Today I’ll go over a way to supercharge your Chase Sapphire Preferred, earning 7,500 or more UR along the way. I’ll go over why this is the ideal time of the year to process this upgrade, and I’ll also end today’s post with a clear cut way for you to retain all the benefits of a Chase Sapphire Preferred card while avoiding the Annual fee.

Now Through March 14, Convert and Reap the (Ultimate) Rewards

The card I’m advocating you upgrade your CSP to is the amazing, Chase Freedom (Preferred):

El alprostadil, que figura en la lista de medicamentos vitales, prácticamente ha desaparecido de la mayoría de las farmacias moscovitas. Según AptekaMos, a 2 de octubre solo estaba disponible en siete puntos de venta. Y en los sitios web de los mayores mercados haga clic en este enlace de farmacias -Apteka.ru, Zdravcity y Eapteka- no está disponible en absoluto. En un grupo profesional (que reúne a casi 6.100 farmacéuticos de distintas regiones del país) de una de las redes sociales, los usuarios informan de que los propios farmacéuticos también buscan alprostadil y se recomiendan unos a otros pedir el medicamento a Alemania.

Yes, that’s right. The $0 Annual fee, Chase Freedom (Preferred) is the card we’ll be discussing today. Because of the way Chase has created the 5x Chase Freedom (Preferred) Calendar the best possible time to get rid of a Chase Sapphire Preferred and upgrade to the Chase Freedom (Preferred) is right now:

Upgrading your CSP between now and March 14th allows you to earn 7,500 UR at grocery stores between now and the end of March.

Grocery stores are an absolutely fantastic place to buy gift cards. Between the 5X UR, Grocery store gas rewards and possible coupons or discounts on Gift cards you should be checking your local stores and using your Upgraded Chase Freedom for the complete $1500 bonus this quarter. In addition to this 7,500 UR bonus I’ll highlight other areas where your upgraded Chase Freedom will continue to out-earn your lowly Chase Sapphire Preferred in the rest of this post.

First, Second, Third AND Fourth Friday Dining Bonuses

The CSP has proven itself time and time again to be a poor card at earning UR. The signup bonus sure is great, but the longer you hold the more you miss out on these Chase Freedom Bonus categories.

One of the Benefits often touted online about the Chase Sapphire Preferred is the “First Friday” dining bonus the CSP offers. Instead of 2UR per $1 you earn a massive 3UR per $1 at restaurants. In contrast the upgraded Chase Freedom (Preferred) You’ll earn 5UR per dollar every Friday in April, May, and June.* And you won’t just earn 5UR only on Fridays. No, you’ll earn 5 UR per $1EVERY DAY in April, May and June on your upgraded Chase Freedom (Preferred)

*Bonus 5x UR only on first $1500 spent in the quarter. All other Restaurant spending will be at 1 UR per $1.

