-

– Are your mile balances piling up?

-

– Are you paralyzed with fear over redeeming your miles for less than their maximum value?

-

-Do you have more miles than you know what to do with?

Milenomics can Help!

Yes, Milenomics, that mild mannered website, will teach you in the next three days to let go of your anxiety and use your miles.

But Wait, there’s more

We’ll also learn how to think about using miles in a way that is productive, not destructive.

And, if you promise to tell a friend about Milenomics you’ll receive not one,

not two,

but Three, YES Three posts on this subject!

—

Today’s earlier post, the Life of a Mile and the start of this have been a little tongue-in-cheek, but the underlying idea is sound. Range Anxiety is a term borrowed from the electric car industry–where customers are worried about running out of batter power. Similarly in the world of Milenomics we can suffer from a similar problem; the fear of running out of miles.

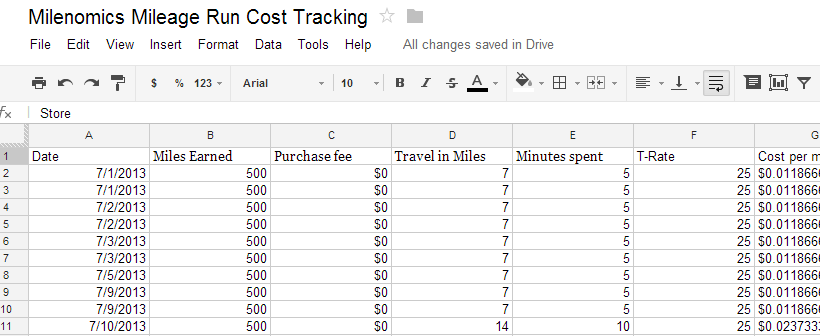

We’ve covered a lot of ground in the last 6 weeks– an excellent recap of most of it can be found here. Early on we discussed knowing what your costs are for your stash of miles. I keep track of all of my purchases and the associated costs. If this seems like a lot of work with little payoff I’ll illustrate today how this cost tracking helps aleviate Range Anxiety.

Placing a Value on Your Miles

There are plenty of lists out there saying what a mile is “worth.” I believe most of us try to keep a list of what miles are “worth,” even if that list is in our head. Unless you’re actively trying to barter and sell your miles, Milenomics says to throw these lists away.

Remember back to the Value of Airline Elite stats post? In it I outlined that what something is worth to two different people can be very different. Nowhere is this more true than with miles. If you (like me) Love traveling to small out of the way places, a SPG starpoint isn’t going to be useful most of the time. Sure you can give them an value of $0.022 Based on C&P awards. But Hotel points and Miles are linked in a way (if you can’t find a C&P night at the hotel you want to visit, or can find C&P availabilty but not an award flight) it is a bit simplistic to just say that each point holds a value based on what you can do with them.

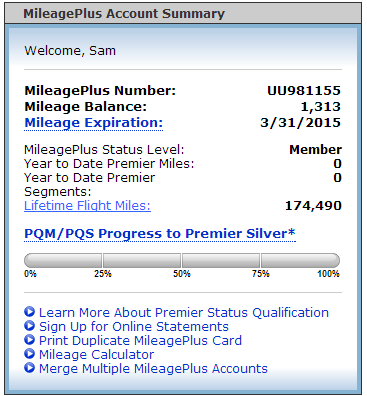

Instead, to Milenomics, the value of the miles are what you put into them. Remember our T-Rate? We use it in calculating the cost of our miles. In my case my UA miles cost me (on average) $.013. However the overwhelming majority of this is my time, at my T-Rate of $25/hr. What I’ve done is invest my time in these miles. By using them I realize the value I’ve put into them, and I turn my time back into money. Redeem at the Cost Per Mile or higher and you’ve effectively earned your T-Rate per hour you’ve worked on earning those miles.

The idea is similar to the thought process of earning a return on the stock market. Yes you can claim your investment has gone up in value 25%, but only when you sell, and realize that gain is it real.

The Value of Your Miles on Paper

If someone else pegs the value of an AA mile at 1.8 CPM, and you’re chasing this 1.8 CPM redemption you’ll probably hold onto those miles, and continue to hoard them. The value of a mile on paper is no good to us, because we’re not in this game to earn miles, we’re in this game to travel. Spending money on a flight to save your miles means you’ve made your miles sad.

When planning my trips I use the technique I’ve talked about before; figure out which of my mile stashes can get my wife and I where we want to go, and then book with the ones that have the lowest cost. You can then continue to earn and use the miles with higher costs for another trip.

Using the Leapfrog Method in Conjunction with Cost Tracking

As Milenomics continues we’ll be building on what we’ve already learned. The leapfrog method, whereby you are earning in more than one program, with a goal of redeeming for your upcoming trip, and the trip after that, is an important technique to use in these cases. As the above example illustrates you should use your cheapest miles first–except when those miles are the ones you’ll need on your next, leapfrog trip. If that is the case, you should look at both trips, and see which makes the most sense.

- Example: A classic example would be when your first trip is to Asia, and your next to Africa. If you hold UA and AA miles, you wouldn’t want to use the UA miles to go to Asia becasue even if they’re cheaper, they leave you with AA miles to fly to Africa, which means Fuel surcharges, since AA and Oneworld rely heavily on BA for Africa Flights.

