Those of you who have been with Milenomics from the start will remember that Milenoics strives to avoid annual fees whenever possible. Today I’m updating you with my personal experience getting annual Fee Waivers on my Citibank Visa Cards. I’ll continue to update all of my Annual fee waivers this year for you to see how the process works, and how it can absolutely save you money, earn you miles and let you keep your cards, or at least your credit line open.

The techniques used to do this are:

- 1) Calling and asking for an annual fee waiver.

- 2) Downgrading the card to something without an annual fee

- 3) Merging the credit line with another card we have.

I’m sure some of you will argue that the benefits of a card are worth the Annual Fee. However, the calls I outline below took me 6 minutes each and netted me $95 in annual fee waivers. With my T-Rate of $25/hr I spent $2.50 of my time to earn back the each annual fee.

Citibank Annual Fee Waivers

My yearly call to Citibank for a of my AA cards came due, and I thought I’d update readers with what my ultimate results were.

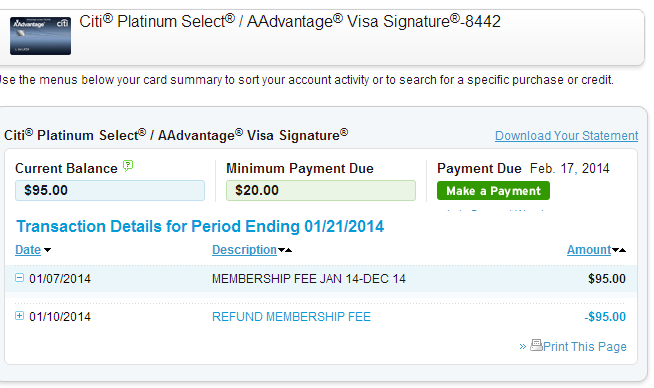

Card #1 Citi AAdvantage Platinum Visa: This card saw almost no use last year, under $500 in charges total. I called and the exchange went pretty much this way:

Me: “Hi, I noticed that the $95 annual fee was charged on my recent statement, and I really don’t use the card very much. I’d like to know if you could waive the fee somehow.”

Agent:“I’m sorry, but the fee is a valid charge, and covers many great benefits of having this card. Since the charge is valid I’m unable to remove it.”

Me: “Ok, I understand. If you can’t waive the fee I’d like to cancel the card then.”

Agent:“Am I to understand you wish to cancel the card because of the $95 annual fee?”

Me: “Yes, that’s right.”

Agent: “Please allow me to first transfer you to a specialist who may be able to offer you a fee waiver. If you do not wish to take any of those offers you may then cancel the card.”

(Transfer to Retentions officer)

Retentions:“I’d hate to see you go, and would like to offer you a waiver of the $95 on the spot, and an offer of 1,000 extra AA miles for each month you spend $1,000 or more on the card for the next 16 billing cycles.”

Me:“Oh wow, that’s so generous of you, I was going to cancel, but you’ve totally changed my mind. My faith in your company is restored!” (Ok, I’m punching that last one up for effect here on the blog).

The agent also did a review of my credit line and bumped it up $3,500 without a hard pull. I’ll take any extra credit I can get from Citi, as I’ll be applying for another Citi Card sometime this year, and could do a carve out of the unused credit line or close an account to open the new card.

Card #2 Citi AAdvantage Platinum Visa: I didn’t use this card at all last year. The annual fee hit, and I called in and spoke to a somewhat surly phone agent. She insisted that the annual fee could not be waived. I requested to cancel the card, and was then offered a fee waiver if I spent $3,000 on the card in the next 3 months. I pushed for a different offer, and asked about the 1,000/$1k offer. I was told I did not “qualify” for the offer.

Having doubles of this card I could have asked to merge the credit line, instead I asked to downgrade to a Bronze card, remove the annual fee and keep the card open. The agent downgraded me to the AA Bronze card. I won’t use the card ever, and keeping the credit line open will help me for my next round of applications, should I need to close a card to get an approval from Citi.

Was it possible to get a better offer than this? I think it might have been, but since I almost never use the card I felt the downgrade was a smart second option.

