Yesterday we talked about the Best Cash Back Card on Earth, and today we’ll follow it up with a post about the Best Travel Cash Back Card. I debated writing just one post comparing the two cards, but ultimately split this into two posts so I could focus on the differences between the best Cash Back Card, and the best Travel Cash Back Card a little better.

The top travel cash back cards out there usually tout a return of somewhere between 1.5%-2.2% when your cash back is spent on travel. Many have annual fees which further eat into the profits of the card.

Today’s card bests all of these returns with as much as a 3.2% return when your “points” are used to book travel. And did I mention that this card has no annual fee? What kind of behemoth could this be you ask?

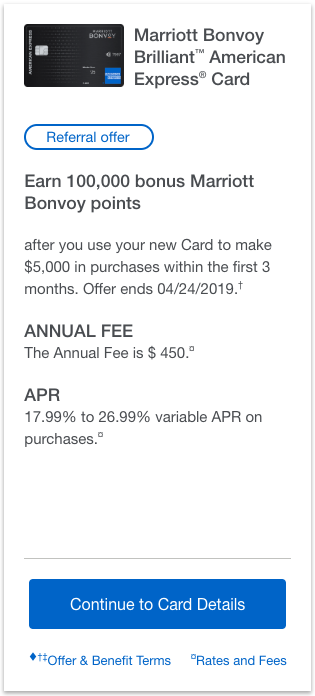

Why, none other than the Fidelity Investment Rewards Cash Back Card:

Wait…What?

Wait…What?

Yesterday when I mentioned that you don’t hear enough about this card I left off one of the killer features of the card–the ability to book travel rewards with it. The card is good enough without its unadvertised travel rewards that I didn’t feel the need to include them in the first post. I also thought it a bit dramatic to do a reveal of the best Travel Cash Back card only to find out it is the same card. Sneaky, I know. 😉

So, with all of this out in the open now, lets delve into using this card for flights.

Fidelity Points are Not Exactly Fidelity Points

Note:If you know more details about this please do reach out to me. What follows is the best I can grasp from the little there is about this card out there and my own personal research.

Fidelity doesn’t actually administer this card–Bank of America does. This is the reason we’re able to pay this card at Wal-Mart and double dip, and also the reason this card is a great travel card. The “points” this card earns are not Fidelity points, but are instead a form of BofA Worldpoints.

Worldpoints have their own shopping portal, they’re a currency of sorts that many other cards used to earn, and a few still do. Basically they’re points which can convert into pennies if you deposit them into your Fidelity account. But when you use them for travel, and specifically flights, something magical happens.

