Update (3/20): The Monthly fee of $5.95 has been reported to be charged as early as 7 days after activation. This is much sooner than prior reports (30 days). Be sure to drain within a day or two to avoid this fee if at all possible.

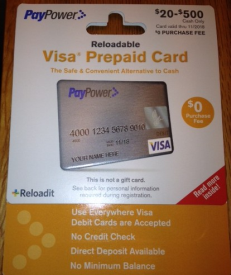

Update: On Saturday (2/1) I went to my local Safeway Brand Store (Vons) and saw the $0 fee versions of this card had been stocked. I successfully purchased one with a CC. The package is identical to the one emailed to me last week by a reader:

I’m changing this post from a Rumor to Confirmed–these cards are indeed going fee free. This is still a YMMV deal since the new packages have “Cash only” as well on them, but still this is good news.

Note: I usually limit Milenomics posts to those which I can verify myself. I’ve done some verification by calling the nice people at PayPower. That said, there’s not a 100% guarantee that these cards are going fee free nationwide, so for now I’m keeping this as a rumor.

We’ve been focusing on PayPower prepaid Visa Cards over the last week here on Milenomics due to a promotion where fees are waived at Safeway Brand stores until (at least) Wednesday 1/29/14 .

Reader DCbroker mentioned new packaging in his Safeway store which mentions a $0 fee. These look to be very new as the expiration date is 11/2018. My store still has cards with 1/2016 and 6/2016 expiration dates.

Milenomics reader Elaine was kind enough to email me the following photo of the $0 purchase fee PayPower card:

As DCBroker brought up, could this mean that the $0 fee Visa Cards are going to be around more than this week? Printing new packaging would only be done if the fee were to be waived for longer than the 1 week Safeway deal. This reminds me of the Green Dot Fee Waivers we saw in December 2012, the card itself was printed with a $0 fee.

I sure hope the fee free cards are going to be nationwide. I’ve had good luck buying these at my Safeway Branded (Vons) store this past week.

Some questions I’ve thought about past few days:

Why are there Fee Free Cards?

When will they roll out to XYZ location?

I’ve done some research and have theories on the matter I wanted to share with you. In addition we’ll discuss why this is important, and what to be on the lookout for.

More about PayPower Cards

PayPower cards are available in stores nationwide, you can check for them using this store locator. The card you buy at the store is a temporary card. A PIN Can be set on the temporary card, and can be used as you would use a Debit card with PIN, or a Visa Credit card in store. Once you register your name and information a permanent card is sent to you. This permanent card can be reloaded and reused over and over.

Using them as a reloadable card isn’t a good idea. They use +Reloadit cards for topping up. While the basic PayPower card is fee free to buy and use for PIN based transactions there are some significant fees to using a permanent PayPower Prepaid card (See back of package below). And Finally, I’m always leery of letting a large amount of my money be tied up on a prepaid card, always keeping in mind the float rule.

Fee Free? For How Long?

I spoke to Customer Service at PayPower, and I’m going to still call this a rumor at this point, but I believe these $0 fee cards will start rolling out around the country in the next few weeks. PayPower is trying to capitalize on the time of year–and make money not on the purchase fee, but on fees for holding a card ($5.95 a month) and other assorted fees:

PayPower is making a big push during Tax season. They want users to deposit their tax return onto a PayPower reloadable card, and then continue paying monthly fees and transaction fees along the way. Should any of us ever do this? No, of course not. We’re Milenomics, so we should be using these cards as best we can, for our purposes. If PayPower wants to waive fees while they try to get the unbanked into a high fee card, so be it.

In addition there seems to be an updated version of the +Reloadit reload packs rolling out in the next few months, which also seems to be tied to the push to get more users of these PayPower Cards.

Fragile–Handle With Care

I don’t usually discuss deals so openly–but this one was discovered by Milenomics readers. It is a niche deal for now, but I wanted to take some time to discuss it in more detail since the deal could go larger soon. Be on the lookout for stores which:

1. Display the $0 Fee PayPower cards.

2. Aren’t hard-coded at the register for cash only purchases.

Really that’s it– the only thing you’ll need besides 1 & 2 is a weak link in the armor–a cashier or manager who allows the purchase. With “Cash Only” printed on the front of the package you’ll need a friendly cashier to overlook that. If you find one, cultivate that relationship.

I usually start small–to test both the register, and the cashier. Showing up with 10 cards and asking to put $500 on each is a good way to burn your best purchase spots–by being too greedy, or looking too suspicious.

Total Cost & Don’t Forget to Close the Loop

Removing a Purchase fee should always be at the forefront of your MMR strategy. Some of the tricks I use for removing purchase fees wouldn’t last long if I wrote about them online; we could discuss them in person, and in confidence, but I won’t put them on Milenomics.com. For now, deals like this are a good way to avoid fees. Additionally, try to come up with creative ways to negate the purchase fee on your cards, such as when I discussed using Prepaid cards for online one-per-person deals.

When I’m on a Milenomics Mileage Run I’m always concerned with three variables: Time, Distance, and Fixed Cost (Fees). Removing the fees from a purchase makes the miles you earn MUCH less expensive. They’re not free–to be free you’d need a negative fixed cost to cover your variable costs like time and distance. If you only buy these when you’re already near a store, or as part of a pre-planned shopping trip you could discount your travel and your time.

Even with $0 purchase fee there’s still the matter of getting the cash off of these cards; or as I like to call it closing the loop. With these VISA debit cards adding a PIN gives you options to close the loop. On the low end these options incur fixed costs of between $0 and $.375 per card. Again doing this may involve time and travel–so all of that should factor into your Cost Tracking on a deal like this.

Keep Yourself (and this Post) Updated

This thread will be a debriefing of sorts for the Safeway Deal, as well as for future discussion of finding and buying $0 fee PayPower Cards. Please feel free to share your experiences, good or bad, in this post. Some of you haven’t been able to buy these–share that too, especially if you’ve seen the $0 fee cards in the wild near you.

I appreciate the feedback from the readers who brought this one to my attention, this $0 fee product is here to stay.

Everything below this line is Automatically inserted into this post and not necessarily endorsed by Milenomics:

Funny that you mention this, I just filed a BBB complaint against PayPower. I was told by a CSR that the only way you could close your account would be to spend down to zero or let the monthly fee wipe out your balance. I couldn’t get a split transaction to work to spend down to zero so I let the monthly fee wipe out my balance… and it took me to a negative balance.

MLH: That sounds terrible. Stories like yours (and worse!) are always something we should be cautious about. Best of luck with the BBB–I’ve found them to be useless, siding with the business whenever they respond at all.