Citibank–11 Month Itch Friendly

The yearly dance with Citi continues. Citi and I go around and around and around. They claim there are wonderful benefits to their cards; I call and ask for a waiver of the fee or I’ll cancel. They then waive the fee.

Take note: There needs to be some truth to the cancellation threat. Some banks will walk you right to the edge, and really push you to cancel before you get a waiver. My experience is that Citi usually puts an offer up without too much struggle, but I’m always ready to cancel, downgrade or merge. My threats are not empty–and yours shouldn’t be either.

The two offers being pushed right now by Citi seem to be the two I received, either spend $X,000 in 90 days and receive a waiver, or receive the waiver on the spot and the 1,000 bonus miles for $1,000 in spending each month.

A third option is the downgrade to an AA Bronze card, a novelty card really, earning half a mile per dollar and with no other real benefits. Still, keeping the credit line alive can be important for our credit score, and for future CCC applications.

General Tips to Receive Annual Fee Waivers

What follows are my tips for receiving waivers of Annual Fees. Feel free to share your own tips in the comment section:

1. Be polite. No one enjoys talking to a grump on the phone, and you catch a lot more flies with honey than vinegar.

2. Be Direct. Don’t beat around the bush about how you wish the annual fee was lower, or you’re “thinking” of cancelling the card because of the Annual fee.

3. Be ready to cancel (or at least downgrade). There needs to be some truth to your threat.

4. Say what you want. If you want an offer that you know someone else got–bring it up. If you want bonus miles instead of an annual fee waiver say that instead. You can negotiate to some extent with Retentions agents, but they’re not mind readers.

5. Know a good offer when you receive one, and accept it.

Update: Twitter user Gil C offered another great tip:

@Milenomics helpful to know that the offers are preloaded, just keep asking “what else can you offer me” to make sure you take the best one

— Gil C (@gil949) January 24, 2014

For a really interesting read here’s a blog post from an ex Citi retentions agent. Retentions departments exist because it is almost always cheaper to keep a customer than to acquire a new one. Keeping you as a customer has value–and we’re trying to exploit that value to our advantage.

Keeping Benefits Without Paying Annual Fees

We’ve discussed card benefits before, and we should be using them to simulate Elite benefits, using the Milenomics BYOE approach to travel. A big part of BYOE is keeping the benefits of these cards without paying an annual fee. The best way to do that is to receive annual fee waiveres.

The next best way is to be strategic about when you apply for cards, especially when playing the CCC in 2 player mode. For cards that are difficult to receive a fee waiver you should alternate years you hold the card. Applying in alternate years between yourself and your spouse/partner and ensuring you hold just one at a time would be a good strategy to gain the benefits but avoid the fee.

Know when to hold them and know when to fold them: I’ve got a backup City AA Visa, as well as my Citi AA Amex and my wife’s matching card as well. Should I not get an annual fee waiver and be forced to close a single card (such as the Visa I downgraded today) I’ve still got 3 backups giving me the benefits of free checked bags, boarding, and 10% back in AA miles per year. Knowing when you absolutely need a waiver and when you can downgrade is important before your call to ask for a fee waiver. Today I knew I only really needed a waiver on one card, so I was able to downgrade the other.

This type of strategy might not even be necessary with Citi AA cards. Getting a fee waiver seems to be consistently easy with these cards. For 4 years I’ve never paid an annual fee. Twice now I received a bonus where I would earn 1,000 extra miles per month for 16 billing cycles. After completing this bonus I’ll have earned 32,000 bonus AA miles over the life of the cards just because I called and asked for my Annual fee to be waived.

What’s better? Paying $95 a year, for 3 years or paying $0 and earning 32,000 extra miles?

Wrap Up

At the end of the day Annual Fees add up. Milenomics might love credit cards, but it hates Annual Fees. When the 11 month itch comes around be smart, and save yourself hundreds of dollars a year.

Annual Fees take our money and give it to others. Let’s Keep our Money and earn as many miles as possible. That’s Milenomics.