Worldpoint Flight Rewards, Two Types

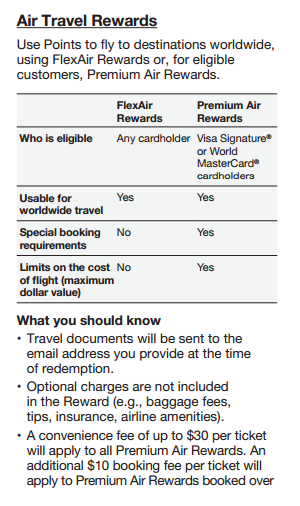

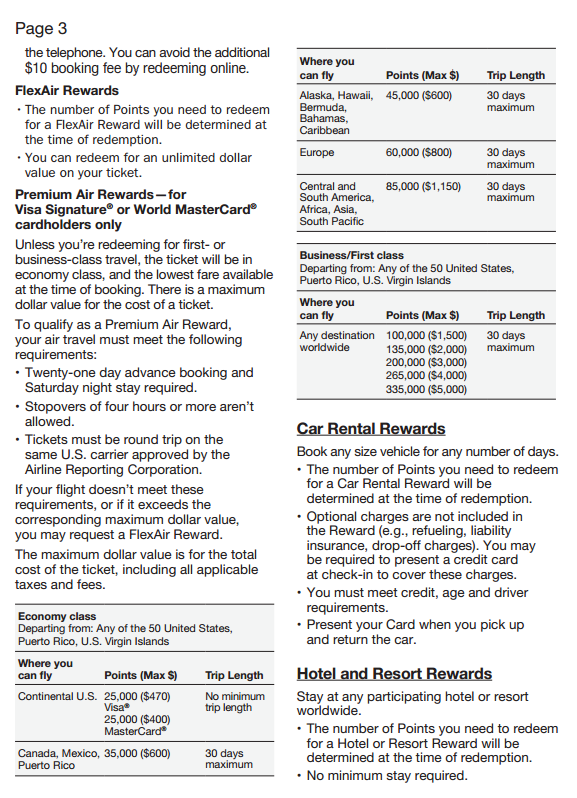

Buried in Pages 2 and 3 of the long disclosure of fine print you receive when approved for the Fidelity card is the information about Flight rewards:

There are two types of Flight rewards, Flex Air and Premium Air Rewards. The nameing is incredibly confusing so I’ll go over the benefits of each here, and paraphrase how I’ve come to know how they work:

Flex Air Rewards:

- Any flight, any day, any time, anywhere

- $.01 per point redemption value

- Can Be Booked Online with no added fees

- No limit to the value of the ticket, except for your available points

Premium Air Rewards

- 21 day advance booking

- Flight cannot have >4 hour stopover

- Saturday Night Stay Required

- Must be Round Trip

- Maximum ticket price of $400

- Must be lowest priced qualifying flight *(More on this later)

There really is no reason to use the Flex rewards, or any other travel reward with this card that is valued at $.01 per point. Doing so is no better than simply depositing the points as cash and booking a paid ticket elsewhere.

Where the card shines are the Premium Air Rewards. Premium Air Rewards are much less flexible than Flex Air Rewards–but the reason to pursue Premium Air Rewards is because the cost is fixed. Where a $350 Flex Air Award will cost 35,000 points, making that same booking as a Premium Air Reward by following the 21 day advance purchase, and such will only cost 25,000 points + $30 booking fee.

It is these Premium Air Rewards which help us to receive even more value than 1cent per point with our Fidelity Investment Rewards American Express Card, and I’ll focus mostly on them for the remainder of this post.

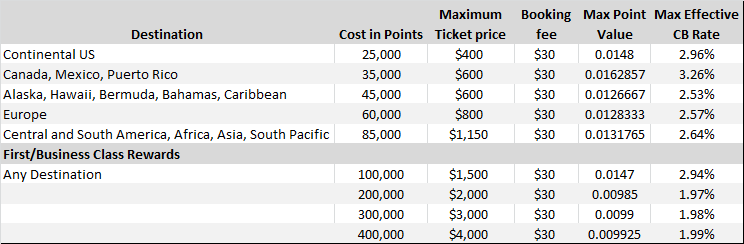

Calculating Potential Value in Premium Air Rewards

Before we go through booking Premium Air Rewards we should first discuss the maximum value you’ll be able to extract from these awards. I’ve compiled a table of the award types, maximum ticket price, and the effective Cash back rate for purchases on the card at each level:

It should be mentioned that the Maximum effective rate is not really ever going to be in play. You would simultaneously need to find a fare which was exactly the maximum and also exactly the cheapest flight option to see such a rate of return on your points. In reality there’s about a 10% reduction in each of these Effective rates due to lower than maximum flight costs. Furthermore you would always have to use your points for Premium Air Rewards (never depositing them as cash) to keep your effective CB rate at or near these top percentages

There also may be times when no flights qualify for Premium Air Rewards. Finding a Sub $800 fare to Europe may be impossible–as could a sub $1150 fare to Africa. These Premium Air Rewards should be though of as saver level awards–we’re not always going to be able to book them. They’re capacity controlled by the cost of airfares, and your ability to book a Saturday Night Stay as well as the lowest priced fare*.

