Quick Summary: You can pay federal taxes online with a credit card for free through bill pay service Plastiq as part of the Masterpass/Mastercard promo they’re running through September 30, 2018.

Why use Plastiq to Pay Federal Taxes

If you have federal taxes to pay, you can earn credit card rewards and/or liquidate Mastercard gift cards through Plastiq. Plastiq usually charges 2.5% so it’s generally better to go with one of these Payment Processors. However during this fee-free promo it’s advantageous to use Plastiq.

How to Pay Federal Taxes Online with Plastiq

Paying bills with Plastiq is mostly straight forward, but paying US Taxes is a little different than other bills.

Step 1: Log in -or- create an account with Plastiq

If you’re new to Plastiq you can use our referral link: https://try.plastiq.com/milenomics

Terms: Earn $500 in Fee Free Payments after you pay your first $500 in payments with a fee of 2.5%. You’ll also need to make that first $500 payment to unlock the current Masterpass promo for no-fee $250 Masterpass payments.

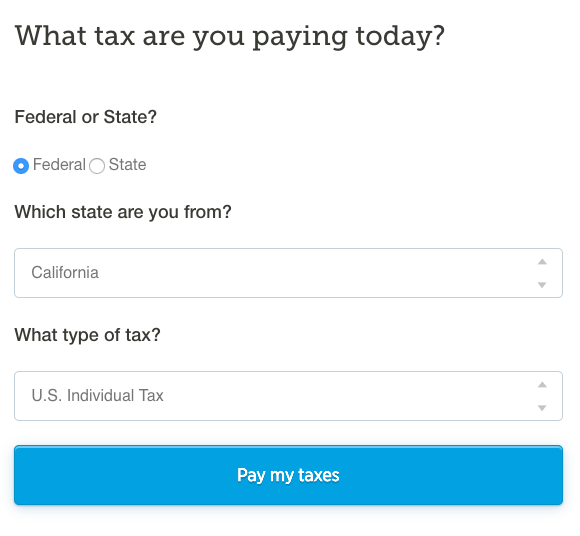

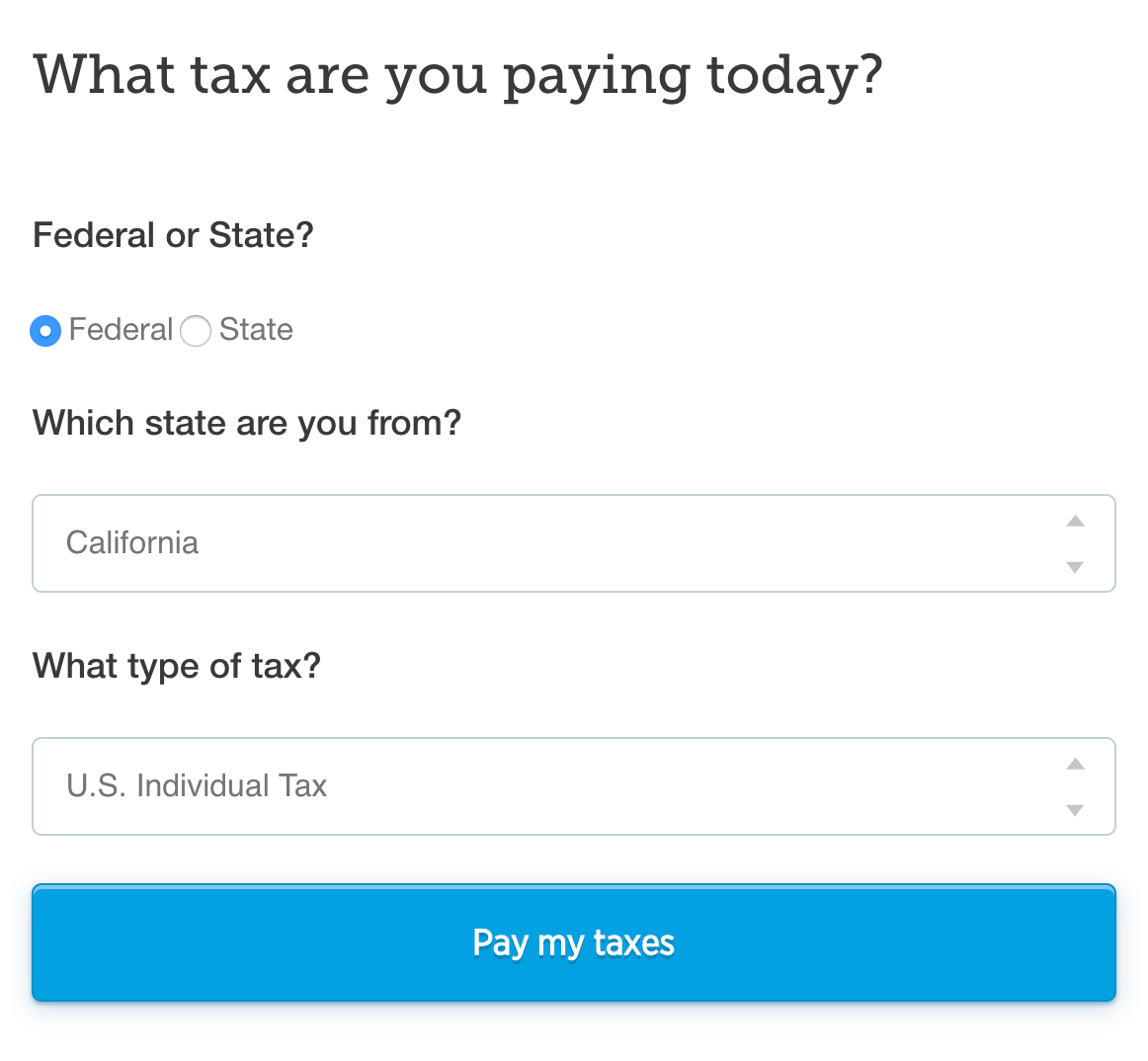

Step 2: Go here: https://www.plastiq.com/us-taxes/

Note: This is a different procedure than adding a payee manually.

This approach allows you to enter your SSN and notate the type of tax you’re paying.

If you’re paying quarterly personal estimated taxes, enter Federal, your state, and U.S. Individual Tax.

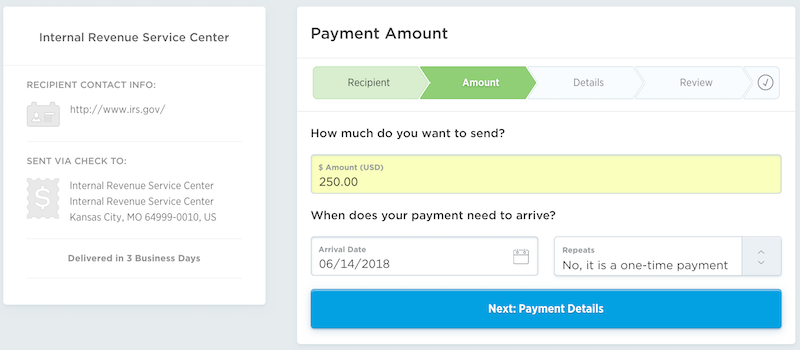

Step 3: Enter the amount

For the payments to be fee-free they need to be $250 or less. If your taxes due are greater than $250, submit multiple payments.

Then select the arrival date, and decline repeat payments.

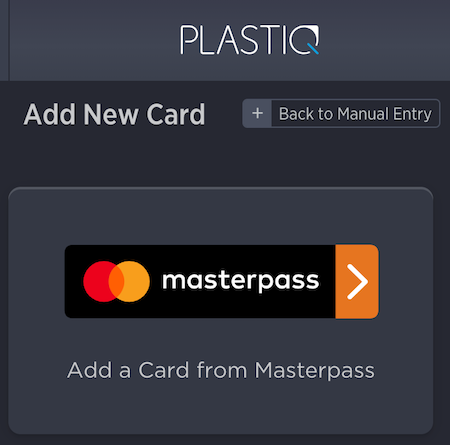

Step 4: Select Your Payment Method

If you’re going for the fee-free Masterpass/Mastercard promo select Add New Card -> More Ways to Pay -> Masterpass then select a Mastercard credit card or GC associated with your Masterpass account. Other payment methods will incur a 2.5% fee.