Everything below this line is Automatically inserted into this post and not necessarily endorsed by Milenomics:

How do you deal with Chase Sapphire. I believe they are tough to waive annual fee and I consider that, one of the most useful cards in chase arsenal.

CSP is tough (maybe impossible) to waive AF. First, please read why I prefer the Chase Freedom over a CSP http://first2board.com/milenomics/chase-freedom-vs-chase-sapphire-preferred/.

How I deal with it: I apply for the CSP, and hold it until Dividend or Annual fee, and then call and downgrade it to a Chase freedom. Then I have my wife Apply for it, hold it for months, and do the same. Doing this has earned us multiple Chase freedoms with 5x UR categores (will have 4 total in a few months) and avoided the CSP Annual Fees.

I’m not a huge CSP fan–yes the UR transfer portion of CSP is good–but that comes with Ink Bold as well. Between CSP and Ink Bolds, 2 people can rotate between them over 4 years and not pay an annual fee. Is the $95 worth other CSP benefits like travel insurance and 2x on travel? for me it isn’t–but you might think so. Just make sure you really run the numbers to ensure the benefit is there for you and you’re not just paying $95 a year to earn less UR (than a CF) and the right to transfer those UR out.

Another post to read on the subject: http://first2board.com/milenomics/in-depth-look-at-chase-ur/

Darn I had the same thing about the $95 waiver and the 1000/month bonus for 16 cycles, and I put close to $9k spending on the card for the year! (Then again, it wasn’t my money, I was helping a friend make some purchases…) So I could’ve got it even without spending much… For the second card, why didn’t you just HUCA?

Joel: I was fine with downgrading–I probably should have HUCA, but I have plenty of other AF’s coming up, so I didn’t need this one since it is a double card. Your point is a good one, thanks for reminding us of it.

I’ve noticed that when my wife calls and asks for waivers she gets significantly weaker offers. I often have her hang up and then I call as her, and tend to somehow get better offers.

Are you calling in saying you are her, or having her call in and having her pass the call over to you? Just trying to get my strategy down for my wife (who hates hates hates to talk on the phone).

Bear: I call and just say I am her, answer the security questions and such. My voice is male sounding and they call me “Mr. Simon.” even when I’m calling about her account. It probably helps that her name isn’t very gender specific (like Sam, actually now that I think about it).

Thanks for this, will need to be making a lot of calls this year 🙂

Thanks for this post – I’m going to have to be making some of these calls over the next few months

Hey Sam, thanks for earlier.

My 11 month mark is coming up at the end of the month for the citi Plat visa. I thought I was going to cancel and reapply for the signup bonus later on, but reading this post makes me reconsider. What do you recommend? This is my only citi card, so I can’t transfer the CL out to another citi card or anything of the sort– it’s either cancel and lose the CL or keep and hopefully waive the AF.

Thanks,

JTP: The only time I don’t try for an annual fee waiver is when continuing to hold the card has negative value to me. An example of this would be the SPG Amex–the sooner I downgrade the sooner I can re-apply in the future. Also for me turning a CSP into a Chase Freedom is a better value than an annual fee waiver on the CSP.

For Citi AA cards the AF waiver is so easy to get there’s no harm in at least trying for one. You can even end up profiting from bonus miles as I did in the above $1k example. You can downgrade to a fee free Bronze card as well. My advice is that you should always hold onto a credit line whenever possible. Basically keeping cards gives you flexiblity, and also reduces your utilization percentage. If you then in the future get another card you can merge the two into a bigger line, for better spending, or keep both cards open, or close one to open a new one.

Applying for the signup bonus later won’t be affected by holding an open Citi AA card, Citi goes by your last application date, not when you last held the card. In addition you can alternate between Visa/MC/Amex versions of the AA cards as well.

What would you downgrade the SPG to? I just got the BC old.

I’d move the credit line over to that new BC and give yourself more credit line to play with. 🙂 You could also convert to a regular Amex blue as a place to keep your MR should you ever close a premium MR charge card I’m the future.

Thanks for your reply. You’re right, maybe I should try to leave it open.

