On last week’s Milenomics² Podcast we tackled the following question:

My friends frequently use co-branded cards like Marriott, United, and AA for all their spend, including restaurants. Help me convince them that they would be significantly better off with a different credit card strategy?

I started off talking about how co-branded cards are a bit of a paradox. They’re a paradox in that you’d think that if you like a certain entity that it would make sense to earn rewards that can be redeemed with that brand. But compared to other options, co-branded cards are rarely good for spending outside of their bonused categories. Sometimes they’re not even the best option for earning rewards that can redeemed with the brand.

The Freequent-Flyer extended the discussion on this topic brilliantly.

See: My version of the co-branded paradox

For a better credit card strategy I recommended carrying multiple cards within a flexible bank point system. Although some might not want the hassle that comes with “juggling” multiple cards, I think the upside is worth it.

I say this not just because you can optimize which credit card you use depending on the category you’re spending in. But more so because when you can earn rewards in one scheme, then redeem them in another thanks to co-mingling.

Pure Transactor

When banks design a credit card, they think of its profitability as used by a pure transactor. They anticipate that the volume and categories the card will be used for will roughly align with typical household spend.

Co-branded cards tend to bonus spend at the brand they’re affiliated with, along with a couple other loosely related categories that people think they spend of lot of money on but in reality comprise a rather small portion of a consumer’s overall spend.

See: The Best Credit Card For You: Calculate [Disappointing] Yearly Earnings

When the mix of overall spend is considered the card remains profitable for the bank since much of the spend is not bonused. Add in annual fees, interest, and other fees and you see why we actually want as many people as possible using their credit cards poorly. Because it’s on the backs of these consumers and businesses that we’re able to be rewarded for optimizing our credit card portfolios.

Optimizing Transactor

A step beyond a pure transactor is an optimizing transactor. This is someone who switches up the credit card they used depending on the category they’re spending in.

If a consumer is skilled in their optimization they can improve the overall rewards as a percentage of their spend. But thanks to annual fees on cards that most handsomely bonus categorical spend, sub-par award redemptions, and the inevitable breakage that occurs for card benefits – banks are still profitable even with an optimizing transactor.

Co-Mingling Credit Card Rewards

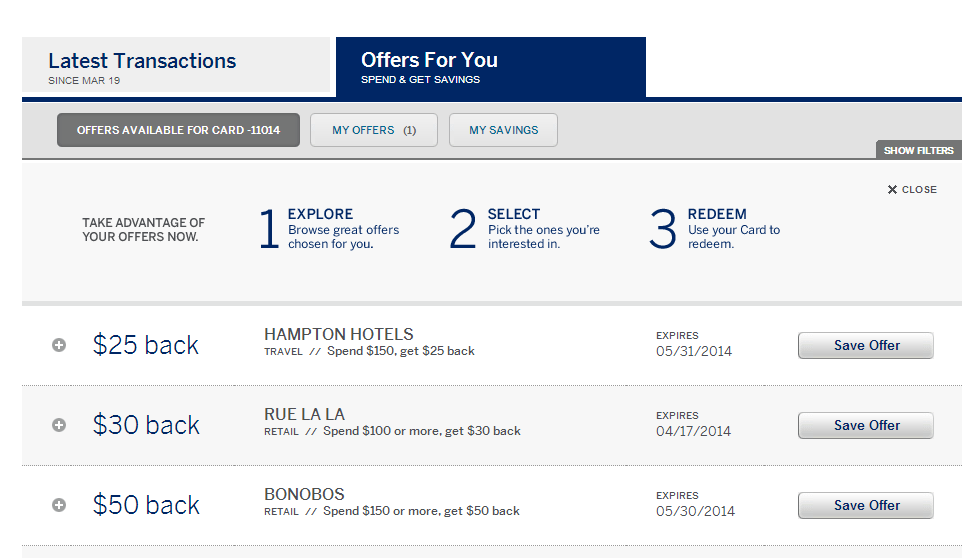

If you’re categorically optimizing your spend across several cards within a flexible point system, most banks allow you to co-mingle the rewards and redeem them according to the best redemption schemes available in the program.

Take for example the Amex Gold card that earns 4x at grocery stores. If you also carry the Amex Business Platinum card your rewards are co-mingled and you can redeem them for flights with 1.5 cents per point of uplift.

I show in this post how you can sometimes get close to 2 cents per point of value when redeeming for flights that earn miles with Amex. That makes your grocery spend worth almost 8% cashback.

Similarly if you’re invested in the Chase Ultimate Rewards program you can earn 5x in rotating categories on the Freedom card, then redeem them with 1.5 cents per point of uplift towards any travel bookable through the Chase portal. That’s 7.5% back on your spending in those categories.