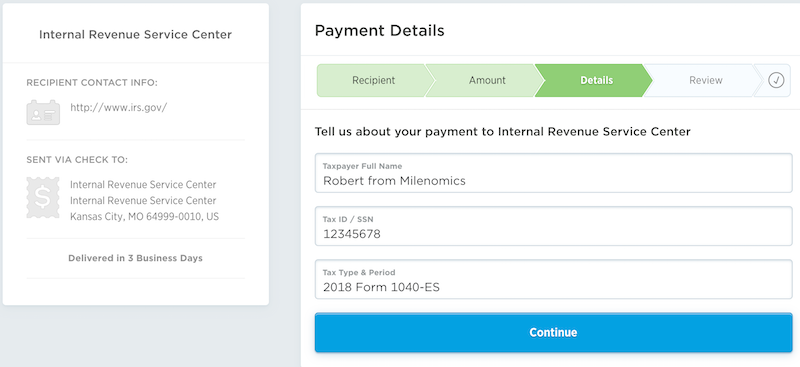

Step 5: Enter your SSN and the Tax Type you’re paying

For example, 2018 1040-ES.

This is where it’s important to submit the payment this way rather than creating a new payee by scratch.

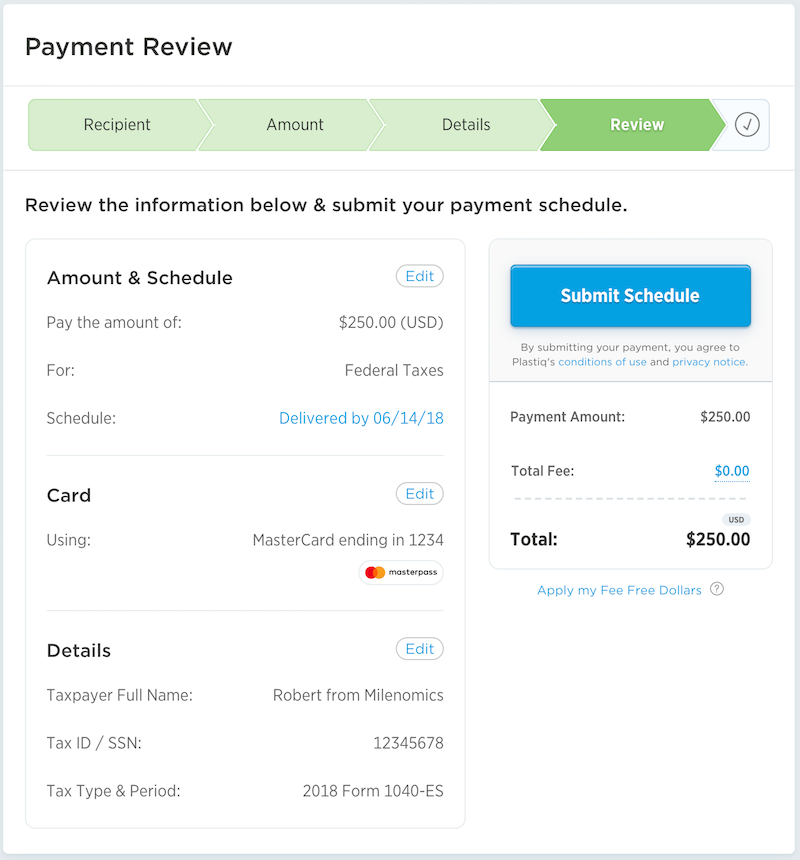

Step 5: Review and Submit payment

Once you have the Internal Revenue Service as a payee and one Mastercard credit card in place, subsequent payments are a lot quicker.

Questions and Answers

What is the advantage of using Plastiq instead of Pay1040/PayUSATax/OfficialPayments?

- At the moment, payments of $250 or less are fee-free through Plastiq with Masterpass/Mastercard

- Those other services are limited to 2 payments per processor

Do you have to give Plastiq your SSN?

