Last year here on the blog Robert broke the news about the 3-for-all promotion from American Express. This was a referral opportunity–The person doing the referral was rewarded not only with a bucket of Membership Reward Points, but with 3 extra points (uncapped!) for three months.

The planets aligned in a way that we might never see again, and this uncapped opportunity collided with the ability to use American express from home for huge amounts of Membership Rewards.

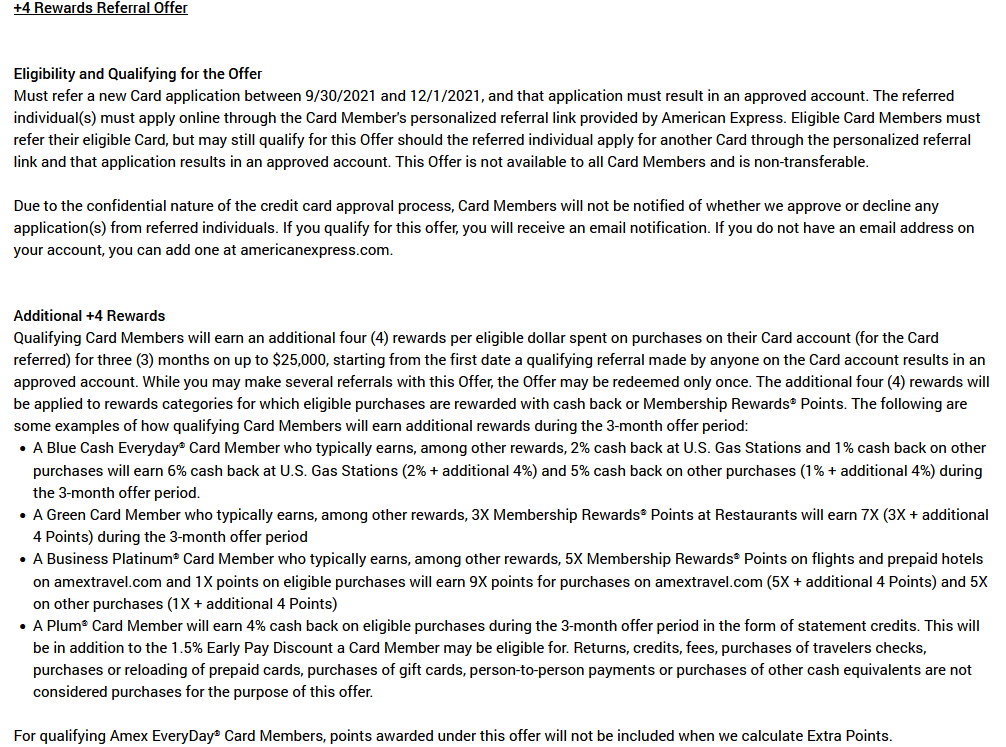

This year the referral promotion offer is slightly different. Instead of three extra points for the person doing the referral this year you earn 4 extra points per dollar spent. For this reason we’re calling this a ‘4-for-us’ referral. One big change this year: spend at 4x is capped at $25,000 per referral for a maximum of 100,000 Membership Rewards per referral. We’ll dig into the opportunity, and how to stack it for even more earning. Finally we’ll talk about the timing of this offer as we approach the end of the year.

4-For-Us: How it works

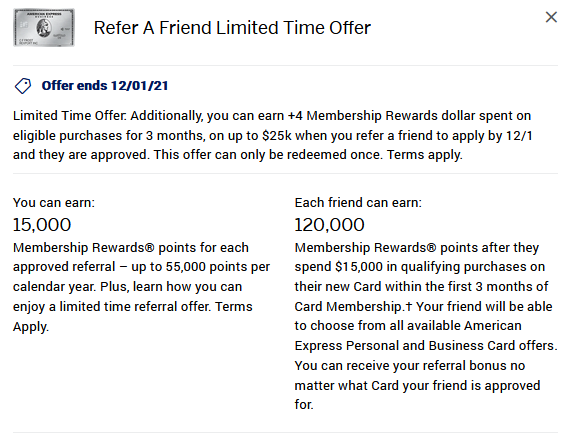

The 4-for-us Promotion has supplanted the standard offer almost all cards that American express offers. There are a few exceptions, but for the most part the bucket of Membership rewards points you used to earn for a referral, up to a yearly maximum of 55,000 are gone for now–replaced entirely with the wording about the referral spending bonus:

