Earlier today I posted about the Chase Freedom vs. Chase Sapphire Preferred. In that post I outline the best parts of the CSP–notably the 40,000 bonus UR points. I’ve mentioned before that the best time of year to apply for the card is March, and we’ll include it in our March CCC applications. Applying for the CSP and then converting it to a Freedom is the best way to get a Chase Freedom card, or even a second Freedom card. You gain the 40,000+ Bonus UR points from opening the CSP, and then have the benefits of the Freedom once you convert.

I also covered the benefits of the Chase Freedom–its ability to earn tons of UR points. Today we will talk about those UR points a little more. They certainly can be confusing, I’ll try to demystify them.

I wrote a paragraph in that earlier post and said I’d explain it more in detail. That paragraph was:

- “What about all the travel partners that the Sapphire Preferred have? You don’t need a CSP to hold UR points. You do need one to transfer UR-UA or Hyatt. However if you’re a 2 person Milenomics team (husband + wife for example), that just means that one of the two of you needs a Premium Chase card. You could transfer your UR from your chase freedom to your SO’s CSP or Ink Bold and then to either of your United accounts. If that sounds confusing, it is 😉 I’ll go over it tomorrow when I discuss flexible points more in depth.”

Let’s unpack that paragraph a little.

“You don’t need a CSP to hold UR points.”

This is a very common misconception. Each Chase UR card has its own pool of points. The Freedom may be described as a cash back card everywhere, but it is in reality a UR Card which can only tranfer UR–>Cash or UR–>UR.

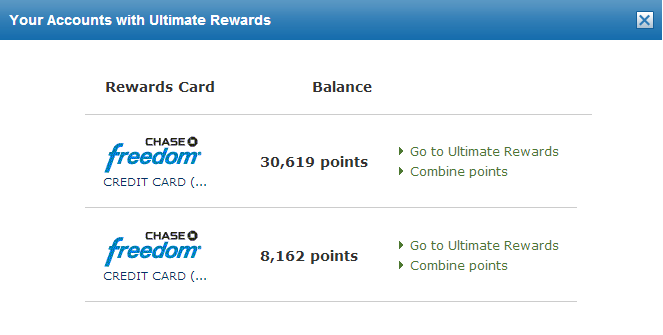

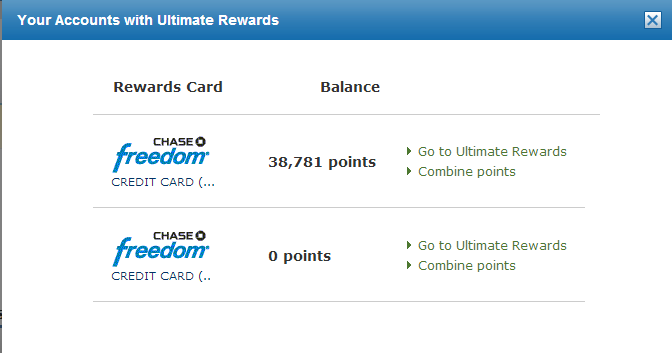

Now if she were to outright cancel one of those cards, she would lose all those UR points. Milenomics places an importance on avoiding annual fees, but does not advocate outright cancelling of cards. Let’s assume for whatever reason the card did need to be closed, say to merge the line of credit. With just a few clicks, I can transfer them to her other Freedom’s UR Pool.

“However if you’re a 2 person Milenomics team…that just means that one of the two of you needs a Premium Chase card.”

My wife’s Freedom UR points can be transferred into my CSP account. We do not both need a Premium UR card like an Ink Plus, Bold, or CSP. She would use “combine Ultimate Reward points” in her UR Mall, and send them to my CSP card (using the card number and the name). I would then be able to transfer those points to a travel partner like United, or Hyatt.

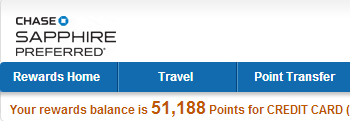

When my Annual Fee comes due on my CSP I’ll downgrade to a Freedom as well, and my 51,188 UR points will safely stay in my new Freedom Account. This is the best way to make sure you don’t lose your UR points when cancelling a card.

A note about tranferring UR-UR: Chase has a problem on it’s hands. They allow you to transfer UR to any other UR account. Technically all you need is the card number, and the name on the account. This is being abused to sell UR points. Chase has shut down accounts of people who transfer out too many UR to too many different accounts. I’m not advocating that at all, I’m telling you how you and your Spouse/SO can pool your UR points

Chase may shut down your account if you are transferring UR-UR and the accounts are not your spouse’s/SO’s.

As with anything, be careful. There’s a good saying, bulls make money, bears make money but Pigs get slaughtered.

[rule]

Come back tomorrow for details on the first Milenomics Giveaway!

I’m wondering why you don’t advocate canceling cards. Doesn’t that allow you to come back and apply for the same card after 12+ months and get the sign up bonus again. There are so many cards that are associated with UR that it’s easy to move your points around and not have to pay an annual fee.

Donnie,

It is ok to cancel if you downgrade/merge the line of credit with another card. But an outright cancel destroys the Credit line, and will increase your Utilization %. As soon as your downgrade, you’re in essence cancelling that card, so your X month clock starts from there.

With UR points being so easy to earn with the 5% categories on a freedom I almost always recommend converting to a freedom from any other Chase card. You’ll have to eventually close one (Freedom) to open a new Chase card, but that’s really just shifting the line and getting a sign up bonus on top of that. Each Freedom is basically worth 33,000 UR points a year.

For MR points, you need to convert to a Amex Blue to keep your MR points open. For Citi Cards you’ll likely be able to get a fee waiver anyway.

I see…

I think I’ve had the wrong strategy with this. When I call to cancel a card they always offer to move the credit to another card. I was unsure what to say. I know there is a maximum amount of available credit at certain banks and I thought not shifting the credit to another active card keeps some credit available with Chase for new credit card signups.

As far as the utilization percentage… If you pay off the credit card before the statement is cut, won’t you always have a 0% utilization for that particular card?

Good stuff here on mileconomics!

If you do pay off before the statement hits you’re right, $0 is 0% 🙂 However, your Utilization is your balances on all cards at statement closing divided by total available credit. So unless you pay every card off before statement date (which is hard to do sometimes), increasing your available credit helps bring down utilization ratio.

There is a maximum amount of credit a bank will extend to you. IF you apply and are denied you’ll be able to call and ask for them to split off a certain amount from your other card/cards to create the new card. You’ll know at that point that you’ve hit your maximum. In my experience the max has usually been 50% of your yearly income (Scary!). No reason to give back that credit, who knows, your situation might change in the future and getting approved without splitting some of that credit off might be the only way to get a new card open. Also some deals require the ability to charge large amounts… which you can only do if you have access to a very high credit limit. Building up that limit by pooling credit allows you to have more tools at your disposal. These are very much not Milenomics #101 techniques, more like #201/#301 level stuff.

Beyond a certain level, you do want to cancel cards to maintain credit vs income ratio, not just utilization. Banks are usually hesitant to offer more credit to people who already have 2x credit (vs income).