When something goes wrong with these types of unbanked products the companies treat you like a criminal, spend down your cash with fees and/or hold onto your money for weeks/Months. Buyer Beware indeed!

Yeah, people always think the BBB is worth something until they have specific experience with them. They are totally and completely useless. The only time you see a negative rating accumulate against a company is when the company doesn’t respond. If the company responds at all, even just a he said she said response, the BBB will eventually clear your complaint and it will not show against the company ever again. Pointless.

Just set the PINs on the cards my husband and I bought successfully at a Safeway in Portland, OR. It is a brand new store which might explain why there were only the cards with new packaging. The same clerk rang up the first card along with some sale apples for my husband, and then another for me with the rest of the groceries. No problems, and no need to call a manager. Sales were rung up on different CC cards.

I was a little uneasy about if I could set a PIN without fully registering the card but it was quite easy, explained in the instructions which note the same phone number as what appears on the sticker on the card. I set a PIN but did not register fully.

I always sticker the cards once a PIN is set with the info: “$500, has PIN” and I put that little sticker on top of the place where my name would be imprinted on a real debit card, to cover what was there. I forget what it said but it was clearly not my name! I have never been asked to hand over a card for examination at WM but just in case, I like that the sticker covers up the fact that it is a generic rather than a personal debit card.

I think this has potential not unlike when Chase was selling GCs for no fees and no postage. With no CVS stores in my area, and no fee (like the VRs I might buy at a CVS if I had one!), this seems like a very nice MS deal.

All that remains is to do a WM run to load onto BB – but that will have to wait until I am near WM! Hopefully it will go as smoothly!

Elaine: Great tips as always. I too leave the stickers on–just to give the cards the look of legitimacy. I’ve done regular loads at a cashier, and also done split tender loads to drain 2 cards at once inside the WM Moneycenter–no issues. As long as I can keep these going I’ll be buying, this and a few other unadvertised MMRs have been a great start to 2014.

This Paypower card might be a good permanent card to use, if no-fee options ever run out. The fact that you can load this card using Reloadits, which have a 3.95 fee and are loadable up to $950, makes them look attractive. If you’re buying the Reloadits using a credit card that earns double points at grocery stores, then you would be earning points for about 0.2 cents per point.

I have seen the new packaging in one store, but none of the half dozen nearby stores have them – still using old stock.

SW tries to enforce the “cash only” rule with any reloadable cards, so it’s very YMMV situation depending on the cashier/manager you run into. Stores that sold me them a few days ago, now won’t, as new people are working.

Pretty sure If SW sees a hoard of PayPower buying, expect to soon see a system wide memo going out to remind everyone that they are “Cash Only”. I wouldn’t expect this to last long, so make hay while the sun shines…

Just an update on loading the PayPower cards onto my BB at WM: It went swimmingly. My small neighborhood WM has no do-it-yourself machines, so I have to go to the CS desk. The asst. manager knew just what to do even when it didn’t work the first time and he was happy to help me load five GCs – 3 to my BB and 2 to my husband’s. Some had been purchased at OM last week (when they had the deal on MC GCs); the rest were PayPower ones from Safeway.

I asked about the WMs with the self-service kiosks and the asst. manager suggested I avoid them, “They never work right and then your money is tied up and I know because I worked before at a huge Walmart!” “But do you mind,” I inquired? “I had 5 cards.” “Not at all!” he assured me.

Which is very, very good, because I just took on a big spend – not big by you “professional” MSers, but the biggest since I started at this 14 months ago. Here’s today’s card and miles/points/cashback haul:

AA 100,000 MC offer

Discover with $150 cashback

New Freedom with $200 cashback

US Bank Cash+ (no promo but I will use it for all charitable giving to get 5% back on that)

And then, at the last minute, just in case my luck would hold, I tossed in an app for a second US Air card… and that was approved too!

So if we spend $11,250 on credit cards in next 3 months, plus make any first purchase on the US card, and pay $450 in fees, we will get:

100,000 American Airlines miles

30,000 US Airways miles

$550 cash back (plus the cashback on $1,250 Discover/Chase Freedom spend)

I will net 130,000 miles and $100, plus some perks like American Airlines lounge access, free checked bags, a $99 US Airways companion ticket, and a few more bennies that come with the cards.

Not a bad day’s work! Thank, Sam, for posting about the PayPower card. I will be buying them quite a bit more as soon as the new cards arrive! Thanks again!

Elaine,

Great feedback. I’ve enjoyed using these at my WM as well–they work smoothly for me as well. It sounds like you have a great WM–nothing like some of the ones I hear about where anything over $200 draws red flags. Cultivate those relationships, you’ll need them with spending like that these next few months!

Tried to buy these at a Safeway in Sunnyvale, CA but got turned down, “cash only”. Tried 3 different clerks but none of them would let me use my credit card.

I repeated my experience at my Safeway on Saturday and it worked again. I had picked out the checker and the line I wanted at the checkout when they opened a new line and a helpful young staffer chirped “You’re next!” and took my cart to it without really asking me. The manager was bagging at the new line and the clerk was young, but he rang it through with no questions and no comments from anyone.

BTW, the display now had cards with both new and old packaging. I selected the new one, as it had worked fine both at checkout and WM on my first attempt.

This is just super – a great replacement for the VRs that I can’t buy with a CC in my state! Let’s hope it stays under the radar enough to not disappear!

Elaine,

I had an almost identical experience; my usual Cashier (who is a “supervisor”) was swamped, and a regular clerk opened and saw I just had the cards. This had me worried I’d be denied. He rang me up and then asked my usual Supervisor, who knows me well, for an override. The supervisor quickly gave him the override and I was on my way.

My store also has both fee and no fee versions–I’m unsure that the fee would be waived on the old package. There is also a Blue version of the package for a “Travel” card–Also no fee. As far as I can tell the blue and orange packages function the same.

Glad these are working for you, and can hopefully help others cut their Cost per mile down.

Yes, you are right – it also crossed my mind that the ones with a fee just might ring up that way, as the promo was last week.

I’ll be back at Safeway tomorrow to take advantage of a great deal on a fav wine of mine that ends tomorrow, and of course, another card or two.

After you buy these PayPower prepared visa cards, where to you use them? Can it be deposited somewhere like VR cards to BB?

I can confirm that the PayPower cards in old packaging with a $3.95 purchase fee are still going for $0 purchase fee at Safeway. I just picked one up tonight (2/3/14). Not sure if this will only last through the current weekly ad or if they are coded to be fee free for an extended period.

Aaron: Fantastic. Great data point. Thanks for sharing this. My Vons is getting low on $0 fee cards so it is good to know that the old package is pricing at $0 as well. I don’t recall the ad this week saying $0 fee, so this is indeed good news.