From now until 12/1/2021 if you refer someone and they’re approved for any card your 4x in earning will run 3 months and up to $25,000 in spend. Eligible purchases are basically anything that currently earn points. The terms and conditions even go into specifics, and outline ways to earn as many as 9x MR on specific category bonused spend.

This isn’t even just a Membership Rewards bonus, depending on the card you refer from you will earn an extra 4x MR or 4% cash back, and any bonus category points earned will also be paid out. This last point means cards like the personal gold will be earning 8x MR at grocery/restaurants, a Blue Business plus will be 6x MR anywhere, and so on.

Bottom line is that if you’re going to spend $25,000 anyway the referral bonus on American express cards is now 100,000 Membership rewards, or $1,000 in cash back on a Cash back earning card. a ridiculously high amount for a single approval of any American Express card by someone you refer.

A more complete image of the terms and conditions can be seen here:

Referrals, a Quick Refresher

This sounds fantastic: 100,000 Membership rewards if you spend the whole $25,000. BUT you can’t get this 4-for-us offer unless the person you’re referring is approved for a card. Be sure to read the excellent post Robert wrote years ago on the universal referral program. The biggest thing to be aware of is to not refer yourself for a card.

If you don’t have a spouse or family member finding a trusted friend to swap referrals would be ideal–and remember the approval just has to happen–you don’t need to meet the sign up bonus on the new card, or even be a first time cardholder. American Express’ referral program lets you generate a link for a specific card, say a personal Gold, and then navigate to any other card they offer. This means you can refer from the best card for your earning and ask your family/friend to apply for a card like a Personal Everyday, Delta Blue or a Business Green ($0 annual fee first year) to just get the clock running on the 4x.

Once the person you refer is approved you’ll receive an email like this:

A similar email was sent out last year. For some reason these emails seem to not always arrive right after your referral is approved for the card. In some cases last year people, myself included, never received the email. If you don’t see one after a day or two I’d put a small charge on the card you referred from and see if the 4x extra points post. Amex chat reps have been less than helpful in verifying the status of offers like this in the past.

What Card Should I Refer From? What should my P2 Apply for?

On a recent episode our Podcast we were giddy, almost unable to contain ourselves when this opportunity first arrived on September 30th. Little did we know just days into October massive account closures would occur, apparently tied to approvals of extra Business Platinum cards.

This waive of shutdowns had a chilling effect on us, and I didn’t do anything until I was relatively certain I had made it through the shutdown wave. Now having crossed that challenging period I’m looking to do this referral as many times as I can.

My initial idea was to refer from my Blue Business Plus for 6x MR anywhere. This felt like a great way to not cannibalize my current Grocery, office Supply or other highly bonused spending. I’m constantly looking at the opportunity costs of decisions I make–and a BBP at 6x would let me use avenues that I’m not currently using, expanding my earning instead of just nudging up the multiple on current earning.

In the end, at least on my first 4-for-us referral the Personal Gold 4x Grocery/Restaurants won out over the Blue Business Plus. A referral on a Gold right now would earn 4X up to $25,000 in spend, which could straddle the Jan 1 reset of the $25,000 personal Gold Grocery cap, allowing me to use this 4x + 4x for 8x at restaurants right now, and then for 8x in January as well.

Questions Answered: American Express’ Responses.

Even with 3 pages of Terms and Conditions read it wasn’t 100% clear to me about a few unknowns. For this post I was able to contact an American Express Spokesperson and ask the following, with their answers in italics

- Q: Is this limited to one per person? one per card? Can you do this more than one time if you have it as an offer on multiple cards.

- A: If a Card Member has more than one eligible Card, they can earn the referral bonus on each of the Cards they have, but only once per Card.

