Editor’s Note [Sam]: The following is a guest post, written by long time friend to the site, Elaine Friedman. With the recent news of Citi pulling travel insurance benefits on all cards I though it would be helpful to share a real world view of what the Trip Cancellation and Interruption coverage from Chase is like. I think Elaine really gets to the heart of the issues that are not given enough coverage online: Most notably that this coverage is not a benefit administered by Chase, but rather by their 3rd party insurance company. Nowhere are Elaine nor myself claiming this is bad/good, simply that this means an extra ‘layer’ between you and the claim process. As you’ll see the process is not always simple, not always successful.

There’s a truism that you never really know your insurance coverage until you file a claim. It is certainly true for travel insurance that comes with selected credit cards.

Since it hit the market in 2016, I’ve been a big fan of the Chase Sapphire Reserve Visa Card, or my CSRes, as I fondly call it. I put nearly all my out-of-pocket travel expenses on it. Not only do I like the 3X multiple for travel, but it has an impressive set of benefits.

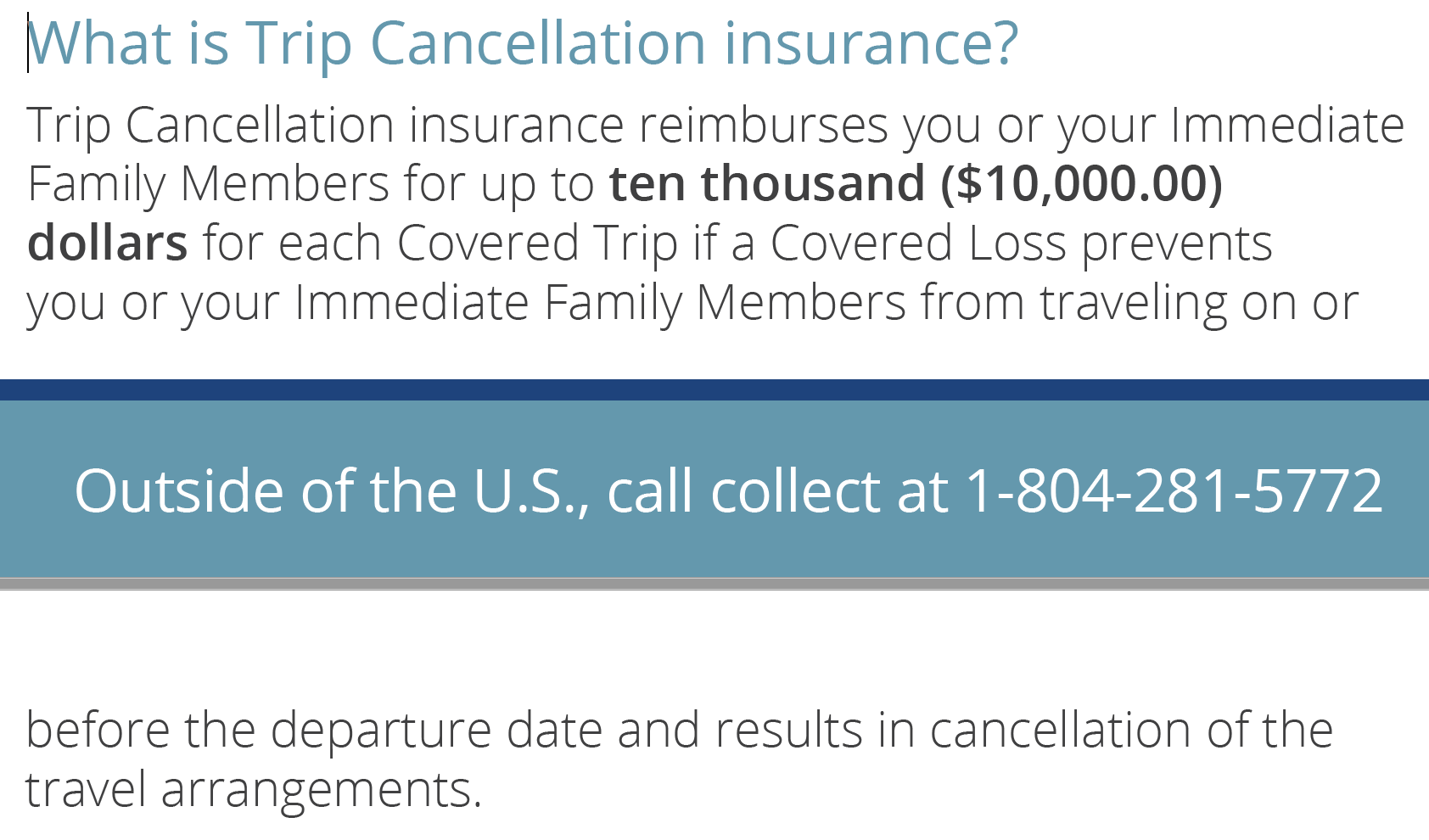

What really got my attention was the Trip Cancellation coverage. Why? Because I wanted to book a cruise for a date eighteen months in the future. If I was willing to pay in full in advance, I could get a very hefty discount. But what if someone got sick? And what if that someone wasn’t me, but a close enough relative that I’d need or want to cancel the trip?