Can you please write a new post? Reading your headline for a great deal I can’t use (No Safeway) is driving me crazy!

See Safeway website for other chains it owns.

Do you have any other creative ways for cashing these out aside from BB? My local WM isn’t very friendly when it comes to cashing out GC’s :/

J: Have you tried Money Orders? Anywhere that sells MO with debit should work too. Money orders bring their own set of problems, but they are a valid way to unload debit cards. Grocery Stores, Drug Stores, even Gas Stations can sell MO.

There are also some other prepaid cards you might want to look into: Barns & Noble Campus Edition, or Amex for Target (I use neither because the fees are beyond what I’m looking to pay). With $0 purchase fee these options may work–but proceed with caution.

Today I could not buy money orders using this card. I tried USPS, Wellsfargo, Krogers, US Bank… –> got declined all. I have not tried walmart, since the money order machine in walmart store was out of order today. I could not get cash from ATM, too. I do not have BB. So, please let me know where I can buy MO or how I can cash out the cards. Thank you so much!

Do you have a REDbird or Amex for Target?

Li,

Make sure that paypower hadn’t charged you their bogus monthly fee. If they have it would explain why your MO purchases have failed as the card will now have less money on it that you’re trying to spend. Let me know.

Ken, I do not have BB, or Amex, or REDbird, so I think that I have to buy MOs to cash out money 🙁

Milenomics, thank you for your response. I have 3 x $500 cards. When I called them, the balance was $500 each. I even tried to buy a MO of $490, but still got declined. I got the PIN over the automated phone. Do you think I need to give MetaBank (the company provide this PayPower card) my SSN in order to buy MOs? Do you know anyone who got the PIN over the phone but was still be able to buy money order successfully? I now get stuck with 3x$500 cards 🙁

Thanks.

Li, I unfortunately haven’t bought a Paypower in months, so I cannot say whether MetaBank has changed their terms and is now requiring SSN for PIN based transactions. Historically they have not required a full registration for such use.

You could try to speak with someone from Paypower and ask why your PIN based transactions aren’t working. You could also try giving your SSN for just one card–if that does in fact work you could then decide whether to give your SSN again for the other two cards. If you do register with your SSN you should also have access to Paypower’s online bill payment, and you might be able to send payments with the cards from there.

Best of luck Li, I know the unease which comes from having cards you cannot get rid of.

Thank you, Milenomics.

Actually I could buy things at grocery store using this card and the PIN, but I could not get cash back.

Today, they have already charged me $5.95 each card, so I may have 3 more weeks to cash out the 3 x $500 cards, to avoid another 3 x $5.95 for next month charge, right?

Li, so we know the PIN is set right since it worked for groceries. I re-read your original question and can add some detail: Don’t try using these cards at banks–they code their transactions as cash advances and paypower is blocking such transactions. The Post office is the same, they code their MO purchases in a way that they can be blocked. I’d suggest Wal-Mart for MO, but that also might not be convenient for you.

Yes, since you’ve paid the $5.95 you now have the month before being charged again.

Edit to add: as always, ES’s advice is spot on, take what she says into consideration as well.

Meijer sells their GCs at 3% discount if you buy $5k worth. You then use those in store to buy BB cards. then goto BB and buy BB VGCs with 3% fee. So now you break even. Then add on your CC rewards and portal (AA portal gives 1 mile/$ at meijer)

Anon: Thanks for the comment. I’m not in the meijer footprint, but that does sound like a lot of back and forth. I don’t know if possible, but if you could buy no fee Paypowers with Meijer GCs you could skip the Best Buy step and go directly to BB @ 3% savings.

I found the cards are two places yesterday in KS. Both were willing to let me buy with CC but both packages were labeled at $3.95 and I couldn’t get either to waive that fee.. I am jealous.

Thanks for the feedback Trudy. Keep an eye out for the new packages, They were spotted first in the Portland area, came down here to Southern CA about a week later, and may be spreading slowly across the country. The good news is you have somewhere you can buy with CC already lined up…imagine having the $0 fee cards and being cash only, that would be a horrible tease.

Meier will only do cash, no CC

Subscribe

To avoid all of the add on fees with the Pay Power cards i assume the best thing to do is unload them quickly and then toss them. I got a pin for it without completing any registration. Free short term use after buying with my bonus paying cc for groceries. 🙂

Matt: You’re correct. The best way to avoid the fees (which hit 30 days after purchase) is to register the PIN and drain them as soon as possible.

How do you rinse and repeat with this card. After you drain it within 30 days and get rid of it to avoid fees, you can just but another one? ( don’t they check I’d?)

P.L.: There are two ways to use this card. The first (and most common) is to only register a PIN on the card. Doing this allows you to spend the amount you’ve loaded on the card. Once the card is drained you’re done with that plastic, and can move onto others. At best all they would have would be your phone number, as the call to set the PIN is fully automated.

The second way to use the card is to register–give your SSN and activate the reload and online bill pay features of the card. I’ve done 3 of them that way, but all were set up prior to the new 7 day fee structure. I also stopped prior to the 30 days to avoid the fee. Using them as re-loadable cards is far riskier–you could be shut down and your money kept hostage for a while.

Trying to link paypower debit card with my bluebird account. I have activated paypower card via phone and addd 4 digit pin. Bluebird doesn’t want to add debit card as “billing address doe not match”. Any advice?

Jon, Adding these Debit Card Gift Cards to Bluebird for online transfers won’t work. If you want to load from Paypower->BB you’ll have to set foot into a Wal-Mart.

Has anyone tried buying these at Home Depot? That’s the only place that has them in Denver according to the Store Locator page for the Paypower cards.

Not I, but would be interesting to know if they’re available there and can be bought with credit.

Me too! Especially when that Home Improvement bonus comes around! Thanks for the tip; I never thought to look at HD because they are so plentiful at my Safeway! I will see how it works next time I pass a HD and report back.

No cards at my Safeways yet, but I’ve tried in the past and they were all cash only for all vGCs.

Ken, I just bought one today at SW in Denver with a CC. No problem. After reading all of the fees associated with them using them long term I was searching for a way to set the PIN, unload and toss this. That’s how I came across this post. I also came across some info on creditcardforum.com that people using these and reloading are having issues with accounts on hold. I was originally looking to these to unload some Amex GCs. I had heard that dcBroker had done this. Anyone know how to liquidate the AGCs?

Maria: you’ll have 30 days or so before you’re hit with a monthly fee, so register and toss or use for a while before the fee hits.

