Note: This is not a post for those with excellent credit. With excellent credit your declines are usually because you have too many cards with an issuier, or too much total credit. We can get around that with tricks like reconsideration calls. Yesterday I wrote about how Monetizing your good credit through sign up bonuses. Today we’ll discuss what to do when you have less than stellar credit.

It is a fact that the best products for earning miles can be hard to get when your credit score isn’t quite high enough. This might sound counter intuitivie, but the first step is to stop applying for cards you can’t get.

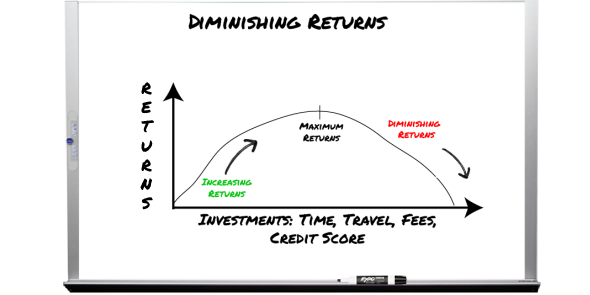

Credit Applications & Diminishing Returns

When it comes to applying for credit with less than excellent scores, when you’re declined for a card stop applying unless you have found the best credit cards for no credit. I know it is enticing to try to apply for something else, and see if you get it. And then if you don’t get that card, you feel the tug to apply for just one more card, to see if maybe an approval will slip through there.

The sad truth is that if your credit isn’t all that hot each application is only going to make things a little bit worse. Be happy for the card/cards you were able to get, and work on making your credit better in the long term, rather than trying too hard in the short term to apply for more cards. Even if it means checking out personal line of credit rates to help improve your financial situation, do this before trying to apply for more credit cards.

The Law of Diminishing Returns states that: Once you’ve received a decline from a card issuer–the more you apply the less likely your chances of being approved will be, and the lower your score will continue to fall.

If this sounds odd remember that each application bumps you down about 5 points. That doesn’t sound like much when you’re up above that magic 720 number for your credit score. But when you’re down to 675 every point coints. Remember yesterday we went over the credit “score” tiers that I like to use:

As you can see from the above diagram the 20 point difference between 710 and 690 is much larger than the different between 730 and 710. With the former you’re dropping a tier, with the latter you’re falling inside the same tier. Applying for cards, bumps your score down. Normally the new credit card you get will help to raise your score in the long term. By not getting those new cards means you don’t have the new credit line to help increase your score in the long run, and so each application has a harsher effect both short term, and long term. This can be confusing for anyone to understand, especially if you are trying to manage your finances a lot better. With this being said, doing a search into something simple like best credit card consolidation may give you tips on how to make your financial situation stable once again.

Think of your credit score like a pulling a very long train. In the short term, like a train, your credit score is incredibly hard to move. Finding different ways of how to improve my credit score tends to be a lot easier said than done, and it can take a lot of time to take off. Longer term, with continued payment you’ll get to a point where the train starts to slowly move. Finally you’ll get to a point where constantly paying off many cards gives you an unstoppable score, one which continues with little effort, and little effect from new applications (approved or not). How do you get the train rolling? The best advice has been, and continues to be:

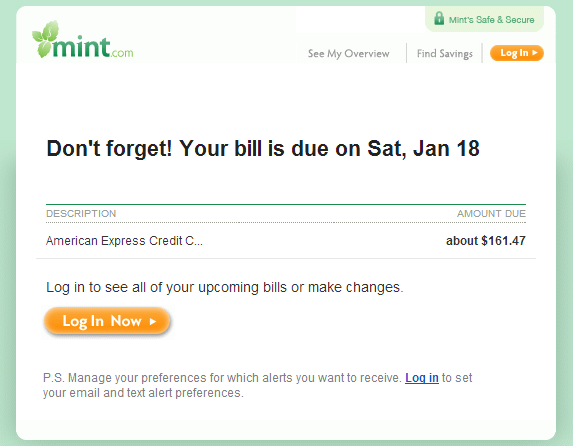

Pay Your Bills in Full, on Time, All the Time

I get a chuckle out of long articles written on how to increase your credit score. There’s not a huge mystery to it: Pay your bills on time, and pay them in full every month.

Those two factors account for the overwhelming majority of your credit score (75%). There’s no other way around it–if you have missed a payment, or were late once or twice your score will take a big hit. The key is making sure that doesn’t consistently happen. If it does, you’ll be stuck; trapped in a revolving door of paying late, and not getting caught up.

Update: Reader econjon added a great tip I neglected to add: Ultimately you’ll want to pay your cards off before the statement is generated. Doing this means your statements are all cut with a $0 balance. This means your utilization will be at or near 0% for those cards. If you’re paying late–right now focus on just getting current in the short term, and in the long term switch to paying off before the statement date.

Should You Even Be Trying to Earn Miles?

Right now your focus should be on repair. For a year, maybe 2 you’ll need to focus on paying you credit cards down, and living within your current income.Thinking back to yesterday’s post: Travel is Not Free. When you make the mistake of thinking it is free you can overspend. You think you’re spending nothing–but in reality you’re paying interest on credit card debt, and neglecting bills, hurting your overall credit worthyness. Doing so is another area where Sunk Costs come into play. Sunk Costs have you thinking you need to use your Miles, so you’ll spend hundreds of dollars to take a trip you really shouldn’t be taking.

This game has very real negative consequences. When you’re not fully equipped to play it those negatives can compound, quickly. That doesn’t mean you can’t collect miles, after all even regular spending can earn you miles. While you’re working on your credit it I would however caution you from spending any miles.