- UA on the other hand can get you to Africa without fuel surcharges–so even though your mileage might have cost you more to earn your redemption will make up for that difference in cost.

Your Miles are Only Worth the Value You Place on Them.

What all of this means is that your costs to generate miles should be the value you place on your miles. Only you will know this number. Your proximity to stores, ability to manufacture miles on MMRs, and your credit card bonus categories/double dipping techniques will all be unique to you.

My cost for Delta miles is crazy low– under $.004. This means even if I redeem at $.009 I’m doubling what I paid for those miles, and earning not only my $25/hr but much more than that. Someone’s listed value of a Delta mile might be $.011–and if I don’t reach that redemption level I would probably think about keeping those miles. Doing so is foolish.

The reason this works is simple: You can’t easily sell miles (more on that later if you’re all interested). So you have two options:

- 1) Collect them forever and only use them on expensive, high value trips. In doing this you likely pay for many smaller trips along the way. My Money is precious, I’d rather not use it unless I have to. My ability to make more money is not unlimited. But through MMR’s I’m able to generate instruments that allow my travel to be paid for me at greatly reduced prices. Being a mile hoarder means locking up your hard earned miles, and spending money to keep them from being used.

- 2) The second option is to stop earning miles, and switch to cards that earn cash back. The very top end cash back cards earn 5% during promotional periods. I know people churning $30,000-$50,000 a month on these cards. They know they’ll be shut down eventually. So we’re going to throw that idea out the window.

- 2% cards represent the most long term susstainable cash back card you could churn on. However there are only just so many of these cards. Should you stop using all your miles earning cards and focus on one or two cash back cards you’d be pooling your purchase, and increasing the likelihood of a card being shutdown.

- Also, there’s nothing that says you can’t churn both a 2% cash back card and miles cards.

Flip it around

Lets say you have miles that someone has told you are worth 1.56 CPM, and you’re looking at a redemption for 32,500 miles in coach (Maybe using the low level hedge). The cash fare is $425. Would you redeem or pay for the flight? Most of you would say pay cash.

Milenomics says to redeem miles anytime you can do so for equal to or more than your Mileage costs.

The idea is simple: Bring your carrying costs down as low as possible, and redeem against that number. If you want to focus on anything focus on brining down those costs through more efficient travel to stores, or buying with bonus category cards/double dipping. The harder you focus on getting costs down the better you’ll do at it.

Remember, tell a friend, and subscribe via email (the link is on the right side of the page). Or follow @Milenomics on Twitter, or Facebook for all the latest posts.

Happy Travels

-Sam[rule]

What about the opportunity cost of not using a 2% cash back card?

I’m glad you brought it up SAS: I touch on it a bit in the article. There’s clearly nothing stopping us from also using a 2% CB card for MMRs. In fact we shouldn’t limit ourselves to 2% back cards–there are higher earning instruments out there. I stopped using mileage cards and started using Cashback cards for the recent Safeway deal because I’m flush with miles right now. There’s a time and a place for miles, and a time for cash back cards.

However (as I mention in the article) you’re unlikely to be able to do all your churning on 2% back cards. Also some deals are Debit card only, so no 2% cards allowed. And finally, large signup bonuses during CCC applications will boost your mileage account balances to the point where you’ll be “filling in” those balances versus a 2% card where you’re only churning.

Not saying the 2% discussion isn’t important–it is. But I am saying that the idea that all redemptions must occur at or near the 2CPM level is hogwash, and leads to hoarding of miles. Learn what your average cost to generate miles is, and redeem against that. Since we include our time in those calculations we monetize our time by redeeming at or above that level.

What are your thoughts on the subject of 2% cards?

I agree the debit card generated miles don’t have this dynamic.

For the miles/points I earn with a credit card (at least up to a certain point where you can use the 2% card), I am foregoing 2%, so I have to value them at least that much. You could think of it as getting 2% back in cash and using that to buy the miles/points. However, if you’re diligent, most of your purchases can generate 2x-5x depending on the category.

For example, I have the Thank You card that gets me 5x at grocery/gas/drugstore. So a $100 purchase would either get me $2 or 500 Thank You Points (which cost me $2 in opp cost) are worth at least $5.00-6.25 based on the fixed redemption rate, so that’s $0.004/Thank You Pt. Or $100 at dinner using my Sapphire Preferred gets me $2 using a 2% or 200 UR points which “cost me $2” in opp cost, which is $0.01/UR point. In these situations, my CPM is lowered by the bonus.

I 100% agree with your overall concept or redeeming at values > earning cost, but it’s hard to ignore that the marginal opportunity cost of an incremental $1000 of spend would have earned you $20 on a 2% card. You should be redeeming for at least that much, otherwise, you used the wrong card.

Great write up SAS. I can’t argue that there isn’t an opportunity cost to everything–there is. Trying to get readers to not fear using their miles–only through using them (even for sub 2CPM tickets) will they see any value from them. CB cards are great because cash is liquid. Miles are not, at least until you use them. Sitting on tons of miles means you’ve locked up all that time, effort and money. Hope you keep reading and commenting.

-Free your miles, and the rest will follow.