The way DC broker was unloading his Amex gcs was by buying these with his Amex cards. There’s no way to load an Amex directly to these cards. You’ll need a Cashier who allows purchase with credit and doesn’t check your ID (unless you have embossed named Amex gift cards)

@Maria – Which store did you try? I tried a store in Aurora recently and they didn’t have any of the PayPower cards to even try.

Keep trying. I saw them at 2 stores in Aurora, but only bought at one. Picked a young guy cashier.

Yes, I just set the PIN via the phone number. The website wants too much info. It’s all set. I walked into SW trying to use the AGC to purchase and the register wouldn’t allow it, even though it came up on the screen as an option. The cashier asked if I had another card. Since credit/debit was an option I tried my MC and it worked.

Last week I tried unsuccessfully to purchase at one Safeway. Much better luck tonight with purchasing (2) PayPower card fee free! Thanks for the tip on this. I wouldn’t have thought to try without this post.

Trevor: good stuff, glad you were able to find someone willing to sell to you. The post might have given you the tip, but your trial and error is what really paid off.

Home Depot only one in my (Dallas) area to sell PayPower ($3.95) and PayPal cards but cash only. Same for green Dot cards.

Breaking news – at least to me!

My typical strategy with this form of MS is to buy Paypower cards when I am at Safeway anyway, and then load them on to BB when I pass WM. I have done this with many cards to date with no problems. Today I had trouble, finally determining that the card I thought had $500 on it actually had $494.05.

A call to Customer Service – they came on the line quite quickly – informed me that the $5.95 fee is charged at 9 days. Indeed, the card was purchased on 3/9 and the fee was pulled from the card on 3/16. Not sure how they count to 9 because the fee appears to have hit on the 8th day, counting the date of purchase as day 1.

I had thought that the monthly charge only hit after a month; that is, that we had a full month to spend down the card before the $5.95 monthly maintenance charge would automatically be subtracted from the card balance. Not so! The CSR said that for the last 3 months, they have been charging at 9 days. It seems to me that I did not always get to WM within 8-9 days of all my previous purchases, but I don’t know for sure and perhaps I did.

Another anomaly is that the card was the only one I got at a different Safeway than my usual, local store. Not sure how that might factor in but it is an odd coincidence.

So, if you are not going from Safeway to WM directly, pay attention to the calendar. And since Paypower can’t seem to count to 9, or perhaps the CSR gave me the wrong info, my plan going forward it to be sure to load BB within a week of all Paypower purchases.

I’d read elsewhere about the monthly showing up at the 7 day mark. I’ve made sure that I unload them within a couple of days. I suspect this may how they’re making up for the 0 fees up front.

Elaine: thanks for the feedback. This is unfortunate news indeed. Seems like some have been successful in arguing for the fee to be refunded. Milenomic Maria has also done some research and it sounds like 7 days is the new point where they’re charging the monthly fee.

Either way I’ll update the post, holding these for more than a few days sounds like it has gotten riskier. I’m sure this is in direct response to the number of Cards being Pin’d and drained right away.

Sadly, my local Safeway has started to shut me down on these, so I haven’t bought one since last week. It was great while it lasted for me. Enjoy it while you still can.

I was able to buy one just yesterday. They may not be refilling the stock, though, because each time I buy them it seems that there are fewer and fewer on the rack. I will cross my fingers for continued success tomorrow.

It is definitely a store by store decision. I might have burned my store by buying too many during the last few weeks. A vons farther from me is still ok to sell to me, but the distance makes it not nearly as convenient. I’ll be sad to see these go when they finally stop being fee free, but all good things must come to an end…

Yes, I’ve started getting “you again” glances and comments. So I just say “I will use them to pay my tax bill” and the cashier and manager who must approve all charges over $500 nod at me and process it. I do have quite a few Safeways that are close enough, though, and the two I have tried allow it. So I guess time will tell how long I can make it work.

The registers at SW down in Eugene seem to be hard coded for manager override. Granted, I’ve only tried to buy them for the full 500 at two locations. I was able to snag one because the manager overrode before she realized what I was buying and told me cash only next time. That location happened to be completely out of the Spanish version. Coincidence? I have one more location to try and might try some smaller amounts to hopefully avoid the override.

Apparently these are available at Albertson’s as well, so I’m going to try my luck there. They just announced a merger with SW, but hopefully they’re not sharing memos yet.

I have had some success with another no fee card, but I’m not sure I want to let the cat out of the bag until I hit my minimum spend. Anyone want to share experiences with RCL?

e36: A strategy you might want to start to employ is buying for under $500. Doing so will not need an override swipe. $492.11 is nearly as good as $500, and infinately better than $0! 😉

Keep us informed what you find at Albertsons, and welcome to Milenomics.

What’s your reasoning behind that amount? Why not $499? Or $495? Cashiers look at me funny when I don’t do a round number.

Ken, My cashiers have gotten to know my quirky numbers, and are always trying to guess the cents I’m going to add at the end. Not sure it will make much of a difference but try giving the amount as, “497 dollars ….and 22 cents.” Build in some suspsense for the pennies.

Personally, I do the odd numbers for two reasons: #1: encoding. Paypower #1 would be $492.01, PP02 would be $492.02, etc. Allows me to track easier if cards get shuffled around. I’ve also started to keep the pennies on the card–allowing me to see when the monthly fee hits (now seems to be down to 7 days).

Reason #2: I also have a few friends who’s Chase accounts were shut down for “round number purchases” (Chase’s explination when pressed) so I am a bit sensitive towards $X.00 purchase amounts. No fee is great, except if all the large round number purchases cause an issue down the line.

Good point, makes perfect sense. On my Executive card they kept flagging for fraud when trying to get a $505.95 vGC from Krogers and the second I threw in a can of $0.69 beans it went through no problem. I’ll also probably start throwing in a pencil or some other cheap filler for office stores.

I always buy them at $500 but never without tossing in a banana or some other small item. Or I just do a regular shopping for items I need and then the $500 card as well.

I need to think about what e36 meant with RCL – clearly he didn’t mean my husband’s initials but that is all that comes to mind for me! And then I am totally blocked for other meanings!

RCL is also Royal Caribbean Cruise Line 😉

Think Quicker…and more lively. 😉

Haha, great hint, Milenomics!

I went to a new WM for some MOs today and the guy asked me where I get all the cards. He said dozens of people come in to buy MOs with them.

Not a single PP or any non-gift cards at Albertsons or the 3rd SW in town. However, I went back to my original SW and the supervisor working rang the PP up with credit, no questions asked, for $240.01. I’ll go back and try something in the $400 range soon.

