This is a potentially very lucrative card for anyone who’s able to apply for, receive it and spend heavily on it. Uncapped 5% back cards are a rarity. Today’s post outlines one with a 2.5 month unlimited cashback period, after which your bonus from those 2.5 months might be paid out to you.

This card is not available to a wide geographic location. I’m posting about it here even though the vast majority of us won’t be able to apply for it for two main reasons:

- There may be readers in Philadelphia and surrounding areas who can get an account opened. If that’s you, carefully read this post and consider your options.

- Even if you’re not going to apply for this card much of this post is useful for any other similar card a CU near you might offer. Let this post push you to seek out local CUs and see what types of cards they have.

The Card and Offer

The card is called the “Visa Cash Back Credit Card,” and is issued by Freedom CU, a small 4 branch credit union located near Philadelpia, PA.

The offer, which can be found here is valuable for one major reason: uncapped 5% rewards on all spend between now and January 31, 2019.

This card doesn’t need a Royal Title like other cards we’ve covered here on the blog. This is a blue collar, hard working card, and the name given to it supports that background. The, “Visa Cash Back Credit Card,” if you’re able to apply for it and hit it hard (and the CU actually pays out) could set you up for a huge 2019.

Uncapped 5% is the stuff of legends. Uncapped 5% makes you do crazy things–like pay nearly 2% to liquidate cards or quit working and devote way too much time to spending on your credit cards.

What I like about the Card

If you’re expecting a snarky–“there are 5 things I like about this card and they’re the 5% cash back it earns,” type comment here I’ll actually be disappointing you.

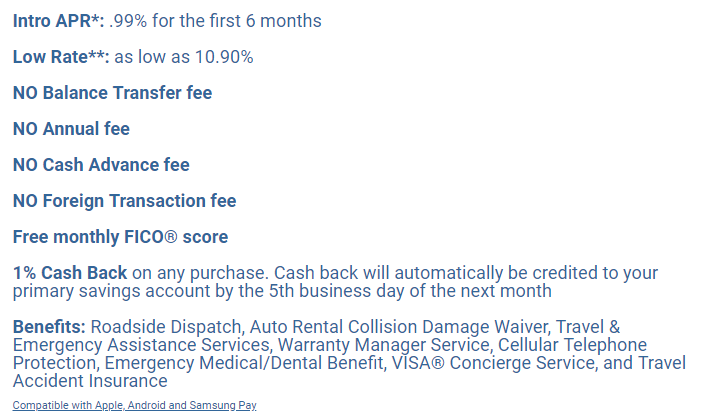

The 5% back is clearly the entire reason for writing this post. Why else would a card from a small 4 branch CU in eastern PA be seeing time on this stage? But beyond the 5% there are actually some interesting uses of this card longer-term. Take a look at the offer details for the card, which I’ve taken a screenshot of:

There is no annual fee, no FTF on the card either. That’s nice–but the earning at 1% make this card hard to recommend for anyone long term. It is possible someone without a better option might find the cellular telephone protection worth charging their cell bill to this card.

- The item that caught my eye here was the “NO Balance Transfer Fee.”

Long ago on this blog I detailed a rather risky method of generating a ‘safer’ Bill Pay target using no fee BT cards. That method ultimately proved futile and a waste of time. But times are very different now–and a No Fee BT card could be useful if you don’t want to make risky ‘anonymous’ payments to your Citibank/Amex/Chase cards for fear of shutdown.

Sure the interest will start charging from day 1–but a quick Bill Pay to bring the balance down to $0 would end up costing you about $2.40 a day on an $8,000 balance transfer (maximum monthly at WM). Would you pay $2.40 to protect your actual card from shutdown? If so the 5% is the ice cream and the no Fee BT is the cherry on top.

Will This Bankrupt the CU? Will They Even Pay Out?

I can’t really answer #1, but I can say that if the solvency of the CU is at risk they’ll almost certainly nix the payout entirely. The ‘safest,’ relatively speaking, way to play this is to not exceed or cycle your credit line each month between now and Jan 31st. Let’s call that 3 statements.

If you’re approved for a $15,000 credit line you’d be looking at $45,000 in 5% back if you don’t exceed the credit line on the card. That’s $2,250 back (minus fees, your time and travel). $2,250 is great , but there’s also some uncertainty there, a risk of malfunction that’s greater than 0.