A careful reading of their Guide to Benefits was promising. It appeared that Trip Cancellation coverage reimburses for a loss when canceling prepaid non-refundable travel arrangements because someone in my immediate family gets sick. Chase says:

What Exactly is a Covered Loss?

Could I really cancel the trip, lose a big chunk of money, and then have the loss reimbursed by Chase if, let’s say, my granddaughter got sick, and my daughter needed my help?

“Yes,” the Chase benefits rep assured me. In fact, she continued, “There were many such claims during the last flu season, when travelers had to stay home to care for immediate family members.”

And the definition of immediate family is very broad:

Immediate Family Member – you or your Spouse’s or Domestic Partner’s children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephew

Now I haven’t – fortunately – had occasion to test this, and it is the third party claims adjusters, not the Chase benefits reps, who make the final decisions. But that is how it is supposed to work. So I booked that cruise!

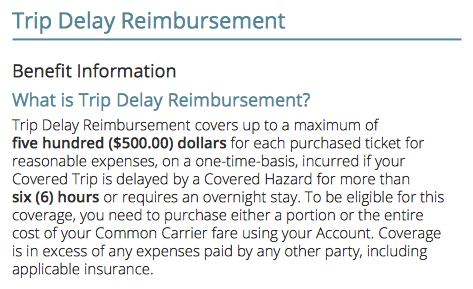

I knew about the card’s pretty straightforward Trip Delay coverage: if I was delayed 6 hours or more or a delay meant an unexpected overnight stay, expenses for meals; lodging; ground transportation; toiletries; medication; and other personal use items would be reimbursed up to $500.

Putting Trip Delay Coverage to the Test

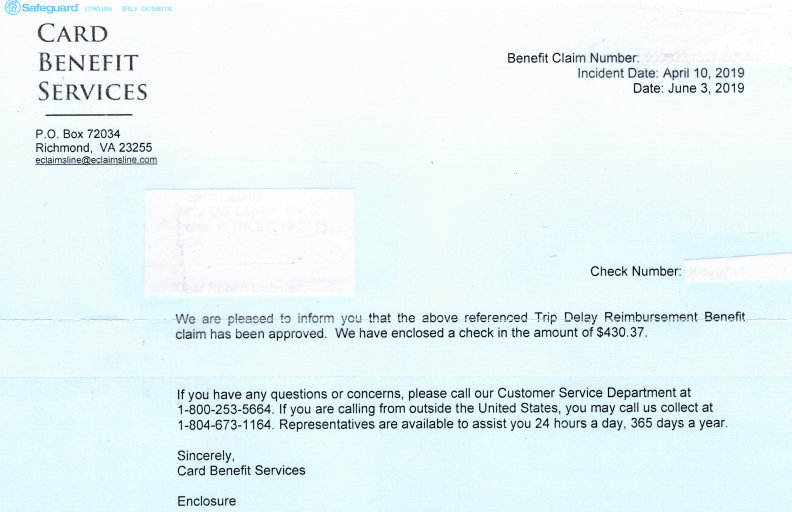

So on a recent trip when a huge storm cancelled all flights in and out of Denver, delaying me a full 24 hours, I was confident that my out-of-pocket costs for an extra NYC hotel night, Lyft rides, and a few meals would be reimbursed. And they eventually were, to the penny. More about that “eventually” later….