You could buy MOs with this card at Walmart, right? Did you have to provide SSN to set the PIN, or just called the automated phone system? I now got stuck with 3 x $500 cards, and I do not know how to cash them out!

Elaine, send me an email to e36bmw4dr (at) gmail (dot) com. I’d love to swap tips with a fellow Oregonian.

Done.

Still working on Milenomics hint…

Me too. Had a dream on a cruise ship last night hahaha.

Ditto for the registers in PDX at the two SWs I have tried. But the manager just comes and waves a card and the sale goes through. I often buy two cards in two separate transactions using different CCs and they don’t mind that either. But from all the stories I am starting to think my luck may not hold out much longer. Maybe it is just as well that I did not go for a second AA CITI 100,000 bonus points card. I held off because we are doing a refi right now. Without this easy MS, I would have had a harder time making the spend!

Now I want to determine which cards I now have that are best to use with no spends to complete. Sadly none are 5% on groceries right now!

Was party successful in CO tonight. Cashier rung up and I swiped and signed, then a miserable cashier in the lane over ran over and said these were cash only even though the register took it. She said the vendor (paypower) would take back the money that I spent and I’d be out that money. So they checked with a manager who said, “These used to be cash only but now you can pay with debit or credit”. The miserable cashier said she was chewed out earlier by a different manager who said they were cash only. So it looks like this is dieing very quickly.

BTW, what a royal PITA to call and set the PIN on these. It takes forever compared to the minute long call for vGCs.

Ken: a tip for setting the pin: when you call as soon as the recorded message starts press a few keys and then hit #. The recording will tell you that your card number is invalid, and ask you to enter it again. Entering the full card number followed by # will skip you ahead of the long message and allow you to set a pin rather quickly. Give it a try.

Will do, thanks.

@Ken I’m having no issues at all. I just got another one tonight and plan on getting a few more over the next couple of days to liquidate my Amex GCs. I’ve always gone at night. Are you calling the number on the sticker for the PIN? It’s not that bad once you get past the Spanish options.

I did the store in Brighton. The numbers on the sticker and the back are the same. Yes, once you’re past the Spanish options you can enter the full number. We have spend to meet on the Executive, Arrival, SW, and AA cards. We’re up by Brighton so probably far from you.

Yeah, I’m way down south. I did one with Barclays and two with Amex GC. Bought the GCs for 2% cash back and buying the PPV with them, so I’m making money on these.I think it’s more encouraging that they told you they used to be cash but are now accepting other forms of payment.

One manager says that they were once cash, and the other earlier manager says cash only. And the fact that they say cash only on the packaging isn’t helping either. I just don’t see it lasting too long. I think Citi codes Amex GCs as cash advances so that’s out for me at least for the Executive card.

I hand it to the cashier upside down since they have to pull the tab off anyway.

That’s smart!

I ripped off the panel and handed it over barcode side up. She grabbed the gun, scanned it, and entered numbers on the register. It was then that the other miserable cashier ran over from her register (while checking someone else out) and flipped it over. So if you hand it over barcode side up there’s a good chance they’ll never check the reverse.

Ken, which Safeway in the front range was this? They shut me down at the N. Boulder one (south Boulder doesn’t have them).

whoops…*now* the full responses open up. Brighton I see. I’m going to test Longmont today and see if they’ve shut it down there as well.

Be sure to post back. Longmont or Boulder is too far of a trek for me, but any data is good data. Maria is south of me and has had success as well, just not sure when I’ll be down that way either. The Denver metro is HUGE.

Gabriel, which S Bldr–foothills or 28th? Haven’t tried either…

Was @ NBldr SW Monday, talked to a mgr to find out what was definitely allowed w CC (only GC), but after I explained that I was doing it for miles she was nice enough to point out that there was a Catalina deal for $15 off coupon if I bought >$250 on a vGC! I hit it hard til it expired the next day, but note that the deal wasn’t public anywhere in flyers, just a paper taped up near the cuts svc desk. Pays to be nice!

Everywhere in Boulder is dead. South 28th doesn’t have them and Foothils is cash only. I have had success in North Longmont on Hover in the past week, however.

Still working for me – bought 2 today, in separate transactions, using 2 different CCs.

Went to a Safeway in the mountains after snowboarding and the cashier called the manager about it saying cash only. Manager said as long as my ID matched the CC I’d be good to go. Then my Executive card wouldn’t go through and I had to sit there on the phone going through all the fraud prompts.

Went to 2 other stores on the way home just south of I70 in Denver by Highlands and both of them refused due to the cash only language on the front of the pack. So I’ve been about 3 out of 8 so far in actually getting these cards.

I’ve tried 5 different stores around Denver now for testing purposes. Have had no issues buying at all of them. 2 checked ID either because of dollar amount ($495) or as they said just to verify name. Also tried buying 2 in one transaction.

Man, we’ve just had completely different luck in close stores. So yesterday we went to the store in Brighton, 144th, 128th/Midway, 104th, and 92nd all in Thornton or Westminster. Seems like it all depends on if the cashier reads the package and is a stickler or not. Luck of the draw I suppose.

Yesterday both my wife and my PayPower cards would not load to BB at WM either through a cashier or the kiosk. Balance was still correct. Today tried again and they were again declined, reason “debit not allowed”. Uh oh… So we tried a $495 amount to load to BB when there was $497.xx on the card and it worked. The cards that were already declined didn’t work, but 1 of them was declined yesterday and worked today so PP may be putting a temp hold on $1 or something similar once you activate the card. Pretty sheisty if you ask me.

@Ken Odd amount. How long did you have them? I just loaded a couple at WM yesterday. No issues.

Yeah i didn’t want any trouble with Citi or Chase since Citi has already told me they lookout for even transactions like $500 or $505.95 when I last called in for a fraud alert.

It’s weird that we were able to load an amount less than the loaded amount today (but not the exact amount) when 2 days ago we loaded 4 cards (2 each) to BB with exact amounts at the kiosk with no problem.

Hmmmm… I always get an odd amount though. I guess trying to be more obscure. I did have an issue loading at WM a couple of days ago. Turned out that I was at my $1000/day max. The night before I loaded a couple of VRs onto my BB. The new day starts at 12:00 EST (10:00 MST) and it didn’t occur to me the next day was still considered the same day. in fact, I was at my 5K/mo max and just got a MO instead. This hobby is addictive.

I thought that at first, but it was well before 8pm last night so today should’ve been a totally new day, plus it let us load a slightly lower amount today. Just weird all around.

Maria: how can you get MOs with this Pay Power card? I tried many places: Krogers, US bank, Wells fargo (which accept debit), and got declined all. CVS, Kmart, Safeway only accept cash for MOs.