Some banks allow you to co-mingle between spouses (Chase, Citi). Others allow you so share points with anyone (Wells Fargo is a good example of this).

If we take an optimizing transactor and stack the ability to co-mingle points towards effective high value redemptions – we’ve really got something. We’ve got a reward scheme that works better for us than the banks.

If a high enough percentage of users maximize these opportunities it becomes unprofitable for banks. Fortunately, a large amount of the credit card user base doesn’t take advantage of co-mingling. Many people like two things in a credit card rewards program: No annual fees, and cashback.

That said, I wouldn’t be surprised if a major bank eliminated the ability to co-mingle rewards in the near future, and others followed suit. For that reason I’d encourage anyone who isn’t already doing so already to optimize their transactions and co-mingle their rewards effectively. Because when the opportunity is gone you’ll wish you had.

A Milenomic Approach to Rewards

Some say they don’t have time for all this. That they don’t want to juggle cards, they don’t want to pay annual fees, and they don’t want to be frustrated by ever-changing bank policies.

And that’s fine. To that audience I’d recommend taking a look every year or two to make sure the card you’re using is as rewarding as possible.

See: Best Credit Cards For Unbonused Spend

Here at Milenomics we like to push the limits of what’s possible with rewards. We’ll take on annual fee credit cards if we can eradicate those fees with effective use of card benefits. We’ll optimize the heck out of categories. And we’ll work to take exactly the trips we want to take for the least amount of money possible.

If this is the kind of thing you’re into you might like the paid version of our podcast:

Milenomics² Podcast on Patreon

We’ve had a blast creating it, and the interaction we’ve seen between listeners has been outstanding.

If you’ve got a question you’d like to tackle on the show drop us an email or ping us on Twitter @Milenomics

“Some say they don’t have time for all this. That they don’t want to juggle cards, they don’t want to pay annual fees, and they don’t want to be frustrated by ever-changing bank policies.

And that’s fine. To that audience I’d recommend taking a look every year or two to make sure the card you’re using is as rewarding as possible.”

This hits at the heart of a topic that is a pet peeve of mine whenever I read or listen to people talk about our hobby: is the effort sincerely worth it? (“worth” as a measure of $$ return versus real costs, breakage, time, effort, mental bandwidth, etc.) I’ve recently asked you guys about this with respect to MS and it also applies just as much to being an “optimizing transactor”.

The trouble for me is, I’ve never seen any hard data and I’ve never bothered to gather it for myself either. I figure it’s too much trouble and, frankly, I’m a little afraid that I will find that I’m wasting my time doing this. I hope you guys will one day consider laying out your numbers for all the world to see.

BTW, I’m asking not just to be a contrarian in this game. I used to be a non-questioning “believer” like many, running to the Staples around town whenever they had a gift card sale, etc. But then some of my friends had to start asking the hard questions about whether it’s all worth it, and one even asked for data (!). I could only tell him that, after meeting initial spend requirements for a card, the data I had on MS and what you call “transaction optimization” was more iffy. He smirked, darn him.

So, does the emperor have clothes on, or not?

Blue: I don’t take it as you’re being a contrarian. I think you’re bringing up important discussion here.

Between you and I, and anyone who’s reading this, part of why I quit writing was that I saw the game as inherently stacked against most, unfairly almost. Maybe it still is? I do a lot of talking about who’s paying for our travel, who’s subsidizing our out-sized rewards. It’s a bit depressing to think someone out there is buying a ‘FREE!’ TV with membership reward points so that you, or I can earn 110k a year in MR and fly R/T to EU in J or cash out those same poitns for $1375 (at 1.25cents cash out with schwab PLT).

Is all of this a net gain or a net loss? I’ll come back to that question later, in a more general way. For me specifically, I can say that for some time I had quit entirely doing any and all MS. The cost/reward wasn’t working for me at all, even the easiest, lowest hanging fruit (sign up bonuses!). Life was just too too busy for any of this. I would have paid someone to do daily things for me like cook/clean/groceries/my day job, just so I could sleep. We did still have time to travel–but I will say that we didn’t do nearly as much as we do now. Now things have changed, both the landscape and what does/doesn’t work, and my time and sleep.

For me I’m a big fan of budgeting, which I think is not always in the picture for most. Setting a good budget–funding retirement accounts, making sure you have health care costs covered, long term savings, etc. That’s all an important first step–travel should be a part of that budget–just like anything else that’s important to you. Once that’s set for me everything is about maximizing the amount of travel I do within that budgeted amount.

