experience Amex bonuses post quickly–within a week after hitting the minimum spending requirement. That means you could have 2+ months to meet the spending through organic regular spend if for some reason your spending is disqualified.

Extending This Beyond Amex

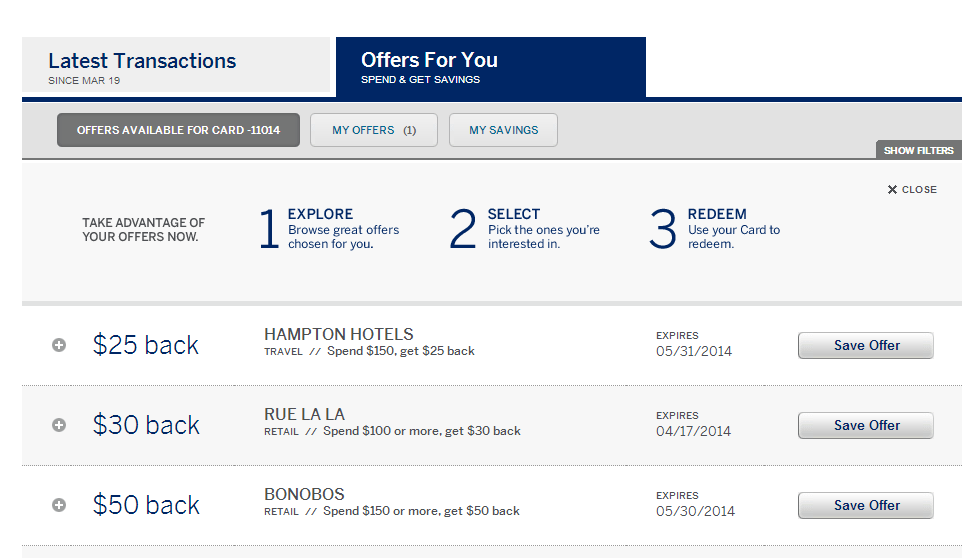

It is a best practice to make sure your application and bonus are successfully attached. You could do a similar type of inquiry with all most card issuers. Citi and Chase both allow you to send a secure message asking to verify the terms of your offer. Wells Fargo is now a leader in letting you proactively see and manager your progress towards a bonus. (I never thought I would write that Wells Fargo is a leader in anything). And then there’s Bank of America–well you know the deal there.

So what rhymes with whiffed yard ball .com? Seems I am clueless

John: It is more likely because I’m terrible at rhymes.

Does biffed-charred-saul.com still work for meeting Amex minimum spends? I thought they basically outlawed all cash equivalents?

I’ve personally switched to giftcards.com from biffed-charred-saul.com and have had good results as recently as May. I’m using it right now for the first $5k of the above spending (MCGC via-plastiq) so I’ll have fresh DP in a week or so.

Update: GCs.com working fine. Bonus posted w/o issue a few days after reaching min. spend threshold.

Is this supposed to be illuminating? Could you please just say what you mean? Thanks, would appreciate that. And clearly I’m not the only one struggling!

Kate: I appreciate the feedback. I’ll update it for some clarity. In the meantime here’s some background: https://www.doctorofcredit.com/american-express-cracking-giftcardsimon-malls-purchases-minimum-spend-requirementsauthorized-user-bonuses/

I do this regularly. And I have written confirmation in chat that bonus was attached, i was eligible, and I fulfilled the requirements. However I’ve opened an investigation and they closed it after 10 weeks saying I wasn’t eligible. This is for MB plat. I have had all other varieties already (vanilla, amp, cs, ms).

Ryan: I know you’re not alone with that mb platinum bonus issue. It almost seems like when they eliminated the card they also eliminated the bonus in the system. I unfortunately don’t have any additional resources to offer you except maybe a SC filing.