Today’s post is best expereienced while listening to this song. Press play, and then start reading. 😉

—

A quick post today, but one which could save you a some money nonetheless. Here at Milenomics we focus on avoiding annual fees whenever possible. This means either calling in and pressing for a fee waiver, downgrading to a fee free card, or merging our credit limit into a new card.

Most cards come with the first year annual fee waived (*ahem* new Chase 70k Ink Plus not withstanding). Which, combined with a spouse who can apply for the same card, allows you to churn cards over and over every other year. We call this “two player mode” here on Milenomics, and it can be a fantastic way to avoid annual fees while retaining card benefits.

Today we’ll cover a little known loophole which allows you to extract an exta 25% more annual fee free months. Benefits like additional “elite only” award space, or transferring your Membership rewards to airlines are great–but you might only use them a few times a year. If you know you’ll need a benefit, such as primary rental car insurance, and your annual fee is due today go ahead and pay the annual fee.

THE SKY IS FALLING

Did I just advocate paying an annual fee?

Yes.

But knowing how much I love my money and hate giving it away there’s always a catch when I advocate something that seems to go against the very core of Milenomics.

Today’s Catch–The 90 Day Grace Period

Card issuers give you a grace period on annual fees. Knowing when your grace period ends and paying the annual fee can extend your benefits another 3 months. Just make sure to get in writing the last day you’ll be able to cancel and still refund your annual fee. I’ve been pushing some of my cards to the limit, into this 90 day grace period, and then earning back the annual fee when I cancel. I make sure to Secure message the card issuer and find out the final day I can cancel and be refunded my annual fee. Take the following card for example:

For benefits which are useful now, like transferring UR, or United additional Award seats, once you’ve booked you’re done using that benefit. Even if your flight is months from now there’s no reason to keep the card all that time if you’re not going to use it again.

Update: Reader Al reports that he was quoted 60 days for a BA Visa from Chase. Al’s experience is different than mine. Such different grace periods further reinforce the importance of getting in writing the grace period before trying to extract the extra months. Al also was told of a 60 day grace period on his United Club card.

Other Banks:

I have personal experience with Barclay’s, with a 90 day grace period as well. Reader Cindy reports Barclays informed her of a 60 day grace period. Always verify in writing.

I’ve also used Citi’s 90 day grace period personally.

American express should give you 90 60 days for their products and then pro rate the remaining fee if you cancel after that.

When in doubt, message the card issuer and ask how long your grace period is.

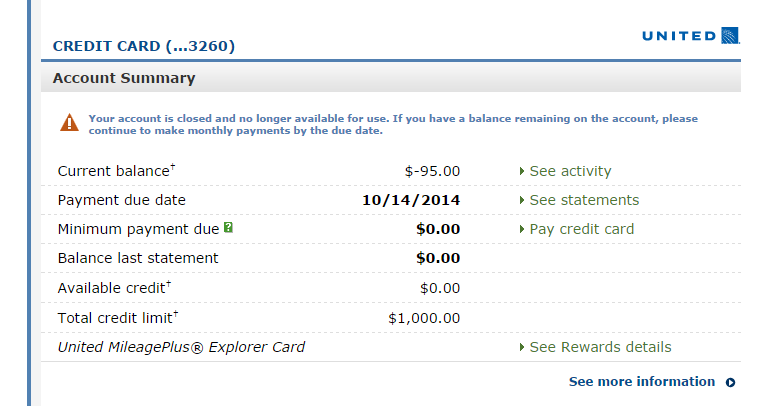

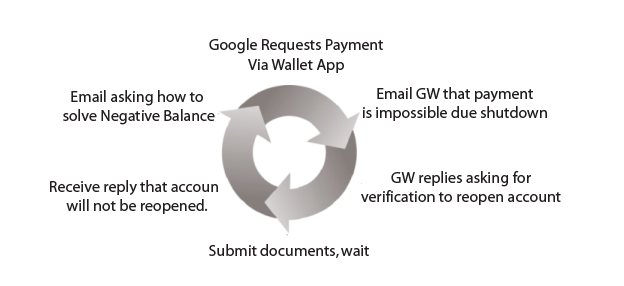

One Small [$95] Negative

Quite litereally there is one small negative to this plan. Your account will be closed and a negative balance will be issued. This means the bank will have to cut you a check for the annual fee you’ve already paid. Citi has been quick about cutting AF refund checks, and no surprise Barclay’s has been the slowest in my expereience. Chase is middle of the road.

Make a note to yourself to follow up in a few weeks if you don’t see a check. It isn’t a huge inconvenience, but it is something to keep in mind.

Leveraging this into an Annual Fee Waiver

Cancelling after the Annual Fee comes due and has been paid could put a phone agent on alert that you’re serious about cancelling, and could indeed end up getting you the annual fee refunded. Even if it doesn’t you’ve extracted another 3 months of fee-free benefits, and you’re likely onto the next card anyway.

If I timed this post length correctly our song should be fading out right about…now.

I was told by Chase reps the grace period is 60 days. I canceled my BA Visa and Sapphire Preferred within the past month:

“Thank you for your recent inquiry regarding the annual fee on the now closed British Airways credit card account.

