Welcome to another edition of Shop Talk where we discuss what’s going on in our personal points & miles space and highlight what we think is interesting in the broader space as well. This is the kind of “Shop Talk” many of you are engaged in on a daily basis, so feel free to discuss with us in the comments section.

Sam: Hi everyone, and welcome to the latest guest edition of Shop Talk. We’re tackling a very risky topic here today, the idea that there might be ways to get greater than 1 cent per point while cashing out Ultimate rewards. We’re not talking about booking travel or transferring points to airlines. We’re talking about taking the cash out, with uplift.

As you’ll come to see us discuss increasingly riskier methods you should seriously consider the negatives of the following discussion. However, this blog has never shied away from truly risky strategies, and I think there is an awful lot to be gleaned from today’s discussion, whether you use it for cashing out UR at 1.3-1.5 cents per point, or not.

I’ll pass it over to you Robert, for an intro to our special guest for today’s Shop Talk.

Robert: Today’s special guest is Rachel from Award Travel 101 and a new Disney site we’re collaborating on called Miles to the Magic. Rachel, welcome to Shop Talk.

Would you mind giving our readers a little babackground on what you’re focusing on in your travels and writing, and maybe your thoughts on where flexible bank points fit into your overall points & miles strategy?

Rachel: I’m traveling with a family of four–my children are four and two years old–so our focus is on destinations that will be enjoyable for the whole family. Sometimes this is easily compatible with a more aspirational trip (we have loved meeting local families at playgrounds!) and other times it means we head somewhere kid-centric like Disney. We also do three to four trips per year to visit family in the U.S. and since award availability isn’t always perfect for our needs, we often cash in our flexible bank points.

Robert: Fantastic. Thanks for coming on to discuss this with us. I know we’ve both enjoyed using flexible bank points to fund more complete vacations so I’m looking forward to comparing notes with you and Sam today.

Specifically I wanted to talk today about cashing out Chase Ultimate Rewards (URs).

I got to thinking along these lines due to the recent change whereby URs can no longer be redeemed with uplift towards Disney vacations. Even if you don’t give a rip about Disney, you might want to cash out your URs so you can book travel through another channel. Say for a better price or direct booking benefits.

Or you might just prefer cash.

So today I’d like to discuss the following…

If you could cash out your URs with uplift, would you? You’d be giving up on the potential upside of 1:1 transfer partners but it would free you up to spend the money on anything you wanted.

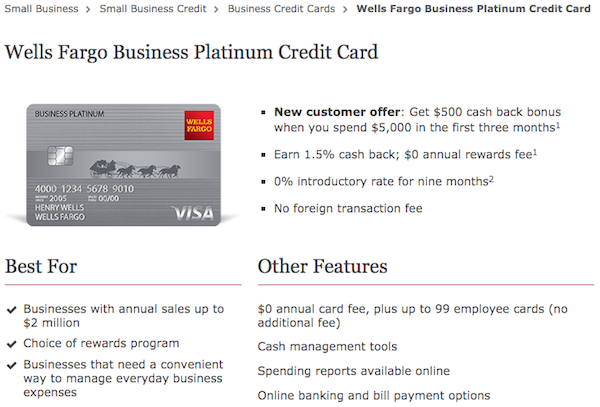

If you were interested in maximizing the cashout value, how might we go about that? URs can be readily cashed out of 1 cent each. But this really feels like leaving money on the table relative to the 1.25-1.5 cents a piece we can get when booking travel through the Chase portal depending on the cards we have.

We’d like to keep this as “above board” as possible to minimize shutdown risk.

Sam, would you help set the table here with your thoughts on why you might consider cashing out URs – even if you enjoy traveling?

Sam: Hi Rachel, very nice to meet you, and thank you for agreeing to come on the blog and give your perspective on this topic.

I know Robert and I have talked a lot about this question in private; Cash out or hold for maximum value. I’m so biased in my mindset that UR=Cash first and everything else second that when Robert brought up this topic I was like “Of course I would cash them out with uplift. I’d cash them out *without* uplift.”

Some background: I’ve gone back-and-forth on cashing out a large chunk of UR, now nearing middle 6 figures. There are two main reasons I want to cash out: AirBnB bookings and my earn/burn rate. There’s just more incoming than outgoing, and the excess is starting to lose value over time as these UR sit as numbers on a Chase bank server somewhere.

