Beyond the big three banks with the best flexible points programs (Chase, AmEx and Citi) there’s a second group of banks with travel/rewards credit cards worth exploring.

The longer you play this game the more limitations you start bumping into. Each bank has policies in place to limit repeatedly dishing out signup bonuses and rewards.

With the list below I sought to rank these “tier 2” banks in terms of the value of the credit cards in their portfolios so I could mentally prioritize my relationship with each of them going forward.

Conceptually, I considered the Net Present Value a typical points enthusiast could derive from each bank over the next couple of years considering signup bonuses, ongoing spend in the current climate, and the probability of malfunction with each of the banks.

Here’s my ranking of these 7 “tier two” banks:

#1 Barclays

Pros

- AA Personal 50,000 and Business 40,000 cards

- JetBlue 40,000 card provides a path to Mosaic status without setting foot on a plane

- Lufthansa 50,000 card opens award space on Lufthansa metal further out than for partners, and useful for domestic First on United

- Arrival Premier offers value for those who easily spend $25,000 and make effective use of air transfer partners

- Churnable

Cons

- Unknown approval standards

- Prone to shutdown

Review: They really missed the mark with their recently announced Arrival Premier card, but maybe they can patch things up by adding a signup bonus and opening up more transfer partners. Especially ones they already have relationships with. The real wildcard here is the probability of malfunction. Do I think you can get 4 Barclays cards in 2 years while churning cards from other banks? No. But you might be able to get 3, and with effective redemption you could get a lot of value out of the rewards associated with their cards.

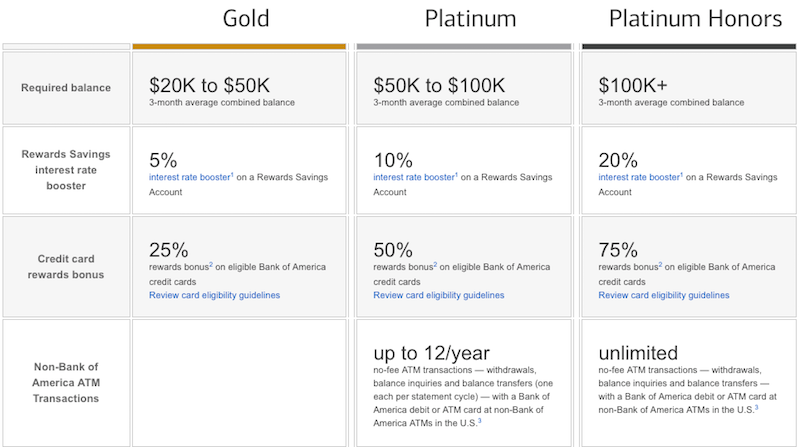

#2 Bank of America

Pros

- Premier Rewards card is worth $500 cashback

- Virgin Atlantic 75,000 card has high but attainable min spend

- Alaska 30,000 card is useful for a lot of partner awards, plus companion certificate

- Increased credit card earning with Preferred Rewards makes their Premium/Travel Rewards cards 2.625% monsters

Cons

- Will approve no more than 4 new BofA cards per 2 years

- Setting up automatic payment of credit card online is ridiculously complicated

- Prone to shutdown for high volume manufactured spend

Review: Not as free wheeling with approvals as they used to be, but as things currently stand there’s some value to be had here. If you can get 4 cards every 2 years they’re worth taking advantage of.

