We’ll start today with a question: I’d like to ask you to decide which path would you follow:

Maximum Miles for Real Spending?

or

Maximum Miles?

There’s a subtle, but big difference here. Maximum Miles for Real Spending is great–and I’m all for making sure you earn miles for day-to-day spending. There are people who aren’t comfortable with MMRs, or who don’t have a large cash reserve in case something goes wrong. In those cases, strive for Maximum Miles for Real Spending.

The fact is: Milenomics isn’t excatly about “real spending.” In fact if you’re looking at real spending as a vehicle to earn more miles you almost always can do better by first analyzing your spending and cutting costs wherever possible. The draw of using credit cards for miles can, and does, entice us to overspend. We’ve covered this before on Milenomics, when talking about your budget for travel.

Responsibility is Boring

Responsibility is Boring. I get that. Spending is often way sexier than Saving. But If we’re talking about your long term financial health, knowing when to say when (with spending) is incredibly important.

Chasing more and more miles because of where they can take you instead of where you will use them to go is a slippery slope.

It is for this reason that we need to know our limits, and respect them. We don’t want to earn Miles and points haphazardly, we want to know what our demand is, and use that demand as a target for our earning of miles. Once we have enough miles we switch to cash back cards.

I enjoy reading the posts from Matt over at Saverocity. I feel like his blog does the best at trying to make Responsible spending/saving as un-boring as possible. I’d like to dig up a post Matt wrote last month titled, “Flat Fees and Percentages.” If you haven’t already read this I highly suggest it. Near the end Matt argues you should know your percentage back/value of miles, and be negotiating against that amount using the phrase “How much for cash?”

Now I’m not insisting you go to every store and try to negotiate a 2-5% discount. I want you to just be conscious of when paying with a card actually costs you more. A simple, but effective example can be seen here:

Gas Station A: Cash or Credit

Gas Station B: Cash only

Now I know this isn’t going to be an example most of us can relate to–but I’m asking you to consider this “textbook” type example. In the above example assume everything is held constant, location, quality, service, everything except the cash/credit card issue.

10 Gallons of Gas at Station A: $35.11

10 Gallons of Gas at Station B: $34.11

If you subconsciously chose Gas Station A because you knew they take credit cards, then you just paid a $1.00 premium for this. That premium equates to 2.8%, or 2.8 cents per dollar. If Your gas Credit card earns 2 Miles per Dollar your cost per mile is 1.4 Cents. Looking at your cost tracking sheet, can you buy miles for less than this 1.4 CPM with MMRs? If you can you just experienced the over-payment with a credit card that Matt was describing in his post. Miles earned from your real spending can end up being your most expensive miles.

I would bet you subconsciously do this more often than you think, whether it is opting to use a credit card vs. buying a discounted gift cards (Great for Gas by the way, because they count as the “Cash” price), Paying for Gas with a CC vs. Cash, or staying away from a location, like a restaurant that is cash only–your subconscious mind is powerful at directing your purchases.

Your Subconscious is Costing You Money

Numerous studies have shown that our subconscious has very real effects on how we behave. A great interview with Jonah Berger in Scientific American showed how our Subconscious mind affects our real life decisions. Two examples given are:

- An unexplained increase in sales of Mars Candy bars after any new rover landing on the planet Mars.

- Voters being more likely to pass tax increases if they’re voting for those taxes at a polling place inside a school building. For more on this example Jonah Berger, Marc Meredith and S. Christian Wheeler published this paper on the subject.

The marketing departments of large companies have known that something as small as the color of a product packaging can be up to 85% of the reason people buy a product. The tobacco industry has done research into such subconscious purchases. For example, lighter color packages of cigarettes are viewed, subconsciously, to be more “healty.” Source: Bansal-Travers, O’Connor, Fix.

Along these same lines, you better believe Credit card companies focus on subconscious ways to get us to spend more. In fact Jon over at Wanderlusty mentioned this subconscious advertising in a post he just wrote titled “Finding Inspiration and Truth in Marketing Slogans.” I don’t take issue with his claim that this marketing slogan is inspirational, because it is. Nor do I have an issue with embracing the slogan; both creating connections and great experiences are why I love to travel Internationally.

My issue with the ad is that for the most part Citi doesn’t “sell” experiences.The subliminal message of the ad is: using your card to do “something” is a great way of increasing your joy. This is the exact type of subconscious marketing we’re talking about. Citibank want 1) to be the first card you think of, and use, and 2) to ensure you spend, spend, spend.The last thing the credit card companies want is us trading in our credit cards and moving back to cash.

For even more on this subject see the NYTimes Magazine article “Get Out of My Subconscious!”