Yes you do, so the IRS knows what to do with the payment.

My tax return/1040-ES has a different address than where Plastiq wants to send it. Will the IRS get it?

It worked fine for me. My 1040-ES says to send it to Connecticut, Plastiq sends it to Missouri. The payment posted without incident.

How can I tell if the IRS received the payment and it posted to my account?

Create an account at IRS.gov. It will show when the IRS has received these payments.

Note: EFTPS.gov does not show these types of payments.

How long does it take?

They say the payment will “be sent in 3 business days”. I initiated payment on a Wednesday. It arrived Tuesday.

If one of the checks gets lost in transit how can I tell which is which?

Some suggest making payments a bit “self-documenting” by paying $250.01, $250.02, $250.03 etc with a credit card. Or $249.97, $249.98, $249.99 with a gift card.

Related Reading

- Thoughts And Datapoints On Maximizing The Plastiq Masterpass Deal

- Why I Just Paid My Taxes with a Credit Card for the Points from Sriram at Travel Codex

- Pay taxes via credit card, 2018 edition from Frequent Miler

Terrific post. Thanks!

SIgned up for a new account using your link. Tried to pay $500 to IRS with a Visa card, and was shown a fee of $12.50. What happened to the fee-free $500?

Dave: email me your account email and I’ll ask my contact. samsimontravel@gmail.com. If they don’t make it right (and soon) we’ll make sure to personally make you whole on this one.

Done. And thanks!

Were you spying on me? I did this before they nerfed the $500 free free payments in May for both my June and September estimated taxes.

You can use prepaid mcgc bought at a grocery store or od as well if you add it through masterpass.

Instead Im using the att access and more citi card with which i got the 35,000 point max earned 2x bonus points on all spend (so max spend $17,500 over 6 months) retention offee. The timing of these two promotions have been awesome for paying my taxes and mortgage.

I like this method, but will owe about $8k for this quarter. Would it be a bad idea to send 32 checks, each with a track able value around $250?

I did an amount slightly less than this and they’re just now showing as arrived on IRS.gov.

These payments took 2 weeks and were longer than the singular trial payment I did before writing this post.

I checked with Plastiq as I was getting concerned about things. They suggested they might have been lost in transit and they’d be happy to cancel them.

Seeing as how I didn’t want to bounce 20+ checks to the IRS I let it simmer and they did indeed post.

All in all it’s a good deal on paper if you’ve got the constitution to deal with it I’d say.

Did you send them all as due on the same day?

I don’t mention the due date. I just notate they’re for 2018 1040-ES.

Thanks – so you sent all 20+ on the same day, rather than spacing them out and this was ok?

Plastiq doesn’t seem to mind multiple $250 payments on the same day.

I only spaced them out insofar as I was paying with MCGCs I acquired over the course of a few days.

Hope this helps…

What’s the most anyone has paid in taxes using Plastiq $250 fee free option?

So if you need to meet the quarterly deadlines, I’m assuming submitting a payment on the due date would mean that it would actually be late?

Pam: one thing I didn’t even get into it this post is that payments with plastiq often show up more than a few days past their guaranteed delivery date. I would give yourself plenty of time.

anyone else send a bunch of checks thru plastiq for tax payments? Looking for a 10k+ payment of taxes and would like to earn some miles as well. just concerned the 50+ checks might not post in time or get lost in transit ..

Nick: in the past when I’ve landed many payments like this I made each one unique by a penny. Doing so would cost you about $5 for 50 payments, or about $0.10 a card on average.

That said, I’ve never had a payment go missing in the long-term. Sometimes it takes a little while for them to show up.

I have two questions.

(1) Anyone tried to use BOA Premium card recently to pay tax via Plastiq? Did you get the points?

(2) What does the transaction look like on you credit card? Does it only show Plastiq or does it indicate it’s a payment to IRS?

Seems Plastiq doesn’t have option for Estimates payments category 🙁 leaving bit of ambiguity on how the payment will get processed by IRS (would have expected Plastiq to take care of most basic thing)