Welcome to another edition of Shop Talk where we discuss what’s going on in our personal points & miles space and highlight what we think is interesting in the broader space as well. This is the kind of “Shop Talk” many of you are engaged in on a daily basis, so feel free to discuss with us in the comments section.

Robert: This week we have Dan Podheiser (@danpodheiser) joining us to discuss the time and cognitive bandwidth this game has the potential to consume.

Dan is a professional poker player in the Boston area. I’ve traded hundreds if not thousands of direct messages with him over the years on Twitter. It’s great to have friends like Dan in the game, and I’m sure our spouses appreciate not having to listen to [all of] our latest bright ideas on points & miles.

This week, I’d like to challenge each of us to scrutinize the actions we take in the pursuit of points & miles to make sure this game is a profitable one that doesn’t detract from more important things in life-like, I don’t know, watching our children grow up?

Dan, welcome to Shop Talk.

Dan: Hey guys, thanks for having me on the blog. One topic I’ve been thinking about lately is the idea of valuing our time, not just in executing the deals themselves, but in figuring out the deals to begin with. I’ve seen you and Sam both mention this recently, and its it’s become especially applicable to me since my wife and I had our first child 10 months ago.

For instance, we have to buy baby formula for my son. Usually we just do Amazon Subscribe & Save, which gets us an easy 5-20% off everything on our subscription list, plus 5% back on the Chase Amazon Prime credit card. A nice clean deal I don’t have to think about.

But last week, I found that Target had a deal where you could buy three cans of our preferred formula and get a $15 Target gift card. The formula was also on sale via the Cartwheel app for an additional 5% off. And I could stack the deal even further by going to Lowes and using an Amex offer to get $10 off $50 Target gift cards.

After spending quite a bit of time crunching the numbers, I determined that the best bang for my buck on this deal was to buy seven cans of formula using all of the methods I described. This would save me a whopping percentage vs. what I would have spent on Amazon, but in terms of absolute cash value, it would have only saved me about $60. Plus, I’d have to go to Lowes, deal with cashiers, go to Target — probably multiple Targets, because they might not have seven cans of that formula stocked. The whole ordeal might take two hours, and that doesn’t include the time I spent calculating the deal.

I finally realized — I value my time much more than this.

The thing is I find myself constantly drawn to the “crunching the numbers” part of the exercise. It’s like an addiction. And though it’s also kind of a relaxing hobby for me that I enjoy, it’s really just a huge waste of time when I consider the opportunity cost.

Sam: Dan, this is going to sound like a bad pun; but I really appreciate you taking the time to come on here and write, especially with a little 10 month old at home. I think this is an extremely important topic for everyone to think about and consider, so I also want to thank Robert for coming up with the topic.

There are two things I want to say in response to Dan’s opening comments. The first is that I agree there’s a certain amount of ‘fun’ in the puzzling of things like the above baby formula issue. So there’s some wiggle room there, and the same thing is true about miles and points. Some of it is fun, and finding the line for you (and your family) is important to finding a healthy hobby/life balance. I somewhat irrationally think my daughter might grow up and love booking complex award travel together with me.

The second, and more important (I think) issue is being ok with trading money for your time. That’s a VERY hard thing for a lot of people to do. We’re taught from a young age that our money is precious. Because Ducktales is back and I’m watching it right now at home I’ll use Scrooge McDuck as an example here. He’s got a giant bank vault full of pennies. A somewhat frequent running gag on the old show was that Scrooge would take a swim in the vault and could tell if a single penny was missing. He’d then spend a not-insignificant amount of time tracking down the missing penny. As a kid you can relate to this–your small piggy bank is all of your money in the world. As an adult I can’t help but cringe a bit at the visual of a billionaire Duck squandering minutes of his time over 1¢. Budgeting down to the penny is no more fun than scheduling your life down to the second.

There certainly are people who have more time than money, and there are people who are the other way around. That’s not a constant either–at different times of my life I’ve had an excess of time, at others I’ve had more money than the time to spend it. Both of those extremes present a different set of issues.

Extending this to the points/miles world: Especially for anyone reading the blog who is a newcomer I have some bad news. There’s a really steep learning curve in this game. Along the way you’re going to either trade your time or your money to get over that initial hump. Maybe you don’t need 10,000 hours to fully grasp this game–but you certainly need to invest hundreds, and maybe even thousands of hours. I hate to keep beating the point, but setting a value on your time is critical here. Pick an amount, and make sure you at the very least have it in mind while you start out in this game.

The words that Robert wrote above sting a bit, and I can’t help but think, are my miles and points pursuits detracting “from more important things in life-like, I don’t know, watching our children grow up?” Am I Scrooge, Chasing pennies? The margins in this game have certainly fallen. And the natural reaction to lowered margins are to increase volume to make up for it. That means throwing more money and more time at the problem.