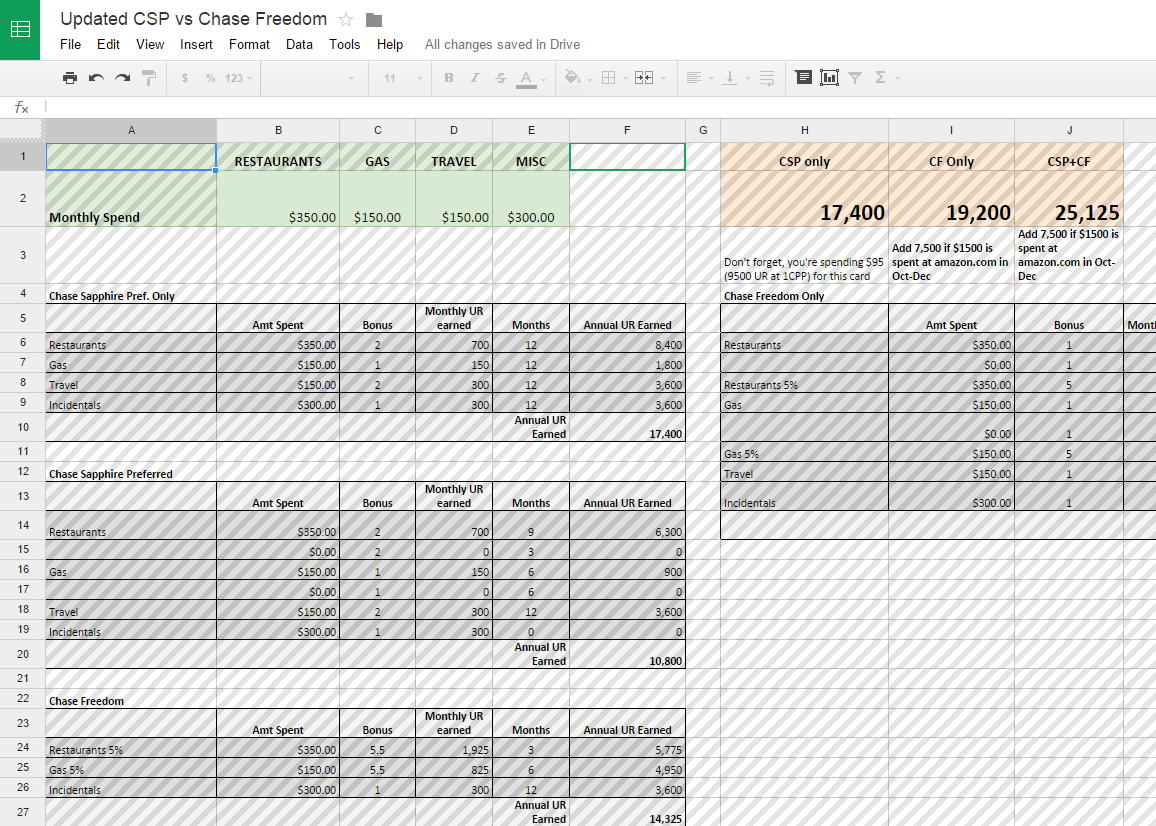

Updated Chase Freedom Vs. Chase Sapphire Preferred Calculator

Over a year ago I put up a CSP vs CF calculator. I used it to illustrate that for most people who aren’t heavy spenders in travel or resturants the Chase Freedom is a better card. I’ve updated the calculator to reflect the changes in the Chase Freedom and Sapphire Preferred . Try it out and see how much better the Freedom is for you:

The above calculator has a fatal flaw–it assumes you only are allowed to use either the CSP or the CF (or both together). For real maximum earning I’d suggest adding in the Fidelity Investor Rewards American Express for all 1 and 2x UR categories.

Keeping the Benefits without the Annual Fee

Feel free to use the Ultimate Rewards Shuffle along with the new and improved 13 month-itch to keep a CSP and never pay an annual fee. The two ways to do this are to either alternate applying for CSP and Chase Ink cards, or Simply churn the CSP every 2 years. There isn’t good evidence that you won’t get the bonus for a CSP application 2+ years after your original one.

The above Ultimate Rewards Shuffle either takes you into the year 2018 in single player mode, or into the amazing to say 2021 if you play with a partner. I wouldn’t dare try to forecast that far into the long term, because too much could change between now and then. Chase seems to continually tweak their products, and the Chase Sapphire Preferred and Freedom are not immune to such tweaking. As long as the products stay the same as they are today along the way continue to convert your Chase Sapphire Preferred cards to Chase Freedom (Preferred) cards, and let the Ultimate Rewards Roll.

I don’t think you can apply for the Chase Ink Bold anymore.

Thanks for the reminder Charlie. A good example of Chase tweaking their offerings. I’ve updated the section a bit to make it clearer.

I spend quite a bit at restaurants, but since I just got the Hyatt card, I’m planning on putting my restaurant spend on it and switching to freedom.

My problem with the timing is that my wife is going to get the sapphire and i’d like the referral bonus. I wonder if I refer her and switch the next week if I’ll still collect the bonus.

Scott: You’ve got until March 14th to add the 5X UR to your Chase Freedom (Preferred). Your card number won’t change which might allow you to go beyond next week. Your UR will also stay put, which might mean Chase can credit you the 5k UR (same CC number, same UR account) even after you’ve converted. Neither of these are definite answers, so you may wish to consult with Chase, or sit this one out.

One of the features of the CSP is that you can move points to it from other Chase accounts, allowing for combining points into a lump sum. Is this an option with the CFP?

Tim: You can combine UR into the Chase Freedom (Preferred) just like the CSP. You can also add a spouse/domestic partner and transfer your UR to/from them. One significant limitation to the CFP: You cannot transfer out to Airline programs unless you first transfer from your CFP to an Ink or Chase Sapphire Preferred.