Real Spending = Real Money

When we are too focused on our “real” spending, and how to maximize Miles earned from it we run the risk of overspending. I don’t have a good way to analyze this for you–but I know my own personal spending got out of hand 8 years ago when I first started really trying to earn more and more miles.

After I stopped looking at my real spending as a way of earning miles, and instead looked at it as a way of spending money things changed. It was at this time when I started to look at acquiring Miles as a business venture, and applied constraints like time and costs into the process. I was able to increase my mileage balances quickly, and for very little out of pocket costs by giving priority to the business of earning miles rather than my personal spending.

You could say Milenomics was born out of the need to stop spending real money and instead start earning as many miles as possible for as little as possible. Looking at real spending vs. “fake” spending has made me much more aware of my real spending, and has helped me try to eliminate bias in that real spending.

Opportunity Costs Are Very Real

Take the above example of a Gas station selling gas for two prices; a $.10 cash discount, and a credit card price. If you pay for the gas with cash you give up the Miles you’d earn with the credit card. If you pay with the credit card you give up the cash discount. Each purchase has an opportunity cost.

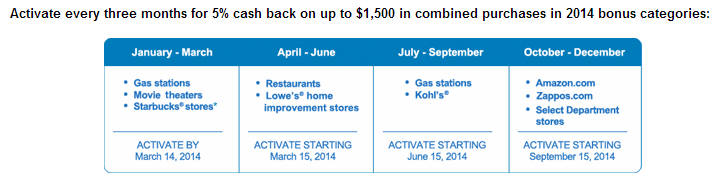

This is also a great example where your real spending gets in the way. Let’s use the current 5X Chase Freedom Gas Bonus. If you choose to pay with a credit card during this bonus period you’ve given up a $.10 discount to earn 5X UR points. At $3.51 a gallon that’s 17.6 UR per gallon vs. 10 Cents per gallon cash discount. Sounds easy–go with the Credit card, right?

But what if you had a gas station that sold you Reload or Gift Cards? You could earn the whole $1500 worth of your Chase freedom quarterly bonus, and pay for the gas with Cash. I’d argue that this is really the best way to handle the situation.

Option A (Real Spending):$1500 worth of gas = 427 Gallons @ $3.51 a gallon. A 10 cent premium for credit card = a total cost of $42.70.

Option B (Fake Spending): 3 x $500 cards at 5.95 each = $17.85.

These are the kinds of questions I’d like you to consider when you balance your real spending and your fake spending.

If you don’t have access to a gas station which sells cards then the example isn’t valid for you. Instead lets look at a different example:the Chase Sapphire Preferred. I love to beat up on this card–and I’ve done it many times, both here on Milenomics and on other blogs. For someone who has high real spending in travel this card is always pointed to as a keeper. Similarly someone who eats out a lot is usually pushed to keep this card as well.

What we’re missing in this discussion is the fact that no card exists in a vacuum. If it did then we’d be able to make the case that keeping it open was the best idea for all people with high travel and dining expenses.

When you strip this vacuum away and hold it up to the light of other cards you can see that the opportunity cost of keeping the CSP really does hurt you. I long ago wrote a comparison piece about the CSP vs. the Chase Freedom. This straight up, head to head comparison is great for driving page views–but it is terrible in the real world; We’re not limited to just one or two cards.

Real Spending Complicates the Discussion

For a moment lets assume our real spending is $0 and our ability to Churn is limitless. The opportunity cost of the CSP is easy to calculate when you remove real spending; If you can figure out a way to churn $1500 a quarter (per Freedom) in these categories:

You’ll end the year with 30,000 UR (33,000 with Chase Exclusives). Doing the same spend with your CSP would earn you 7,500. In this example the maximum opportunity cost of holding a CSP instead of a Freedom is 25,500 UR, (33,000-7500)

But What about my real spending?

Obviously the above example isn’t realistic. We have to put our real spending back into the equation for a complete picture. If we’re going to be realistic I’ll also throw another variable into the mix: The Fidelity Investor Rewards American Express Card. This is the same card Jason at Food, Wine, and Miles was considering as part of his overall strategy, and a card that I’m absolutely in love with.

Not enough is written about this card, and that is something I’d like to change. Today I’ll offer it as a replacement for the 2x UR points earned on Travel and Dining with the CSP. An effective combination would be:

1) Convert CSP to Chase Freedom, use for Churn in 5X categories.

2) Open and use Fidelity Amex for all non Freedom Bonus spending and non bonus Travel & Food.

Earning 2% (or more) cash back with the Fidelity Amex compares to the 2UR earned with the CSP in bonus categories, and crushes it for 1UR normal spending. Keeping the CSP open and using it for “real” spending also has the opportunity cost of the churn possible on the Freedom card each quarter.

Where all of this fits into your spending may be different. Your ability to use a Freedom for MMRs and churn will dictate your opportunity cost of the CSP vs. the Freedom.