Tempted to do a test, but I’m maxed on BB until 4/1. Time for my husband to get one. Did you check your balance with PPV? It’s got to be either a fee they imposed, you are at your BB max, or cashier error.

Yup, called last night (can’t get balance online) and the balance was correct. We were using the kiosk yesterday and the kiosk and cashier 2 days ago. When the first card wouldn’t load yesterday to my BB I tried the 2nd card but did an amount $1.04 less than the card balance which worked. Tried card #1 for a lower load and it was still declined. I suspect using card #1 today with a slightly less load amount today would work. But, we live in Reunion by the airport so it takes 20-30mins to get anywhere for us.

Ken,

Why would a card #1 with lower load amt, which did not work on Sunday, work the following day?

It sounds like no fee was imposed…. or was one?

Thanks,

Elaine

I have no idea, your guess is as good as mine. I thought there was a fee but when I called the amount was the same as when I originally bought the card for the one that didn’t work and the remaining balance on card #2 was exactly as it should be given the original amount. And also why would it work only a day later when most holds are for several days? I’ll try to load the remaining low $1.xx balance soon though. We had no trouble loading a set of cards last week for $500 each or another set of $496.xx each Saturday either so I don’t know what’s going on. I am a few bucks short of $5k for my BB this month but my wife still has $1,215 left for March on her BB.

Just another data point here – I was able to load 2 $500 PP cards at WM yesterday (Sunday) with no trouble; one to my BB and the other to my husband’s. They were purchased a few days before.

OK, thanks. Bizarre! But I guess these glitches are part of the game, although when a card doesn’t load properly the first time I do get anxious. Good luck.

Anxious is an understatement! We were standing at the kiosk with roughly $2k in PP cards with the “oh crap” look on our faces.

Bought a half hour ago and loaded a card just now at WM to test myself. Worked without any issues. Really odd Ken, keep me informed what it might end up having been. You could see more detail if you register the card to your SSN and log in online, but that might not be something you’re comfortable doing.

I’d like to avoid registering with my SS#, and the website is useless without registering. A regular Visa GC is so much better on that front. I really have no idea. I’ll try an even amount card to see if that works, maybe it was something funky with the odd amount we used.

The only PayPower cards in Dallas, Texas are at Home Depot and are cash only to buy them. Any other ideas?

Vons/Tom Thumb should also have them.

Is this nationwide? I’m in Minnesota, and haven’t seen a fee-free PP yet.

Yes, keep looking 🙂

Thanks. There are plenty of Tom Thumb stores here in Dallas but none near me or on routes where we usually go but I’ll look for them. The problem is that all the cards say cash or debit card only. Can you talk a cashier into letting you use a credit card? I see that Albertsons’ parent company is trying to buy the Safeway system but Kroger is also interested.

Luck of the draw really. If a cashier refuses to accept a CC not much you can do when it says cash only right on the card itself. I apologize and leave in those cases.

I don’t even ask. At “my” Safeway in OR the cashier asks me how much, I say $500, she rings it up along with a bunch of other items or something I toss in to make the total sale an odd number (and not $500 exactly), I swipe my card, the cashier calls over a manager because it is a sale above $500, the manager waves his/her authorization ID over the scanner, I sign and we are done.

@Elaine: Why not just load an odd amount to avoid the manager override and having to buy additional stuff?

I lost my pack code in the washer and have not all the numbers very bad luck what to do any option to havey code back?

1) I do most of my shopping there anyway and always can pickup something. Usually I get the PP cards when I am there to buy groceries anyway. If I buy 2 cards, I split the grocery order into two separate transactions to pay.

2) The managers never even look at what I am buying (although they’ve seen me buy the cards enough times). Often they just toss their ID over to the cashier who swipes it.

3) I like $500 because it is easy to remember – every PP card I buy is the same amt. And I get the max points/miles I can each time.

4) My WM has no kiosks so I always have to deal with a clerk there. I come in with perhaps 4 PPs and maybe some GCs to load 2 BBs. Knowing all PPs have the same amt and pin makes it easier to do the transactions.

@Elaine: Definitely makes sense if you do all your shopping there. Our closest Safeway is 30min+ away and the King Soopers is 10mins away so we go there. If we had a closer Safeway we’d just pickup the PP cards regularly along with some odds and ends we need anyways.

My Walmart in San Jose shut down funding via gift card all together. Need to find another place.

Brandon, maybe start looking for prepaid cards which are reloadable. The reason I bring these up is that most will send you a permanent card with your name embossed on it. There is no difference between these and a true debit card to a picky Cashier. The negative of these cards are that they can carry fees and also can shut you down and make you wait for your money… Buyer beware, but something to consider.

Brandon, no they didn’t. I redeemed Gift cards at at Walmart in San Jose earlier this week. No issues. I’ve certainly had problems with certain cashiers. Try another cashier or leave and try another day. The cashiers may even tell you there is a store policy or whatever. Doesn’t matter. Try again. Most of them will do the job. Or go over to the Money Center and do it there.

Went to a different WM tonight and loaded the remaining small balances on the PP cards that wouldn’t load the full amount. Also loaded $495 of a $497.xx card tonight and then loaded the remainder right after the first time. This was a different store too so maybe that’s why it worked this time.

Had trouble at WM unloading one of three PP cards yesterday. Although I had registered the PIN properly on all three, when I called on the problem card the system responded as though I had not set a PIN. Thinking back, what I thought was exclusively a PP problem was part PP and part having reached the daily limit on BB.

But remembering Ken’s problem, and being told by the PP phone rep that one can’t use a PP card to load BB, at the time I thought that 1) PP was changing the rules (as they did when they changed the timing for deducting the monthly fee); or 2) I had a bum card; or 3) the ability to load BB at WM with PP was changing. So I decided to just try to drain the card ASAP elsewhere.

That ultimately brought me to Safeway to try to buy some GCs that would get extra fuel points, where I stumbled on a repeat of the Safeway MC promo of a few months ago: spend $100 in MC giftcards and get $10 off your next grocery purchase. Also spotted a card I’d never seen: a variable load, no fee Starbucks. I could combine MC GCs and that Starbucks card to drain the PP. Safeway also allows split sales so I could scan the PP card, drain it, and then supplement with a CC of my choice. Good to know that!

So while I wasted a lot of time, stayed too long at WM trying to make it work, and had to register the PP card (which I never do), in the end I’ll make $4.05 in Safeway credits towards my next grocery purchase, and save $1 a gallon when I fill up later today. I also learned about the MC promo, which I’ll take advantage of again. It goes into April but I sadly don’t recall the exact date it ends.