I’ve never heard of the Chase Freedom (Preferred) and I don’t find it available on Chase’s website. Can you please provide a link? One of the big benefits of the Chase Sapphire Preferred is the ability to transfer Ultimate Rewards points to travel partners. You currently can’t do that with the standard Chase Freedom card. Can you do that with the Chase Freedom (Preferred)?

Brian: I’ve described this as if it were a new card in order to really drive the point home that it is underrated. Chase may not call it the Chase Freedom (Preferred) but because I have such a strong preference for it I’ve decided from now on I will be calling it the Chase Freedom (Preferred). You can use the UR earned with the Chase Freedom (Preferred) to transfer to travel partners, but only by first transferring them to either a CSP or an Ink card, and then transferring them out from there. Think of the CF(P) as a safe you can store your UR in, and then you can take them out in the future and cash them out with the help of a CSP or Ink.

Question: How does the travel benefits (trip cancellation, baggage delay, etc) compare b/t the two cards? Any difference?

Ben: That’s an area where the CSP does win out over the CF(Preferred). There aren’t travel protection benefits with the card. The basic decision you’ll need to make is picking between earning big amounts of UR (CF(P)) or trip protection and rental car coverage (CSP). I’d suggest taking a look at your travel patterns and see if you absolutely need a CSP. If so, consider converting your CSP to a CF(P) and applying for a second Sapphire preferred via a spouse/partner. After the 13-14 months are up on the new CSP consider converting it as well, and start all over applying for a new CSP yourself.

Not knowing that I could convert to CF when I closed the CSF last month, I now wanted to hit my head against the wall!!

🙁

Try calling them to let you convert or to reopen (so you can convert after). Within 30 days it’s for sure no problem to reopen closed card.

I’m coming up for renewal on my CSP and called retention. I was told it was only able to downgrade to the Chase Sapphire. Is this a classic case of hang up and call again until an agent will do it? I’ve also heard to try after the annual fee hits.

Or maybe the route is to downgrade to the Sapphire and then convert it to the Freedom? Is that conversion easily done? Or will I have a tough time with that too?

Pork: I’d recommend calling back, and asking specifically for the upgrade to the freedom.

Tried two more times, they said the Sapphire was th only option. I asked for the retention department, and they said there is no retention department. I don’t think it’s possible to switch from CSP to CF.

PorkisKing: I just got off the phone with Chase Sapphire Preferred CS, who I reached at 800-493-3319. They confirmed I could convert a CSP to a Chase Freedom(P). I don’t know if you’re calling a different number or just getting bad reps. I asked “what other cards can I convert this CSP to?” The rep mentioned the regular Sapphire, and then the Freedom. 100% still alive.

I tried again, same thing. I asked if it was different for every person, and they replied yes, it can be different for every person. So maybe it’s a YMMV.

Maybe this option will become available to me later on.

If i already have the CF, can i convert the CSP to a 2nd CF?

Kampung: Yes, you can. Both my wife and I have 2 CF(P)s.

Suprised it’s not mentioned here, but from what I was told by CSR, it is not allowed to convert an existing Chase branded product incl Sapphire Pref to Freedom unless over 1 year has passed since applying. Have you heard different? It’s not mentioned on this blog so just wondering.

Kent: I’ve personally converted prior to 1 year, but would love more data points from readers. Given my success in converting I’d have to say this is either a very new requirement or a CSR making the rules up. Even if it is a new requirement you have ~2 months after the Annual Fee hits to convert and still be refunded the AF by Chase.

I forgot you can still get refunded even after cancelling post 1 year (as long as like you mentioned it’s done within those 2 mo). Thanks for the reminder.

One benefit I have not seen discussed regarding upgrading a CSP to a Freedom is that the first friday dining bonus somehow stays with the card. In January I upgraded my CSP to a Freedom, kept the same card and card number. Since this quarter is restaurants, I’ve been using my Freedom. I just checked my account and I actually got 6x for all dining done on April 3 (first friday of the month).

Problem now is with the new chase rules regarding ultimate rewards cards (can’t be approved if you have opened 5 ccs from any issuer in the past 24 months) basically to me has made chase cards useless. I’m ready to transfer all my points to United and change CSP into a 2nd chase freedom then just use it for 5% cash back.

Too many opportunities for other cards to stay in the ultimate rewards world.