The only thing stopping me from cashing them all out at this point is the idea that maybe with Chase UR changing travel portal providers somehow there will be a better way to book boutique and even homestay type travel moving forward (with uplift).

All of that said, if we can cash out with uplift there might be no need to hold for such reasons of course. I *don’t* want to bog the three of us down in minutiae like erosion of value in the Chase UR Travel Portal–or comparison prices of hotels and AirBnBs in certain destinations. I don’t think that’s fair, as travel is very much personal. If you like a certain hotel chain I’d only ask you consider why, and if something else might better fit your need. For all the negatives I speak about hotel points I’m not anti-chain hotels, I’m just more about location really (and I tend to like to be away from crowds).

Recently I started off looking at hotel chains for an upcoming Mexico trip. But I also started sending out some feelers for an AirBnB rental and a private chef in house as well. And finally, I’m also looking at small, boutique hotels. Where will I end up? I’m not sure, but the value my points get me at each has no bearing in my decision at this point.

Will I at some point start to consider how to pay for this stay? Of course. But the idea that I *could* get 4 cents per point somewhere like an all inclusive Hyatt is like saying I could go somewhere in Asia and get 8 cents per point–If I’m not seeing the value there in the tangibles or the location then the 4 cents per point aren’t real to me.

Rachel, you’ve said you already cash out when necessary, so I’m interested to hear your take on cashing out with uplift.

Rachel: I think a lot of this is a mindset. I frequently redeem my Ultimate Rewards for 1.5x on domestic flights so being able to cash them out at 1.5x would be appealing to me. While I have transferred my fair share of Ultimate Rewards to Hyatt, United, and British Airways, if I wanted to go somewhere where transferring Ultimate Rewards to a partner doesn’t make sense, I wouldn’t hesitate to cash them out if there was a way to do so with the 1.5x uplift.

Robert: The question of whether to cash out URs (with or without uplift) is a mind bender [for me] for a number of reasons.

First, there are two levels of uplift to consider. The first one is 1.5 cents per point through the Sapphire Reserve towards any travel bookable through Chase. The second is the uplift associated with 1:1 transfer to travel partners.

By cashing out URs you’re giving up on the upside associated with a 1:1 travel partner. For me, with a family of four travelling out of Boston to Europe every year or two, transfers to United for Star Alliance Business Class has been a solid, easy, and reliable redemption. If I cash out, I’m giving up on that upside and I might get caught short of airline miles to fund trips I want to take.

The second threshold, 1.5 cpp through the Sapphire Reserve, is readily overcome if I can cash out at 1.5 or close to it. I wouldn’t cash out at 1 cpp. The spread between 1 and 1.5 cpp is just to great for me to get behind.

Second, this is where demand schedule comes in. Because I’ve faithfully populated my demand schedule through 2019 I know that the one international trip I’m eyeing is already funded. That means that I have time to earn for 2020 international travel. And if I keep some URs on hand I should be able to fund smaller redemptions like Hyatt stays.

I have a healthy current point balance and a good idea of what my needs will be over the next couple years. I could always take the converted cash and buy points & miles if a truly terrific opportunity presents itself.

Third, it brings to mind the notion of making asset fungibility work for us instead of against us. What I mean by that specifically is that some people [including myself] use our point balances as a sort of “vacation savings accounts” that give us permission to spend without feeling like we’re diminishing our overall financial health.

If we take our point balances, cash them out, and roll them into our checking accounts they’ll get lost in the shuffle. We’ll feel “vacation-poor”. One way to combat this is to create a separate savings account for these funds. But that feels artificial and I know I’d feel like I should just sweep it over to pay bills or invest for future growth. Maybe I should invest it for future growth!

But what I mean by making asset fungibility work for us is the following. Say for example I really wanted to take a Disney vacation with my URs. I was perfectly happy to stay within the Chase eco-system and give them the commission associated with the booking while redeeming my points with 1.5 cpp uplift.

If I found a way to cash out at 1.5 cpp I’d be empowered to book that trip or any other exactly how I wanted to. I could buy discounted Disney gift cards. I could book a hotel stay through Hotels.com for an effective 10% rebate. I could earn credit card rewards for the booking. I could book through a portal. I could work with a travel agent that stacks other benefits on the trip or provides agency exclusive discounts. I’d come out of it with more than a 1.5 cpp redemption.

Ultimately (pun intended) I have to stay true to why I’m playing this game. For me, that’s travel. Cashing out doesn’t mean I’m punting on travel. It could mean that I’m getting even more of exactly the kind of travel I’m looking for.