As you scale this up the possible take home gets larger–as do the losses and the likelihood of malfunction. Say you churn your credit limit 3x a month for the 3 statements. That’s now $45,000 per statement, for a total of $6,750 at 5%. Again this is minus any fees, your time and travel. But this isn’t Gas, Grocery, Drugstore limited. This is straight 5% everywhere. Buy GC at Giftcardmall/Giftcards.com with portal cashback and only leave the house to drain them.

Note: I would not use Plastiq and pay 2.5% (or even 1.25%) to drain these cards. That could leave you holding the bag for thousands of dollars in fees if no payout comes after January 31st.

Of course as you increase your spending you increase the chance of shutdown. The payout of the 5% only comes at the very end of the spending period. That means you’re potentially out all of the costs associated with your $135,000 in spending ($15K CL x 3 times a month x 3 statements).

Will there be people shut down? Almost certainly. Will someone be approved for the maximum $30,000 line, cycle it 5x a month and be able to run the table on this and make $22,500 in a short period of time? I’d say that’s also possible. If 50 Heavy Hitters do the above the CU stands to lose about $1Million dollars on this card. That’s probably not sustainable for a small CU.

There is a fairly broad clause allowing the CU to wiggle out of paying anything. The following are the T&C for the card, a copy of which I’m preserving here:

“may be withdrawn at any time and is subject to change without notice.”

I’m about 90% certain the offer will be withdrawn and changed between now and January 31st, 2019. The most likely change would be a cap on the 5%. If I had to guess I’d guess I’d say a cap of $10,000 in total spending ($500) could be what is put in place. But then the question would become, “Would the cap be retroactive?”

An additional area I expect the CU to clamp down on are applicants for this card who do not legitimately qualify for CU membership. They could close accounts that aren’t in the correct Zip codes, and since no rewards are paid out until after Jan 31 you’d be stuck with no rewards.

Membership Restrictions:

According to the FAQ on membership:

You can join Freedom Credit Union if you:

- Live, work, worships or go to school in Philadelphia, Bucks, Chester, Delaware, or Montgomery County

- Are a family member of a current member. (Spouse, children, parents, siblings, grandchildren, grandparents, stepparents or stepchildren.)

- Employed by one of our Select Employee Groups

The Select Employee Groups list mentioned above appears to be a list of local and regional employers, and can be found here.

Wrap Up

5% everywhere for a little under 3 months is a great offer–and one that I’d take if I had a legitimate way to apply for this card. Small CUs often times create insane promotions, as the above CC proves. Even if this isn’t an offer you can go in on consider looking at the smaller Credit Unions near you for something similar.

If you’ve already been approved for the card or have any data to share please leave a comment below.

In closing, the above offer likely won’t last. It isn’t ‘secret’ or hidden–but it is possibly too good to be true.

Nice writeup. This is a great deal, no need to abuse it.

I live in Philly and applied. There is an online app, but as you’d expect, it has to be manually reviewed and processed by an underwriter, so there’s little chance you can do this outside the region. No hard pull yet so I don’t know which bureau they pull.

Thanks J. Best of luck with the card. I’d appreciate if you can keep readers in the loop.

“Sure the interest will start charging from day 1–but a quick Bill Pay to bring the balance down to $0”

Wouldn’t that negate the 5% due to the “Balance must remain through first billing cycle” term?

Aahz: You’re absolutely right. If you did a balance transfer and paid it off immediately it would not qualify for the 5% bonus. As you mention the interest charged in 1 month would negate a lot of the 5% back (approx 20% of it), but even worse the T&C cap the 5% for BT at the total credit line. The discussion about using the card for a monthly BT and paying off immediately that I was outlining would be if someone was trying to extract utility *after* the bonus period is over. In that respect the card is nice because you can BT other cards to it for $0 fee and pay it off quickly with anonymous bill payments instead of doing those risky anonymous BP to your ‘real’ CC. This is a very, very niche tactic–but some do look for $0 BT targets like this.

I forgot to report back on this one. It was weeks before they called back about my application to ask if a $10k line was acceptable to me. I then had to go through the process of getting a savings account set up with them before they could open the credit card. The savings account app got stuck in banker hell for some days, then they finally said they were shipping out the card which would take 10 days. Unfortunately, I was going on vacation for a few weeks and just missed getting the card in the mail. I finally got it in my hands in January, and there were issues with fraud alerts. Given the manual nature of everything with them and their very primitive IT, I was expecting difficulty getting paid out if I hit this too hard, but the bonus was there automatically in full on February 1. I wish I had more time to experiment with this. Hopefully they bring it back again. They were still openly promoting it in January with no signs of wavering.