I can’t help but think what’s a solution to all of this? Robert, what is your take on all of this?

Robert: I should disclose that I stole that line from one of my favorite podcasts Backside of Magic. One of the hosts, Jeremy, used it in a self-deprecating manner (with a healthy dose of levity) to acknowledge how utterly ridiculous it was for him to be experimenting with booking Fastpass+ reservations at the end of the day with with the goal being to attain reservations for other attractions the next day on the off chance the ride breaks down.

The points & miles game in general can be a fun diversion (we all need diversions) for people who like solving puzzles. But for others it’s an absolutely miserable fit.

I find I’m happiest when I’m doing the kind of things I like to do. For example, I like poking around on the computer and figuring things out. I hate doing yard work. So, if I can advance my position through points & miles shenanigans and avoid doing the kinds of things I don’t like to do it’s a win.

If you think back to what you did with the time you now spend tinkering with points & miles I bet you’ll find that some other interest has declined or been replaced by this new game. If those activities were fantasy baseball, playing video games, or watching a lot of TV, I’d say playing the points & miles game is a better use of time because it enables travel and/or puts money in your pocket. If those activities were regular exercise and reading books to your kids, well – not so great.

Sam, I remember you saying at some point how techniques learned in points & miles can be leveraged in other aspects of personal finance. I think Dan’s purchase optimization puzzler is a great example of this. But it’s worth considering whether we need to optimize every purchase decision down to the penny.

One of my grandmother’s financial sayings was:

“Mind the pennies and the dollars will take care of themselves.”

Another line I heard more recently and appreciate is:

“Kids learn what’s important by seeing what’s important to us.”

There’s a very good chance the personal finance patterns we model will be picked up by our children.

This becomes really important as kids start making their own financial decisions. Are they able to manage the data usage on their cell phone plan responsibly? Do they buy a $10 lunch every day when you yourself as a money-earning adult forego that indulgence?

I was walking through Disney World with my son who was 9 years old at the time. We went down there on a father-son trip, just the two of us, and we visited all four parks in one day. As we were walking through a mostly empty Epcot World Showcase after a storm passed through he turns to me and says:

“Dad, will you teach me how to use points & miles so I can take my kids on family vacations?”

It made me so happy and proud because it showed me the wheels in his head were turning and processing things at a higher level than what was in front of him at the moment.

I said to him in return that he may not realize it but he was learning all the time about how to take his family on great vacations. When he joined me on a Vanilla Reload Hunt when he was younger. When we stopped at the grocery store to pick up some gift cards and money orders. And when we were taking trips and figuring out how to navigate an airport.

These are all skills that give me confidence that he first time he goes on a business trip by himself he’s going to be a pro.

On the transactional side of things I’ve got a $20 rule which means I won’t beat myself up over some transaction gone awry, some discount not given at the register, some purchase not optimized. Sure, I’ll do my best. But things happen and I’m not going to drive across town on a Saturday afternoon to right a wrong. It’s just not worth it.

But Dan’s example is more complicated – more important – because it’s a subscription situation. An ongoing purchase. The mental energy he puts towards optimizing this purchase decision is going to play out over and over again. And perhaps he’ll have more kids.

And it’s more than just the formula he’s buying. It’s diapers. Wipes. He needs to get this right!

That said, another mantra I have is to scrutinize subscriptions.

We’ve all noticed how much service providers like subscription models. Amazon Prime, Netflix, Spotify, Dollar Shave Club, meal prep, wrist watches, you name it. On the sell side the subscription model makes perfect sense because a stream of recurring payments is far more valuable than a one-time hit.

But on the consumer side of things, we should only sign up for a subscription if it significantly and certainly benefits us.

One way to look at it is that the time spent optimizing purchases like these is building a mental database you can later refer to for later decisions. This happens big time in the points & miles game as you become familiar with more credit card programs and more rewards schemes.

So, I’d say it’s not a total waste of time scrutinizing purchase decisions, optimizing point redemptions, and finding easy ways to earn points & miles that work with your station in life. You just need to find balance. Everything in moderation.

Dan: Regarding your idea of building a mental database, Robert, I think that’s really important. Having already spent hundreds of hours over the years doing these types of transactions, I can pretty easily make snap decisions on whether or not to go after a deal. In the case of the baby formula, had I not already had plenty of experience, I might have gone after the $60 savings, only to be disappointed by the amount of time and energy I wasted in the process.