I think it is extremely important for all to see discussion like this, and consider the place all of this takes in their life. I will say the following, as I swing back to a more general discussion: If you’re a pure transactor you’re likely worse off that an optimizing transactor. But both pure and optimizing transactors are probably WORSE off than someone who uses cash for their spending. Numerous studies comparing how you spend with cash and how you spend with CCs show that overspending with CCs happens due to the ‘pain’ of paying with cash. Numbers between 19% and 100% in overspending are common: Sources: https://www.forbes.com/sites/billhardekopf/2018/07/16/do-people-really-spend-more-with-credit-cards/#95a7efe1c19a https://www.psychologytoday.com/us/blog/the-edge-choice/201207/the-way-we-spend-impacts-how-we-spend & https://www.moneyunder30.com/cash-vs-credit. This isn’t comparing people who hold a balance and pay interest, this is just your subconscious saying “$200 is a quick swipe” versus “handing this guy 10x$20 bills hurts my wallet.”

For more on this see this milenomics post: http://www.milenomics.com/2018/07/best-credit-cards-for-unbonused-spend-after-the-amex-spg-becomes-less-rewarding/ (And Robert’s recommendation on that post of Dan Ariely’s Dollars and Sense)

If you’re looking at overspending by 19%-100% using CC vs. Cash there’s no reward program on earth that can help you. So the focus needs to be on setting realistic budgetary goals with CC and keeping tabs on them. That’s true for Pure transactors this post is speaking to, as well as optimizing transactors. I have to imagine a large portion of the public says they want to just use one card and be done with it. That’s absolutely not the way to proceed–you’re possibly spending that 19%++ more on CC than cash and only getting back a smaller fraction of it.

Optimizers aren’t immune here: I think the awareness that comes with optimizing transactions is good–but not if it results in even higher purchases as well. (Hey this dinner is good for 4X MR, lets get a few more bottles of wine). So there’s a more complex picture even to just earning points. Could someone read all of the posts we have on Milenomics and decide to throw all of this out and just use cash? Sure. Would he/she be better off? Maybe, but this blog doesn’t exist in a vacuum–there are other blogs out there who will preach the absolute nature of the benefits for points. That reader would likely find themselves there, and with a narrower view of the real issues in this game. I hope that as a group we’re the tip of the spear–and I hope that we’re educating people to be the best they can in this game–even if that means they realize the entire thing isn’t worth it.

I think there is enlightenment that comes from really seeing the entire game for what it is. The redemption side pressures (limited seats, subpar days and routes), the earning pressures (time, fees, overspending), and the idea that the type of problem solving that works for this game can be extended elsewhere into your personal finances.

I also think this kind of discussion isn’t happening in enough places. There’s too many people being paid too much money by the wrong side of the game (banks, airlines, etc). And for all of that I’m very much glad you brought this up.

Thanks for the thoughtful reply, Sam.

You brought up spending (and overspending) versus not spending. Personally, I don’t *think* I have a problem with spending too much because I’m whipping out plastic versus hard cold cash. (Still going to check out that Dan Ariely book, though.) I spend bloody little “out of pocket” anyways, as the vast majority of my spending is via online bill pays, and Amazon/other online spending.

I think my original point was not made clearly enough, though. I’m not talking about overspending or subsidizing poor cash-out choices. I’m basically asking the question about “is this part of the game–MS and transaction optimization–really worth it?” We all see a lot of the miles blogosphere talking about spending bonus as if it’s a given that it’s worth doing (from a time, expenses, and hassle point-of-view) but how much money/points are we really talking about?

In our private exchange last week, you gave out some real-life numbers that told me you could easily net an extra $80-100 a week, for about an hour’s worth of work…but it probably wasn’t scalable. Now *that* is good data and people can make a decision about that.

But those bloggers (not either of you) that hype that, for example, an extra N points per dollar is now available on the XXX card for gas or groceries or whatever, often fail to show what it could be worth and what the cost might be. (Makes for credit card clicks, though, I guess.) For me, an extra 2 points per dollar on gas purchases would be about 300 points per month….hardly worth the bother.

My attitude–backed up with no hard data either (!)–is just play the game in two areas : meeting acquisition/welcome spend bonuses and for large purchases over $100 (travel and expensive consumer items). Everything else is not worth the hassle. (I value my time at about $60/hr, though…maybe this is why I’ve got this opinion…. ?!?)

Blue: I wrote 900 words about everything except the topic you were asking the most about. Classic me. 😉 Also in reading back my response I was super, super negative about the entire game. Cue the office space line: “Somebody has a case of the Mondays.”

I agree with what you’re saying–that an extra 1-2points per $1 itself isn’t going to get you anywhere. Dilute those earnings further with the overspend that is possible and the numbers are worse. In fact the spending that average Americans do is not going to result in many completely ‘free’ trips (if any) for a family of 3-4. $50,000 in spending at 2x is 100,000 points = $1,000. That might cover airfare, but you’ve got to stay somewhere and do something.