Booking Premium Air Rewards (*and Getting Around the Lowest Priced Fare Restriction)

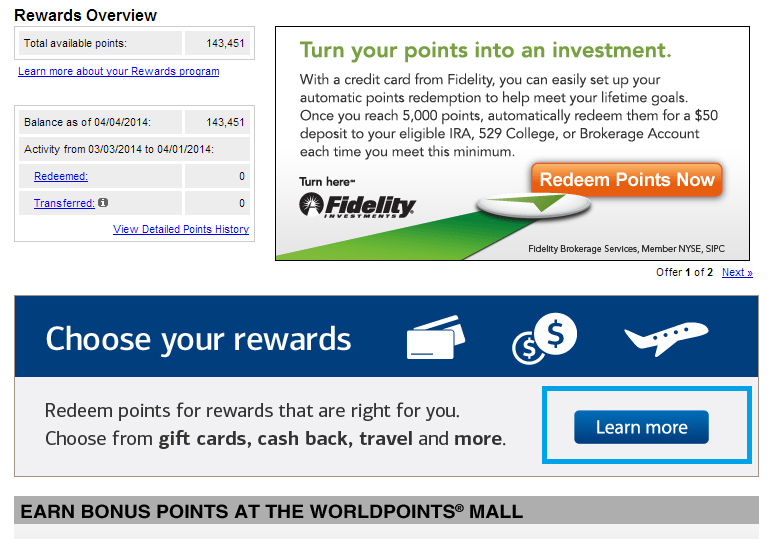

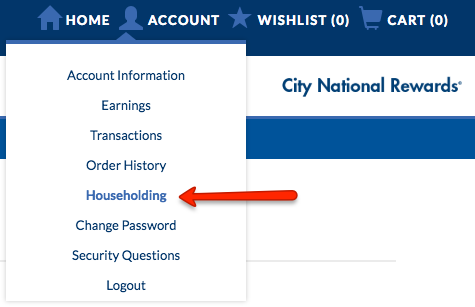

Booking these Premium Air Rewards is a bit tricky the first time, so I’ll step through it with you here. The first step is to log into your Fidelity Credit Card online, and select Rewards:

From there you’ll be presented with quite a few options, from gift cards, to cash. Make sure to click Travel, and then select the following option for Air Travel on the screen that follows:

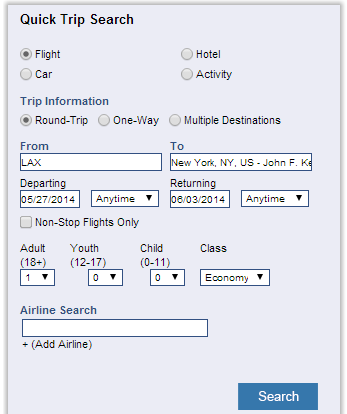

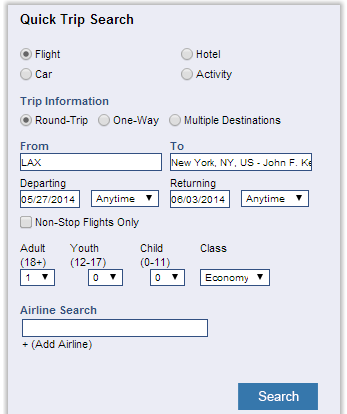

From here we’re presented with a relatively standard Air search screen:

I like to search on kayak or itaMatrix before doing my booking here. I want to know the specific flight I want and verify there are sub $400 fares to be booked.

