A heightened offer for the new AmEx Hilton Business card (125,000 + a $50 statement credit) and expanded eligibility of the targeted 50,000 AmEx Premier Rewards Gold with no lifetime language might be worth applying for both on the same day.

The Offers

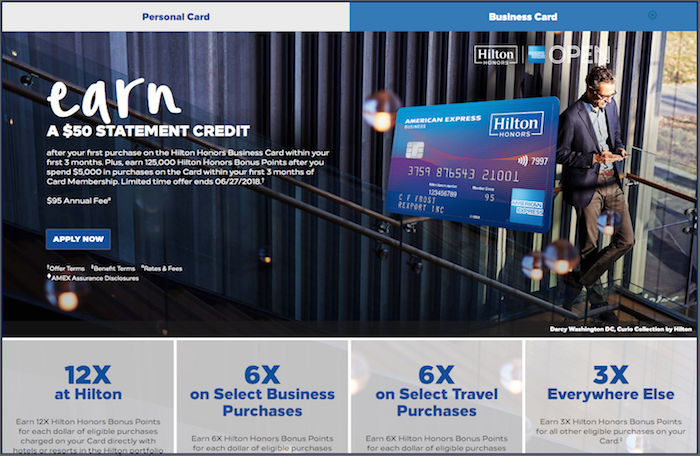

AmEx Hilton Business

Signup bonus: 125,000 Hilton points + $50 Statement credit

Min spend: $5,000 in 3 months

Annual fee: $95 (not waived the first year)

Bonus categories:

12x Hilton, 3x everywhere else

6x on “Select Business Travel & Purchases”

- on flights booked directly with airlines or amextravel.com

- on car rentals booked directly from select car rental companies

- at U.S. restaurants

- at U.S. gas stations

- on wireless telephone services purchased directly from U.S. service provider

- on U.S. purchases for shipping

How to get it: $50 statement credit offer appears while making a reservation on Hilton.com

Hat tip: Doctor of Credit

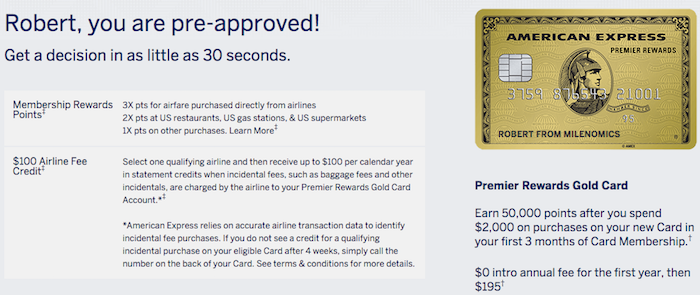

AmEx Premier Rewards Gold

Signup bonus: 50,000 MRs (no lifetime language, targeted)

Min spend: $2,000 in 3 months

Annual fee: $195 (waived the first year)

$100 per calendar year for air travel incidentals

Bonus categories: 3x on air travel, 2x at restaurants, gas stations, and supermarkets, 1x everywhere else

How to get it: Log in to your AmEx account and check for it alongside AmEx Offers on existing cards

See: Targeted: No Lifetime Language 50k MR American Express PRG Offer

Commentary

The $50 statement credit on the 125,000 Hilton Business card helps take the edge off the $95 annual fee that’s not waived the first year. I’d value Hilton points at around a half-cent a piece, though award availability can sometimes be annoying.

Still, since Hilton points can be pooled I think I’ll be able to get good value out of this card without too much effort. I much prefer Hilton points to free weekend night certificates that expire.

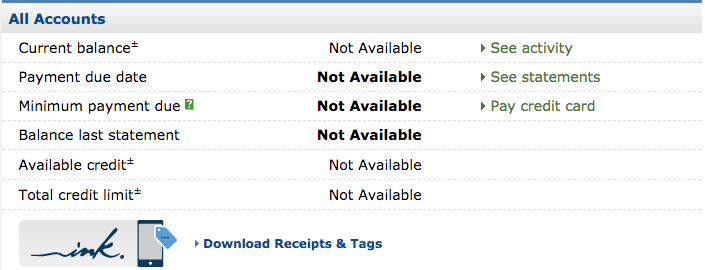

I applied for the Hilton card first, and the application went pending. While I was poking around checking credit limits on other existing AmEx cards I noticed the 50,000 Premier Rewards Gold offer pop up. When I checked a couple months ago, the offer was for only 25,000 so it might be worth checking again to see if you’re targeted. I had it on one of my Old Blue Cash cards.

50,000 Membership Rewards are worth a minimum of $750 to me in conjunction with the AmEx Business Platinum with its 1.5x uplift towards air travel

The Premier Rewards Gold offer said “Pre-Approved” but is there really such a thing as pre-approval in this game? At any rate, I was instantly approved for the Gold card even though the Hilton card was still pending.

A couple of hours later (on the weekend) the Hilton card was approved without needing to call reconsideration to prompt them.

One good thing about applying for 2 cards from the same bank on a single day is that the hard pulls will be merged into one. Not that hard pulls are that big a deal these days, but still.

For more info on AmEx approval policies check out DoC’s 25 Things Everybody Should Know About American Express (including guidance on how many AmEx credit cards you can have at a time).

Summing it up

AmEx’s “one signup bonus per product lifetime” rule is proving to be more workable than Chase’s 5/24 policy for me.

If they keep creating new products and sending targeted offers for cards I’ve gotten the signup bonus for in the past I’m happy to keep applying for their cards.

Strangely, the Hilton Business card is not eligible for referral as of yet. That may change, but even when it does I doubt it’ll include the $50 statement credit. Banks love to invite you to refer friends for inferior offers. It’s a shame because when in 2-player mode it would add even more value to signups.

Just wanted to alert folks to a caveat re: the “no lifetime language” you mention in the first paragraph . MileNerd had two posts this week re: his ongoing efforts to get a promised promo on an offer for an Amex card that also had “no lifetime language” in the offer’s T&C. Here’s a link:

http://www.milenerd.com/2018/05/follow-up/

Short summary is that he hasn’t, so far, gotten the bonus. So readers considering these offers who have had cards before might want to add the possibility of being shorted into their calculations re: applying in the first place. It has cooled my own strategy a bit,

ES: I appreciate the concern. I’ll offer a counter-point: I applied for and was approved for this card with the no lifetime language for second time in late march. I met the spend a few days after receiving the card, the bonus posted in early April for me. (total of 10 days)

My advice is whenever you apply for a card, prior to even receiving it, chat with Amex and ask for them to check and make sure the bonus is attached to the approved card. This gives you early leverage as you can escalate it and get the correct bonus attached before any spending happens or the 90 days expires. I had an issue in the past similar to milenerd’s. I was offered a no lifetime language card I had before (Business Gold), and something went wrong on the app. I found out about it because I chatted with a rep who told me no bonus was attached to the application. This was solved over the course of a few weeks back/forth with Amex. After I hit the spend the bonus posted correctly on that card as well.