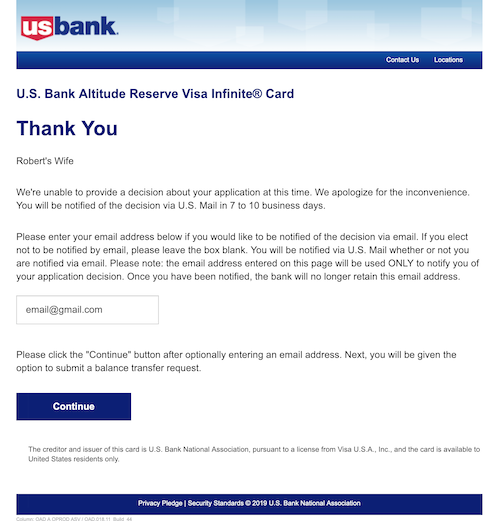

#3 US Bank

Pros

- Altitude 50,000 card is worth an easy $750 towards any travel

- FlexPerks program

- [Targeted] $500 Business Edge card

Cons

- Tough on approvals

- Prone to shutdown for 3x digital wallet spend

Review: The inability to redeem rewards for more than 1.5 cents per point limits the upside of their programs.

#4 Wells Fargo

Pros

- Business Platinum $500 card

- Propel World 40,000 card

- Visa Signature card earns 5x at gas/grocery/drugstore capped at $12,500 in spend first 6 months

- Allows co-mingling points earned on different cards

- Allows sharing points with others

- 1.5-1.75x upside when redeeming for air travel with Visa Signature

Cons

- 5x cards are severely capacity limited these days

- Sinisterly incompetent customer service

Review: They once allowed an amazing amount of lucrative manufactured spend, but no more. This is a bank without a cohesive credit card strategy.

#5 CapitalOne

Pros

- Venture card $500 signup bonuses

- Spark $500-$1,000 signup bonuses

- Simple redemption on 2x everywhere

Cons

- They find it necessary to pull credit reports from 3 bureaus

- Some have a hard time with approvals due to too many accounts across all banks

- Shutdowns on business cards for spend “inconsistent with a business”

Review: Like Barclays, erratic approval criteria makes it hard to get excited about them long term.

#6 Discover

Pros

- Double earning on rewards the first year, including 1.5x cashback card for 3% cashback first year

- Cards with 5x in rotating categories

- Strong online shopping portal

- Good customer service

Cons

- Acceptance isn’t as widespread as Visa/MC

- Shopping portal is hard to track and they want you to pay with a Discover card to earn cashback

Review: Solid cashback cards with little redemption upside.

#7 TD Bank

Pros

- TD Aeroplan card

- Some cash back cards

Cons

- Small player, limited to the east coast

Review: For a bank that prides itself on being America’s Most Convenient Bank they can sure be confusing to interact with.

Honorable Mention

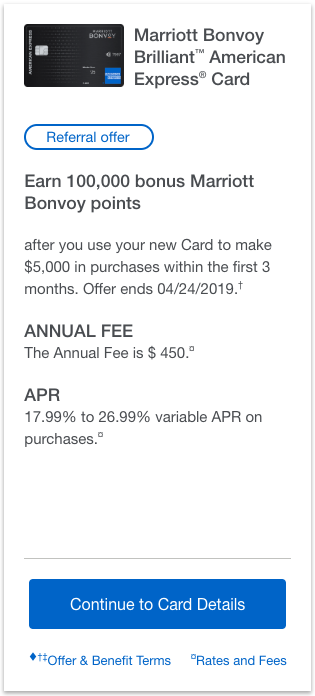

- Synchrony Bank for its Cathay Pacific 60,000 card

- Banco Popular for its Avianca 60,000 card

- And of course many regional banks

Further Reading: The Best “Tier 3” Credit Cards

What do you think? Any banks I missed? Disagree with the rankings? Let us know what you think.

And how about “Tier 3” like Pen Fed and First National of Omaha’s American Express cards?

No annual fee, or foreign transaction/currency fees, offer $100 annual travel credits on any airline, Global Entry or TSA Pre credit plus a 1.5 points/$1 ratio with 3 points/$1 on travel.

askmrlee: I pitched the FNBO Travel Elite card as a possible tier 2 before this post was published, but it just didn’t make the cut. Such a solid card, thanks for bringing it up so readers can consider it as well.

Synchrony has decent cards and great rates on the banking side. But dealing with them on just about anything is like pulling teeth.