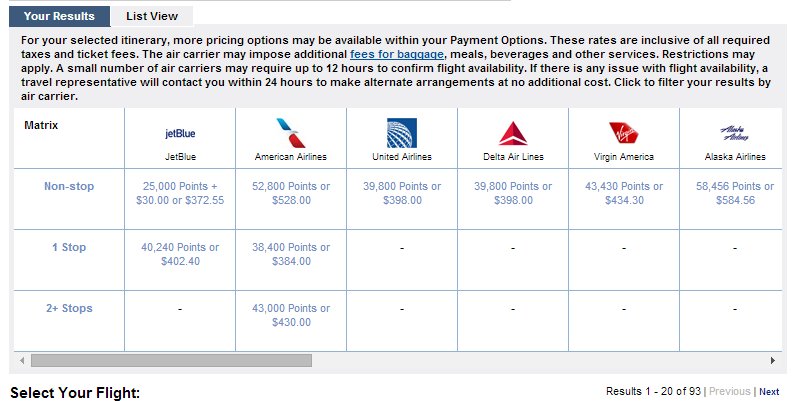

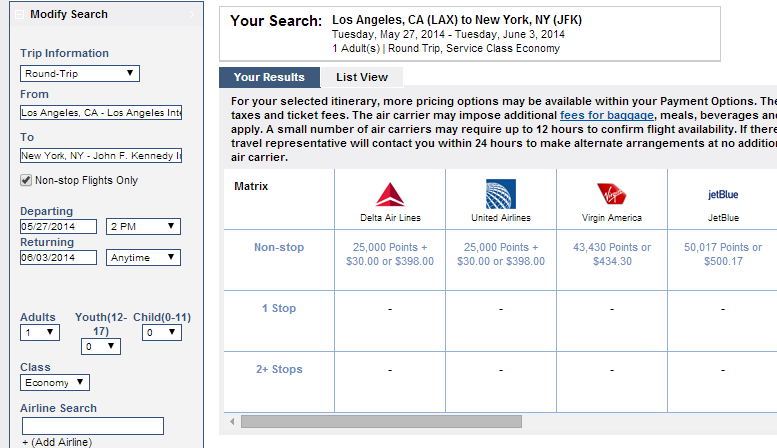

Our sample booking will be a search for a flight from LAX-JFK leaving May 27 and returning June 3rd. Once the search runs we’re presented with the following results screen:

The Rules of Premium Air Rewards state that the lowest priced, 21 day advance, Sub $400 ticket will be available as a Premium Award. Looking at the above you can see that there is exactly one Premium Air Reward, even though there are more than 1 sub $400 tickets. Now if we want the jetBlue nonstop flight we can click it, and check out and pay, but let’s assume for whatever reason we want to fly on Delta or United both of which have a $398 flight. This is pricing as a Flex Award, but we don’t want to pay 39,800 points for an award we can get for 25,000. Since both of these flights are under $400 they should be bookable as a Premium Award, if we can just trick the booking engine into seeing them as such.

The key to turning Flex Rewards into Premium Rewards is a more restrictive search. There isn’t an exact science to this, but try one or more of the following:

- Selecting “Nonstop only flights” if the search is defaulting to a 1-stop 25k Premium Award even though higher priced nonstop Sub $400 options exist.

- Changing the departure time to a time later than the flight you don’t want to take.

- Adding a restriction to flights of only a certain carrier

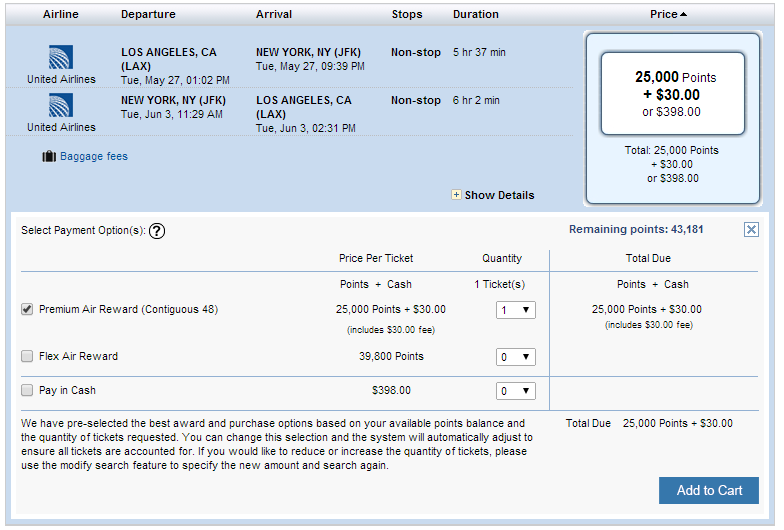

You’ll need to play around with it a bit–as I did, but sure enough I was able to use the following search to return both the United and the Delta flights as Premium Air Rewards:

The United and Delta flights are just $2 from the maximum $400 ticket price you can redeem a Premium Award for. Redeeming 25,000 Points +$30 for a $398 fare calculates out to a value of $.01472 per point. A redemption like this would in essence be turning your Fidelity card into a 2.94% Cash back Travel Card.