That Said… the Best Ways to Start

The best way to start with less than stellar credit is to take inventory of your current credit cards. Do you have at least one Chase Card? Hopefully you have a Freedom card. Do you have a Discover Card? Or a CapitalOne card? All of these are popular first or second credit cards for most people just starting out. They don’t get much play on the blogs–but both have excellent uses. For Example, did you know that the best US Airways card is actually a Discover Card?

With less than top tier credit you’ll be playing a different game than most people do. There’s nothing wrong with that. Milenomics is about finding our own personal best, not anyone else’s. I’ve described the path I take pretty heavily on the blog. Today I’ll decribe a different path, and imagine a world in which I had limited credit card options.

With Limited Options, We Need to Get Smart

If I had just three cards: A Chase Freedom, a Discover Card, and a Capital One Card (A pretty common set of cards for people just building credit. I wouldn’t apply for anymore cards until my credit was at or very near 700. In the meantime I’d do the following with each card:

Discover Card: Every quarter Discover gives 5% cash back on revolving categories. Make sure to max these out using MMR techniques. Especially easy are the Gas and Grocery categories. Also access to the Shop Discover portal for cash back will help you save as well.

Chase Freedom: This is going to be your go to card for all churning. I’ve covered how Chase Freedom is a better card to have than a Chase Sapphire Preferred. Along with Discover you’ve got 5% back categories each of 4 quarters. If you open a Chase checking account you’ll get an extra 10% on all purchases, making the Freedom earn 1.1 UR per purchase, and 5.5 during the bonus quarters.

Capital One: Likely earns 1%-1.5% cash back. I wouldn’t use this card for much. But if you have trouble keeping your MMR spending and your personal spending separate you could use this card for your legitimate spending, and help keep yourself on budget that way. You’re giving up some UR–but if you can’t trust yourself this might be the best way to protect yourself from your own bad habits.

The goal during this next year should be to:

- Never carry a balance.

- Pay off all your cards on time. Doing so will help you to really jump your credit score up.

- Collect as many UR as possible, keeping an eye on costs, and working on how your personal MMRs work best.

No, you won’t be traveling every weekend during the next year–but you really shouldn’t be. Working on getting that credit up means next year could be the Summer of YOU. You could be debt free–and in a position to really enjoy your travel, instead of feeling pressure from overspending on it.

Where You’ll Be in 1 Year

Following this incredibly non-glamourous, non-standard way of spending within your means, and building your credit up let’s look where you’ll be:

Discovercard: $75 per quarter for the next 4 quarters = $300. In addition cashback from Discover’s shopping portal could be another $100-$200 (or more.) Total $400+.

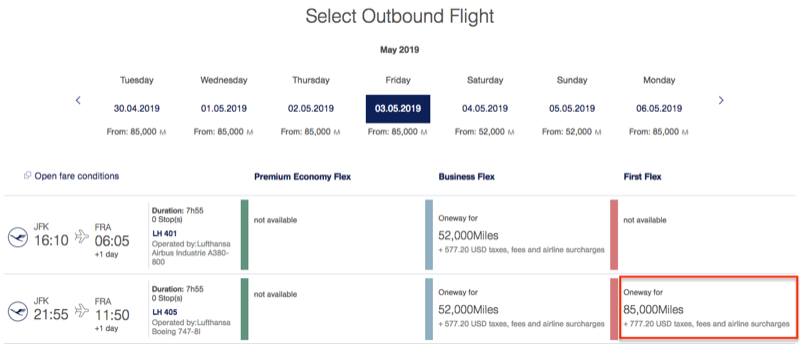

Chase Freedom: With chase Checking; 8,250 UR per quarter = 33000. Through Milenomics Mileage Runs the sky is the limit–but let’s estimate 5,500 UR per month (maxing out 1 BB). 66,000 UR from MMR. Total: 99,000 UR. And by earning your UR now–when your credit is good enough to finally get a premium UR card you can transfer those miles out (See my guide on doing this here.)

Capital One: Sorry Cap1–you’re sitting on the sidelines. If you chose to use this for your day to day spending, and budgeting then you’ll have some rewards here. You could use these to buy miles when they go on sale, or for Lifemiles during their promotions.

More importantly any delinquent marks you have will be 1 year older–and you’ll be one year closer to them falling off the report. Your credit score will have started moving in the right direct. Remember that train analogy? You’ve started the engine that will eventually carry you to a higher score, and the promise of great credit card offers, and monetizing your credit score.

Just a reminder that you want to pay your cc bill in full before the statement closes. This way the CRA’s see relatively low overall CU.

Good point econjon. I’ll update and credit you. Thanks for adding that.

My ex left a joint card with a balance, which I didn’t know until they started calling me about it. I just paid it off for him last month, so I wouldn’t have to deal with it anymore. All my other credit is perfect. How long do you think until I can recover from this?

Extrouble: Negative items take 7 years to totally “fall off” but one or two 30 day lates will lose their negative impact in far less than that. I I had a 30 day late many years ago and after a year it had very little impact. If it went to collections you could have tried to “pay for delete” (google it) which means you don’t pay until they remove the collections account from your credit reports. Either way–what’s done is done– glad you found it and can move on from that bad chapter.

Even better, pay down the balance to $1 and pay it after the statement closes. It’s proof that you pay your bills on time.

It’s helpful to let your statement close with a few dollars on it, then pay it off right after your statement closes. Of course never let it close more than 10% utilized.

Hi El Ingeniero,

What do you mean by “Of course never let it close more than 10% utilized”?

Thanks!

John