- Q: Will these points earned be 1099’d like a standard referral credit of Membership Rewards are?

- A: The points earned through this offer will not go towards your referral cap because you must spend to earn them, so Card Members will not be taxed on them.

- Q: Will spend on employee cards count for the $25,000 — if the referral comes from the main account.

- A: When this referral offer is earned, qualifying purchases made by any additional Card Members on your account, such as employees, will be included in the offer, meaning +4 rewards will be earned on these purchases and they will count towards the $25,000 spend ceiling.

The biggest takeaway for me is that this is something you can do one time on each of your American Express cards. Don’t forget you can also upgrade American express cards while a promo like this is attached.

Taking it to ’11’ — How to Maximize This

The offer itself is good enough that almost everyone who’s a heavy spender will do better under this current offer than from the old 5k/10k/15k/25k flat referral offer. That’s true for heavy referrers who were capping out and for anyone holding lower tier cards where the old offer was 5,000 or 7500 MR. Even if you spend just $3,000 a month for 3 months you’ll be looking at 48,000 more Membership Rewards under just one referral.

But there’s always a way to take this further. One way is by using a Business Platinum for the referral card. For whatever reason the Business Platinum still retains the old 15,000 MR referral structure and adds the 4-for-us on top of that.

The 15,000 would be part of your 55,000 yearly cap–and that could be as little as 0 MR if you’ve already met the cap. The problem as I see it with this referral is that the base earning on a Business Platinum for most people is going to be pretty inferior to most other American express cards.

Take that Blue Business Plus that I was considering earlier, the $25,000 in spend on that would generate 150,000 MR (2x for the base spend, plus 4x for the 4-for-us). That same $25,000 on the Business Platinum in nonbonus spend would earn just 125,000, plus this 15,000 in referral points for a total of 140,000 MR.

That’s not to say there aren’t ways to get above this 140,000 point cap. 1.5 Membership Rewards for spending over $5,000 in a single transaction would bump this to 152,500. Book a ton of travel on American Express and you could earn 5x on the Business Platinum, which would certainly be a great kicker to the 4x as well.

Generally speaking however, most people won’t have a better total with the Business Platinum than a Blue Business Plus. But the ideal, the ultimate way to really take this to the next level would be to double or triple dip stacking a referral with a sign up bonus or another spending bonus you might have access to. Is 9x the maximum you can earn with this promotion? I don’t think so, and we’ll have a lot of fun testing that as the next 3-5 months go on.

Repeat, Especially as the End Draws Near

Last year I regret not doing another 3-for-all, and this year I want to do as many of these 4-for-us referrals as I can. I’ll be bouncing them from P1->P2, and hope that as 2022 begins I’ll have a few months more of 4x spending on multiple cards to really help make 2022 as good a year as 2021 has been.

If you’re engaged in this offer and have tips or questions please leave a comment.

Could you clarify what you mean by “I’ll have a few months more of 4x spending”? Seems like the referral has to be approved by 12/1 so at most by the end of Feb 22? Also, just want to confirm that P2 can sign up for a business card? Thanks!

Gaurav: I’m thinking of it as per card months of spending. So if I have 2 cards I get a late approval on I can do 1+ month each, for 2-3 total.

My referral applied for a Business card and the 4 points are posting correctly now for me–so I can confirm you second question.

Thanks! Out of curiousity–would you push this/do MS on a bonused category, think groceries on a personal Gold card. Normally I’d be fine pushing a category bonus to capacity but this extra bonus feels more like a SUB and makes me a little nervous.

Gaurav: Certainly not 100% risk free, but for me that’s the only way I’ll make a decent dent in the multiple $25k spend opportunities. I’m willing to risk it.

I’m spending on the Amex Plat 15x bonus dining shop small. If I refer P2 with the 4 for us is it 4 x on top of the 15? Thanks

Hi Abby. Yes! This would be on top of any other bonus spend.

“this uncapped opportunity collided with the ability to use American express from home for huge amounts of Membership Rewards.”

Would you care to refresh my memory?

PPK was working with Amex and PPK was working on Plastiq at the time.