#BYOE and Premium Air Rewards

The above UA flight could be upgrade eligible. In a very Be Your Own Elite move, these flights would be a great use of a traded RPU/GPU to put you to the front of the plane on a United p.s. route. In addition these flights book as paid seats–so you earn Elite Miles as well as Redeemable Miles on the flights.

A great use of Fidelity points are on United p.s. or AA A321 routes along with an upgrade instrument.

Update: See bk3day’s comment below for a word of warning about this.

Should you Ever Do This?

I struggled with writing about this deal. The alternative, retirement account use of Fidelity points is just so much more fiscally responsible. At the end of the day I’d hope that if you used 50,000 Fidelity points to book 2 $400 flights you’d at the very least deposit $500 into a retirement account to offset this.

Even if you don’t, cash is fungible, and so long as you make and stick to a budget using these points for paid flights is surely better than using cash for the same flights. And when no award seats are bookable with points the Fidelity card can be a great low level hedge.

Take yesterday’s post and today’s, Add them up, and the Fidelity Card should really be in your wallet.

Great article. I’m going to submit to your wisdom and just apply for this card. I will also get the Barclay Arrival since it will cover merchants who do not accept Amex. Great post!!

Can you tell me how you calculate the Max Effective CB rate?

Anthony: I’m taking the Max Ticket price–and subtracting the $30 fee to book. Then dividing by the 25,000 points you’ll use to make the booking. This gives us a value per point. Since you earn 2 points per $1 spent on the card I’m doubling that, and converting to a percentage for easier viewing.

As I mention in the post you’d have to book a fare exactly at the maximum to see this effective CB Rate–In my experiences the numbers are usually about 10% less for most bookings. In the course of writing this post I did find a great example flight which was $398, using almost the full Max Effective CB rate, but that was mostly pure luck, and the Jetblue flight would have given a lower effective CB rate as well.

Too complex for me to book the Premium rewards travel option. I’ve got too many of these fungable points now and it’s driving me crazy” PenFed Travel, Navy Federal travel, Flexpoints, UR. MR—probably a couple more to boot. Each has it’s own set of rules to maximize value.

I need to simplify! 🙂

Simplify? Never! I think I am finally sold on giving this one a shot, even though I just got an Arrival card and now need to get my wife’s Arrival closed or the fee waived. One question – the screenshots say Visa and MC cardholders. This does work with the AMEX as well?

Kenny, I have the American express version. The terms and conditions are rather oddly worded and don’t even mention Amex. Everything works with the Amex at the levels I’ve outlined in the post.

I’ve tried this on my FIA amex account and I can’t see the 25k points option showing up for a flight that needs 39150 points or $391.5. It seems to me that this feature doesn’t work for amex card unfortunately… the visa signature only offers 1.5x cash back so FIA is a smart axx…

Jason: The screenshots I’ve used or this post are all from the Amex Fidelity Card, so it does work for that card. The issue is that it must be the *lowest* priced option, Saturday Night stayover, and 21+ days advance purchase for a ticket to be a 25k award. Try fooling around with limiting the airlines, or the connections and see if that helps.

You should see at least one 25k option, so long as you’re obeying the 21 day advance purchase and saturday night stay–and there’s a flight under $400. If not let me know and I will try to help.

This is pretty cool. I knew about the BOA Worldpoints program, but had no clue that Fido card qualifies. This card is even better than I thought!

Meh. You’ve cherry picked your examples. And the rules limit useability. And even 3% is marginal return if you want premium cabins or fly short routes where other programs offer better value (Avios).