I recall a change in these cards with not being able to hold more than one type (in this case, the AA card) of citi card, regardless of if it is Visa/MC/Amex, so I thought I had to cancel one to be eligible for another?

I believe you need to wait the full 12-18 months even when you change to a different version–you’re starting the clock over with each AA Approval.

That said, there are other Citi cards–so you might end up turning it into something other than an AA Card in the future. Please report back with your experience getting the AF waived! Thanks for the comments.

Thank you so much for your help.Your website is so insightful. I just finished getting the same retention offer that you received($95 statement credit, 1000 bonus miles for 16 months for $1000 spend). Keep up the good work!!

I call Citi and have the same conversation at 10 months, get the credit which posts right away, open a new Citi card and transfer most of the credit from the 10-month-old card to the new one, spend $95 to bring the balance up to zero, and then cancel via secure message. Miles and money!

Question: My annual fee of $395 is coming up in March for the Chase United Mileage Plus Club Card. Can I ask them to downgrade to a no annual fee card, such as the Chase Freedom card, even though I do not currently own that card? And how soon so should I call to request the annual fee waiver?

Sandra: The United Club card isn’t one I have personal experience with. I did look up what other people have gotten–and it seems like the best you could do is to receive a $100-$150 waiver against the Annual Fee. Other offers people have received have been 10k-15k in United Miles. Calling and pushing for a fee waiver might be worth it to you if you use the Clubs enough.

For your second question: I don’t believe they will do a United->Chase Freedom conversion. But if you do decide to downgrade the card, I’d ask them to try that first (can’t hurt to ask). I would be very interested in whether that works and you get the Freedom. For the most part the best you’ll be able to do is downgrade to a no fee United card which earns 1 mile per $2 (a card you should never use). You could keep the card history, and the credit line open with this downgrade, and use both for future Chase cards. Best of luck, and do keep me updated.

FYI. This is also doable well after the AF hits. I have been busy and didn’t get around to calling until 3 months after the fee hit. They gave me a $95 statement credit and same offer of 10000 bonus miles for 16 months with $1k spend .

what if i already did the fee waiver and 1000/$1k retention bonus last year? is citi likely to give me another waiver this january when my fee is due again?

Benjamin: As often as you make the request they should offer you something. I do it every year, on every card. Why pay an annual fee when you don’t have to? Citi, in my experience, has been the best at waiving the fee, and/or adding in some perks like the $1000 spend 1,000 mile bonus. But all card issuers will value your business to some extent. If you’re using a card a lot, they want to keep you and will offer you a fee waiver. If you use a card infrequently they want to keep you and get you to start using it. In fact the $1k spend w/ 1,000 bonus miles is more likely to appear if you don’t use your card than if you do!

have you ever tried the Citi Executive / AAdvantage World Elite MasterCard? It carries a killer 100k bonus miles offer from time to time 50k miles all other times but a $450 annual fee. I want the card perks but don’t want the fee. I am trying to find a loop hole to avoid paying it. Any ideas or assistance?

Chris: I have not. To the best of my knowledge most have only avoided the fee by cancelling before 30 days are up. Of course that then means you don’t gain use of the card for the next 11 months! The best bet I’d suggest is to wait and see what happens for everyone who applied in the last few months; as they approach their 1 year anniversary and threaten to cancel we’ll get a more clear picture of how far AA will go to keep you all.

Also bookmark this FT page: http://www.flyertalk.com/forum/credit-card-programs/1537455-citi-retention-offer-reports-all-cards.html And refer to it for offers others have been successful in receiving.

Just received an offer for 2,500 additional points for $2500/month for 16 months. No waiver of annual fee. They offered statement credits for other offers, but this one seemed like the best one for me. Thanks for the help!

So I am almost at 11th month – do you think it better to call and ask PRIOR to the annual charge, or to wait and ask to have it reversed? Timing can be everything right?

CCH: I used to always call before the fee hit. If I didn’t get a waiver I then would wait until after the Annual Fee is charged to cancel and be refunded. I do recommend calling and finding out how long after the fee is charged you can still cancel and be refunded, and I like to get that in writing via secure message.