What I knew little about was how the CSRes coverage handled Trip Interruption. I was able to alert the Denver hotel in enough time to cancel my first hotel night without penalty. But had the hotel charged me, Chase would have reimbursed. So far, so good.

Finding Where the Line Is Between Covered and Not

Here’s where it got dicey: When JetBlue canceled my Wednesday JFK > DEN flight, they couldn’t get me on another flight until Saturday! Knowing I could book something sooner myself, I opted to instead get a full refund of the $113.30 – actually I’d paid in 7,653 Ultimate Rewards points – for a one way ticket that would have cost me $113.30 if done as cash booking through the Chase UR Travel Center. I paid no taxes or fees; just a nice, clean, cheap 7,653 points.

Unfortunately, the best flight I could find for the next day was $295, considerably more than double the JetBlue refund. Still, I had to get to Denver.

Which was when when I learned that not one of the CSRes travel insurance categories – not Trip Cancellation, not Trip Delay, and not Trip Interruption – will reimburse that difference. In the end, I booked that Delta flight using 19,666 Ultimate Rewards, saving a little, but I still spent significantly more than what I’d paid for the original JetBlue flight.

I’ve since heard similar tales of travelers surprised to learn this too. When they bought new tickets to get to their intended destinations, or had no choice but to rent a car to get there, the CSRes travel insurance was to be of no help at all.

While my love affair with CSRes has cooled a bit, I still value the generous Trip Cancellation coverage. Doing research for this post, I found myself attracted to the CITI Prestige card. According to that Guide to Benefits and confirmed by a benefits rep by phone, their coverage would have paid for the new flight, as would the coverage they currently offer with a few other CITI cards. But not for long – as of September 22, 2019, CITI is discontinuing Trip Cancellation, Delay, and Interruption on all their cards. So for now, I’ll stay with Chase.

Tips and Suggested Best Practices

First I’ll cut to the chase – pun intended – and tell you that in the end, I did get reimbursed for all my Trip Delay expenses, but it was very time-consuming and not easy.

The Trip Delay claims process requires, understandably, a copy of the credit card statement on which you charged your air ticket. But because I paid only Ultimate Rewards points and no cash to buy the original ticket, there was no transaction line for a cash amount on the CSRes credit card statement. It did show I’d used UR points that January, but we’d used lots of URs that month for both hotels and airfare, so the amounts did not match.

So I wrote a statement detailing that, and instead submitted an Ultimate Rewards Travel Center receipt for the cancelled flight. But that receipt does not tie the ticket purchase to the card used; no trusty last four digits of the CSRes number appear anywhere on it.

So the phone calls began, with the claims rep asking repeatedly for a “credit card statement showing the transaction” or something called a “rewards statement.” That was a new one for me, and after more calls, I learned that neither the CSRes card reps at Chase Card Services nor the travel reps at the Chase Travel site had ever heard of a rewards statement either. I finally asked the claims rep to have the adjuster handling my claim call me.

Then I remembered that I had paid extra for a JetBlue EvenMoreSpace seat! And I’d done it the very same day, using my CSRes. Sure enough, I was able to find a transaction for that seat on my credit card statement. I quickly uploaded the statement to the claims website. And that worked!

By the time the adjuster called two days later, it wasn’t to answer my question on this so-called rewards statement, but to say that my claim was approved. She turned out to be a lovely woman who was quite knowledgeable. I took the opportunity to ask about the elusive rewards statement the phone rep insisted was required in place of the credit card statement showing a transaction.

The adjuster explained that if I hadn’t bought that seat upgrade, she would have requested a rewards statement directly from Chase as a way to prove that I’d used URs attached to the CSRes. Why the phone reps thought I could get it myself is unclear, but apparently such a document does exist or can be generated somewhere in the bowels of Chase at the request of a claims adjuster. It might take a few weeks or more, she noted, but eventually she could have gotten what she needed that way.

I didn’t ask whether the rewards statement was detailed enough to show if a claimant had moved URs from a Chase Freedom card or another CSRes account. Hopefully not. But I made a mental note that I’d rather not have to depend on an adjuster successfully getting one from Chase, or what it might actually say!