I also learned some valuable MS lessons, the main one being that if one does this more than a few PP cards a month spread over two BB accounts, best to get to WM knowing exactly how close you are to your daily/monthly limits. And if you whip out an ST or Alaska debit card when a PP card does not scan right, remember you did that before you try again to load the fixed PP!

I must say I was reminded of an epic Marathon Man rant, I think in a comment at Saverocity, documenting all the things that can go wrong at WM and how newbies can as a result get in trouble holding lots of GCs or prepaids, or ultimately be responsible for a store or cashier or prepaid card company shutting down a method of MSing. Since my WM has no kiosks, the WM clerks were well aware of my troubles, but their take, like mine, was that it was a PP problem. They were sympathetic and helpful. But I think I’ll stay away from that store for a bit.

In Dallas, Texas, PayPower cards are cash only.

Went to a SF that had a ton of the cards in two spots and today they’re all gone. None in either spot. Crossing my fingers that there are more at other stores still.

That should be SW, Safeway and not SF. Have a trip to San Francisco this summer so it’s been on my mind.

Business as musual for me. Just got back from the store.

Yes, there are now some zero fee PayPower cards in Tom Thumb (Safeway) stores here in Dallas, Texas but cash only.

Up thread in these comments I wrote of a problem the result of which I had to register a PP card to get access to the $500 balance. Permanent card is on the way. Does this mean if I just leave it at a zero balance that they can somehow charge me fees? FT seems to indicate the answer could be yes. But how? If I don’t put any more money on it, will they start to bill me $5.95 a month? They do have my contact info. Should I cancel this permanent card on its arrival?Or just not activate it?

Thanks for any light anyone can shed on this; the website seems woefully uninformative and I would love to not have to call….

Elaine: I spoke with them about this WAY back when these first went $0, and they told me they will deduct one month’s fee regardless of your balance, taking your account as far as -$5.95. If you never reload then there’s no way they can come back at you for the $5.95, and they won’t hit it again (this could have changed in the past 3 months). I asked if they would somehow bill me, they said no, only if I reload would they asses the $5.95. I would still cancel since it takes just a few moments via phone.

Thanks. BTW 4X in fuel pts at SW for buying gift cards until 4/22.

Elaine: I got an offer for 3x on GC purchases, and only on one of my shopper cards. I think these are targeted, or at least they are down here @Vons. Did you have to add it to your Just4U? or was it in the weekly ad?

I don’t get fuel points at SW when buying the PP Visas.

Maria: correct, no fuel points on PP’s, only on a couple of other products which are still paying Fuel Points (but have a purchase fee).

You do get fuel points 4X on the $100 fixed value cards though, but it is a $5.95 load fee I believe.

I seem to remember there being a lot of fees. After I read it, I thought “I don’t want to do that.” You had to activate it? What about closing it, even though there’s a fee. BTW, I’ve had no issues buying these and using them at all. Glad to have them since there are no CVSs around me. And that doesn’t matter now anyways.

Purchase / Maintenance Fees:

Retail Purchase Fee:

$3.95 (may vary by retailer)

Monthly Maintenance Fee:

$5.95 per month

Online Purchase Fee:

No Charge

Value Load/Reload Fees:

Retail:

$3.95 (may vary by retailer)

Direct Deposit:

No Charge

Visa ReadyLink:

Varies by retailer

Transaction Fees:

POS PIN Transaction:

No Charge

POS Signature Transaction:

No Charge

ATM Fees:

Domestic ATM Withdrawal Fee:

$1.95 per transaction

Domestic ATM Balance Inquiry Fee:

$0.50 per transaction

International ATM Withdrawal Fee:

$3.95 per transaction

International ATM Balance Inquiry Fee:

$0.95 per transaction

In addition, when you use an ATM not owned by us for any transaction, including a balance inquiry, you may be charged a fee by the ATM operator even if you do not complete a withdrawal. This ATM fee is a third party fee amount assessed by the individual ATM operator only and is not assessed by us. This ATM fee amount will be charged to your Card.

Service Fees:

Foreign Transaction Fee:

2.0% of the amount of Foreign Transaction

Teller Cash Advance:

$2.00 per transaction

Card to Card transactions:

No Charge

Customer Service:

No Charge

Reissue Card:

No Charge

Lost/Stolen Replacement Card:

$5.95 per request

Secondary Card Issuance Fee:

$4.95 per request

Express Card Shipping Fee:

$25.00 per request

Check Request Fee:

$5.95 per request

(charged if you ask us to close your Card Account and issue a check for the remaining balance)

Bill Payment Fee- Electronic/Paper Check:

No Charge

Bill Payment Fee- Expedited:

$9.95 per transaction

Fee for Written Account History:

$2.95 per transaction

Maria,

I hate fees, and there are quite a few to wathc out for there. The good news is the account can be closed for free so long as there’s no funds in it. I’ve done this myself, before they started voluntarily closing them for me 😉

In Dallas, Texas they are cash only.

Re: the SW 4X fuel points – It was part of the SW Just For You offers that I got this week and had to be added.

Re: Success/Failure with PP – After my perfect storm of problems with loading a PP card last week, I am happy to report success loading 2 PPs and 2 MCGCs at the same WM. It went smooth as silk. With success under my belt, I sought out two of the clerks who helped me last week.

I thanked them for being so patient and helpful, explained it was a combo of daily/monthly fee issues plus a card that needed a PIN reset, and said that I had been so persistent last week because $500 was a lot of money to have tied up in a card and I was nervous about that. They agreed completely and were happy to hear that today’s effort went easily.

My confidence in PP is restored and I think I made some friends at WM. Mission accomplished.

I can’t find any place to buy PayPower cards that don’t require cash.

Could Evolve Money be used to ’empty’ these cards of funds?

Yes, I’ve used them for Evolve and Bluebird.

thank you. awesome. you are my new favorite person.

All PayPower cards seem to be cash only.

The package says cash only, but the register will accept a CC if the cashier will.

User beware… the paypower product is backed by bancorp. This means if something goes wrong–held funds, activation issues, credit back done by a wmt, etc, it is the evil giant you are going to have to deal with. Know the risks and be prepared to float funds when going at this heavily. I have done many cards like it in my tenure but not yet this one until the guys mapped it out at the CLT DO (thanks!) but from my experience in this area, the more you do of something, the more the odds are the proverbial printer will break or the activation will fail. It is a matter of math. Know this going in and you are set. Deny it and you may pay.

Great tip MM. Would have loved to had a chat with you at CLT.

You’ve described the float rule a cornerstone of Milenomics, a glossary term on the blog and a rule as important to the game as paying off your balance in full.