One thing I find interesting is how deals can often scale in conjunction with each other. Back in the Wells Fargo 5x/Tio heyday, I would make my rounds through the Boston MetroWest area, stopping at every grocery and drug store that sold VGC. I optimized my routes to be as profitable as possible, which sometimes included stopping at a Walgreens to buy one single $500 VGC. Now, in a vacuum, going to a Walgreens 25 miles from my house to make ~$12 in profit sounds ridiculous. The process of doing that alone would take well over an hour. But when the Walgreens is located in between two Stop & Shops that allow for $5,000 buying capacity each, the marginal cost of stopping at that Walgreens is basically nothing — I’m now making $12 for an extra 4-5 minutes on my route. All of a sudden, that Walgreens stop is a no-brainer.

And the same goes for a deal like the baby formula. If I’m already out on a massive VGC hunt that takes me to several strip malls, it’s not such an added cost anymore to pop into Lowes and Target and execute the deal. Now, instead of taking 2+ hours to save $60, I might spend an extra 30 minutes on my route. $120/hour prorated ain’t too shabby.

Sam: I’m absolutely digging this discussion. I’m right there with you Dan on the route optimization front. As you’ve both mentioned, crunching the numbers and getting that mental database going is really critical to future success in this space (and many others).

The thing I often get down about is that there has to be something ‘bigger’ than all of this. The game we play is fun, that’s for sure. But it isn’t sustainable long term and it doesn’t scale to infinity. Yes it is nearly ‘Free!!!!!’ money, and guaranteed returns, but it takes an awful lot of your time and energy away from other things. And the mental database, quick calculations, and overall ability to act on an idea are all transferable to a real business. And instead of doing that we’re chugging along wasting time at the same old game.

My point is that lines blur really easily here between skills that are only useful for travel, miles and points and those that can really set you on a path to future financial success. If you’re spending time grinding it out and just capturing pennies are you missing out on something bigger?

The flipside of the above is that a game like this can ruin you for future business dealings. There’s nearly nothing as much a ‘sure bet’ as this game is. Sure there’s P(malfunction) for all of the things we do, but besides that you have a pretty solid margin on your activities.

Take the current Plastiq promo. If you figured a way to generate a liability that was infinite, and used plastic to pay it with a 2% card you’d approach 2% profit on that deal, with virtually zero risk and almost no outlay of your time. How does this compare to a real business?

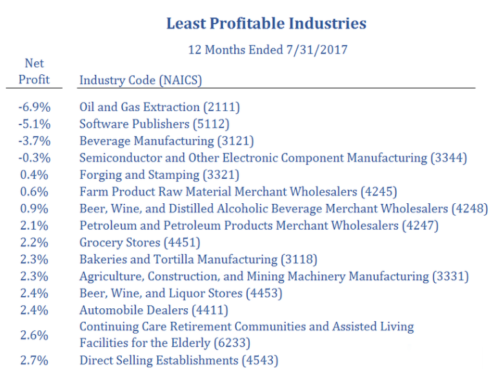

Yep… you’re probably running a more profitable business than the grocery stores, bakeries and tortilleria’s around you right now. But you can’t scale it to make the kind of bread they can.?

One thing I’ve started doing is burying my profits into other things. Trying to seed something…bigger, or at least something that gives me some additional free time. I’d hate to miss out on the really important things in life because I was standing in line at WM. I think there’s a danger in this game to take the ‘free’ money you’re making in it and overspend on travel with it. I certainly want to travel as much as possible–but not to the point where it gobbles up all my yearly profits in this game.

Dan: I constantly think about opportunity cost. When I use a Chase Freedom for 5x UR at grocery stores, I am “buying” those UR for 40 cents on the dollar, because I could have just used a 2% cash back card. When I redeem 200,000 UR for $3,000 in travel using the Chase Sapphire Reserve, I just “spent” $2,000 that could otherwise now be sitting in my bank account (earning a minimum of 1.5% APY these days).

No matter how many mental hoops you jump through to justify the value you get per point on a redemption, the reality is every time you redeem an Ultimate Rewards point, you are spending 1 cent. And make that 1.25 cents when you redeem an Amex Membership Reward. Are you still getting a good deal for travel you were going to take anyway? Probably! But are you justifying more expensive travel than you’d otherwise take because it’s “free”? And what about all the time you spent acquiring these points to begin with? Could you have used that time to make more money on another project, or invested that time into your career to boost your earning potential so much that you can just buy the travel you want with cash? These are all things we should all always be considering.

I think Robert helped frame this game nicely for me when we first started chatting about points and miles a few years ago. He said he was in it to improve his quality of life — nothing more, nothing less. I think that’s the right attitude to take. I worry sometimes, though, that we are creating more distractions, more anxiety and more bloat in our spending due to this game we play. Striking a balance is key, and it’s something I’m striving for.

Robert: Great stuff, guys. You’ve given us a lot to think about and as much as I’d like to take this in three or more directions we’ve run pretty long here already and I’ll look forward to continuing the conversation in future installments.

My thanks to Dan for joining us here on Shop Talk!