For premium seats (particularly international) that I want, I always put my non bonused spend on SPG and get much more value out of my spend. Can lever SPG and get 5-15cpp value, which is impossible using Fido. And Everyday Preferred 1.5x transferring for BA Avios offers better value on shorter/mid range domestic flights. A r/t to Hawaii is 25K Avios from west coast vs 45K Premium Air Rewards, a rather large difference. R/t LAX-SFO is only 9K Avios vs 25K PARs. About only clear value I see for PARs over Avios is longer transcontinental trrips, but not by much.

Best cashback card is Blue Cash 5% if you have decent CL and know how to use it…

Are you 100% positive that these type award redemption/purchases are eligible for upgrades???

Merrill Lynch/BoA has a similar program and despite the ticketed fare class, UA codes the ticket as “Bulk fare – NOT eligible for upgrade”

Recently my friend using her Merrill Lynch/ BoA card points, redeemed/purchased an international B fare on UA.

When I went online to apply the upgrade, no option to do so appeared. I then called UA & the 1K rep said that despite the proper fare class, the ticket was coded as a “Bulk Sale” and consequently, NO upgrades were allowed.

Luckily she got a supervisor to approve a “1 time exception’. However, she still needed to find another agent who knew how to override the restriction and manually apply the upgrade request as she didn’t know hope to do it. The process took close to an hour.

just want folks to double check and hopefully avoid a similar situation.

bk3day: I’ve updated the section with a disclaimer, and appreciate the detailed feedback. Also important for those who are trading for upgrades to make sure to trade only after the upgrade is cleared. And finally, you sound like a great friend to have 😉

Can anyone comment on credit lines on this card? I get $10k+ on most cards but I’ve had this one for many years and it’s $5k which makes it hard to use. I hate to do a hard inquiry on raising the limit if they generally do low CLs

Jason- they gave me about 7K, but you can swap lines from Bank Of America to boost it up. I transferred the Virgin America credit line to the Fidelity Amex.

Matt,

That’s a tremendous tip. I’ve got $10k CL sitting on a Cash Rewards card I can move over.

—FQF

9-10k+ lines are possible on first approval. I’m with you, hate to do a hard inquiry for a credit bump. FIA seems pretty sensitive to going over your limit (charge & pay, repeat type stuff) so Matt’s idea might be the best way to go.

I got $35k on approval in 2009 and called in last December and got it raised to &50k

1. It says these awards are restricted to World MC or Visa Sig cardholders? But you have an Amex…

2. Is it $400 or $470 limit? Seems to depend on Visa vs. MC but you have an Amex…

3. Your first/business spreadsheet numbers don’t match the literature…

4. If I buy a $400 ticket, I can get 2% cashback, 1% cashback via a click-through mall, and 1% Orbitz Rewards. That’s $16 in value (4% total). So with this card I’m really only getting $384 in value minus a $30 fee = $354. That makes it a 2.8% CB value… A little less…

Fidelity has a no-fee Visa card, which pays 1.5 World Points/$ on the first $15k/year, 2 points/$ after that. You can transfer points back and forth between the Visa and the AmEx for no fee.

I applied for the AmEx about four years ago, and then applied for the Visa about a month later. I was initially declined for the Visa because I had been issued the AmEx so recently. I explained that I wanted the Visa for where AmEx is not accepted, and that I would be happy to have my credit limit taken from my other Bank of America or Fidelity cards. The agent promptly approved me (but without increasing my total credit capacity).

Also, you don’t need to link these cards to a retirement account. You can apply for the ones that link to a regular Fidelity brokerage account, which has no minimum, no annual fee, and unlimited free bank transfers (in the US). When I opened my Fidelity brokerage account, there was some confusing language in their advertising and account creation screens that suggested that there were minimum balances, but it turned out that those minimums were just to qualify for certain interest rates. I suppose you could even use the deposits into the Fidelity accounts as part of Fidelity’s frequent flyer miles program. If you link to a regular account, you can always choose to move the money from there to a retirement account if you want. Since those numbers are something you want to track, and you may even want to choose which tax year to apply the deposit to, I think it’s much safer to link to a basic Fidelity brokerage account. However, the advice in this article about redeeming for travel awards seems to be a much more compelling use than I had previously realized. So, I not not be depositing to my Fidelity account by this route as much in the future.