Putting this all together helps me see that I not only would cash out, but I absolutely should cash out Ultimate Rewards at 1.5 cpp – if I can find a way to.

Sam: Robert coming out with the great, core Milenomics principles here. I love it.

My personal life is in a bit of flux right now (that’s actually quite the understatement), so I’m unable to plan much of anything beyond one month out right now. I have loose plans–Return to Italy next year, Mexico next month, Somewhere with snow Between Christmas and New Years’ Day. Japan, which keeps getting planned and then scrapped.

That makes me (right now) probably more similar to the average traveler than to the average Milenomic, but I think it serves a useful purpose to illustrate some background into why I’m looking at cashing out. Nothing is firm enough for me to be able to do the long term forecasting and redemption that gives outsized value, through partner transfers, to the points I’m holding.

So the discussion becomes now about the mechanics of cashing out. I’ll throw a big curveball into this discussion and mention that everything that follows is likely #RiskyBusiness . If you’re going to go down the road of cashing out at greater than 1:1 you’re likely going to have to accept some additional risk.

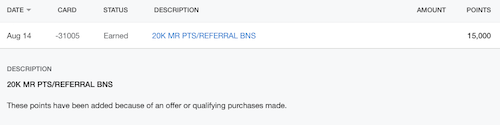

A real life example from me: I’ve been able to sell miles and points to point brokers for 1.20-1.3 cents per point/mile. That’s not something I’d consider everyone doing–but it has come in very handy in the past. When selling miles I didn’t create a special travel fund with that money, it did just get ‘absorbed’ into all other investments.

Are points brokers for everyone? No, absolutely not. Are they as risky as everyone says they are. In my experience, no. I’ve sold more than 2MM miles and points across multiple programs, and have had zero issues so far doing so. *Knock*knock*

This isn’t 1.5 CPP, so beyond brokers, what else can readers do to cash out with uplift? Robert? Rachel? Any tips?

Robert: One idea I had actually came from a Chase Disney booking.

A month prior to our trip, Disney sent me a targeted 25% discount for a room I’d booked at the Disneyland Hotel. My first thought was to cancel and rebook, but I was inside the 30-day window where Disney charges a $200 cancellation fee.

I ended up being able to modify my reservation and Chase/Connexions Loyalty sent me a check for the price difference. This was terrific! But this got me to thinking…

Say I booked a $5,000 Disney vacation with URs with 1.5 cpp uplift (333,333 URs) then cancelled within the 30 day window. They’d send me a check for $4,800. This would effectively be a 1.44 cpp cashout.

Sure you can’t book Disney through Chase now, but presumably you could find a variety of cancellable reservations that would result in a check rather than a points refund. Perhaps without a cancellation fee at all.

Understanding when Chase issues a refund for the cash value of the redemption vs refunding points would be key. Experimenting with this by starting small could lead to a useful discovery.

What do you think, Rachel? Any other ideas?

Rachel: Umm, I think you have an earn and burn problem if you’re able to build a balance of that many Ultimate Rewards! If you believe in cashing out, how do you set a threshold for when to do it? Is it like my checking account where once it reaches a certain threshold, I send the rest to Vanguard? Am I going to now feel like I should be saving my points for practical things and not splurging on luxury hotel rooms?

Essentially this makes it so our travel points are now our travel budgets and not just virtual currencies. We already budget $3,000-$5,000 per year to travel (everything including visits to family, out of town weddings, and international vacations). Being able to easily cash out will likely make me feel guilty upgrading to a better hotel when a mid-range one is good enough and helps me stick to the budget. While it “hurts” to spend more points for something nicer (like my upcoming trip to California when we’re staying at the Courtyard across the street from Disneyland instead of a Hyatt House that’s a 15 minutes walk with fewer amenities) it’s easy to justify because they are not tangible. If it only took a few clicks to send them to my bank account at 1.5x and suddenly go on a staycation instead–well probably not quite that dramatic–to alleviate my guilt.

That said, I grabbed the Schwab Platinum card several months ago with the idea of using it to cash out my Membership Rewards points to my checking account. But I’ve never actually done it!

Sam: This is a particularly great time with respect to earning Ultimate Rewards. Having a ‘spare’ 500k is certainly possible. Earning 500k in a single year (in two player mode) is doable. Chase is really crushing it lately on the earn side.