That means either getting serious about this game or quitting it entirely. Part of getting serious is to comingle your points, whether you optimize or not. Another serious response to the fact that everyday spending isn’t going to cut it for most is your move to work on sign up bonuses over and over. Sign up bonuses (perpetually high-bonused spend basically) are the only real way to make real travel and returns happen without MSing on the side.

A quick peek at MS numbers: At $60/hr you could make the numbers work in person–but the scale it takes to make it profitable is not ‘fun’ and very much feels like a job. Case in point: Simon Mall GC. I *Could* drive 22 miles to a Simon Mall, Park, walk in, buy $9500 in Simon GC at 2-2.625% ($190-$250) at a cost of $75 in fees. Then I can drive back 22 miles and stand in line at a WM for ~45 minutes to try to drain those ($5 in MO fees).

I’m sure many people who do this put their ‘profit’ at $110-$170 for the day. But you’re looking at 44+ miles driven ($25), and at least 2.25 hours ($135). I don’t think people stop and rationally think about that situation–they just see “this is free money/free points.” That cuts both ways–when they go to redeem the points/money they feel “this is free” and splurge on that side as well. See: http://www.milenomics.com/2018/01/power-free-leading-predictably-irrational-behavior/

Second example: I’ve met people doing this weeks’ ODOM $10 off $300 GC deal with a Citi Double Cash. That’s insane to me. $6 in profit on 2 cards? $12 on 4? And then taking them to liquidate? Maybe for minimum spend, but without 5x leverage that’s a fool’s errand.

In my opinion you either need leverage, or scale. I’ll take Leverage over scale every day because leverage (2x, 3x, 5x) makes my work easier, whereas scale just means harder, longer hours. I’ll try to buy those same $9500 in GC from the comfort of my desk at work, get them at less that $75 in fees, and liquidate them in as little time as possible. And I’ll do it with leverage. The numbers there are much better-$285 at 3x (1.00, at 1.5 even better), fees of <$20, and cost in MO fees ($5) time ($100) and mileage ($5) to liquidate. The difference between my move and the Simon GC Grind is I can't do $9500 a day....but I wouldn't want to. I don't even do $9500 at a time, I usually break these into smaller amounts and liquidate when I'm near a WM. My MS revolves around my life–my life doesn’t revolve around MS.

A second example is leveraging your current shopping patterns to buy cards at stores you’re already at, or nextdoor to, even in small $1k-$2k amounts. The cost to acquire in time is near $0, especially if you’re already at the store.

I know you’re a subscriber to the Podcast–we talk more freely about some of this there. I’m not comfortable putting a lot of this out on the blog for public consumption but I think the above is a good ‘quick peek’ at the numbers.

And if any readers are out there reading these comments–this discussion is GOLD. Absorb what Blue and I are talking about here, Read this post, and consider all of this as you move forward refining your personal system.

Thanks, Sam. The numbers (cost) you mention are a good counterbalance to the incessant hyping of the hobby that we get all the time. Great food for thought.

Also, thanks guys, for the pointer to the Dan Ariely books–I started Dollars and Sense last night and couldn’t put it down. I thought I wouldn’t be learning anything from it, but I was dead wrong. If nothing else, all the little anecdotes about spending are going to be shared with my kids.

“I think there is enlightenment that comes from really seeing the entire game for what it is. The redemption side pressures (limited seats, subpar days and routes)”

Sadly, I’ve been getting a hefty dose of that type of “enlightenment” lately. It seems to be getting much harder to find reasonable uplift on premium cabin awards these days. There are still some sweet spots on flights and hotels, but finding them does take more time and effort than it used to. This is why the flexibility of bank points is increasingly valuable.

One thing I’ll add: perhaps I’d have a greater net worth if I went cash-only vs my credit card swiping, but I don’t think I’d travel nearly as often if I paid for my family’s travel fully on cash.

Using points feels like fun money, even if I earned them at a cost (be it financial or time).

Psychologically it is harder for me to justify a trip (or perhaps better accommodations) paying cash.

I would add that there are very tangible financial benefits to putting certain types of spend on specific cards. Paying your monthly cell phone bill with a (no annual fee) Wells Fargo card can save you the cost of cell phone insurance for up to four phones. Booking travel on the Chase Sapphire Preferred card gets you fairly extensive travel insurance and primary collision damage coverage on your car rental. The (no annual fee) Amex Hilton card will double the manufacturer’s warranty on a purchase up to an additional two years. There are probably a few other meaningful benefits. The value of these benefits for this spend far exceeds the incremental point value from any optimized card strategy.