*testing, testing* 1, 2, 3. Is this thing on?

Hello, Hello. Happy new year to all. I’m dusting things off a bit here and wanted to start the year with a post about my views on 2018. I’ll be looking into my crystal ball here, so plenty of what I say might end up not happening at all. In fact, as you come to read my predictions you’ll see that for many of them I don’t want to be right. I’m Bearish overall for 2018, continuing a trend for the past few years and believing that everyone in this game (Yes, even banks) is too addicted to just walk away.

An Overall Strong Economy Will Be Awful For Traditional Miles and Better Still for Bank Points.

I think it is pretty clear that the economy in the US is strong and has been for a while. People are traveling and have disposable income to spend on airfare. I think Open System Miles (Variable Value Miles) will continue to stink the next year+. These miles have the potential to be worth 2-10cents per mile, especially if you try extremely hard to overvalue your flight cost (I can’t bring myself to link to examples of this, but you should know what I’m talking about). But in reality they tend to be worth $0 when you can’t fly where you want when you want.

I think that trend will continue, with tight award space on low levels. Cheap airfare will continue to make Closed System bank points the most valuable tools for discounted travel. There are even going to be situations where paying for low cost business class seats with these Closed System Points (WF points, UR, etc) is a better ‘value’ than using miles. We’re in the golden age of Bank points.

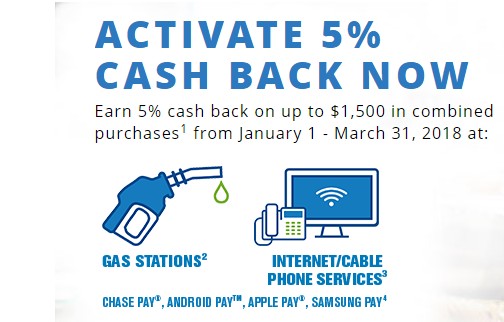

Competition for payment processing will heat up and we will be the beneficiaries.

The Q1 bonus for Chase freedom including mobile wallets is a good example of this. I think you have a critical mass now of people willing to tap to pay. I call this the “Parent Trap,” Something hasn’t gone mainstream until your parents call you and ask you about it. You know the call you got from your mom asking about setting up apple pay? Or your dad calling to get information on Bitcoin? Or looking at sites similar to https://cryptoevent.io/review/bitcoin-revolution/? That’s a signal that the tech is ready for prime-time. And prime-time users mean prime-time deals for us all.

There’s also a huge competition between some big names for your hard earned spending dollars. Mobile payments, online order for in-store pickup and delivery of goods are the tools of warfare between tech giants and old school retail. This past Christmas saw an overwhelming glut of deals. So many that I personally became numb to them. We’ll discuss more of this as time goes by and these deals come up, but I passed on quite a few deals this Holiday season as they just didn’t meet my T-Rate.

Rising oil prices will push airline tickets up in cost.

This is one area where I’m bearish. I think low oil prices are causing some significant issues worldwide. While I’m enjoying the cheap fuel and I know airlines (especially American ones) are absolutely loving it as well. That said, this can’t continue forever.

To make things easier for future readers: Current price of a Barrel of crude oil is $60. I think we’ll end the year closer to $90.

The end of 25,000 points for low level domestic flights-

Not that there have been many/any of these really available. But I think you’ll see low level awards going up from 25,000 on those who still have them there. These saver prices were set so long ago and haven’t budged much. When seats were empty and the extra revenue was free money airlines cared little. Now those award seats are competing with paid passengers so you need to up the value to the airlines to compete. You’ve also got customers like Citi buying up tons of these miles and their customers have to be getting frustrated about being unable to use them.

This could be a net gain if it ups the low level availability. This is especially true of partners who just can’t book any flights because no low level seats are being opened up.

Credit Cards: Sign up bonuses will trend upward.

The card issuers don’t need churners anymore–now that their cards and points/miles have become huge business and mainstream (See: The parent trap above, as I’m sure your parents have emailed you about a CSR, or sent you a link to TPG posts). They’re also getting better and better at creating systems that exclude our kind based on a ruleset. They don’t want us, and have come up with great ways to exclude us.

This has allowed banks to offer some historically great sign up bonuses, and in doing so target longer term, higher value customers. I think you’ll see $600-$750 bonuses (or the equivalent) rather than lower bonuses.

Citi Double Cash Will Devalue

This card is just way, way too good. I think it is the best credit card out there right now. It is definitely the card I recommend first to anyone new. There’s now way after the 2017 holiday season and the inevitable flood of lost revenue in price rewinds will this card continue to be as generous. I don’t know where or how they’ll devalue, but this one I’m pretty sure of.

At least one major GC issuer will start to issue GC without PINS.

Someone has to go first, and test the waters. I think that this would probably be Vanilla as they probably have seen their PIN use all but destroyed anyway. Greendot is also annoying and a crappy enough company to try to do this as well.

Either way the entire GC economy is on life support with the switch to Chip vs. Swipe, fraud and the current regulatory culture in DC.

Interest rates on savings will continue upward. The true AOR will return in 2018 or early 2019.

AOR used to be about floating money and dumping it into CD for the spread on a 0% and a high interest CD rate. In the Zero/Negative interest rate world that occurred post 2009 that changed to the signup bonus game. I think that the original AOR will return in 2019, but I’m putting it here because I think it could happen late this year as well since rates are creeping upward. Getting enough cash out at a 2-3% spread is something that we should be conscious of moving forward.

You should now be earning *something* significant on your float from your MO deposits if you’re still doing GC purchase and cash outs. If you aren’t check out these possible places to dump your money while you let your statement hit. (More on that to come as well of course).

Annnnd that’s it for me. Like I said I hope I’m wrong about a lot of this, but we’ll have to see how the year shakes out. Either way get out there and travel. We’ll continue discussing ways to discount travel (because travel is not free). Happy New Year everyone.

Why is the Citi Double Cash card way, way too good?

What gets you so excited about a 2x card?

Cash is way, way better than airline miles. The price rewind is very easy to use. You can also pay with debit card.

The MC route from GC.com isn’t dead.

Where have you been Sam? Happy New Year!

Thanks Mel! I’ve been around, just doing my own thing. Traveled plenty the past few years, and learned a lot about being a dad (With a lot more to learn I’m sure!). Happy New Year to you and yours as well.

You’re back! Hooray!

Glad to see you back! We’ll have to see how the interaction of #1 and #3 plays out though — closed loop points are less interesting if cash prices for fares increase in a significant way. Still preferable/more flexible than open loop, but the gap narrows significantly.

Andrew: That’s exactly the kind of thing I’m keeping an eye on this year as well. If airfare prices stay low and the dollar stays strong I think you’ll continue more of the same. But airlines love to plan for today and not tomorrow, so if something changes high capacity + high fares has traditionally been a recipe for award flights. If that happens Bank points always have an escape hatch–statement credits, but I airline miles can be sold as well in a pinch.

Glad you’re back!

Welcome back stranger.