Going forward, I will make sure that, anytime I use Ultimate Rewards points towards travel, there is some cash transaction on the CSRes at the same time. Just as paying the tax on an awards air ticket provides a record on your credit card statement, I’ll then have an easy way to prove that I used URs attached to my CSRes for the booking in question.

For example, here’s the payment screen from the Chase Travel Center showing an air ticket will cost $190.30 or 12,686 URs:

But I won’t pay that. Instead I’ll pay 12,000 URs + $10.30:

Or I’ll make sure to upgrade my seat at the same time so that charge will show as a transaction on my credit card statement. As tempting as it is to use nothing but URs, so your out-of-pocket cost is zero, doing it this way provides a little insurance for your insurance. It may someday speed up a claim, avoid repeated emails that a claim is incomplete, and save you a bunch of phone calls to resolve it all.

More Tips For the Claims Process

Though I didn’t promise multiple tips, here’s a few more:

The emails that come during the claims process requesting more documents are not well tailored to specific claims or issues. There’s clearly an algorithm at work that just doesn’t always fit. I was baffled why I got repeated requests to upload the same items, and it was only on calling that I learned from the phone rep that the adjuster couldn’t read the boarding passes well enough. I quickly sent new scans with a much higher resolution.

It is ironic that while Chase wouldn’t pay for the new flight, they still wanted to see the boarding passes for that flight, so save everything!

Finally, it was only after multiple phone calls that I requested a direct call back from my adjuster. I expected to be told that wasn’t possible, but not only did the rep take that message, but the adjuster called back within the promised timeframe, and on a national holiday too! Should I have to file another claim, I will remember I can ask for a call from the adjuster, and I’ll do it much earlier in the process.

Insurance claims are never easy and insurance coverage is the clearest only after a claim is settled. With hopes you will never need to confirm that yourselves, happy travels!

Disclaimer: The author is not an insurance professional, has no professional relationship with Chase, and cannot in any way, shape or form promise or guarantee the coverages described here. Please do your own due diligence!

Are there any other cards, chase or others, that offer travel insurance benefits such as this?

Hi Kathy, Here’s a link to a blog post that can get you started. A few caveats, though:

1) The CITI benefits are changing radically from what is described in the following link on Sept. 22, 2019; and 2) You really need to dig into each credit card issuer’s Guide to Benefits because Frequent Miler’s post is just a summary, and, according to a note at the bottom, was last updated on Oct. 28, 2018.

https://frequentmiler.boardingarea.com/ultra-premium-credit-card-travel-insurance/

Great post Elaine! I had no idea the coverage was so robust.

Thank you!

The lengthy back and forth and numerous phone calls is, unfortunately, common in my experience — I’ve never had a Chase claim go through quickly/easily although like you, it was paid eventually.

FWIW, Eclaims/Benefit Services is powered by Allianz and I got the exact same runaround when filing directly with Allianz several years ago. It’s one thing to put up with frustrations on a free benefit, but the time-wasting calls is the entire reason I stopped paying for “premium” insurance with Allianz.

Thanks, Becky, for the info that Eclaims – the benefits servicer Chase uses – is Allianz. I wasn’t aware of that.

A few years back, we had a small claim on a policy from MH Ross, which was processed by TripMate, for some medical bills we had during a southern Africa trip. It was easy to file and paid off with little drama.

Now, we prefer to get an annual travel insurance policy through GeoBlue to cover foreign medical expenses and emergency medical evacuation. A few days before a big foreign trip, we sign up. It remains in force for a year. Then we let it lapse until the next big trip.

Between this:

https://www.geobluetravelinsurance.com/products/multi-trip/trekker-5-overview.cfm

and the CSRes, we have a good (enough) combo for both medical and trip cancellation/interruption/delay coverage.

Wonderful post. Does the coverage differ from the Sapphire Reserve and the Sapphire Preferred?

Yes, they do differ in some respects. Trip Delay with the CSRes kicks in at 6 hours or an overnight stay; CSP is 12 hours or an overnight stay. From a quick look at the Guide to Benefits which I found online, the Trip Cancellation coverage appears to be the same as what I described above. But I noticed a few other differences as well.