You have over 100k points why?

The point total has been randomized to protect the innocent. 😉 I would never hold more points than you think you might need for a flex award. The exception to this word be if you’ve already maxed your IRA contribution for the year, you would have to hold whatever points are over the max until Jan 1.

Regarding the Visa Signature or World Mastercard, does it necessarily need to be fidelity product?

I mean, since the points are redeemed through Bank of America, if I have a Visa Signature card issued by Bank of America, will that help?

Thanks

Michel, I don’t have another worldpoints card to test it but I don’t see why it wouldn’t work. If you have a travel portal in your BofA card’s rewards give it a try and see if you have the same options. My guess is most cards which earn world points should work.

I’m just seeing 1:1 point to dollar options in the griid. No 25k. I did a search obeying all the rules (e.g. 21 day advanced purchase, saturday stay etc.

I only have 15k in my account right now, yet shouldn’t the 25k option still show up in the grid?

Roger: How much is the cheapest priced fare you’re looking at? I just did a sample search, LAX-ATL leaving July 9 returning July 16th. Only one flight is under $400, an AA flight for $367. It does show as 25k points + $30. If you do the same search do you find this same flight for the same price? Let me know, thanks.

It shows the AA flight as:

36,700 Points or $367.00

in the grid.

I have both fid. amex and visa and clicked through via the amex card -> book travel and I see the same type of grid you pictured above. The last 4 of my amex cc is in the top right corner with my points available.

Very, Very odd. The only thing I can think of is something on Fido’s end. I’d suggest giving them a ring and inquire about Flex Rewards and why they’re missing. I would appreciate if you let me know how it turns out so others might benefit as well.

I am finding it hard to get Premium Air Rewards (PAR) because 3 carriers offer the same sub $400 price! It seems the tool only shows PAR if there is a single ticket with the lowest price. I tried filtering by air carrier, no go. I tried filtering by time, and I got an unique lower price. But it didn’t price at 25,000 World Points.

[IMG]http://s1369.photobucket.com/user/noelandres/media/Sample_zps71gsztts.png.html[/IMG]

I am probably doing something wrong. Maybe this example being a flight from PR to US continental has something to do with my problems?

Note: I don’t have 25,000 WPs on my account. This is only an exercise.

Andres: You don’t need the 25k points to see the PARs. I too have trouble tricking the online booking to show me them on routes with heavy coverage and similar pricing. The best advice I can offer is to make sure you’re fulfilling the Saturday night stay, lowest total price and 2 week advance booking requirement. If you’re still not finding the flight at 25k you can book via phone with an agent at 1.800.433.5662. This comes with a $10 phone booking fee.

Thanks for the reply. Just to clarify: when you say I need to “fulfill the Saturday night stay” you mean that the roundtrip flight should enclose a Saturday night (like leaving on Friday, and returning on Sunday)?

By the way, thanks to your article I suspended the automatic redemption of my points. Even if it is hard to find flights at better than 1:1, it is still a possibility! The only cons I see is that FIA devalues the World Points down the road, and does so in such a way that we can’t exchange at 1:1. My strategy will be to collect WPs until I reach 25,000 , and then on the next statements redeem the excess.

Andres: Glad to help. Just a heads up, FIA pushed a new travel portal out, and you do now need 25k points in order to see the premium awards. Your strategy of keeping 25k is a good one. I keep 50k just in case I need to book something for my wife and I, everything else gets dumped into a statement credit.

Did FIA change the program? I just did a searach all flights now has 1 point to 1 cent exchange ratio, no 25k miles plus $30 fee option anymore.

There has been a slight change; you now need the 25k points to be in your account for the lower price awards to show.

You can choose “non-stop flight” on the old website, but now only “prefer non-stop flight”. The cheapest option that can book with 25K points will always applies to stop flight only. That is a big drop. But it seems there is no $30 fee anymore.

Does this still work now that Elan Financial Services issues the card?

Sadly, no. The card from Elan is now crippled and not recommended.