This Doesn’t Have to Be True

I’m not saying to leave points on the table by sticking to just one card for all your “real” spending. A truly efficient strategy includes cards which have bonuses in the categories you spend in. What I’m asking you to do is to think about your spending pattern, and compare it to your MMR churns. If one is hurting the other analyze that opportunity cost, and see if you can do better. Our real spending should be dwarfed by our MMRs, and as such it really should take priority in which cards we hold.

Note: For some things the security of a CC purchase are worth even a large premium. When I want my purchase backed up not just by the store, but by my CC issuer, even a 10% cash discount might not entice me to put the plastic away.

nice — appreciate the tie-in! and i totally agree, i’m not all about that subliminal “spend spend spend!” subtext. but what i appreciate more is the thought you put into this post. (even though most of it is over my head as a non-points-person!)

Thanks Jon, I think that is why I appreciate your trip reports so much, they represent realistic travel and responsible levels of spending and comfort.

As for the thought put into it… I started with a very succinct idea and it really snowballed. This was going to be a short little post but, as the saying goes, “the best laid plans of mice and men often go awry.” :

I need to get a Freedom. I have a Sapphire but don’t have a Freedom yet. I’m toying with the idea of converting my Sapphire to a Freedom once the annual fee hits (in April) but I think I should probably get a Freedom before then (for the signup bonus). I am hoping another 20,000 bonus comes around soon…

PWAC: There’s nothing stopping you from doing both–Open the freedom and convert the CSP after the Dividend. There’s no real benefit to keeping it until AF, dividend hits in Feb/March. End result is you’ll have 2 Freedoms. 🙂

One thing you did not mention is that the CSP gives you the opportunity to transfer your UR points to airline and hotel partners. The Freedom does not. So you need to transfer points before closing the CSP, and then once you do that you cannot transfer any more UR points earned with the Freedom. So it becomes essentially a cash back card. My understanding from various blogs is that churning the CSP will not earn you the sign up bonus again.

Sam, really good post and thanks for the link to my blog! I think opportunity cost is very often forgotten or ignored in this hobby. I’m glad you are helping to change that. I’m also happy, I’m not the only one not “in love” with CSP card! It’s actually interesting that I wrote a somewhat similar post on it and published it on the same day as your CSP vs. Freedom write-up. That was before I even discovered your blog!

It seems, all the sites in this hobby advocate renewing CSP and paying the fee, even the ones geared toward low spenders. “Worth it and than some” is the slogan. Umm, I think not. Not if you constantly churn cards or are a low spender, though the CSP/Freedom combo might make sense for some. The card is clearly intended for a business traveler who also happens to be a high spender.

Great Post! I already have the Freedom and CSP card. I am planning on a slightly different strategy. I plan to downgrade CSP to the no annual fee Chase Sapphire. Chase Sapphire still gets 2x on dining and 1x on all other with no annual bonus. Whenever I don’t have a 5x dining bonus quarter I will use Chase Sapphire in its place for 2x. Slightly more optimal for my spend pattern. I know I could have 2 freedoms but I can’t max out $3000 in one quarter very often. I am better off this way in the long haul.

To further optimize I say everyone should add in a Discover card. They are also no annual fee and have rotating 5% cash back categories with the same $1500 per quarter cap as Freedom. You also have to register each quarter on the website. It just so happens that Jan-Mar 2014 is dining! I am using my Discover now for dining for cashback. You can redeem cashback in $50 increments with Discover. Maxing out the 5% equals $300 per year. Not bad for a free card!

Finally I would add in the Fidelity AMEX for non-bonus-category spend as well after all demand for miles are satisfied. That said I am probably going with the Barclay Arrival card which works out to be 2.2% cashback when redeemed for travel. If you always redeem Arrival points for travel then you would need to spend around $4050 per year on the card to “break even” on the annual fee. It earns 2x on all spend so it is a strong contender. Any spend beyond $4050 is “profit” beyond the annual fee. If you travel often enough and have cash travel expenses the Arrival can definitely work in place of a 2% cash back card. I personally would use the card to pay for award ticket taxes, hotels, and any other travel costs that would otherwise take money out of my pocket for this hobby. With a 2.2% Travel cashback this makes MMRs profitable every time.

Everyone’s situation is different. Infrequent travelers are likely better off with the free Fidelity card since the 2% can be used for anything. Heavy travelers like me could see greater benefit from cards like Barclay Arrival (and that doesn’t even consider the 40k bonus offer currently). I don’t have the Arrival card yet but it is on the top of my list for the next round of applications!