Since the annual fee of $95.00 was billed to your account within 60 days of the date the account was closed, a refund of the fee will automatically post to your account within one to two billing cycles. Once you see that the credit has posted, please contact us again to request the refund. We regret any inconvenience the delay may cause.

If you have new concerns, reply to this message via the secure message center. Thank you for being our customer.

We appreciate your business.

Thank you,

Linda Lundelius

Customer Service Specialist

1-800-436-7927

Al: I’ll update with your experience, thanks for reaching out and letting me know your experience. I know on my Sapphire Preferred they offered me 90 days, as well as on my UA cards. Either way the advice to verify the grace period prior to trying this is still the best way to go.

Great and timely post for me. Will see what happens when my husband’s United Explorer fee hits.

Can you use the card to make purchases during the 60 or 90 day period? Does that in any way negate the ability to have them refund the fee?

I have this perhaps inaccurate idea that using the card to make a purchase is equivalent to agreeing to the new terms which include paying the annual fee.

Good questions Elaine! Your card is yours until you cancel–so it functions like a normal card until then. You will lose any miles that have not posted at the time you cancel, so that could be something to consider.

The only other thing I could think of to watch out for is: if you had a card with rental protection or trip interruption insurance and actually used the protection during your grace period (had a loss/accident) it would probably be prudent to not cancel the card and ask for the annual fee back.

Have you ever done the math on the 7% annual bonus? IE when does it make sense to pay the fee in order to preserve the bonus.

Me: I’ve done a bit of analysis on it… And my position is that the csp is a useless card for earning UR. See why here: http://www.milenomics.com/2013/09/chase-freedom-vs-chase-sapphire-preferred/. The basics are that you can earn more with even a Chase freedom. In addition why keep a card which earns less miles than an Ink Bold, but costs the same?

And in more bad news, the 7% dividend is being eliminated for any new cardholders and for all existing cardholders in 2016.

According to the representative I just chatted to, the grace period for AMEX cards is only 60 days, not 90 days.

Amex AF: In preparing this post I contacted them as well, and asked what the grace period was. I was (quite rudely) told there is no grace period, a fact that I know is not true. I’ll update with your 60 day number, thank you.

Also: In the past Amex used to prorate the Annual fee if you cancelled after the grace period–so you could push it another month or two for a few bucks more. Since CS was so unhelpful in my attempt to fact check before posting I’ll have to call that prorate a possible fact, but one that should also be verified.

I was told by Barclay that their grace period was 60 days as well. Thanks for this tip- I very well may try it as my fee will be charged next month.

Liking the new theme. Keeping it clean and simple. Now we just need more posts from you 🙂

I received an email concerning my United Club card. Again, the grace period is only 60 days, not 90:

Thank you for contacting Chase concerning the annual fee on your United MileagePlus® credit card account ending in xx.

Your account has an annual membership fee of $395. This fee is charged during the same month each year and assures you of many benefits and privileges associated with your

card. Your annual fee billed September 1, 2014.

The account would need to be canceled within 60 days of the date it was billed to the account to receive a refund of the fee. Once the account is closed the credit will automatically post to your account within one to two billing cycles.

At this time we can only advise you that there is no promotion tied to this account that would allow you to retain the account without being assessed an annual fee.

Because the fee is consistent with the terms and

conditions that apply to this account, we are unable to remove the annual fee from this open account. The annual fee does remain valid as long as you retain an open account.

To close your account, please use any of the following options:

* Call us at the number listed below.

* Send us an e-mail using the Secure Message Center.

* Send a letter to the following address:

Cardmember Services

PO Box 15298

Wilmington, DE 19850-5298

We would like to offer you the option to review our Cardmember Redemption program where you can redeem miles to offset the annual fee within 90 days from the date the annual fee posted to your account. You can go to our

Cardmember Redemption website at http://www.united.com/chase.

This website allows you to redeem miles for a statement credit in the amount of your annual fee.

Please also feel free to contact our customer service center at the number listed on the back of the credit card to see if this account is eligible to be converted to our fee free Mileage Plus credit card where you can earn miles

at the rate of one mile for every $2.00 in transactions without being assessed an annual fee.

If you have any further questions, please reply using the Secure Message Center.

Thank you,

Barbara Kinsella

Customer Service Specialist

1-800-436-7927

I just received notice that the grace period for my United Club card is 60 days also, so I would be careful about trying to stretch it to 90 days.

Al: Another good data point. You’re absolutely right, if they say 60 days do not go beyond that date. But there’s no reason not to get an extra 2 months of free club access, if they’re willing to spot you 60 days, right?

Yes, but in all honesty, the feature which I’m going to miss the most is the waiving of the $75 “close in” award ticketing fee which, as we all know, is a load of bull. Personally, I find it more egregious than any other fee.

Yes! The close in fee bugs me the most. Pure cash grab, plain and simple. You’re booking a seat which is becoming closer and closer to worthless and they’re charging you for it. If you have MR you can avoid the close in fee by booking ANA awards on United flights, and might even be able to pull a free one way (or round trip) out of it too.