I love the discussion. I am over 60 so My attitude is I can always make more money but I can never make more time. I am a “low hanging fruit” ms’er. I won’t spend hours on a layover in some airport because it is a “free” miles ticket. I rather pay to fly non stop, direct to spend more time where I am going. I use sign up bonuses and regular spend and have plenty of mile and points to do what I want. After a number of years in this game, My system works for me.

It’s an interesting topic. For me, this hobby allows us to take more and better vacations. My most recent example, going to universal studios in February — it simply wouldn’t have happened if I didn’t have flight and hotel covered on points.

It takes a bit of time and mental energy to figure out the best points to determine for your purposes, and then finding an acceptable redemption.

For me and my family of 5, my “acceptable” is going to look different from other people’s.

During the 2008 recession, having debt and a lower income, I also had more time than money and I needed to stretch my dollars. I would take a lot of time reading ams writing coupon blogs, and visit various drug stores to get free or deeply discounted items. It was a thrill, believe it or not.

It also took enough time that if I had just worked harder and cranked out more freelance writing projects instead, I probably would have been money ahead to go for regular deals instead of extreme couponing.

Same goes for the points hobby. Maybe for an average person like me, it would be best sticking to the 5% rotating cash back, then the 2%, then the occasional sign up bonus might be the least time-intensive for the reward. But, the fun factor goes down, and that should count for at least something.

Great shop talk. There are so many intangibles both on the spend and earn side that it’s easy to get lost focusing on the simple I spent X cent per Y points. It’s always a good idea to take a step back and re-evaluate and adjust as necessary.

Great discussion, thank you for being frank and posting this on your blog. I have to agree that it takes thousands of hours to optimize your angle in this hobby and I seen plenty of people who only learned (or got fed?) one technique just through their hands up in the air when that technique ends. If you been doing this for a while, you seen plenty of ways of how to optimize a deal and usually don’t panic if something abruptly ends. Going for dollars over pennies is the good way to do it, and spending your time on exercise and reading books to your kids is a nice way to spend your time as well.

Thank you for the post.

Cheers,

PedroNY

I think that there is something about chasing a deal that gets my juices flowing.

I used to live in the US and moved to Canada in 2013. When I was in the US, I was playing the miles and points game and also doing a lot of extreme couponing.

There was a CVS in the building I lived in and a Walgreens across the street. During halftime of a basketball game, I could go to CVS to run a couponing deal and be back in time for the 2nd half. Given this, the time committment was not very much to me. I didnt have a car ( I lived in Boston), so chasing deals outside what was walking distance never appealed to me.

Now that I have moved back home to Toronto (Canada), the deals are few and far between. My wife allows me a monthly or every other month indulgence with a trip to Buffalo (USA) and I get all my couponing and miles and points runs taken care of during a weekend trip. Now, we never go if there is something important happening, but these weekends away always end up being a fun time. Every IHG accelerate promotion, I keep my eyes out for a place that I can make a road trip out of. The great thing is that we have actually discovered many off beat little gems (e.g. hiking trails or parks) that I have suggested to my wife as a fun destination, with a real goal of making a border run. I think my relationship with my wife is somewhat stronger for it, to be honest.

I just wanted to say that while this is time consuming, there is something fun about it. If you can figure out how to make it fun then it is like a money-making hobby. If I were to sacrifice something of value, then I would really not be doing this. But if doing the miles and points game means that a saturday when I would have been at home watching tv ends up being going for a drive to doing the miles and points thing and bond with my wife, I think that is a win.

Dont discount that value of the fun of this.

Al: Great opposing points. Both you and Kacie brought up the extreme coupon angle, which I think is a good analogy.

“Budgeting down to the penny is no more fun than scheduling your life down to the second.”

Truer words have never been spoken. I used to get my tires rotated when I got my oil changed. It was $20 and it only tacked on 10 minutes to the 30 minute oil change. The auto shop is right next to a nice park, so I would often go for a run or just sit outside and read a book. Then I got new tires at Costco. Free tire rotations! Or so I thought. They have never been able to rotate my tires in less than 60 minutes, and have taken up to 2 hours. And there is nothing near Costco but concrete and interstate. I have also tried to convince myself that I would be at costco anyways. However, I would never spend an hour (or more) at Costco. And I can’t even start shopping until my car is in the bay (don’t want to have a cart full of perishables sitting for two hours. So, I’m going to start paying $20 for more free time and have my tires rotated at the shop again, and I’m ok with that.

Funny. Exact opposite for me.

Our Costco takes an hour, and thats about how long it takes me to shop. So I drop the car, go shopping, and come out right about when it’s done. That extra 10 minutes at the independent shop would be waste for me… not to mention the extra $20.

The point is the same though — I optimize for time, and do the most efficient thing.

Best article on points and miles that I have ever read. Two thumbs up!

Extremely valuable insights and points.