Robert, I *really* like your idea on a buy and refund. I wonder what Chase’s actual T&Cs are for such a situation? Surely readers have cancellations that have happened (legitimately or otherwise). Perhaps they can share their experiences in the comments section?

The only thing concrete I’ve seen on this is this post from TPG last year: https://thepointsguy.com/2017/05/cancel-ur-trip-refund/

Is TPG suggesting a way to cash out UR with 1.5 cent uplift? It certainly seems so.

Like my mile broker technique above readers should consider the risks of these actions, up to and including termination from Chase. I do think that buying a ticket and cancelling it (which we do for other reasons like extending miles) is fair game. There’s just no possible way that Chase can tell the difference between a one time cancellation of 200,000 points worth of refundable fares and trying to game the system

Make it habitual and I think you’d be playing with fire. But for someone like me considering cashing out for 1:1 the idea of being able to cash out 33% fewer UR and end up with the same net amount of dollars is enticing to me.

I see Rachel’s point about the slippery slope from cash out and travel to cash out and feel guilty to cash out and stay home. I also would echo her idea of setting a budget for the year, and go the extra step of including the 1:1 cost of points in that number.

I’ll argue that hoarding miles is no better than wholesale cashing out of any and all miles and never traveling. The balance, between maximum travel and minimum excess points is the place I think we should all strive to be at.

Robert: I don’t have an earn and burn problem! (says the pointsaholic)

I look at my stash of URs as a vacations savings account ready to fund all sorts of vacations at deep discounts. Unlike airline miles I don’t feel like I can have too many of them, so long as I can redeem with 1.5 cpp or better uplift.

I took a look at the Chase UR FAQ and found this:

If I canceled my refundable flight, when will I receive my credit?

If your ticket is fully refundable, in most cases, your credit will appear on your next monthly billing statement from the time you request the credit. If you don’t see the proper credit, call 1-855-234-2542 to speak to a Chase Travel Specialist who will be happy to assist you. Advisors specializing in flights are available 24 hours a day, 7 days a week, 365 days a year.

Like Sam rightfully advises, playing with an approach like this is risky business prone to shutdown. Especially at scale. Proceed with caution.

I wish Chase hadn’t put the lid on Disney redemptions. I really was eyeing a Disney Cruise as a redemption and I can’t do that any more. Between this and their new 48 month rule they’re pulling the rug out from beneath customers quite a bit lately. Good thing there are other banks out there giving Chase run for their money.

Hopefully readers can relate to the vacation savings account/”guilt free vacation” dilemma we described. And I think we surfaced up some interesting approaches for cashing out URs.

Our thanks to Rachel for being on Shop Talk!

We’d welcome feedback in the comments, via email, or on Twitter @milenomics.

Points always, always, always have a cash value.

I hope that’s a major takeaway from today’s post, regardless if you consider the risky business or not.

I love this website, it reminds of the old days when “Men were Men and point blogs were here to share.”

Have Buzz on sometime, once he retires from TBB. I would like to hear if he talks with a Greek accent.

Oh please. Lets have Milenomics continue churning out useful information like they have been and interviewing guests THAT CAN PROVIDE USEFUL INFO. There is no way TBB can do that w/o bringing this blog down into the doldrums of complaining and whining, like his own.

A side tangent — we just got back from Disneyland, and redeemed 140k Marriott points to stay 5 nights at the Residence Inn on Katella and Harbor. It was great! Breakfast included and my kids are older and the walk was no big deal. The Courtyard was definitely tempting for the water park and proximity. I was glad to have an upgrade to Disney view. I watched fireworks from my bed.

Having points to spend helps me choose better accommodations for my travel. If I converted my points to cash, I’d probably cheap out more often.

Kacie: I’ll have to check it out on our next Staycation. But that Water Park at the courtyard really does help!

The pool area does not face the park, so no fireworks there. It was great for our purposes, but my standards are probably lower than yours, so bear that in mind 😉

Refundable flights booked through the portal are refunded in points. This is from personal experience, where I intentionally booked a fully refundable economy ticket via the UR portal that would be eligible for an upgrade to business with airline points afterwards (El Al). My plans fell through, and I had to cancel about a month later.

Points, not cash, were returned in a few days – and yes: I had to call the UR call center to do it.

Morris: Thank you for this data point. It unfortunately sounds like the terms we outline are not being followed. Refunding in points doesn’t do much for us to try to cash out.

Also, smart play on booking the fully refundable ticket in the first place. Knowing you might need that flexibility saved you big time.