I suggest you google “Guide to Benefits Chase Sapphire Reserve” and “Guide to Benefits Chase Sapphire Reserve” so you can compare the specific coverages that are important to you. Or call in. When I was preparing the post, I spoke to a CITI rep who was able to run through all the coverages the CITI cards then offered.

If you plan to depend on a card’s travel insurance, it pays to check the specifics beyond the claims in an ad or the summary in a blog post. Be careful to find the most current online benefits guide and be aware of any changes that have been announced for the near future!.Good luck!

I did something similar years ago comparing the benefits of the CSP to the no fee Sapphire (CS), and IIRC there was no difference between the CSP and CS travel insurance protections. Never (luckily) had the ability to test it out. And I don’t know if they are still identical. But if so, it would make for pretty great trip coverage without an annual fee.

Wonder if they would have covered expenses up to $500 between the cancelled flight on Wednesday and the 1st available flight on Saturday had you not cancelled and rebooked yourself? Technically, your trip would have been delayed by 3 nights at that point and covered under the trip delay? (I know you had to get back, but it got me wondering…)

Really good point, Dan.

Now $500 doesn’t go that far, especially in NYC where I was stuck. But a couple traveling together whose tickets were both purchased with the card would get up to $500 pp.

Anyone out there who had a claim following a several days long weather event, or something similar? Not that I am wishing a trip delay on myself or anyone else, but time may tell!

Just wanted to bring up that trip delay reimbursement has a different definition of who is covered than trip cancellation. I was recently reimbursed a pro-rated amount because my parents were not covered by trip delay.

This is a good point to emphasize. And underlines the importance of really understanding the benefits you have if you plan to depend on them and/or can’t easily handle the cost of unreimbursed claims.

The car damage mentioned above is a good example. Having to pay for a more expensive ticket to get from NYC to DEN – in the end I was out of pocket just some UR points – is very different than having to cover expensive damages to a rental car!

Sorry, car damage is mentioned below.

An acquaintance who saw this post reached out to me with two “war stories.” Here they are, quoted with permission:

“… it’s always interesting to compare war stories with travel insurance claims. Our favorite personal one… was our ridiculous (and infuriating) experience with a claim for reimbursement for cancelling our first trip to Vietnam when my wife was diagnosed with cancer and started treatment. This was on a stand-alone travel policy that we bought for the trip. The insurer denied our claim with the explanation that her cancer was ‘a pre-existing condition’ because of her genetic disposition to cancer! Needless to say, we fought it and eventually got our claim awarded. We had to go back to the Oncologist and other medical providers to get info to fight our claim denial – all while suffering through chemo & radiation.”

I won’t quote the final sentence of that paragraph with his summary description of the entire episode, but as you can imagine, it was not very complementary.

He goes on with:

“… another interesting but more positive travel insurance example: while I was in Cleveland a couple of years ago a big tree limb fell and went right through the back window of my rental car while I was idling at a curb. Freaked me out (and could have killed me). Deductible on my personal auto policy wouldn’t cover the damage, but my credit card paid for it all, no issues! It pays to know what your credit card benefits are!”

Your friend’s experience with the tree falling on a rental car is exactly why I pay for the CSR. In my opinion, the best benefit is that it pays for PRIMARY rental car insurance, not SECONDARY like almost every other card on the market. (And what your friend used ultimately)

For your friend’s example with his rental car in Cleveland, if he had used the CSR he wouldn’t have even had to bother checking with his personal auto policy (and possibly risking a rate increase). Just use the CSR to pay for the rental car and they will pay for any damage to your (not another car however)

This card is now a game-changer and in my wallet any time I travel..

Interesting. What if you dont have actually have your own car insurance (have driving license, but dont own car)? Only have the credit card insurance. Would credit card “secondary” insurance cover entire rental car damage?

Gene, I am not up to speed on the car rental insurance, and do have my own auto policy, but I believe that some folks carry certain credit cards to deal with the exact situation you describe. If no one else weighs in here, try googling for more info, or call the card provider.