Bancorp is super evil, they changed the terms on this paypower card a few months ago-went from charging the monthly fee 30 days after purchase to 7 days after with no notice. I can only imagine how many unsuspecting buyers they burned with that one.

Hopefully this will last a bit longer before the cat is out of the bag, otherwise it will only take a matter of days before this is shut down too.

What do you mean cat out of the bag?? I haven’t found a Safeway since early April willing to sell me a Pay Power. That memo went out and shut down all the ones in the Denver/Front Range area…so if you’re in another city where they either haven’t gotten the memo or just aren’t enforcing it…kudos to you.

hello

i would like to know if this card gets cancelled if you dont used it for 1-2months

like if i already used the money i deposited in it, and now there is less and $1 balance, and then lets say the monthly fee comes out and there is a negative balance and then, another month goes by and then there is more of a negative balance… will the card get cancelled?

because i am expecting a refund in about 1 month – 1.5 months.

so i am just worried that my card will be cancelled,

i dont mind paying the monthly fees but how long after a negative balance does this card stay active until?

@KANDIE – You might be better off getting the refund in store credit if possible. You can check the balance anytime, just go to the website and enter in the card’s info.

I have only found PayPower cards in Home Depot and they are cash only.

Is anyone still finding the PayPower cards with no purchase fee? I’ve found them locally with the $3.95 fee (6/2018 expiration) that I can buy with a credit card. That’s at worst $1 less than the typical gift card, so I’ll probably start using them as my primary Bluebird funding source. Still it would be nice to find them with $0 purchase fee.

I’m planning to limit myself to $1K at a time – while this means more trips to the store, it’s a hedge against a problem loading at Walmart. Worst case I can dump them into Amazon Payments before the fees start hitting.

I can only find PayPower in Home Depot in Dallas, Texas and cash only.

Just noticed that Safeway is offering 75 airmiles for a $200 load…which is worth about $7 (or 3.5%) -are there still fees though?

That is in Canada….

Safeway in my area has stopped accepting CC. Cash or Debit, not even Amex GC.

Li,

I have bought fee-free PayPowers recently and have used them successfully to buy MOs and to load RedCard at Target. I have no experience with the PPs that have a fee.

I always set the PIN using the number on the sticker on the card. I never register them. I buy them, set the PIN and unload them.

I did have one experience when I set a PIN on the phone and it did not work. I had to call PP and register that card to be able to reset the PIN. Then it worked. Could it be there is a PIN issue?

At that time, I asked PP about whether they could refund my money if I could not get the card to work, and they said yes, but there would be a small fee.

So try resetting the PIN or just calling and requesting a refund.

Good luck!

Thank you so much, Milenomics. Your answers are really helpful.

ES: Thank you for your comment. I also used the numbers on the stickers to set the PINs and do not register using SSN. However, I have not been able to unload the cards, then, my PPs have just been charged $5.95 7 days after purchase.

I do not have BB, RedCard. I think Walmart is the only place that I can buy MOs (other places like Safeway, CVS, gas station only accept cash), but I was told that Walmart’s money-order machine at the store near me has been out of order for 3 weeks 🙁

I may have to request a refund, it means that I have to provide them my SSN, right?

Li, I think you will need an SSN but I do not know for sure. If you are near Fred Meyer stores, they also sell MOs. You can also google to find other places that may sell MOs.

Thank you ES. I am in Bay Area, CA. The walmart in my area no longer accept Prepaid Cards. I came there yesterday, and they said that they would not accept PayPower Prepaid cards. I am not close to any Fred Meyer stores. I am now stuck with 3 x $500 Paypower cards hu hu 🙁 If anyone in Bay Area know any place sells MOs with Prepaid cards, please let me know. Thank you in advance!

Li, When I go into WM or any pace to buy MOs, I do not ask if they will accept a prepaid card. I just say I am going to load my BB or get the MO using my DEBIT card. They have asked to see the card very, very rarely. If you ask, they may say no. Just run the transaction as if you were using a bank’s debit card. In most cases, it will work. Good luck.

If you have a Citi credit card, they accept payment with loaded debit cards by phone. So, I charge to that to get AA miles and pay with debit cards to meet min spend./ You can also call your utilities and other monthly bills to prepay with debit cards and get it back from no monthly payment for a number of months.

something i’m confused about, but maybe i’m just missing something—is the cheapest/easiest way to unload these simply purchasing $500, setting a pin, and within the first week just withdrawing $498 at a fee-free atm (like wawa) for $1.95 (and foregoing the $.05)?

Impasse –

That won’t work. You can’t use these for ATM withdrawals until you register with PayPower, who may well figure out what your doing and shut you down.

Better is to use them to load a debit card – AMEX Bluebird loads are free at WalMart.

apologies, i’m still not quite sure i understand—like, they’d figure it out and deny the transaction based on the peculiar withdrawal amount, or on repeatedly doing it with a registered account, possibly in a short period of time? perhaps if you used varied initial purchase amounts? the guy “es” above seems to imply he’s done a similar thing, although i suppose he could just mean the method you mentioned, loading bb. anyhow, thanks!

You can use 2 $500s to buy a MO at WM for $999.30. Or load them onto RedBird or Bluebird for no fee.

Update March 19, 2015: They charged $ 3.95 purchase fee.

Do you guys know what is the best card (with the lowest fee) to buy at this time? Thanks.

Can anyone cconfirm that Pay Power charge monthly fee of $5.95 after 7 days of purchase? Can we just set a PIN via phone without providing SSN? Can we still use this card to buy MOs?

If I want to unload the card immediately (buy MOs, then deposit back to my bank account), which is the best card to buy at this moment to avoid fees as much as possible?

Thank you.

Can anyone confirm that Pay Power charge monthly fee of $5.95 after 7 days of purchase? – Yes, in fact it may be 6-7 days. Not sure when they start the clock or assess fee.

Can we just set a PIN via phone without providing SSN? — Yes.

Can we still use this card to buy MOs? – Haven’t tried but loaded to BB just fine yesterday with 4 PPs.

Elaine, thank you for your response. Do you have to pay $3.95 purchase fee? Do they require Cash only, or you just pay with your credit cards? Thanks.

Yup, the fee of $3.95 now seems standard. At SW I can sometimes buy them using CC, depends on the cashier but it is getting harder and harder.

All of you need to be warned paypower are scammers that put holds on your money and dont release it. I currently have no use of my hard earned money and cant feed my new born baby because they keep givin me the run around and letting me wait day after day over their mostakes the public needs to hear this if u think they r good its only a matter oficial me before they scam u as well media needs to hear this and my only solution is filing a class action suit of anyone else has had similar issues contact me