From the standpoint of a couple or family, I do not understand the allure of paying any fee at 12 months other than hotel cards such as IHG that clearly deliver more value than the fee, and one Ink account per household. I’m wiling to bet you can trade off Arrival cards with your partner and come out $459 ahead per year. CSP is a get-the-bonus-and-get-out card. SPG and all other AMEX cards with an annual fee (including BCP) should be cancelled ASAP so you can get another, and traded off between partners, business and personal. And AA Executive cards make for fun 45 day projects.

You also leave out the opportunity cost of using miles on an award which doesn’t earn miles. In other words, if you fly AA flight that would cost $900 roundtrip to Europe and earn 10,000 AA miles, but you use 20,000 miles. You saved $900 but it really cost you 30,000 miles (if that makes any sense).

ShoNuff: Good point. For me the last step in calculating out the value for a redemption is to take the miles which would have been earned and multiply them by my average CPM, and subtract this from the cash value of the ticket. It is important to do this to get a full picture of the value of an award booking. As you said, this is an opportunity cost, and one that people like to forget about sometimes.

Great analysis, as usual. Our situation is a little different – we need to generate points for two children (no way to get them to generate points for themselves, unfortunately) – and we regularly put $2k-$4k of travel and dining on the Sapphire a month. I have searched and have had no luck finding a gas station that will let me purchase a gift card, although given the general business/craziness of my life I haven’t had a lot of time to do so.

I have been recently thinking about opportunity cost, though in a different way. I decided to make the minimum spend on the 100k Citi cards by paying our taxes with them and paying the associated fees. By doing so, we can continue to use our regular spend (my husband has his own business) to help generate what has generally been roughly 30k to 35k UR points a month. So in a way we are paying a fee for somewhere between 60k to 70k UR points. I’ve been trying to track all of our cost per point for the various things we do. For sure we are traveling at a discount, not entirely for free.

I have a demand schedule (love that term) that goes through the end of 2015 and we are using every point we’re generating. We could use more – even with free one-way tricks, etc. we will still be paying some domestic airfares, as we need to save our points for more valuable hotel/international air redemptions. So I’m not even thinking about a cash-back card at this point.

Sfmom: I don’t recommend going much past 2 years on a demand schedule, and you’ve planned out the right amount of time on yours. Having a family of 4 is tough–as you said you have two earners and 4 burners (Dual-earn quad-burn!). That kind of earn ratio is hard to get around. Earning the miles you need will take precedence over Cashback and such. Sounds like you have a good handle on your demand and supply constraints. Thanks for the detailed comment, I hope it helps others with little ones 😉

More on earn-ratios: http://first2board.com/milenomics/earn-ratio-important-know/

Thanks! I know you are right about not planning too far ahead. I’ve actually kind of mentally planned everything out indefinitely, in a rough way. I realize you are right– everything will change beforehand — but It gives me some kind of peace of mind.

One thing I am trying out for next year is leveraging $100 companion passes for domestic travel – husband and I are both getting Alaska and US Air’s. Hoping to use those to significantly reduce our domestic air costs without burning our precious points. We’ll see if it works. I enjoy this blog and really like your point of view – keep up the good work!

SFmom: Companion passes; I forgot about those. Another Great tip to save! There is also the Delta Companion pass as part of the Platinum (or Reserve) American Express Skymiles card. Platinum’s $150 AF is going up to $195 and the $150 + $100 cost of the pass make it a tough sell for a money saver, but I wanted to add it here for completeness’ sake.

Being new at this – only churning CCs since Dec. 12 – most of my spend goes to making the minimums on our new cards. So the higher percentage categories are nice, but I only really take advantage of them if I’ve been lazy and delayed my quarterly app-o-ramas.

Now if I choose to boost my MSing, the picture changes. But I remain somewhat tentative and still wonder at those who buy thousands of dollars in VRs and prepaid cards a month. I guess I would just need to ramp up slowly so my CC companies – and I – get used to it!

I’m a big fan of Slow and steady… you know the old saying. The great part about matching your demand to your supply is that when demand is low you can test things out, and feel free to slowly ramp up. Moving too fast is dangerous and can be costly. Look at those stuck with dozens of Univison cards for an example of going too fast into the unknown. Now they’re looking at spending an additional $X.95 to buy a different card, or load the Univisons to some other product for additional fees. I have some gems in my back pocket for getting out of jams like that (ways to cash out a stubborn GC that won’t unloack with no fee, etc), but those came from years of cultivating not only the right product purchases–but also the right relationships with managers, and store clerks.

Nothing looks shadier than someone you’ve never seen before walking in and buying $3,500 worth of gift cards. It just isn’t “normal activity.” But if you’re the person who comes in every tuesday and thursday for a few months and buys $500-$1000, then coming in and buying $3,500 draws a lot less notice. I think you’re off to a great start. Now you just need to start enjoying the fruits of your labor 😉