Very helpful post, thanks! One thing I have wondered, since I pay for a lot of flights and hotels with points, is whether lost baggage, trip cancelation, car rental insurance, etc. still apply. Anyone know? If I book a flight with points, but put the taxes on my CSR am I covered? If I use Ultimate Rewards to book a rental car, do I still get the insurance as a card holder? Or if I use Marriott points to book a room, do I get any benefit from the CSR? Thank you,

–Kyle

Lots of questions here! As I wrote in the post, I did pay for my initial NYC > DEN ticket with URs, and Trip Delay was covered. You’ll need to look at the Benefits Guide to verify, but I believe that if at least a portion of the cost was paid for with the CSRes or it was all paid in points, you’d be covered. As for using Marriott points to book a room, I believe you’d need to pay something upfront on the card to have any coverage. I just booked a Marriott on points and no money exchanged hands, so I can’t see how the CSRes coverage would be involved at all. Good luck!

Thanks for the info Elaine!

Your claim situation was a lot easier than mine. It took over 4 months, numerous phone calls from me to them, virtually no help, explanations, or phone calls from them, and repeated requests from the ‘Eclaims’ company for the same data which had been formerly provided. It was a nightmare!! It eventually resolved, but it was not fun. Next time I will buy my own insurance.

Sorry to learn your claim was a nightmare. Much depends on the rep handling the claim but the system is hard to navigate even in the best case scenario. Unfortunately, buying your own insurance is not necessarily a guarantee that a claim will go through more easily. Many claims are farmed out to third party processors and there are both competent and incompetent reps everywhere. Here’s hoping you won’t need to file another claim!

That said, I am currently planning a seven week trip that will take me to multiple countries. Lots of flights and hotel stays. After my own experience, when it wasn’t always easy to remember how I paid for various things, I am now carefully tracking everything, since some bookings are in my name and others in my husband’s, and we both use multiple credit cards. I figure it is easy to track it now and if I have to file any claims, it will be much simpler to reconstruct and assemble any needed receipts.

Update and PSA: One thing that I did not research when doing this post was the impact of pre-existing conditions.

A friend who read the post reached out to me to say that he did look into it. What he learned was that for the CSRes coverage to kick in for a cancellation due to illness, travelers (and their family members) need to have been stable for 60 days prior to making the first trip payment. He helps care for an elderly parent, so he intends to get a doctor’s note to verify that.

Be advised that I got this info second hand. I haven’t checked it out myself because other projects and obligations currently demand my time. But If you may be counting on this coverage, and you or a relative do have pre-existing condtions, please do your own due diligence! You may want to get whatever documentation you could need before you book and pay!

Hi Elaine, very helpful article. I recently got the CSR card and booked my first international travel ticket using the card ($$ not points). Unfortunately, I have completed the outbound leg of the journey (US to Singapore) but I might have to cancel/reschedule my return from Singapore to US due to a medical emergency (no pre existing condition) for myself. I have the medical forms filled from the doctor and I am wondering if I should file for trip cancellation or trip delay based on the refund. Eclaims says they only pay for pre-paid travel which in my case will be $450 change fee. The hefty fare difference will still come out of my pocket since it is not pre-paid.

So I am wondering if I should just cancel the return flight and get reimbursed the entire amount of what my “outbound (SIN to US) ” fare is (I got the inbound and outbound far breakdown from the carrier), I can try and book a one way that’s equal or less than the potential outbound reimbursement from Chase to avoid any out of pocket expense. Any suggestions will be helpful before I cancel/reschedule. Thanks!

I am sorry you have to cancel and for a medical issue. Unfortunately I am traveling myself and dealing with a medical emergency of a family member so I am not able to think through the best option for you. I hope you work it out and get better. Happy holidays. Elaine

Hi Elaine –

Very helpful post on a complicated topic. Thank you for posting.

Have you compared and contrasted Chase Reserves Travel Benefit and other 3rd party providers of travel insurance and determined Chase Reserve Travel Benefits are comparable to other 3rd party providers?

Thank you,

Alan

The short answer is: not recently.

It is a complicated effort since you are not comparing policies that offer the same benefits. Also, third party providers usually insure one trip, not every trip paid for with a particular credit card.

My husband and I maintain an annual travel policy through GeoBlue for medical coverage over and above our regular medical insurance. That plus the travel coverage from the CSRes is the right combo for us.